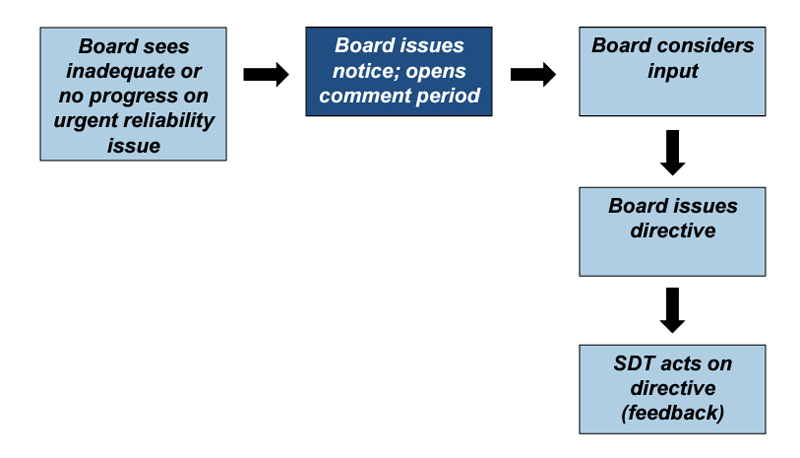

NERC Trustee Sue Kelly urged Standards Committee members last week to support giving the Board of Trustees the authority to issue standards when it sees inadequate progress on an urgent reliability issue.

In a year-end briefing to the committee Dec. 13, Kelly said the board is seeking to “address the increasing disconnect between the pace of industry change and the more deliberative pace of NERC’s processes — which seems to becoming increasingly apparent — without adversely impacting the key role of industry in our work.”

Kelly said the board will be considering “big issues” in 2023, including an expansion of registration requirements and re-examining the definition of the bulk electric system.

She also expressed support for a proposal to add a new Rule 322 to NERC’s Rules of Procedure to allow the board to issue standards on an “urgent and extraordinary” reliability issue. “Right now, only FERC has that authority,” under Rule 321 of the RoP, said Kelly, the board’s liaison to the committee.

Proposed Section 322 | NERC

Proposed Section 322 | NERCThe Standards Process Stakeholder Engagement Group, which proposed the new rule in October, noted that FERC has never invoked Rule 321. “The SPSEG believes that new proposed Rule 322 also should not need to be used, but believes that the rule must be in place to enable NERC meet its [Federal Power Act] Section 215 responsibilities in extraordinary circumstances.”

Kelly said the board is revising its proposal to address concerns expressed at the November meeting of the Member Representatives Committee. The revised package will be posted in early January for stakeholder feedback.

She quoted Trustee Roy Thilly, who said, “‘The proposed directive authority would be limited to extraordinary circumstances, and the board would be required to provide notice of our reasons for preliminarily concluding that a directive is necessary under the circumstances. Stakeholders would have the opportunity to comment on this notice before the board might take any action.’

“So, we built in a lot of process and comment opportunities here,” Kelly added. “Even after the board does take such action, industry would be responsible for drafting the standard. Only if the drafting and balloting process fails would staff then prepare a draft standard for the board’s review.”

Personal Observations

Kelly, the former CEO of the American Public Power Association, then offered what she called her “personal” observations, noting that NERC standards are developed by technical experts.

“They are not an off-the-shelf product by any means. We all understand this, but the outside world does not understand this,” she said. “And I am concerned by some of the recent public comments on our standards process. At FERC’s supply chain technical conference just last week, it was again noted that NERC takes a long time to develop and implement standards. We need to know that those views are out there, whether we agree with them or not, or if we think that time is justified or not. You know, perception can be reality.” (See FERC-DOE Technical Conference Considers New Standards for Supply Chain Threats.)

Kelly said those perceptions are one reason why the board needs the “fail-safe authority.”

“The authority supports NERC’s foundational ability to address urgent reliability issues under our self-regulatory model without FERC having to order NERC to do it. I honestly believe that this authority would very rarely, if ever, be used. But having it in the rules would give NERC the ability to carry out its standard setting responsibilities … if the standards process looks like it otherwise will clearly fail. So, I’m going to conclude by saying we need to collectively show the wider world why our unique regulatory model remains the best one for this industry.”