MANCHESTER, Vt. — ISO-NE is considering moving to a prompt and seasonal capacity market, the organization told stakeholders at its Participants Committee (PC) summer meeting last week.

The RTO has emphasized the need to address the seasonal variance of resource reliability in its capacity market, especially as it expects to transition from a summer peaking to a winter peaking system. The organization outlined potential options for transitioning to such a market, while also accounting for the implementation of Resource Capacity Accreditation (RCA) updates, which likely would affect the scheduling of future capacity auctions.

The RCA project has been an extended effort by the RTO to better assess the reliability of various resource types, which ISO-NE was hoping to implement for Forward Capacity Auction (FCA) 19, which would procure capacity for the 2028-29 capacity commitment period (CCP).

However, ISO-NE announced in June that it had found an error in the software used in the RCA project, which caused an underestimation of the amount of LNG available to generators when assessing winter risk. The RTO has said this error affected several months’ worth of work on the project and will affect its implementation schedule.

In a memo written prior to the PC meeting, ISO-NE Chief Operating Officer Vamsi Chadalavada asked for stakeholder feedback on the best way to incorporate the RCA project into the forward capacity auctions. ISO-NE also highlighted the potential of moving away from the current forward capacity market structure and holding auctions seasonally and just a few months ahead of the CCP.

ISO-NE wrote in the memo that moving to a prompt capacity market would buy time for the RTO to implement the market changes.

“In transitioning from a three-year forward to a prompt capacity market construct, there will be up to a three-year period between conducting the final forward capacity auction and conducting the first prompt capacity auction,” Chadalavada wrote.

David Patton of Potomac Economics, which serves as ISO-NE’s external market monitor, recommended transitioning to prompt and seasonal market as soon as feasible and said a seasonal market would do a better job accounting for the differences in seasonal reliability between resources.

Patton said the current process has a “a dubious track record of facilitating entry of new resources,” and that procuring capacity three years ahead “inhibits resources with fast development timeframes from receiving revenues as soon as they are able to support reliability.”

He noted that the existing FCA structure introduces uncertainty into the expected load and resource mix and added that the current market can also lead to premature retirement of older existing resources.

“Retirement of older units is often prompted by unforeseen equipment failure that is not economic to repair,” Patton said. “Such units must accept a capacity obligation that ends more than four years after the FCA, which creates substantial risk for the supplier.”

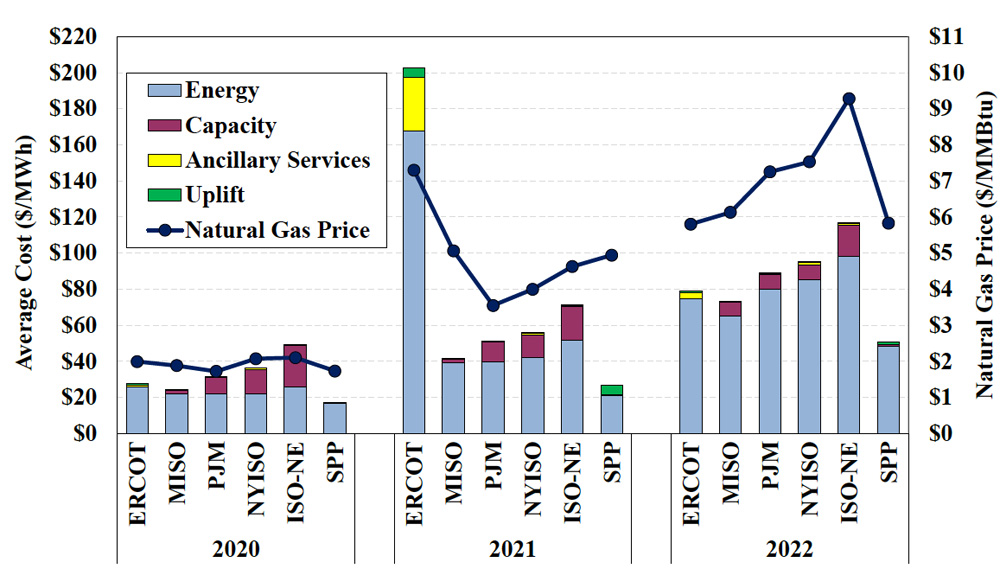

Presenting a cross-market comparison between ISO-NE and other RTOs, Patton found New England had the highest all-in costs in 2022, largely consistent with previous years. Patton said that higher gas prices in the region drive the higher overall costs but added that New England also has the highest capacity charges, largely due to “over-forecasted demand ahead of the FCAs, which are slow to correct.”

