SPP stakeholders have overwhelmingly endorsed a conditional interconnection process for large loads that will be paired with two other FERC-approved processes as part of the grid operator’s effort to approve large loads.

The conditional high-impact large load service (CHILLS) tariff revision request (RR720) gives load two paths for conditional connection: CHILLS with sufficient designated resources but contingent on transmission upgrades, and a large-load generation assessment that requires accredited, equivalent support generation for the CHILL.

“Ultimately, we have what I would consider a policy that has a narrower scope than initially proposed before,” Yasser Bahbaz, senior director of operations, told the Markets and Operations Policy Committee during its Jan. 13-14 meeting. “It’s that way because it does address, and is designed to address, concerns with respect to impact to the system, from a market impact and market-energy pricing standpoint, and also from a reliability standpoint.”

The CHILLS proposal was split in September from the policy package that included a high-impact large load (HILL) study and high-impact large-load generation assessment (HILLGA) to give stakeholder groups more time to refine and address concerns expressed with the CHILL policy. FERC approved the HILL and HILLGA policies Jan. 15. (See FERC Approves SPP Large Load Interconnection Process.)

The HILL/HILLGA proposal accelerated studies and access to interconnection information, but market participants without generation cannot establish a delivery point for the HILL study. CHILLS expands on that policy to enable speed to power, not just speed to information, Bahbaz said.

“[HILL] information was basically saying, ‘This is what it takes, this is what it costs, and these are upgrades that are needed for these large loads to interconnect,” he said. “So, we are taking it from just a speed to information to speed to power.”

SPP’s Market Monitoring Unit said that with recent revisions to the proposal, it now supports the CHILLS policy. However, it called for the RTO to document that it will commit reliability status resources or make local reliability commitments only to supply firm load and ensure consideration in determining whether a participant has sufficient capacity to “cover” a CHILL with associated generation.

MMU lead Carrie Bivens noted that load-responsible entities (LREs) can use the same megawatts for both the planning reserve margin and to cover a CHILL.

“It’s the exact same megawatts of capacity that are pointed at two different purposes,” she said. “It does make the region reliant on essentially perfect responses from resources and CHILLS in order to mitigate reliability risks.”

MOPC members endorsed the proposal with 99.3% approval, although there were 43 abstentions. There were only five no votes.

Peak Demand Assessment Delayed

MOPC members voted to direct staff to modify revision request RR703 by altering the proposed peak demand assessment (PDA) to focus only on the forecast effects of load-modifying demand response resources (LMRs). The revised tariff change is to be brought back to working groups before the April MOPC meeting.

The endorsed motion was crafted as a compromise after a previous motion amending a Supply Adequacy Working Group recommendation to include a cap on LMRs based on 2025 actuals or workbook submittals failed. Members cited concerns over the load forecast’s evaluation while expressing support for the RR’s demand-response portion.

“I was hoping that this wouldn’t happen,” Evergy’s Jim Flucke, chair of the Market Working Group, said in offering the compromise motion. “It would allow for another three months to allow us to work through some of the concerns in the PDA. The big difference that we’re proposing is that we focus PDA strictly on the demand response.”

Flucke said the demand response piece would remain as “previously envisioned.” He said the key hurdle is working through demand response’s deployment and how “that’s going to fit into this approach of being able to evaluate your demand response portion and how well it is meeting what your expectation was in your workbook.”

SPP staff said they can work with the three-month delay in adding “increasingly critical” demand response as the RTO addresses rapid load growth, evolving resource mixes and tighter energy conditions. Natasha Henderson, senior director of grid asset utilization, said the grid operator will be reliant on FERC approval if it is to implement a revised PDA forecast in 2028 and with risk mitigation for 2027 “that isn’t full implementation.”

“I think this is doable … while I ask for 60 days [for FERC action], I suspect it’s going to be more like 180 days, given the contentious nature of this policy,” Henderson said.

RR703 is intended to increase the visibility and ability to deploy demand response by creating a participation model and accreditation framework for non-price-sensitive DR. SPP wants to incent LREs to manage peak loads by qualifying non-registered or load-modifying demand response capable of performing when their peak loads exceed their qualified resources. (See REAL Team Endorses DR Policy, CONE Value.)

