New Jersey is seeking projects totaling 1.2 to 4 GW — and potentially larger — in the state’s third offshore wind project solicitation planned for early 2023, according to a draft document released by the New Jersey Board of Public Utilities (BPU) on Thursday.

The Solicitation Guidance Document seeks proposals that are significantly larger than in the first two solicitations, which awarded projects totaling 1.1 GW and 2.658 GW, and expands the state’s already aggressive effort to become a key player in the growing offshore wind sector. The document presents a new solicitation schedule shaped to accommodate Gov. Phil Murphy’s decision in September to increase the state’s OSW target capacity from 7.5 GW by 2035 to 11 GW by 2040.

“The board seeks to promote robust competition in this third solicitation and future solicitations to support the continued development of the offshore wind industry in New Jersey,” the draft says.

The new schedule envisions four more solicitations after the third one next year, with each additional solicitation expected to award capacity of about 1.2 GW, though the BPU “may award projects above or below the target.”

The first project is expected to come online in the 2024-2025 period, with the final project up and running by 2038. The draft says that for the 2023 solicitation, the BPU “reserves the right to select less than 1,200 MW or more than 4,000 MW of qualified projects if circumstances warrant.”

The BPU will seek stakeholder input on the draft solicitation at a public hearing on Dec. 13.

Building an Industry

The requirements set out in the draft solicitation for project applicants show that New Jersey is looking to build upon the state’s OSW infrastructure already in development.

New Jersey awarded its first offshore wind project, the 1.1-GW Ocean Wind 1 developed by Denmark-based Ørsted, in 2019, and in 2021 awarded two more: the 1.148-GW Ocean Wind 2, and the 1.51-GW Atlantic Shores project, developed by a joint venture between EDF Renewables North America and Shell New Energies US. (See NJ Awards Two Offshore Wind Projects.)

The state has accompanied the project awards with an effort to position itself to serve other parts of the East Coast offshore wind sector by developing a logistics, marshalling and manufacturing hub. The heart of the effort is the development of what New Jersey officials say is the first custom-built wind port in the nation, committing $478.2 million to the project with bonding for another $160 million underway.

The wind port, located at Alloways Creek in Salem County, will include a 30-acre marshalling area for component assembly and staging; a dedicated, overland, heavy-haul transportation corridor; and a heavy-lift wharf with a dedicated delivery berth and an installation berth that can accommodate jack-up vessels. (See NJ Wind Port Draws Heavy Hitters.)

The BPU on Oct. 26 approved the expenditure of $1.07 billion for transmission upgrades to deliver 6,400 MW of OSW generation to the grid. The BPU picked the projects — the largest of which is an onshore substation known as Larrabee Tri-Collector Solution — from among 80 proposals submitted by 13 developers in response to a solicitation issued by PJM under FERC Order 1000’s State Agreement Approach. (See related story, FERC Approves PJM Tariff Revisions for SAA Cost Allocation.) However, the BPU largely awarded contracts for onshore work and left the offshore infrastructure mostly unallocated.

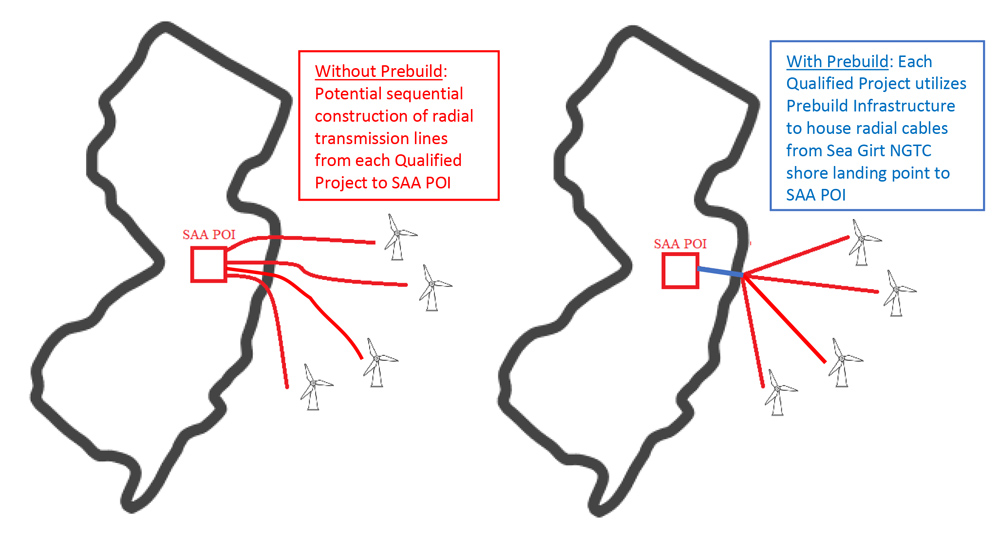

The draft solicitation seeks to fill that gap by requiring applicants to outline a “prebuild infrastructure” that would interconnect with the recently approved onshore infrastructure. Applicants would have to provide plans to build duct banks and access cable vaults for transmission to run to onshore interconnection points.

“Developers of future qualified projects would then install their cables through the prebuilt duct banks utilizing the prebuilt cable vaults, with minimal further disruption to the communities” around the interconnection points, the solicitation says.

Diagram of qualified project connections to point of interconnection (POI) with and without prebuild | NJ BPU

Diagram of qualified project connections to point of interconnection (POI) with and without prebuild | NJ BPU

Economic Impact

The solicitation also seeks to generate a range of project alternatives, requiring applicants to submit at least one 1.2-GW project while adding that they are “highly encouraged to submit applications covering a range of project sizes up to approximately 4,000 MW.”

Applicants would have to submit a package with a completed application form and an explanation of their project, as well as an in-depth analysis of its economic impact on the state. They would have to detail the “proposed investment in New Jersey offshore wind infrastructure, supply chain, labor force development” and other investments. They would also have to outline the economic development impact on communities in the state and provide detailed job creation information, including location, types and number of jobs it would generate, and wage or salary levels.

The proposal must also say whether the planned project will use the New Jersey Wind Port or “alternative infrastructure” located in the state or elsewhere.

“The BPU encourages use of the New Jersey Wind Port for project marshalling and for locating Tier 1 manufacturing facilities, where feasible,” the solicitation says.

The heart of the application, however, is the cost of the project and its underlying economics. Applicants must set out the level of the OSW renewable energy certificate (OREC) at which the developer believes the project would be commercially viable.

“OREC pricing will be on a pay-for-performance basis,” the solicitation said. “Payments will be made on a dollar-per-megawatt-hour basis.”

The OREC must reflect the total capital and operating costs for the project over 20 years, “including costs of equipment, construction, financing, operations and maintenance, and taxes,” offset by any state or federal grants or subsidies, according to the draft solicitation. “The OREC pricing proposal shall specify the nameplate capacity, expected energy output and assumed capacity factor for the proposed project, along with the number of ORECs that the project will produce.”