CARMEL, Ind. — MISO’s attempt last week to justify a sweeping new resource accreditation process gave way to heated debate over how to best alleviate the footprint’s reliability challenges.

The RTO has proposed accrediting all resources based on their performance during predefined resource adequacy hours, or tight operating conditions. It will then adjust unit accreditation by a capacity value determined by loss-of-load expectation. The equation’s direct LOLE piece would replace the grid operator’s use of unforced-capacity values that rely on historic forced-outage rates.

The proposed probabilistic, direct loss-of-load hours calculation would have MISO filing edits at FERC to its availability-based accreditation design for thermal resources that was approved last year. It would also eventually assign solar generation near-zero capacity credits by 2031, based on their marginal value.

Last month, stakeholders appeared to be caught off-guard by the change in direction. (See Stakeholders Cry Foul on MISO’s Resource Accreditation Pivot; FERC Affirms MISO’s Seasonal Auctions, Accreditation.)

During a Feb. 28-March 1 Resource Adequacy Subcommittee (RASC) meeting, MISO adviser Davey Lopez said staff still believes a direct loss-of-load approach is an improvement over the status quo’s accreditation. He said MISO’s responsibility is to accredit resources based on their availability at times of greatest risk, even as that risk profile fluctuates.

“We know that there’s a rapid rise in solar coming, and we know that solar is going to shift periods of risk to late-afternoon and early-morning hours,” he said.

Lopez said a direct loss-of-load methodology balances known operational risk with probabilistic future risks.

“It’s a wide range of reliability risk that we’re capturing, and that’s why we’re proposing the direct LOLE approach. Change is coming; risk is shifting,” he said, adding that the design “better informs the future” while providing stability now.

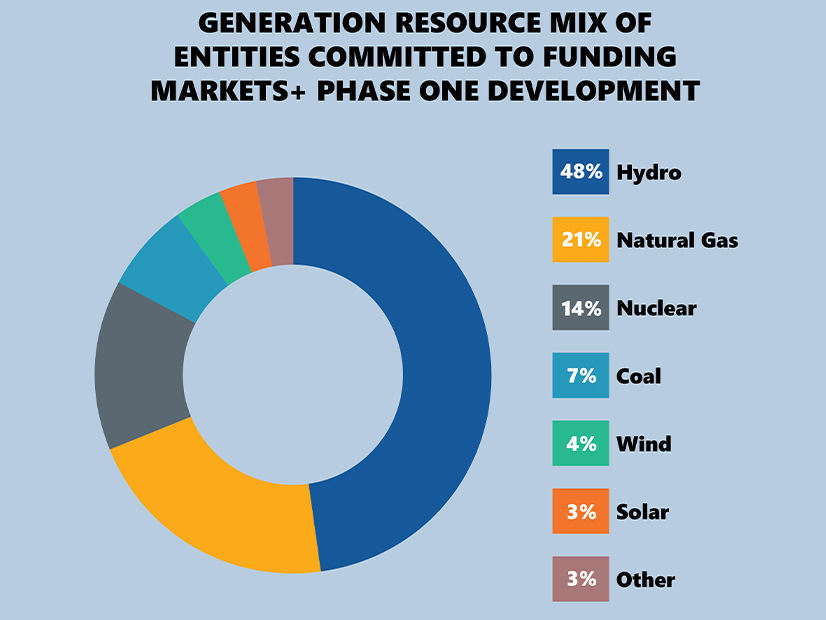

MISO currently has 23 GW of solar resources with executed generator interconnection agreements that have yet to come online.

Lopez said MISO will propose a three-year transition to the accreditation method, which aligns with an influx of in-service dates for solar generation. It intends to seek the design’s approval from FERC by the end of the year.

Some stakeholders said it’s inappropriate for staff to send forward signals with accreditation instead of simply reflecting a resource’s capacity contribution. They said effectively reducing solar generation’s capacity credit to zero isn’t the solution during the clean energy transition.

Entergy’s Wyatt Ellertson asked whether the RTO intends to incent the market to cease investment in the solar fleet by assigning it little to no capacity value. He said if all MISO’s solar is retired, the daytime risk that solar had mitigated will resurface.

“Accreditation needs to capture availability during reliability risk hours. Period. It’s as simple as that,” Zakaria Joundi, director of resource adequacy coordination, said. “We’re not looking into why the risk is shifting. We’re looking into the risk hours and the reliability contribution of all resources.”

January’s tense accreditation discussion gave rise to two stakeholder motions introduced at the RASC: one denouncing the direct loss of load approach and another calling on MISO to share analysis behind its accreditation philosophy.

MISO’s environmental sector said the grid operator has displayed a “relative lack of transparent data supporting the proposal,” with stakeholders not privy to “any of the probabilistic analysis supporting” a change in resource accreditation.

The sector added that stakeholders don’t yet know which risky hours would be singled out under the direct loss-of-load approach.

“The best way to resolve these concerns is through the evaluation and discussion of transparent analytical data supporting MISO’s proposal, rather than discussion guided mostly by narrative,” sector representatives said.

“I think we’re a long way from understanding how this actually works,” Minnesota Power’s Tom Butz said in agreement. “It can’t be just platitudes of how the system risk is changing.”

