Is Cryptocurrency the Answer to ERCOT’s Market Volatility?

AUSTIN, Texas — An executive with the Texas Blockchain Council extolled the virtues of bitcoin mining as an answer to the ERCOT market’s volatility last week.

Steve Kinard, the council’s director of bitcoin mining analytics and president of the Bitcoin Mining Foundation, told the Texas Reliability Entity’s quarterly meeting of its Board of Directors on Wednesday that he has made more than a dozen visits to ERCOT’s nearby headquarters. That includes meetings of the grid operator’s Large Flexible Load Task Force, which is developing policies on how best to integrate the large loads into the market.

“We’ve been having a fruitful conversation there. … The desire there is really to have a discussion on how we can maximize the benefit for all Texans of having a flexible load that can respond to economic incentives and help balance the grid,” said Kinard, a self-described cryptocurrency skeptic turned advocate.

“This is both the traditional demand response, but we’ve also seen miners effectively provide frequency response that helps balance [the grid] in times of unexpected outages,” he said. “Those are two different avenues that we’ve explored in terms of ancillary services that the industry can use. We’re trying to bring more transparency around that, and I think a lot of progress is being made.”

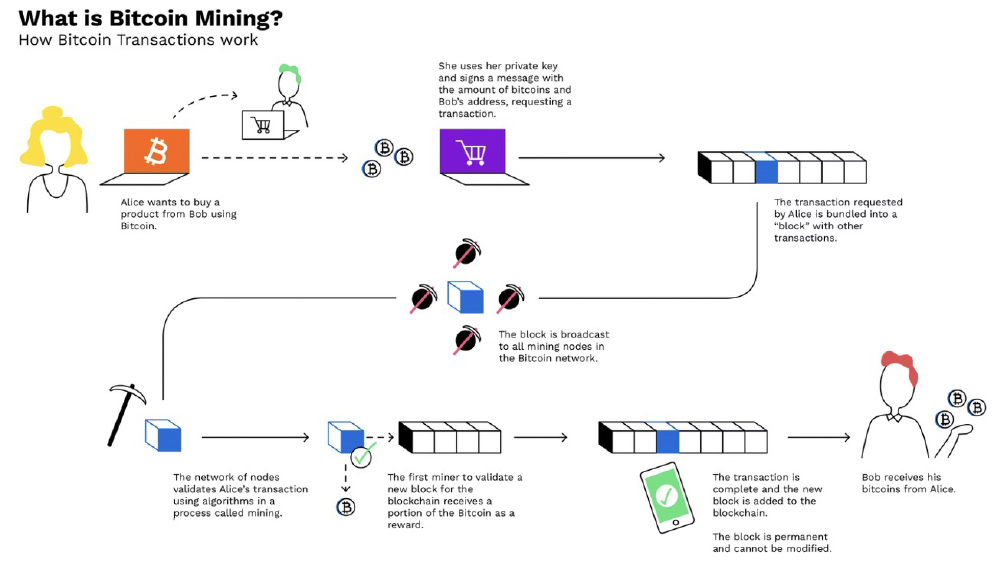

Bitcoin miners have flocked to Texas to take advantage of ERCOT’s low energy prices and the state’s business-friendly environment. The miners rely on the energy to run the massive banks of computers that produce the cryptocurrency. The computers solve complicated math problems, which then get added to the open-source blockchain; the miner is awarded bitcoins.

The average financial exchange can use more than 1,700 kWh of electricity, which is almost twice the monthly amount used by the average American home.

Kinard said mining isn’t a technical term, but “something that kind of snuck into the vernacular over time.” He said a white paper’s author used an analogy to gold miners who “expend energy to mine the scarce gold resource.”

“The bitcoin miners have to expend energy to bring new bitcoin into circulation, which is also a scarce resource,” Kinard said.

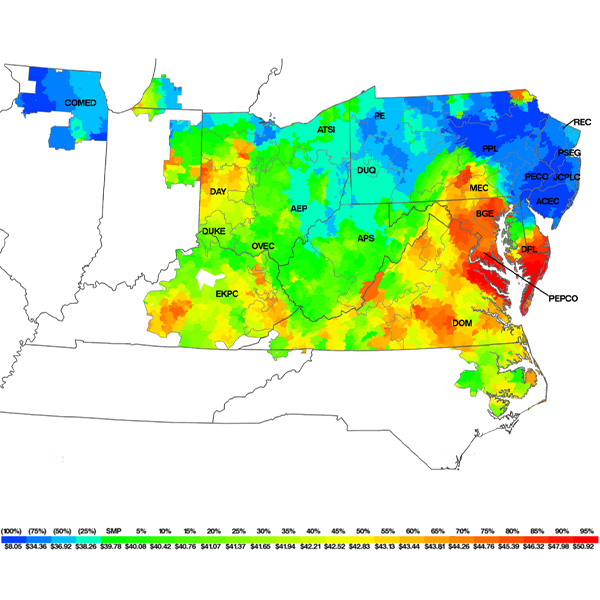

ERCOT has welcomed the industry and its terms because wind energy’s penetration has created market volatility. The coincidence of negative prices and a $5,000/MWh cap creates opportunities and the need for flexible loads, Kinard said.

