FERC continues to sanction MISO’s separate-but-equal postage stamp rate that is divided between its Midwest and South regions for major transmission buildout.

The commission rejected rehearing requests with an order Friday that keeps MISO’s subregional cost-allocation method for long-range transmission planning (LRTP) projects in place (ER22-995-001).

FERC said it continues to believe that it’s appropriate for the RTO to allocate project costs “broadly within a single subregion rather than solely on a systemwide basis.”

MISO is using a FERC-approved 100% postage stamp to load rate for the first two cycles of projects coming out of its LRTP studies. The costs are confined to the grid operator’s Midwest region, where the projects are physically located. (See FERC OKs MISO’s Bifurcated Cost-allocation Tx Design.)

When the RTO begins addressing needs in its South region during the final two LRTP portfolios’ work, it said it might use a new, more specific cost-allocation design that accounts for more beneficiaries. (See “Zeroing in on Cost Allocation,” ‘Conceptual’ Tx Planning Map Troubles MISO Members.)

MISO has already approved $10 billion in projects with its first LRTP portfolio. It may recommend up to $30 billion of work as part of its second portfolio.

Sequestering MISO Midwest from MISO South continues a transmission-planning tactic that staff has used since integrating the South in 2013. Through separate cost-allocation treatment and study deferrals, MISO shields its South region from footprint-wide system planning and allocation impacts.

American Municipal Power (AMP) and MISO’s industrial customers said FERC blindly accepted a “crude” cost allocation method that isn’t supported by analysis and will require transmission customers to foot steep bills, even when a project benefits a neighboring RTO. They argued that the commission neglected its duty to independently assess the rate proposal and said MISO failed to devise a more precise allocation when it had the means to do so.

The intervenors said FERC was wrong to characterize the new LRTP cost allocation as essentially the one used for 2011’s Multi-Value Project (MVP) portfolio with only “limited” changes. AMP argued there’s a “fundamental distinction between regional and subregional planning and cost allocation.” The MVP portfolio was allocated systemwide with a postage stamp rate in 2011, when the footprint didn’t extend beyond southern Missouri.

The industrial customers said that FERC “cannot transfer its duties to the RTO stakeholder process or assume that state regulatory support or majority support in the RTO stakeholder process indicates widespread consumer satisfaction or provides evidentiary support for a just and reasonable rate outcome.”

They also said that the “promise of a more granular cost allocation for future LRTP projects does not justify acceptance of an allocation of over $10 billion in costs that are not sufficiently tied to roughly commensurate project benefits.”

MISO’s first LRTP portfolio alone could raise costs by as much as $2.80/MWh, the customers said.

They also contended that MISO relied on “stale” data to back up its allocation design. The RTO used a Brattle Group analysis that showed the 2011 MVP projects’ benefits were overwhelmingly confined to the Midwest region. The consulting firm said that benefits’ spread will likely continue unless MISO secures more transfer capability between the subregions. (See “Brattle: South Benefits Unlikely from Midwest,” MISO Finalizes Long-range Tx Cost Sharing Plan.)

FERC said that MISO was not required to “re-justify the MVP category from scratch,” nor was it required to “analyze the data from future LRTP portfolios.” The commission pointed out that courts have repeatedly found that a rate should be reasonable, not that it should be “the most reasonable or the best one out of possible alternatives.”

“It is not unduly discriminatory for the [c]ommission to accept a subregional option while MISO continues to discuss with stakeholders a different approach for future projects,” FERC said. “Therefore, arguments concerning future cost allocation method filings are premature.”

The commission said MISO’s LRTP allocation divvies costs on a “basis that is at least roughly commensurate with the estimated benefits” and was the product of “an extensive, multi-year stakeholder process.” It also defended the Brattle analysis, highlighting its “large data set of 16 actual — not just proposed ― projects.”

It said industrial customers’ request to allocate costs to customers outside of MISO is beyond the scope of the order.

