PJM opened a poll on Friday to gauge support for dueling proposals to revise the rules for load behind-the-meter (BTM) of a co-located generator.

The two packages, the first jointly drafted by Constellation Energy and Brookfield Renewable Partners and the second from the Independent Market Monitor, largely differ in how they would account for the power being consumed by the load when determining how much capacity the generator can offer into the PJM markets. Under Constellation’s proposal, the facility’s capacity offer would not be reduced because the energy would remain available for PJM to call upon when needed, with the BTM load curtailed.

The IMM, however, argues that the power consumed by behind-the-meter load should not be counted toward the generator’s capacity offer. Its package would subtract the net peak load from the unit’s installed capacity.

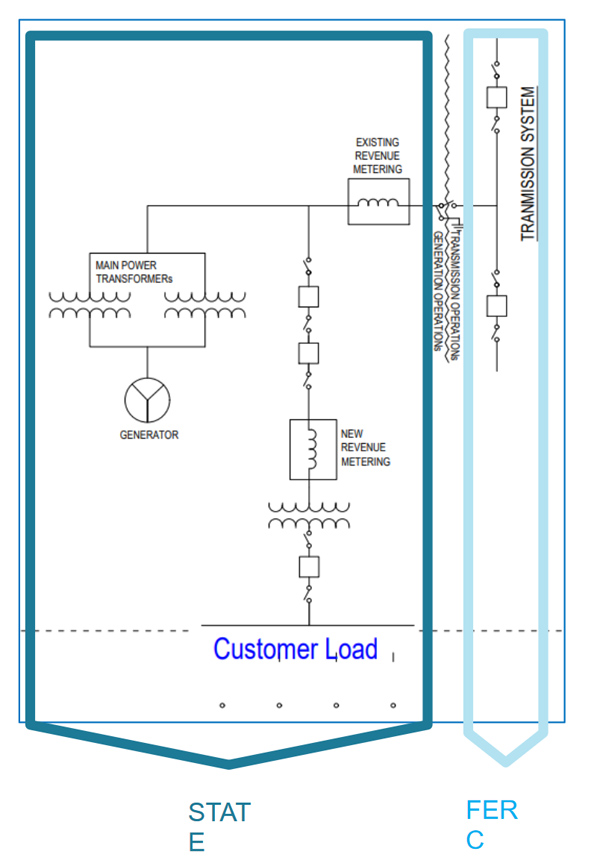

Constellation Energy displays the envisioned configuration of co-located load, which would not be directly interconnected with the PJM grid. | Constellation Energy

Constellation Energy displays the envisioned configuration of co-located load, which would not be directly interconnected with the PJM grid. | Constellation EnergySpeaking during a Nov. 17 Market Implementation Committee special session to discuss the packages prior to the opening of the poll, Constellation’s Jason Barker said his company’s language would expand customer choice by providing options for companies whose loads are curtailable and don’t require the full services of the transmission grid.

“What we have seen is we have new large commercial customers that are choosing to locate highly interruptible loads behind-the-meter of generation resources, both to reduce their costs and ensure physical supply of carbon-free power,” he said.

Since the amount of power produced and consumed would remain the same regardless of whether the load is placed behind or in front of the generator’s meter, Barker argued that there would be no impact on prices. The arrangement would also allow for the behind-the-meter to rapidly be curtailed and that power shifted to PJM when LMPs exceed the facility’s market offer, or when called upon by the RTO.

“The response time is the same as a [synchronized] reserve product. And I highlight for all of the folks on the call that we have many, many, many capacity resources that provide capacity commitments today for which their energy is callable not in minutes, but in hours or in some cases even days. So this is a superior product to most of the capacity commitments you’re getting in that respect,” he said.

PJM’s Independent Market Monitor Joe Bowring told the MIC that even if capacity prices remain unchanged, allowing generators to sell a portion of their energy to behind-the-meter customers while keeping that output in the capacity market would effectively reduce the amount available to PJM and send incorrect incentives to the markets about the amount of additional capacity needed to maintain reliability.

“The Constellation proposal is to sell the capacity twice, once to the behind-the-generator load and once to PJM customers,” he said

“What this is really doing when you think about it is taking a resource which is providing low-cost energy, 8760 [hours a year], and providing energy for a small number of hours a year. … That will create potentially very significant issues, depending on the level of the megawatt hours taken off the system,” he said. “Removal of this level of energy inputs at key points in the transmission system that was designed around these units would have extremely significant impacts on the grid. PJM should provide analysis of the impacts. PJM’s analyses to date do not address the real issues, including the combined impact of multiple such requests.”

Monitoring Analytics President Joe Bowring | © RTO Insider LLC

Monitoring Analytics President Joe Bowring | © RTO Insider LLCBowring said the rules need to be finalized before investments in the behind-the-meter load configurations under discussion start coming in, calling Constellation’s proposal a “sea change.”

To date, PJM has received requests to add 4,469 MW of co-located load behind-the-meter of 18 existing generation units, with a combined installed capacity of 15,800 MW. Of the new load requests, 3,906 MW is proposed to be configured to receive power from the generator without being interconnected to the PJM grid.

“The IMM’s approximate calculations show that removal of 20,000 MW of low-cost energy could raise energy costs for other customers by billions. There is no indication that the referenced loads would join PJM in the absence of the proposal. If the loads did join PJM, they should follow the same rules as all other load,” Bowring said. “There are current provisions for interruptible load that would address the stated goals.”

Studies have been completed for 864 MW of the co-located load requests, which are being treated as amendments to the generators’ existing interconnection service agreements under the existing rules, said Augustine Caven, PJM’s manager of infrastructure coordination.

Jurisdiction Over Co-located Load Disputed

The MIC also debated the issue of whether co-located load falls under federal or state regulation at the Nov. 17 meeting. Several stakeholders argued that such loads receive the benefit of synchronized reserve, regulation and ancillary services through the generator’s interconnection to the PJM grid, even if the load is not directly interconnected itself.

PJM Senior Counsel Chen Lu, who presented the RTO’s perspective that co-located load is state regulated, said during the Oct. 13 MIC special meeting that the issue is similar to the question of power consumed by generators.

“To me this really isn’t that different from the station power cases that FERC has decided. And in those cases when a generator is receiving station power, they may still be benefitting from the grid. But FERC has explained since those are not sales for resale, they weren’t FERC jurisdictional and those are ultimately state jurisdictional retail sales. And so just by virtue of the fact that they may have some benefit from the grid, doesn’t necessarily make it FERC jurisdictional,” he said.

PJM Director of Market Settlements Initiatives Lisa Morelli said a logical extension of requiring co-located load to pay for services such as synchronized reserve would be that generators could also then be required to pay that as well.

“I think if you continue pulling that thread, that is where you would land,” she said.