“As ERCOT has evolved over time, particularly with more and more wind, we see more volatility and regional differences of power,” he said. “A lot of miners are seeking out power at the lowest cost to generate these computations. As result of that sort of [wind] boom that you’ve seen in Texas … often on a windy day, the power prices there will be zero.”

Kinard’s background is in oil and gas banking. It only took two years of due diligence for him to change his mind on cryptocurrency.

He went from “thinking bitcoin is a scam and ridiculous, as most traditional bankers and perhaps some of you in the room would understandably think,” he said, “and then 180-ing to really believing that this is a transformational opportunity for the industry and for the state of Texas.”

South Texas Transmission Project

AEP Texas CEO Judith Talavera address Texas RE’s Board of Directors. | © RTO Insider LLC

AEP Texas CEO Judith Talavera address Texas RE’s Board of Directors. | © RTO Insider LLCAEP Texas (NASDAQ:AEP) CEO Judith Talavera updated the board on the Lower Rio Grande Valley System Enhancement Project, a series of 345-kV lines and interconnections in South Texas, saying the project is expected to be in service by January 2027.

The Texas Public Utility Commission approved the $1.28 billion transmission project in September. It will add 351 miles of lines radiating from a new substation and another link into the Lower Rio Grande Valley. AEP, South Texas Electric Cooperative and Electric Transmission Texas are among those involved in the construction. (See Texas PUC Directs Tx Construction in Valley.)

The valley has long been a high-growth area in both population and industrial facilities, “as long as I can remember,” said Talavera, with 22 years at AEP. However, limited transmission capacity has trapped renewable resources’ output in the region and prevented additional energy from coming in.

“I don’t think I’m going to tell any of you in this room that we’re seeing a tremendous amount of change in our industry,” Talavera told the directors. “And with that change comes some risks, sometimes for a variety of reasons. …

“These projects will certainly help enhance the reliability and, most importantly, the resiliency of the system in that part of the state,” she said. “They’re also going to add more flexibility for how generation as assets can be dispatched or scheduled.”

Talavera said the project will also improve ERCOT’s ability to schedule transmission outages.

The project’s developers are currently conducting open houses and gathering feedback from landowners. They plan to file five certificates of convenience and necessity by September for various portions of the project, Talavera said. Construction is expected to begin late this year or early 2024, she said.

85 ‘System Events’ in 2022

Less than two years after collaborating on the joint NERC–FERC report on the deadly February 2021 winter storm, Texas RE staff will again engage with the organizations on a review of the December winter storm.

While the ERCOT region held together and met demand with plenty of supply to spare, it also saw fossil fuel outages exceed expectations and load forecasts underestimate projected loads. The grid operator sought federal permission to ignore air-quality limitations should it have to declare an energy emergency alert, a move that was never necessary. (See “DOE Grants ERCOT’s Emergency Request,” FERC, NERC Set Probe on Xmas Storm Blackouts.)

“We generally fared [well], but we are in the process of doing some follow-up on some of the things that occurred during [the storm], most notably with some concerns about how we can get our load forecasts analyzed or better … as well as, we had a number of units that had some issues,” said Mark Henry, Texas RE’s director of reliability services and registration.

He said staff “at least took a look” at 85 system events last year. Nearly half (41) involved loss of generation, while there were 16 physical security events. The most significant events were the December storm, the second Odessa disturbance in June, a loss of wind generation in the Panhandle in March, and a loss of generation and transmission in Texas City and its refineries and petrochemical-manufacturing facilities. (See NERC Repeats IBR Warnings After Second Odessa Event.)

Equipment failures accounted for 31% of the events analyzed, and weather was identified as the cause of 25%.

Texas RE added 27 registered entities during the year. The organization now has 310 such entities, the growth being driven by wind, solar and storage resources.

“They tend to want to be independent,” Henry said. “Each site wants to be registered as its own entity. That makes it hard on us.”

Regional Standards Process Approved

The board and Members Representative Committee both approved staff’s proposed Regional Standards Development Process (RSDP) document that will now be submitted to NERC for a 45-day public posting period. Assuming NERC’s approval, the document will then be filed with FERC.

The RSDP defines the open process for adoption, approval, revision, reaffirmation and retirement of Texas RE’s regional standard for ERCOT. The process also details how to obtain a Texas RE regional variance to a NERC reliability standard.

In other actions, the board approved nominations for several of its committees:

- Suzanne Spaulding, Milton Lee, Curt Brockmann and alternate Jeff Corbett to the 2023-24 Hearing Body, a non-standing committee that only meets when a contested case hearing is requested;

- Spaulding as chair, and Corbett, Brockmann, Daniela Hammons and Texas RE CEO Jim Albright to the Director Compensation Committee; and

- Crystal Ashby, Corbett and Hammons to the Nominating Committee.