Solar advocates last week urged the New Jersey Board of Public Utilities (BPU) to maintain or increase the incentives offered for new solar installations under the state’s Administratively Determined Incentive (ADI) Program.

As part of the Garden State’s 2021 Successor Solar Incentive (SuSI) Program, the BPU is required to conduct a reevaluation of SuSI incentive levels after the first year of its implementation. The ADI half of the program targets net metered residential, community solar projects and net metered non-residential projects under 5 MW. The second prong, the Competitive Solar Incentive (CSI) program, creates a competitive bidding process for solar renewable energy credits for their projects.

The BPU could recommend changes to the incentive levels, the share of incentives available to each block of eligible projects or other program rules based on public comment, modeling done by the Cadmus Group, and other factors. Written comments can be filed on the board’s Public Document Search page until 5 p.m. on Dec. 9 under Docket QO20020184.

While the program is on target to meet its net metered residential goal of 150 MW subscribed, it has struggled to attract non-residential and interim subsection grid investments, the latter of which consist of solar installed on brownfield, infill or landfill sites. Of the nearly 289 MW available for net metered non-residential, less than 55 MW was subscribed as of Nov. 10, while just one application has been received for the interim subsection market segment, accounting for a bit more than 5 MW of the 75 MW available.

The BPU says the significantly higher incentives offered under the state Transition Incentive Program likely account for the lackluster interest in net metered non-residential installations under than the ADI program.

At a stakeholder meeting hosted by the BPU Friday, Scott Elias, director of Mid-Atlantic state affairs for the Solar Energy Industries Association, said most of the non-residential developments that have come online did so under the TI program. However, he believes the “market underperformance” of the ADI is also due to historic price increases in the industry and commercial incentives being too low.

“It’s critically important for the BPU to pay attention to some of the justifications for increased incentive levels,” Elias said. “This year was successful from a solar installation point of view, but most, if not all, of those installations coming online are from the TI program, not the ADI program, and the long-term health of the New Jersey solar industry and our ability to meet New Jersey’s ambitious solar goals are really contingent upon the health of the ADI program.”

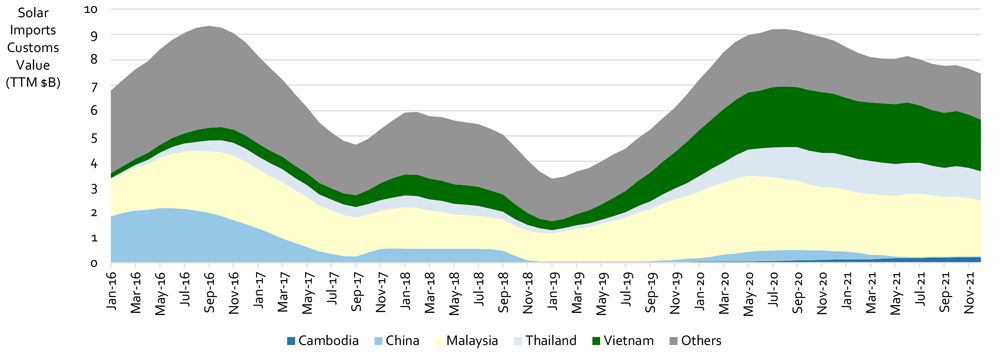

Elias noted that, since the start of 2021, costs for commercial installations have increased 15% while residential costs have gone up 12%, largely due to shipping constraints and other supply chain issues stemming from the pandemic and trade instability. He said those factors should be incorporated into the modeling done by the Cadmus Group, which is used to generate a report the BPU relies on to set its incentives. He recommended that the BPU increase incentives for the non-residential segment and at least maintain them at current levels for residential.

“The residential sector is the only sector performing well right now. But labor rates for the residential segment are increasing due to skilled labor shortages, and increased module pricing is increasing residential system prices. And that alone justifies increasing the incentive level — or at the very least maintaining the incentive level, which is my recommendation,” Elias said. “I want to be clear that it would be a mistake if the BPU reduced the residential solar incentive to moderate market activity and throttle development to avoid reaching arbitrary market segment allocation.”

‘So Many Variables’

Fred DeSanti, executive director of the New Jersey Solar Energy Coalition, said he trusts Cadmus to identify proper figures and metrics for its recommendations to the BPU, but he’s concerned the board will choose to throttle residential incentives to push for the rate of installations under the program to remain at the target. He encouraged the BPU to find a flexible approach in the middle of the two options of reducing incentives or leaving them in place and closing the market when subscriptions reach the 150-MW mark.

“That’s of great concern to me because nobody knows what the build rate’s going to be next year. Nobody knows if a recession’s going to come,” DeSanti said. “There’s so many variables out there that no one can predict accurately. I really am concerned about the fact that we could end up getting to a tipping point” with large-scale layoffs for residential solar companies.

