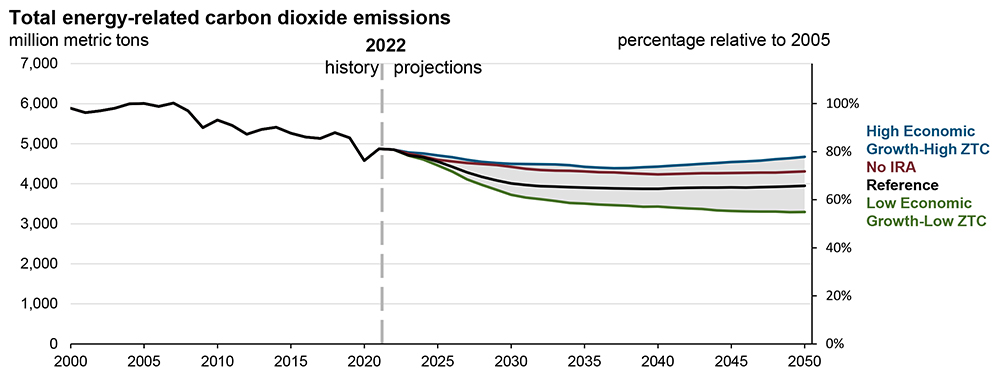

WASHINGTON — The U.S. Energy Information Administration projects the nation will be able to cut energy-related CO2 emissions to 25 to 38% below 2005 levels by 2030, which falls short of President Biden’s target of a 50 to 52% reduction of all greenhouse gases.

But the agency’s 2023 Annual Energy Outlook says its analysis only looks at CO2, not the full range of GHGs, particularly methane.

Still, emissions reductions in the EIA’s 2023 reference case, not taking into account the full impact of the Inflation Reduction Act or other potential economic drivers, are 15% lower than last year’s estimates.

Speaking at a launch event on Thursday, EIA Administrator John DeCarolis cautioned that the outlook is based on federal policy and regulations as of November 2022, and that the full impact of the IRA has been difficult to model and integrate into the report’s forward projections.

By 2030, energy-related CO2 emissions fall 25 to 38% below 2005 levels | EIA

By 2030, energy-related CO2 emissions fall 25 to 38% below 2005 levels | EIA

“We don’t explicitly include a representation of every IRA energy-related provision within the AEO,” he said, noting that “guidance might not be available on how a particular provision is enacted or how agencies will implement it.” Both industry and consumers are currently waiting for IRS guidance for many of the law’s tax credits and rebates.

In addition, DeCarolis said, “There are provisions that require significant model modifications that we simply weren’t able to complete this year.”

While acknowledging the implicit uncertainties of such modeling, DeCarolis also stressed that the report provides ranges of how different aspects of the transition could unfold based on several different scenarios modeled on high and low assumptions of economic growth and costs of oil, gas and zero-emission technology.

For example, the EIA sees electric generating capacity doubling by 2050 with solar, wind and storage accounting for most of the increase, but nuclear and natural gas remain more or less static. The range for solar runs from 22 to 56% of U.S. power production, EIA Assistant Administrator Angelina LaRose said.

Bonus tax credits in the IRA — for example, for projects paying prevailing wage and offering registered apprenticeships — could raise those figures to 39 to 59%, LaRose said.

Renewable growth will be driven by increasing electrification, she said, but “a higher share of renewables in the generation mix [will require] a higher total grid capacity requirement. This is owing to the currently lower capacity factors for solar and wind compared with coal, nuclear [or natural gas] combined cycle plants.”

Natural gas and storage will be needed to firm up intermittent resources, and “a small number of the relatively newer and more efficient coal power plants remain online in the United States due to their ability to provide cheap and dispatchable power to the grid,” LaRose said.

Increasing renewables on the grid may also drive higher levels of power curtailment, she said, with both higher gas prices and lower costs for renewables resulting in billions of kilowatt-hours of curtailment and a greater need for storage, both standalone and as part of hybrid projects combining solar and storage.

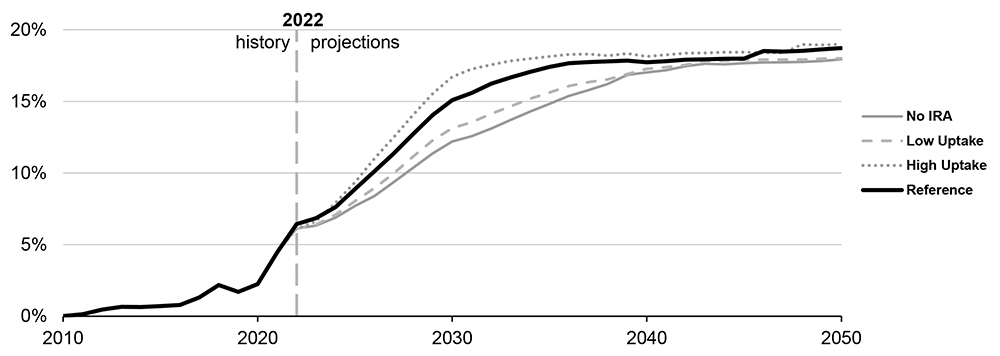

EV Uptake

The EIA does not expect the U.S. to hit Biden’s target for electric vehicles to reach 50% of new car sales by 2030. Even with high gasoline prices, the outlook estimates EVs making up 30% of sales by 2050. The reference case is even lower, less than 20%.

The EIA sees the IRA speeding EV adoption but expects sales to plateau after 2030, accounting for less than 20% of the market by 2050. | EIA

The EIA sees the IRA speeding EV adoption but expects sales to plateau after 2030, accounting for less than 20% of the market by 2050. | EIA

DeCarolis said the EIA’s modeling takes consumer choice into account. “When we all go to buy a vehicle, certainly the price matters a lot, but there’s more to those decisions,” he said. “So, at its core, it’s a consumer choice model. We do model technological learning, but it’s evolutionary.”

The EIA also did not factor in state policies like California’s Advanced Clean Cars II rule, which requires all new passenger vehicle sales in the state to be zero-emission by 2035. Four states have already adopted the rule, and four more are considering it, but DeCarolis said the potential impact was not integrated into the EIA’s models because the EPA has yet to approve the waiver for California’s rule.

He also expects the EV market to continue being limited to the luxury models automakers have introduced as they begin to build out their own electric fleets.

Natural Gas

Energy consumption for space heating will decline by 2050, but natural gas will remain the primary fuel for this end use in both the residential and commercial sectors, LaRose said.

Overall consumption is reduced because of “warmer winters, as well as population shifts to warmer and drier areas, higher efficiency heating equipment, as well as new building energy codes,” she said. But the growing market — and IRA rebates for heat pumps — will not offset ongoing use of natural gas, which will “continue to account for the largest share of energy consumption for space heating in the U.S. residential and commercial buildings.”

Older space heating will be replaced with higher-efficiency heat pumps and natural gas furnaces, she said.

The outlook also anticipates the U.S. will continue to be a net exporter of fossil fuels through 2050 and continue to rely on natural gas in both the industrial and electric power sectors. High economic growth and high adoption of zero-emission technologies could lead to “increased end-use demand, which results in more natural gas consumption,” the report says. “Higher costs for renewables make natural gas a more competitive option in that case, further increasing natural gas consumption in the electric power sector.”