INDIANAPOLIS — MISO members don’t doubt that large loads will turn up at the beginning of the next decade and are occupied with how the industry can make sure ratepayers don’t subsidize supersized customers.

MISO’s Advisory Committee discussed large load integration at its quarterly Dec. 10 meetup, part of MISO Board Week.

“It’s a pleasure to be here to talk about this very minor issue,” MISO Executive Director of Markets and Grid Research DL Oates joked as he introduced the topic.

Coalition of Midwest Power Producers’ Travis Stewart said large loads are a matter of when, not if. He said most of the loads that have requested connection in MISO and are being studied are expected to be online beginning in 2030.

“These years are just around the corner, and we need the infrastructure to support them,” Stewart said.

Alliant Energy’s Mitch Myhre said his company is confident loads will materialize in a magnitude that couldn’t be understood a decade ago. He joked that back in the 1980s, Dr. Emmett Brown discovered that just 1.21 GW was the key to time travel.

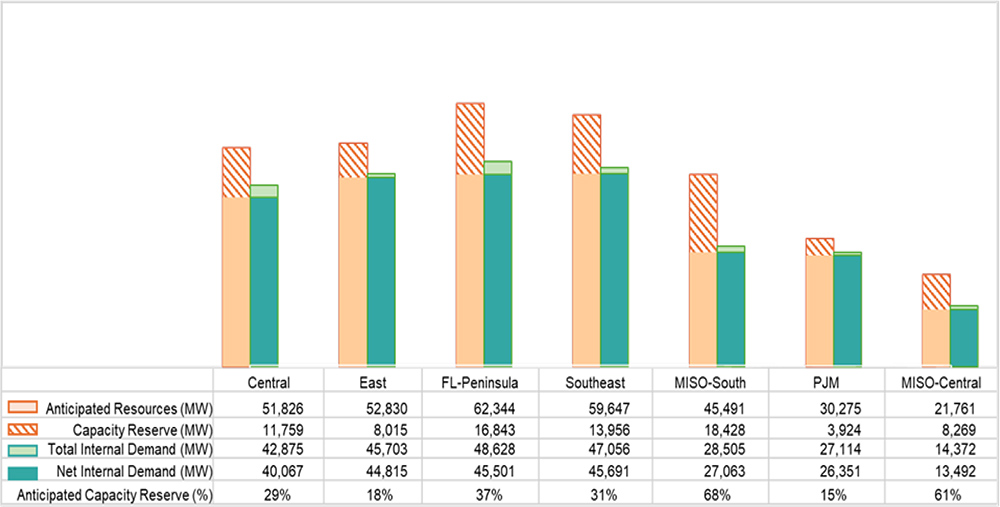

MISO itself is anticipating approximately 60% load growth from 2025 to 2044.

Aaron Tinjum, guest speaker and vice president of energy at the Data Center Coalition, said data center developers consider several aspects to site a data center — tax and regulatory environment and access to IT and construction skilled labor — but he said above all, data centers prioritize access to reliable power.

“Preference No. 1 would always be to locate on the grid and be part of it,” Tinjum said. But he said self-supplied power “makes its way into the equation” if constraints are too tight and the wait is too long.

Tinjum said there’s a perception that data center developers are opposed to consumer protections; however, he said developers welcome provisions such as minimum exit fees, contract requirements and stranded asset guardrails “as long as they’re rooted in evidence.”

Affordability Concerns

Illinois Commerce Commissioner Michael Carrigan said consumer affordability and making sure large loads pay their costs is paramount for state regulators. Carrigan said there’s been a recent increase in intervenors speaking before the commission on affordability, representing “people on the lowest rungs of economic ladder.”

Carrigan told other stakeholders that developers should moderate some of their speed to power expectations because regulations take time, as is proper.

“I’d never call it speedy,” Carrigan said of the regulatory process, emphasizing that commissions must do due diligence before signing off on plans.

Luke Kinder, attorney for the Arkansas Public Service Commission, pointed out that state commissioners have minimal control over the costs associated with the transmission projects needed to serve large loads.