In other actions, MOPC:

-

- Approved base planning reserve margins for the RTO Expansion members of 19 and 40% for the summer and winter seasons, respectively. The PRMs are effective in 2027 to give the RTOE members time to adjust to integration into SPP. They were based on a loss-of-load expectation study and other analysis directed by an RTOE ad hoc study group and other stakeholders. The RTOE is one-tenth the size of SPP, with a little more than 5 GW of accredited capacity.

- Endorsed a proposed tariff revision (RR534) that limits long-term firm services up to the interconnection limit at the point of interconnection for modeling and controlling energy storage resources hybrid configurations.

Wyoming Transmission Outage

A November grid disturbance resulted in a significant “uncontrolled” loss of generation (4 GW) and load (1 GW) across Wyoming and into western South Dakota, staff told MOPC.

The Nov. 13 event in the Western Interconnection began with the planned removal of a 500-kV transmission line in the PacifiCorp balancing authority area. That led to the immediate loss of another 500-kV line that triggered cascading outages around 12:34 p.m. (MST).

SPP’s Derek Hawkins, director of system operations, said the RTO’s reliability coordinator operators immediately responded to address severely loaded transmission constraints, working across internal and external transmission operators and the neighboring RC to return the system to a “secure operating state.”

“We did that very quickly … to get the system in a spot where we could start the restoration,” he said, noting the restoration was completed in the evening of Nov. 13.

NERC and WECC have launched a coordinated investigation into the event. Hawkins said they are likely to file a detailed report that covers the root causes, contributing factors and lessons learned from the event.

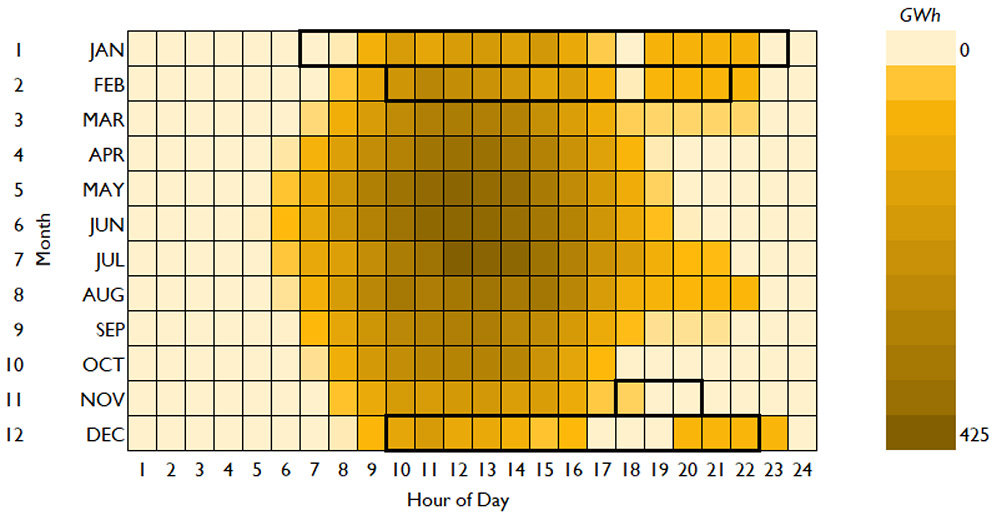

Hawkins also said high winds in December resulted in several new marks for wind generation, eventually topping out at 26.3 GW on Dec. 19. SPP’s previous high came in August 2025 at 24.3 GW.

Dueling CSP Studies

SPP staff told members that its joint operating agreement with MISO requires another joint study in 2026, even as the grid operators are completing their 2024 study.

The two RTOs have conducted preliminary screening analyses of 31 projects, using both original coordinated system plan (CSP) models and those that incorporate approved transmission projects from 2025. Staff will focus next on 14 projects, primarily along the southern seam in Arkansas, Louisiana, Oklahoma and Texas, in evaluating their reliability, economic and transfer benefits.

