The newest crop of wind farm proposals off the New York coast includes the largest plan ever submitted there, or apparently anywhere else in U.S. waters.

The latest iteration of Community Offshore Wind is a two-phase project that would reach peak output of up to 2.8 GW in the early 2030s.

Community has a simultaneous 1.3-GW proposal under consideration by New Jersey regulators. (See 3 OSW Proposals Submitted to NJ.)

Daniel Sieger, head of development at Community Offshore Wind, spoke recently to NetZero Insider about the evolution of the joint effort by RWE and National Grid Ventures and its direction from here.

Community is not hedging by bidding different versions of the same project into two states at once, he said. It wants to send power to both.

“We have a large lease area that can accommodate multiple projects,” Sieger said. “We’ll see how the process plays out with both New York and New Jersey, but right now, those are both active proposals.”

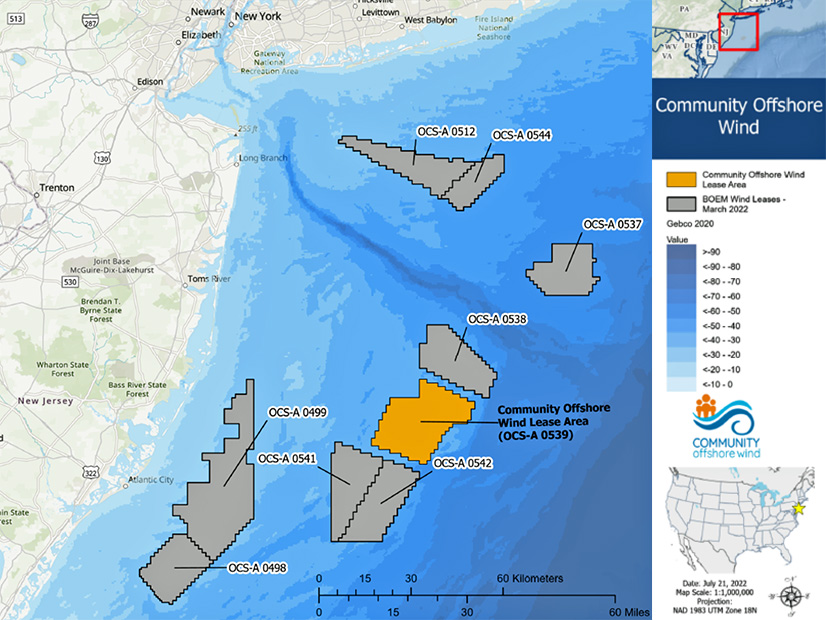

When Community won lease area OCS-A 0539 in the February 2022 New York Bight auction, the U.S. Bureau of Ocean Energy Management calculated the energy potential of its 125,964 acres conservatively at 1,387 MW.

Community’s decision to propose up to 4,100 MW there reflects how far technology has evolved in the intervening three years and how much further it is likely to improve before the time comes to put steel in the water.

“The full capacity is going to depend on turbine technology and permitting and will be done in consultation with state and federal officials,” Sieger said. “But we think that we have the possibility of three different phases of project development in our lease area.”

The path to this point has been neither straight nor smooth: Community has struggled against the same headwinds that have affected the entire industry in the past two years. This latest proposal is its fifth attempt to land a contract.

-

- It proposed a 1.3-GW project in New Jersey’s third solicitation (NJ3), then withdrew it to reassess the financials and the process. (See NJ Awards Contracts for 3.7 GW of OSW Projects.)

-

- It nearly won a 1.3-GW contract in NY3, along with two other developers, but all three conditional contracts had to be scrapped when the GE Vernova halted development of the 18-MW turbine that would have made the contracts financially viable. (See NY Offshore Wind Plans Implode Again.)

-

- It submitted a 1.3-GW bid in NY4, a rush solicitation New York put together after the state’s offshore portfolio collapsed, but New York instead awarded contracts to two mature projects that could get steel in the water sooner. (See Sunrise Wind, Empire Wind Tapped for New OSW Contracts.)

Community now is awaiting the two states’ decisions on the combined 4.1 GW it proposed in NJ4 and NY5.

The progress to date might seem frustrating, but it is not wasted time. Development continues even as a particular path ends or is rerouted; proposals are updated and reshaped through what has become an iterative process.

“The project and the plans evolve as we go further into development and we mature the project,” Sieger said. “But this proposal that we have submitted here [to New York] I think is really well positioned for selection and well positioned to deliver.”

Sieger joined Community shortly after the 2022 auction and has seen shifts as industry, state and federal leaders tried to push offshore wind forward through some strong headwinds in the past two years.

“I think with any new industry, there’s going to be some ups and downs and some stops and starts,” he said. “But I think we’re really starting to see the industry mature here in the United States, to the point where we’ve got projects in operation in the United States, we’ve got projects under construction.”

In its NY5 bid, Community says it would start generating power in 2030 and reach completion in 2032. That time frame should give it some breathing room to let offshore wind technology evolve and a U.S. ecosystem grow to support it.

But there still is a chicken-and-egg balance to strike, in which enough projects are greenlighted far enough in advance to justify building ports and factories, and enough ports and factories are built soon enough to support those projects. The balance goes far beyond development in any one lease area, but Sieger said Community’s plans are big enough to help move the needle.

“I think that as the offshore wind industry and market matures in the United States, we’re going to see a lot of opportunity for localization of the supply chain,” Sieger said. Their project is an opportunity for certainty in the market, “to sort of lock in that pipeline that’ll unlock some of the investment for some of these supply chain entities to localize.”

Community still has not settled on a particular turbine model, port, installation vessel or many of the other critical pieces of building a wind farm.

One of its most publicly visible efforts has been toward public visibility — engaging with the stakeholders and local residents who will influence the reception Community’s proposals receive and the ease with which they move through the review process. Its social media feeds are packed with examples.

Community faces a potential public relations test with one of its possible export cable routes, which would run to the south shore of Long Island near a city that mounted strong opposition to Empire Wind 2’s proposal to use the same point of interconnection. (See ‘What Did We Do to Deserve This?’) That proposal was withdrawn recently, 27 months after it was launched. (See Equinor Yanks Request for Empire Wind 2 Export Cable.)

Sieger did not discount the prospect of local opposition, but he did not seem daunted by it, either.

“We have prioritized, since day one, active engagement on the ground with the communities where our project is going to be located,” he said. “As we enter into the permitting process and the siting process and the routing process, we intend to continue those conversations and work hand-in-hand with the local communities to determine the best route from the landfall to the point of interconnection.”

Along the way, Community is working to recruit allies. In its NY5 proposal, it has committed to $64 million in workforce development, up to $250 million in manufacturing development, $121 million in community support and more than $67 million in fisheries assistance. It also has pledged to support organized labor, disadvantaged communities, minority/women/veteran-owned business and other priorities baked into New York’s offshore wind initiative.

The projected cost of proposals submitted in NY5 by Community, Ørsted and Vineyard Offshore is likely to be substantial but will not be revealed until the state finalizes contracts, which is expected in the first quarter of 2025.

One clue: Community Offshore Wind said its 2.8-GW proposal would drive roughly $3 billion in economic activity, more than $2 billion of it in-state spending.