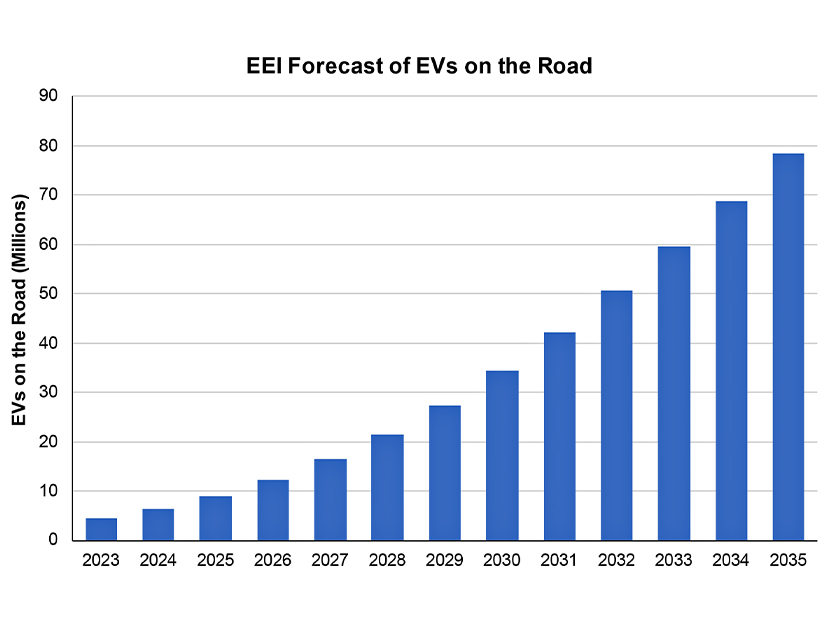

Citing predictions of a 20% rise in New Jersey’s electricity demand by 2034, state officials laid out an infrastructure plan to tie offshore wind projects to the grid at a public hearing Oct. 1 amid skepticism about the safety of running high-powered cables through residential areas.

Speakers from the New Jersey Board of Public Utilities (BPU) said at the hearing on the agency’s OSW infrastructure solicitation that the state needs extensive support for the dramatic increase in electricity supply to meet demand.

The BPU said coordinated developments to tie three or four projects to the shore, instead of several developments each running their own cables inland, would be more efficient, less disruptive to the community and could save hundreds of millions of dollars. The agency will collect comments on the plan until Oct. 15.

“We’re talking about 15,000 GWh of electric demand,” said Bob Brabston, BPU executive director, of the expected increase. “That’s driven by a host of things, including economic development through port electrification, data centers, the growth in electric vehicles, larger homes and population growth in the state.”

The BPU seeks proposals on how to build a corridor linking the Sea Girt National Guard Training Center on the shore, to infrastructure under development at Larrabee Collector Station inland. That station would link to the grid and was approved in an earlier $1.07 billion infrastructure solicitation. (See NJ BPU OKs $1.07B OSW Transmission Expansion.)

Four developers have submitted proposals for the second infrastructure solicitation, which the BPU launched in November 2023. The BPU said it expects to pick projects in the coming weeks, with construction expected to start in 2027 and end in 2029. The developers would build duct banks, conduits or pipes through which the cables run, and cable vaults, which are concrete boxes that house the connection point of two long stretches of cable and can serve four offshore projects, with the actual cables installed later.

A series of speakers at the hearing — held at the office of the International Brotherhood of Electrical Workers Local 400 in Wall Township, N.J. — said they were worried about the community disruption from laying cables and the safety of having them so close to residences. The BPU said about 450 people signed up to attend live, and an additional 75 registered online. Environmental groups and other OSW supporters held a rally before the event.

Mayor Don Fetzer of Sea Girt and Mayor Mike Mangan, of neighboring Manasquan, said resident concerns were widespread and urged state officials to consider the demands of local communities.

“This is not anything against wind turbines,” Fetzer said. “We’re not against alternative energy. What we’re against is more the process, and how they came into our streets when there are other (possible) areas that we feel are well known.”

He said the borough had spoken to the four developers and that officials attended a meeting of 600 people a few weeks ago organized by a group called Stop the High-Risk Power Cables.

From the outside, the cable route landing point “seems like a natural place owned by the state, not a parkland, nothing like that,” he said. “And what has always been infuriating to us as a town is it would make a hard north turn after they made the beach and run into Sea Girt proper on our residential streets. And that’s been the main focus of our complaints and concerns.”

The exact route has yet to be determined, the BPU said.