“We will begin to build a business case for any projects out of those 14 that make it through, that we want to even consider a little more in terms of benefits calculation,” Clint Savoy, SPP’s manager of interregional strategy and engagement, told MOPC. “We will start having conversations about cost allocation … and we expect those conversations to continue through this year.”

The grid operators plan to draft a report on the 2024/25 study’s results by March 9 and then develop a business case and allocate costs. They have yet to agree on a single joint project during the more than 10 years of the FERC Order 1000-compliant CSP process, usually disagreeing over the cost-benefit analysis.

Stakeholders have until Feb. 6 to submit transmission issues for 2026 that could be system needs to either MISO or SPP. The RTOs’ staffs will review the issues 2026 during a March 6 meeting.

RTOE RRs on Consent Agenda

The unanimously approved consent agenda, with two clean energy members abstaining, included an update to the 2027 Integrated Transmission Planning sunset and RTOE transition’s scope; an RTOE trading hub analysis; and the quarterly in-service date delay report.

MOPC also approved 19 tariff revision requests — several related to the RTOE —that, if approved by the board, will:

-

- RR694: Align the analysis and changes during the annual flowgate assessment to the flowgate list with real-time operations.

- RR704: Set standard, baseline assumptions for the annual loss-of-load expectation study and the process for studying sensitivity or assumption changes and their impact on the PRM.

- RR714: Improve Business Practice 7060’s (Notification to Construct and Project Cost Estimating Processes) language for consistency, readability and procedural clarity.

- RR718: Develop inverter-based resource requirements based on reliability needs for SPP governing documents.

- RR723: Update the business practices for transmission service and related tagging practices when RTOE begins operations April 1.

- RR724: Revise Attachment AQ’s study scope to include Integrated Transmission Planning project-selection criteria for network upgrades and consider zonal reliability upgrades.

- RR725: Modify existing language requiring SPP to follow up with a phone call when a market participant does not confirm a commitment by making the calls optional, rather than mandatory, to reduce unnecessary manual interventions by operators.

- RR726: Update applicable governing documents to support the integration of RTOE participants into SPP’s existing modeling and transmission planning processes, clarifying terminology and update references and incorporating modeling considerations specific to the Western Interconnection.

- RR727: Update the revision request process document to include a new governing document (the CPP manual) required for the new regional planning and generation-interconnection study process.

- RR729 Update the cost of new entry value based on SPP staff’s annual review for implementation in the 2026 summer season.

- RR730: Clean up inaccuracies in the list of Western Area Power Administration-Colorado River Storage Project (WAPA-CRSP) resources to be included in its federal service exemption (FSE) resource hub.

- RR733: Update tariff and protocol language to clarify how disputes between the MMU and a market participant (MP) will be handled and clarify that they can dispute the MMU’s ex-post verification of actual costs.

- RR734: Clarify that SPP and MPs can use FSE transfer points and the WAPA-CRSP resource hub to obtain candidates and nominate auction revenue rights and long-term congestion rights consistent with the tariff’s FSE provisions.

- RR735: Align tariff and protocol language with current congestion-management practices by replacing outdated market-flow submission requirements with the parallel flow visualization process.

- RR736: Improve the regulation selection process’ efficiency by automatically selecting resources when their regulation capacity limits and ramp rates are equal to their energy capacity limits and ramp rates. The selection for regulation of eligible resources that cleared in the day-ahead market will be done as reliability unit commitments instead of the real-time balancing market.

- RR737: Add administrative language to the SPP market protocols to effectuate and align with the approved RTOE tariff language. Settlement calculations will be relocated to a settlement-calculation reference manual.

- RR738: Revised Business Practice 10000 (Reliability Coordinator Outage Coordination Methodology) to accommodate RTOE members.

- RR740: Clarify current reliability coordinator (RC) function practices for identifying and addressing emergency conditions in the SPP RC area by adding a new section in SPP’s operating criteria.

- RR741: Add an addendum to the tariff formalizing interregional-transmission planning coordination for the Western Interconnection to meet Order 1000 requirements and allow SPP to coordinate RTOE planning activities with adjacent Western planning regions.