Texas regulators threw another curveball at ERCOT market participants last week, backing away from a market design they seemed to favor a year ago and moving toward a hybrid model recommended by commission staff.

Following an external consultants’ review of the Public Utility Commission’s proposed market redesign, staff urged the commissioners to pursue a performance credit mechanism (PCM) that requires load-serving entities to buy performance-based credits from generation resources. (54335).

Staff told the PUC during Thursday’s open meeting that the PCM design has elements similar to the load-serving entity reliability obligation (LSERO) that commission Chair Peter Lake has frequently pushed, but that it also introduces features “more consistent” with ERCOT market principles. Staff pointed to earned accreditation rather than an upfront administrative process as one example.

Staffer Ben Haguewood said PCM draws on “complementary elements” from other proposals in the commission’s blueprint, released last December. The blueprint recommended several design changes to “ensure sufficient dispatchable” generation is available in the ERCOT market to “meet reliability needs during a range of extreme weather conditions and net load variability scenarios.” (See PUC Forges Ahead with ERCOT Market Redesign.)

The PCM was one of six market designs that Energy and Environmental Economics (E3) and subcontractor Astrapé Consulting have been reviewing and modeling since the spring. It establishes a reliability standard and corresponding quantity of performance credits (PCs) that must be produced during the highest reliability risk hours to meet the standard.

LSEs can purchase PCs, awarded to resources through a retrospective settlement process based on availability during hours of highest risk, according to their load-ratio shares during those same periods. This allows generators and LSEs to trade PCs in a voluntary forward market, E3 said. Generators must participate in the forward market to qualify for the settlement process.

Alison Silverstein, Silverstein Consulting | © RTO Insider LLC

Alison Silverstein, Silverstein Consulting | © RTO Insider LLC“This study confirms that we can achieve even more dramatic improvements in reliability with minimal cost impact to consumers,” Lake said in a press release. “By combining the best elements of each design model into the [PCM], we create a system that ensures enough electricity when we need it most while incentivizing construction of new plants to deliver reliable power to Texas homes and businesses.”

Energy consultant Alison Silverstein told RTO Insider Friday that she was still working her way through the report but said she was concerned that neither the PCM nor the LSERO “give a clear, multi-year forward set of revenue” that would really spark investors’ interest.

“We don’t know what those critical hours are and the level of scarcity and what the price is going to be until afterwards. At the start of the year, the hours that you think might have been great might not be critical,” she said.

“We’ve already set up a scarcity price mechanism to pay more during hours of scarcity,” Silverstein said, referring to ERCOT’s operating reserve demand curve. “The PCM wants to pay for existing generators for the same hours, so it looks to me like it’s a double payment for performance during tight hours. That’s great for existing generators, but I’m not sure that it’s good for accepting an incremental increase over [the PUC’s first phase of market changes last year], which is like throwing money at existing generators.”

‘Detail Devils’

Beth Garza, a senior fellow with R Street Institute and ERCOT’s former market monitor, said there are rarely right or wrong answers when designing a market but “merely choices that will have consequences.”

“Ever the optimist, I think the PCM can be a workable mechanism,” she said. “The detail devils include one, capacity accreditation and two, the definition and number of ‘high-risk’ hours. I am also optimistic that PCM could provide another incentive for loads to consider their consumption during times of potential supply scarcity.”