ISO-NE laid out four potential pathways for implementing the RCA updates as well as a prompt and seasonal capacity auction, including the possibilities of delaying FCA 19, delaying the RCA implementation and/or implementing a prompt and seasonal market along with the RCA changes for either the 19th or 20th auction cycle. The RTO noted that the removal of the Minimum Offer Price Rule will proceed for the 2028-29 CCP as scheduled.

Aleks Mitreski of Brookfield Renewables expressed his opposition to delaying FCA 19 due to the uncertainty this could introduce.

“ISO-NE has a great track record of never delaying an auction, so having FCA 19 run as scheduled will avoid market uncertainty and any regulatory uncertainty if the delay is challenged at FERC,” Mitreski said in a statement to RTO Insider. “By pushing the RCA implementation for FCA 20, this will give the stakeholders time to evaluate the RCA changes, as well as the benefits and tradeoffs for implementing a seasonal and/or prompt capacity market.”

Mitreski added that a move to a prompt and seasonal market would introduce several tradeoffs, and that stakeholders will need time to evaluate the merits of such a change.

“While it will help with the fuel qualification processes for RCA, a prompt market does not enable new entry in the market to address any retirements or transmission issues,” Mitreski said. “The only fix for those reliability issues would be expensive out-of-market reliability-must-run agreements like we have seen in NYISO in the past, something that the New England region wants to avoid.”

Budget Increase

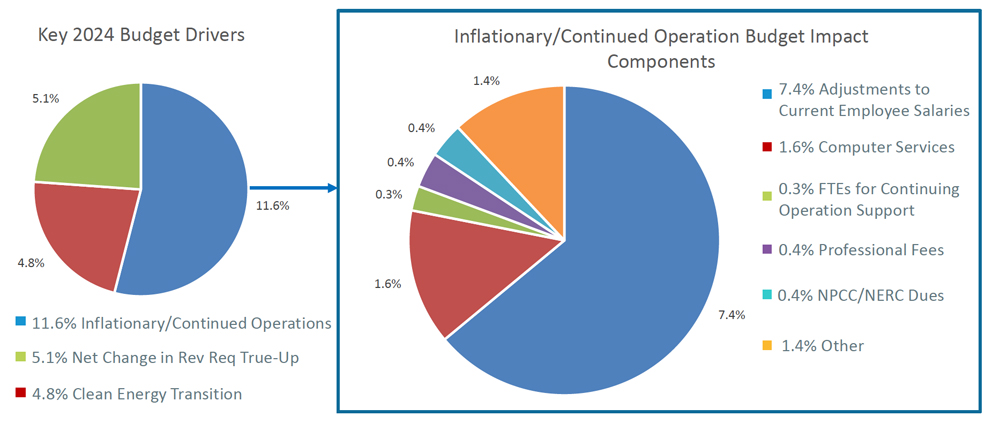

ISO-NE also told the Participants Committee that it expects a significant year-over-year increase for its 2024 budget in its presentation on its preliminary budget for the coming year, equaling a 21.5% increase in the total revenue requirement for 2024.

This increase is driven by increased costs related to preparing for the clean energy transition, effects of inflation on labor and information technology costs, and the net-change from the annual revenue true-up, the RTO said. The largest single portion of the increase is associated with adjustments to employee salaries.

“The 2024 budget represents a ramping-up of organizational capacity to carry out the organization’s mission of planning the transmission system, administering the region’s wholesale markets, and operating the power system to ensure reliable and competitively priced wholesale electricity; as well as developing new capabilities that will be necessary for supporting the grid of the future,” ISO-NE CFO Robert Ludlow said.

Ludlow said that the RTO needs to increase staffing to meet clean energy planning needs, noting that the changing resource mix and the overall increase in generating assets will increase the organization’s workload. For 2024, the RTO proposed the addition of 40 new full-time employees, 34 of whom would be focused on supporting the clean energy transition.

“In order to keep pace with the needs of the transition to cleaner generating resources, the ISO must begin ramping up its capabilities and operational capacity now,” Ludlow said.