In planning meetings, some MISO stakeholders have voiced concerns of disparate treatment between LRTP portfolios, saying a different cost allocation for projects in MISO South will violate FERC’s cost-allocation principle that differing allocations must not be applied to the same class of projects.

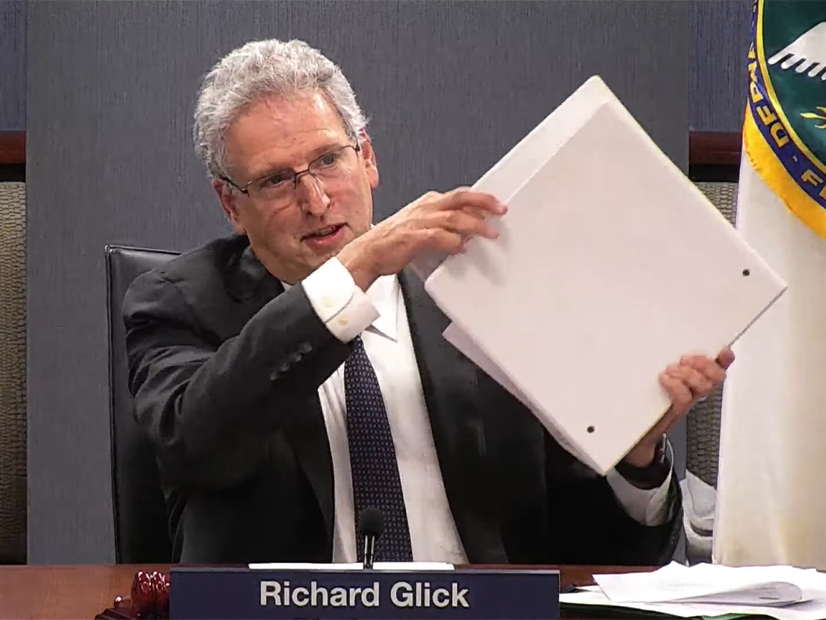

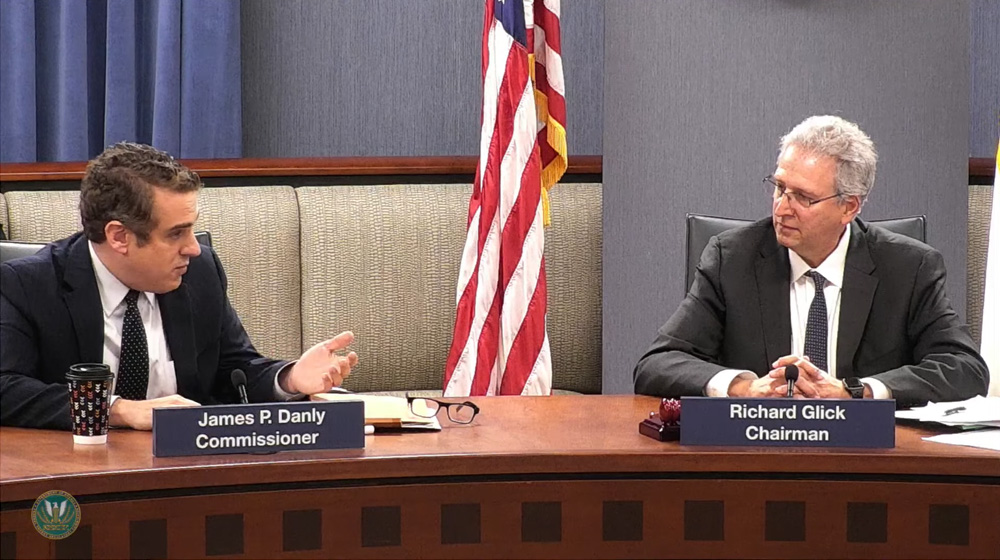

Commissioners James Danly and Mark Christie agreed with the order in short concurrences. Danly said although he had misgivings over the postage stamp method in general, he could not say definitively that its use is unfair.