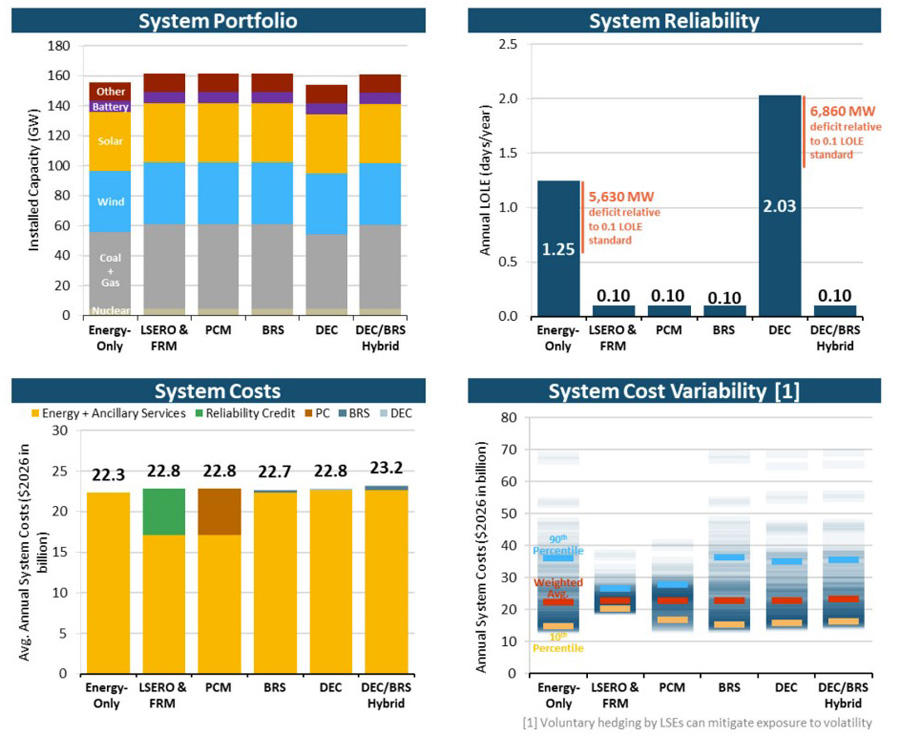

E3 and Astrapé compared each of the six market designs against ERCOT’s status quo energy-only construct. They said the current design results in a 1.25 loss-of-load expectation, above the industry standard of 0.1 days/year, and that it would retire 11.3 GW of thermal resources because of an assumed significant level of renewable and storage additions.

For its part, E3 recommended a forward reliability market (FRM) design that Stoic Energy principal Doug Lewin called a “straight-up forward capacity market.”

“Capacity-ish,” Silverstein said. “I don’t think they’ve found the magic solution.”

Comparisons of the market design alternatives. | E3 Consulting

Comparisons of the market design alternatives. | E3 Consulting

The FRM design establishes a reliability standard and identifies the reliability credits — assigned to resources using marginal effective load-carrying capability (ELCC) — needed to meet the standard. The forward market’s reliability credits would be centrally cleared by ERCOT based on a sloped demand curve, with costs allocated to LSEs based on pro-rata consumption during the highest reliability risk hours.

The PCM, LSERO and FRM constructs would add an incremental 5.6 GW of natural gas capacity, as compared to ERCOT’s current design, the study said. That would improve the LOLE to 0.1 at an incremental cost of $460 million over the energy-only construct’s total customer costs of $22.3 billion in 2026.

The study also looked at the backstop reliability service (BRS) and dispatchable energy credits (DECs), both proposed by the PUC last December, and a hybrid that merged both designs. The BRS would produce results similar to the forward-market designs at an incremental annual cost of $360 million; when combined with DECs, the costs rise to $920 million a year.

The DEC proposal’s eligibility criteria would reduce natural gas generation, according to the study, increasing the LOLE to 2.03.

Silverstein was among several analysts who noted the study looked at winter peak loads across 40 historical years (1980-2019) but did not include the 2021 winter storm that came within minutes of collapsing ERCOT’s grid. E3 said incorporating the extreme event as an “appropriate probability” was beyond the study’s scope.

She said the “strip of weather” E3 used also did not include this summer’s unending heat waves that led to dozens of new records for demand.

“They guarantee that they’re not going to get the conditions that are more challenging for reliability. And in so doing, they say, ‘Look, we have great reliability results,’” she said. “They’re doing that against a three-foot wet bar instead of a six-foot reservoir that is gradually, inexorably rising higher almost every year, in terms of the magnitude of extreme weather events. They’re not a valid test of whether these mechanisms will help us in what are the next set of heat waves.”

