Planning Committee

Update on 2022 Cost Allocation

VALLEY FORGE, Pa. — An error in the power flow case for several generators caused minor impacts to the 2022 annual cost allocations and zonal charges for the units, according to a presentation PJM’s Grace Niu gave at the Feb. 7 Planning Committee meeting (ER22-702).

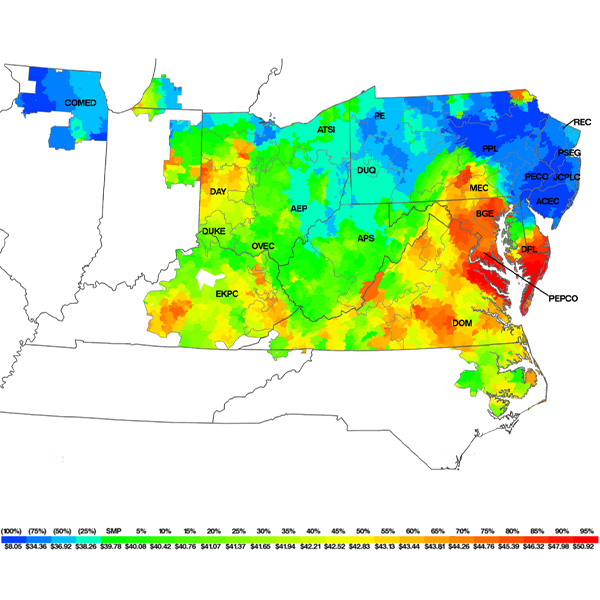

The error affected zonal allocations for 28 projects in 14 regions, with changes being below $1 million for all but three. Baltimore Gas and Electric saw its charges drop by $5.56 million, while APS increased by $1.66 million and Dominion went up by $2.62 million. Liu said the next steps are a FERC filing to make adjustments to the tariff to avoid similar incidents in the future.

Stakeholders Approve New TO/TOP Matrix

Stakeholders endorsed proposed revisions to the Transmission Owner/Transmission Operator (TO/TOP) Matrix, which defines the tasks TOs and PJM are accountable for to comply with NERC reliability standards. Gizella Mali, TO/TOP Matrix Subcommittee chair, said the changes do not add any new standards or remove any retired standards and contain only minor revisions identified in the subcommittee’s review.

The changes include updated document titles, versions and sections, as well as hyperlinks to reference tabs.

Transmission Expansion Advisory Committee

Dozens of Transmission Projects Canceled with Beaver Valley Extension

PJM’s Phil Yum reviewed the baseline impact of First Energy’s March 2020 announcement that it will no longer deactivate its Beaver Valley Nuclear Power Station, a two-unit 1,872-MW generator in Shippingport, Pa. (See Beaver Valley Nuclear Plant to Stay Open.)

Dozens of transmission upgrades had been identified in PJM’s Regional Transmission Expansion Plans (RTEP) since the company’s 2018 announcement that it intended to deactivate three of its nuclear facilities, including Beaver Valley. First Energy has also canceled the deactivation requests for the other two generators identified, Davis Besse and Perry Nuclear Generating Station.

The reinstatement of Beaver Valley has led PJM to cancel 22 baseline upgrades in the APS zone, four in the American Transmission Systems Inc. zone and five in the Penelec zone.

PJM Reviews Baseline Project Proposals

Dominion proposed two solutions totaling $17.8 million to address an overload identified at its 230/115-kV Bremo transformer in the 2027 RTEP light load case. PJM’s preferred solution is to rebuild the Bremo-Fork Union 230-kV line with double circuit structures, achieving a summer rating of 1,573 MVA and disconnecting the line between the Bear Garden substation and Bremo to extending the line 1.6 miles to instead terminate at the Fork Union. The $10.09 million proposal comes with a projected in-service date of Nov. 1, 2027.

The proposal includes the potential to retire the Bremo substation and reterminate all its lines at Fork Union if there is sufficient headroom in the future. Dominion’s second proposed solution would be to retire the Bremo substation now, relocate its lines to Fork Union and install three additional transformers at the substation at a $35.17 million cost.

Dominion also proposed a $7.71 million solution to a 300-MW load drop violation identified at its Evergreen Mills substation. The project would cut the Brambleton-to-Poland Road 230-kV line into two new lines that would run between the three substations, with Evergreen Mills in the middle. Approximately 0.59 miles of new line would be required to cut-in Evergreen Mills, with a total cost of $7.71 million. The project has an estimated in-service date of June 1, 2027.

Supplemental Projects

American Electric Power proposed a $154.53 million supplemental project to rebuild 46.1 miles of 345-kV line with deteriorating wood H-frame structures, some of which have broken in the past and caused conductors to fall to the ground. The faltering equipment is along AEP’s 51.1-mile Conesville-Bixby line in Ohio and is a major source of transmission into the greater Columbus area, making deactivation unviable.

Degrading of the laminated crossarms is a particular concern, with inspections showing decay and rot in the wood. AEP said there are few ways of identifying decay before it causes a loss of functionality and that, paired with the prevalence of delaminated crossarms on the line, many of the failures have “historically been catastrophic in nature.” The Conesville-Bixby line is the only in AEP’s eastern footprint that continues to rely on laminated wood.

Dominion presented two supplemental projects totaling $138 million to resolve two thermal violations at its Bristers substation in Virginia and on the line to the Nokesville substation. The first proposal would reconductor about 9.2 miles of the line between the two substations with higher capacity equipment to achieve a minimum normal summer conductor rating of 1,573 MVA at a $23 million cost, according to the company’s presentation to the TEAC.

The second half of their proposal is to install two 1,400-MVA 500/230-kV transformers and accompanying equipment at the Vint Hill substation and expand the site to the north to provide adequate space for the equipment. Dominion would also cut and loop Vint Hill into the 500-kV lines between the Loudoun substation and the Meadowbrook and Morrisville substations, as well as cut and loop the Rollins Ford-Remington CT 230-kV line to Vint Hill. The work comes with an estimated $115 million cost.