Kyle Wallace, vice president of public policy and government affairs at PosiGen, shared those concerns, saying the Cadmus models seem reasonable and aligned to what he’s been seeing in the residential market, with cost estimates increasing 10% to 20% to reflect the rising costs of capital and labor.

“I’m a little concerned now that we’re seeing that success and, from what I see, the ADI succeeded in a lot of its objectives on the residential side. And now we’re seeing that success as kind of a problem and we need to throttle that back,” he said.

The scale of incentives provided to solar projects has long been a point of contention in the formation of New Jersey’s clean energy initiatives, with developers arguing they’re too low compared with past programs and the state Division of Rate Counsel arguing they’ve tilted too far in favor of developers. The SuSI program combines incentives set at rates determined by the BPU with competitive solar renewable energy certificates through the CSI program to reduce the cost to ratepayers while still advancing the state’s aggressive solar goals. (See Proposed NJ Solar REC Program Wins Initial Support.)

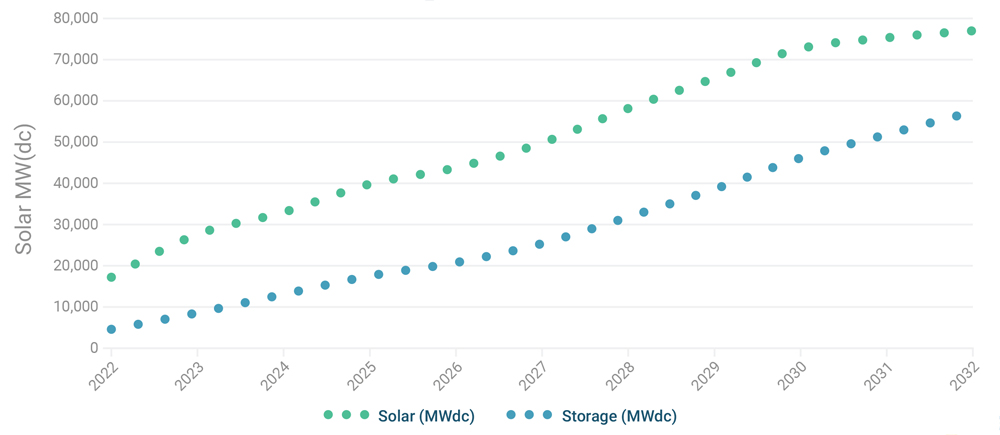

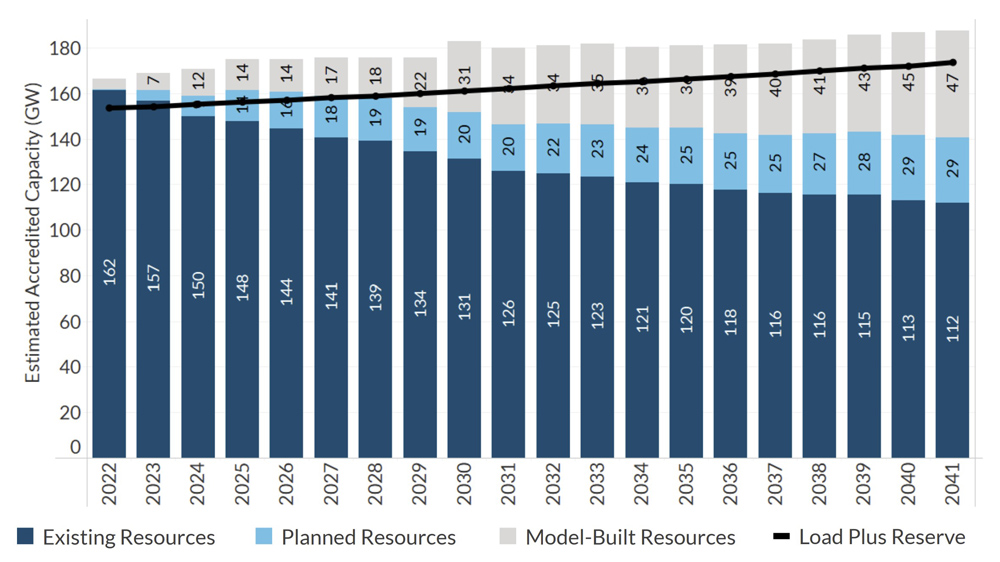

Though the state remains behind on reaching its goal of 12.2 GW in solar capacity by 2030, the pace of development has picked up. The state reached a 4 GW milestone in July and as of Oct. 31 had increased to 4.2 GW, according to the latest figures from the state’s Clean Energy Program. (See NJ Faces Challenges as Solar Sector Hits 4 GW.)