But Michigan Public Service Commissioner Dan Scripps said MISO’s long-range transmission cost allocation that’s rooted in a load ratio share is fitting for the moment. Scripps said MISO designed the allocation with a usage rate knowing that transmission users would change over time. Scripps said new large loads are “proving out the wisdom behind that strategy.”

Jim Dauphinais, an attorney for multiple industrial end-use customers in MISO, said connection agreements today seem to overlook “back-end risks.” He said data centers’ rate contracts typically cover only a 10- or 15-year term.

“But the assets that are being added have a much longer life, and they’ve only depreciated so much at the end of the contract,” Dauphinais said.

Clean Grid Alliance’s Beth Soholt questioned data centers’ commitment to sustainability goals. She pointed out that MISO’s interconnection queue fast lane is overwhelmingly filled with natural gas generation projects.

“So which wins, fast or clean?” Soholt asked Tinjum.

Tinjum said it “doesn’t have to be an either/or” situation, but he conceded that “speed is the overriding factor in many ways.”

“That doesn’t mean the sustainability goals are thrown out. I don’t think it’s coming completely at the expense of clean energy,” he said.

Tinjum said developers are pushing for “firm, clean energy,” including small modular reactors, batteries and geothermal resources in some cases.

Tinjum said the “tailwind behind the data center development” is unprecedented demand for data-centered services, like Ring doorbells and smart thermostats at home and videoconference meetings at work.

MISO is mulling allowing interconnection agreements where generation is barred from injecting on the MISO system to get co-located load and generation up and running faster. (See MISO Floats ‘Zero Injection’ Agreements to Bring Co-located Gen Online.)

Oates said zero-injection GIAs would reduce the overall transmission needed to serve growing load. He added the agreements would be useful only for generation with plans to be situated at the same spot as the load facility.

WEC Energy Group’s Chris Plante suggested MISO consider extending the temporary expedited queue process for states’ necessary generation projects. He said the first two cycles show the queue fast lane is working well. (See MISO Accepts 6 GW of Mostly Gas Gen in 2nd Queue Fast Lane Class.)

But Wisconsin Public Service Commissioner Marcus Hawkins said the Organization of MISO States likely would be against extending the queue fast lane.

“MISO should dedicate focus to fix the existing queue,” Hawkins said.

Queue Work

MISO reported that it’s making progress bringing new generation online.

The grid operator said it has completed 47 generator interconnection agreements representing about 30 GW during 2025. Vice President of System Planning Aubrey Johnson said MISO would double that amount in 2026 with the assistance of Pearl Street’s automated SUGAR (Suite of Unified Grid Analyses with Renewables) study software. (See MISO: New Software Effective, Faster than Previous Queue Study Process.)

At a Dec. 9 System Planning Committee meeting, Johnson said MISO will conduct “SUGAR rushes,” or orientations with developers to get them acquainted with MISO’s reworked study process in 2026.

Yet, Johnson warned that MISO has amassed 70 GW of approved interconnection projects that have not been built. That’s up from MISO’s longstanding 50 GW. About 60% of the waiting generation are solar projects.

MISO leadership emphasized the unbuilt generation throughout Board Week.

Senior Vice President Andre Porter said delayed projects make up nearly 50% (32 GW) of overall approved generator interconnection agreements. He said more should be done to complete network upgrades and overcome supply chain issues and siting delays.

“There’s a significant opportunity for speed,” Porter urged developers.

MISO CEO John Bear echoed the request that members prioritize getting as much of the 70 GW online as soon as possible. “We’d like to work through that with you all,” he said at a Dec. 11 board meeting.

The Union of Concerned Scientists’ Sam Gomberg told MISO that it shouldn’t rush so much to support large loads that it sacrifices reliability.

“If the lights go out, we’re going to find ourselves in a world of finger pointing and in a hole,” Gomberg warned.

Oates said MISO moving forward would update a long-term load forecast annually to have a better idea of what it and members need to do.

MISO will hold a stakeholder workshop dedicated to large loads Jan. 30. Oates said MISO would hold more workshops on large loads throughout 2026.