Changing Strategy

The BPU initially sought offshore infrastructure with the onshore solicitation conducted under FERC Order 1000’s State Agreement Approach (SAA). But the BPU changed its plan and decided the offshore infrastructure — known as prebuild infrastructure (PBI) — should be part of the state’s third OSW solicitation. The BPU then shifted course again in October 2023 to create a separate infrastructure solicitation, and in February initiated a second SAA. (See NJ Revamps Third Solicitation OSW Connection Plans.)

BPU officials said at the hearing that offshore wind is needed to meet the demand increase because New Jersey relies on 6,000 MW of electric power brought in from out-of-state generators. Much of the imported power is produced during critical periods by coal plants, agency officials said.

The BPU since 2019 has completed three OSW project solicitations and approved five projects. It is midway through a fourth solicitation, with a fifth expected to begin early in 2025. Danish developer Ørsted withdrew two of its projects a year ago, while another project approved in the second solicitation, the Atlantic Shores, is now the state’s most advanced of three remaining projects.

Underground Drilling

The PBI solicitation seeks proposals to build two 320-kV transmission lines and two 525-kV transmission lines. Duct banks would be buried five feet below ground, BPU officials said. And there would be no trenches or excavation on the beach. Instead, horizontal channels would be drilled 60 feet beneath the beach and pipes inserted, ready to be filled with cables, officials said.

“There’s no excavation at the beach,” said Nicolas Baldenko, an engineer for consultant Levitan & Associates, which is helping the BPU evaluate the submissions. “Beach landings for cables everywhere around the world, whether it’s power or communications, those are always done nowadays via something that’s called horizontal directional drilling,” he said.

Katharine Perry, BPU’s deputy director of offshore wind, said the agency will evaluate the infrastructure projects based on their viability and cost and to ensure “any successful project results in the least disruptive approach.”

To that end, “during construction the selected developer would be responsible for ongoing and active communication with local communities to ensure any construction activities follow all requirements to minimize disruptions and maintain the highest safety standards during construction,” Perry said.

BPU officials cited several existing examples of similar high-voltage cables in the New York-New Jersey area, most prominently the Neptune Regional Transmission System, a 5,000-kV direct current underground cable that runs from Sayreville, N.J., to Jones Beach on Long Island.

Magnetic Field Fears

Those examples did little to quell residents’ fears. Several speakers focused on possible health damage from high-voltage electricity cables running close to their homes and of a proposed route they said would take the cable through an EPA Superfund site formerly occupied by two dry cleaning operations, White Swan Cleaners/Sun Cleaners.

“A program of this magnitude and proximity to a developed community is untested and consequential health and safety issues have not been adequately established,” said Fred Marziano, a Sea Girt resident. He said the EPA has said, with regard to the Superfund site, that “spreading of the contaminated plume in our groundwater would be very likely if disturbed.”

Manasquan resident Lynette Viviani said the cable would pass “30 feet from my living room.” She asked “what kind of monitoring” state and federal agencies would do to ensure the Superfund site did not spread pollution.

Glenn Hughes, another Sea Girt resident, said the existing cables cited by the BPU aren’t relevant because the voltage on the proposed cables is significantly larger. Moreover, the Neptune cable “does not go through a single residential neighborhood,” he said.

No one can say “with any certainty that this is going to be safe,” and “nobody living in America should have to live with that risk,” Hughes said.

The BPU earlier showed a video in which Benjamin Cotts, an engineer specialist in magnetic fields and cables, minimized the possibility of health impacts from the cables. Cotts, who works for an engineering and scientific consulting firm hired by the BPU, said the cables would carry direct current (DC), and not alternating current (AC), which is most commonly used and studied. Any discussion of electric-magnetic fields relating to AC is “completely irrelevant,” he said.

He said, “the cable construction and the burial below ground will effectively block any electric field from the cables,” and added that the DC magnetic fields created by the PBI would be too small to harm anyone.

The World Health Organization has determined the acceptable limit for DC magnetic fields is 4 million milliGauss (mG), he said. And “the upper range of the DC magnetic fields from the prebuilt infrastructure is expected to be less than one-half of 1%” of that level, he said.

BOEM Approval

In an unrelated development, BOEM announced on Oct. 1 its approval of the construction and operations plans for part of New Jersey’s most advanced project, Atlantic Shores South 1 and 2, which are 8.7 miles from the New Jersey shore and together will generate 2.8 GW of power. The company said they will serve 1 million homes.

“Securing these critical approvals enables New Jersey’s first offshore wind project to start construction next year and represents meaningful progress in New Jersey achieving 100% clean energy by 2035,” said Joris Veldhoven, CEO of Atlantic Shores Offshore Wind.