Sustainable FERC Project senior advocate Natalie McIntire said staff appears “too wedded” to the direct loss-of-load approach.

WEC Energy Group’s Chris Plante also lodged opposition to the design with a stakeholder motion. He said, “any marginal approach to resource accreditation is inconsistent with MISO’s existing resources adequacy construct.”

Plante said MISO’s current prompt-year capacity auction design doesn’t pair well with an accreditation that attempts to send investment signals. He argued that the capacity auction design is residual in nature and was never intended for members to fully procure their capacity needs.

Senior VP Makes Rare RASC Appearance

MISO Senior Vice President Todd Ramey made an unusual visit to the RASC meeting. He reminded stakeholders that MISO Midwest last year came up short against its planning reserve margin requirement in the capacity auction. He said while installed capacity additions are on the rise over the past five years, accredited capacity is on a downward slide.

As a result, Ramey said, the methods for counting available capacity are more important than ever.

“That is the primary reason we’re having discussions about how we approach accreditation,” he said.

MISO Senior VP Todd Ramey | © RTO Insider LLC

MISO Senior VP Todd Ramey | © RTO Insider LLCA capacity shortage may play out again this year in the seasonal auctions held at the end of March. The RTO reported that Illinois’ Zone 4, Missouri’s Zone 5, Indiana’s and Kentucky’s Zone 6 and Michigan’s Zone 7 appear to have smaller amounts of accredited capacity available this summer versus their planning reserve margin requirements. MISO Midwest has almost 98 GW in accredited capacity to meet more than a 99-GW requirement, staff projected. They said the region will likely require assistance from either load-modifying resources, MISO South’s predicted capacity excess, or external capacity contributions to avoid a deficiency.

While other seasons show zonal deficits in midwestern zones and Texas’ and Louisiana’s Zone 9, no other season exhibits risk for a region-wide capacity shortage.

MISO’s Durgesh Manjure said he couldn’t conclusively say whether the grid operator will avoid a shortfall in the capacity auctions.

“System risk is shifting from being driven by peak load today, to being driven by the unavailability of weather-dependent resources — primarily solar — in the future,” he said.

McIntire cautioned MISO against categorizing resources as either strictly “weather-dependent or controllable,” saying “that doesn’t serve anyone well.”

“Wind and solar are controllable,” she said.

Ramey said MISO agrees that other kinds of resources beyond wind and solar can be weather-dependent.

Customized Energy Solutions’ David Sapper said MISO could adopt the phrase, “dependably capable of ramping up,” to describe the resources it’s looking for.

Butz asked Ramey how MISO intends to address the “common conclusion” that there’s a gap between the intermittent resources in the IC queue and the level of on-demand resources it needs.

“I’m taking advantage of your title in this organization to ask how this plays out,” Butz said.

Ramey said MISO and members must enter a “paradigm change” in reliability planning. He said staff stands ready to work with stakeholders on an appropriate accreditation process and implementing a sloped demand curve to better value capacity in the seasonal capacity auctions.

“MISO doesn’t make retirement or investment decisions. You all do,” Ramey told stakeholders. He said, “all MISO can do” is provide its most accurate insights to inform decision making.

Clean Grid Alliance’s Beth Soholt said MISO hasn’t adequately explored the reliability value of the energy storage and hybrid resources in the IC queue. She said the spike in storage queue applications is a response to the RTO’s call for dependable resources.

“It might only be four-hour batteries, but we haven’t fully the run the ground in what batteries can do for the reliability problem,” Soholt said. “Saying we don’t have the right resources in the queue, that’s not the case.”

Bill Booth, a consultant to the Mississippi Public Service Commission, disagreed that MISO isn’t trying to guide generation investment decisions, noting the RTO is considering marginal, declining capacity credits for solar generation as more come online. Booth said the design effectively means the grid operator is “marching down the path” to making solar facilities energy-only and incapable of serving as capacity resources. In that case, they would be rendered useless in the footprint, Booth argued.

“I think you need to listen to the states here: no effect on cost and no effect on our [planning reserve margin requirement],” Booth said of changes to its resource adequacy construct.

Sapper said he took issue with MISO’s approach to resource adequacy, questioning why staff took liberties with its most recent regional resource assessment by envisioning “an optimistic, or ‘best case’ view” of capacity additions. He questioned why projections differed from MISO’s annual resource adequacy survey that is conducted in partnership with the Organization of MISO States. (See OMS-MISO RA Survey Says Supply Deficits Could Top 10 GW by 2027.)

Sapper asked whether MISO is angling for a regional resource-planning process.

“There’s no hidden agenda here,” Ramey said. “We realize we don’t have authority to make these decisions. The only possible path forward here is to partner with those who are in the driver’s seat on investment and retirement decisions.”

“I’m not buying it,” Sapper responded.

“I think we’re at an inflection point in the history of MISO,” Plante argued.

Plante said the capacity market has evolved from its “humble beginnings” of a voluntary reserve-sharing group among load-serving entities. He said MISO and stakeholders should reestablish what they want from their capacity market.

“Do we want a full-blown capacity market? If we do, I think we need to stop putting lipstick and eyelashes on our current RA construct,” he said. “We need to start over from the ground up.”

Plante said a full compulsory capacity market might mean that MISO conducts forward auctions.