Silverstein was also critical of the study’s exclusion of battery storage, which is increasingly accounting for new requests in ERCOT’s generator interconnection queue. E3 included storage with wind and solar in netting out the resources from total demand in the models.

“Storage is a resource, not a bad thing, and it’s totally controllable. So why would you set it up?” she said. “We’re gonna have a crap ton of it. Storage is way too important a resource to play games with it.”

Silverstein, ERCOT’s Independent Market Monitor and other stakeholders will all have an opportunity to comment on the proposed market designs, which have largely been discussed and drafted this year behind closed doors. Staff drafted an initial set of questions that included:

- Would the PCM, having not been implemented anywhere else, present a significant obstacle to operating the ERCOT market?

- Would the PCM incent generation performance, retention and market entry?

- Is the 1-in-10 loss-of-load expectation a reasonable standard?

- Does ERCOT centrally clearing the market mitigate the risk of market power abuse?

- Should a short-term “bridge” product or service to be used to maintain system reliability should a market design be adopted that needs several years to be implemented?

Commissioner Lori Cobos added a question to the list related to the PCM’s costs — but not without some pushback by PUC Chair Lake.

“So you’re not satisfied with the cost analysis provided by E3?” Lake asked during the commission’s discussion.

“I would like for the stakeholders and the public to evaluate that cost run and give us their thoughts on the cost impacts of the PCM,” Cobos responded. “I would like the public, that’s going to be incurring costs with respect to this market redesign, to let us know what they believe are the cost impacts because we can’t just take the E3 cost-impact analysis at face value. We need to hear from the stakeholders in the market that are going to be operating in this market design.”

“Nobody up here is taking anything from E3 at face value,” Lake said, pointing to the hours the commission spent with its consultants “poking, prodding, questioning all of the inputs, all of the assumptions.”

“I don’t want the public to think that, in any way, this is just slapped together with some duct tape. This is hours and hours, months of analysis, iteration, and feedback to get to the assumptions that go into this baseline model,” Lake said. “That being said, no model is perfect, and no model can guarantee future outcomes. It’s, at best, an approximation with the best information we have on what future scenarios may look like,” he said.

The commission is limiting public comments and feedback to the E3 study, the PUC’s blueprint for market design and the commission staff’s memo. Comments are due by noon Dec. 15.

The PUC said it will review and “consider” public comments and feedback in preparing its final design plan. That design will then be shared with the Texas Legislature, which begins its 2023 session Jan. 10.

The state Senate’s Business & Commerce Committee will get a first crack at the proposal when it holds a hearing Thursday on the ERCOT market.

PUC Sides with ERCOT Board

The commissioners also agreed on a statement of input in response to ERCOT’s proposed bylaw amendment that eliminates corporate members’ right to vote on future proposed amendments to the governing documents (52933).

ERCOT in September requested market participants’ feedback on a bylaw amendment proposed by the Board of Directors. The ISO received nine sets of comments, many of which “disagree with the board’s proposal,” General Counsel Chad Seely told the PUC. (See ERCOT Stakeholders Wait on Bylaw Amendment Changes.)

Noting that the state law requires that ERCOT bylaws reflect the commission’s input, the PUC said the board is empowered to amend its bylaws without obtaining its members’ affirmative vote and that the board has the sole authority to make bylaw changes, subject only to the commission’s approval.

Legislation passed in the wake of last year’s winter storm replaced ERCOT’s 16-member hybrid board that included directors from various market segments with an 11- member independent body without segment representatives. It also created a selection committee, comprised of representatives appointed by political leadership, to find and nominate the independent directors.

“The legislation from the last session made it absolutely, abundantly clear … that ERCOT ought to be governed by the independent board that is selected by the selection committee,” said Lake, who filed a memo in the docket. “The bottom line is while our market participants and corporate members play a critical role and offer a unique insight that no other source can provide, the legislature was clear that they need to continue to contribute to the ERCOT market process and be a part of those deliberations, but they can no longer control the market in which they generate profits.”

The commission agreed with a modification to the amendment clarifying that the stakeholder Technical Advisory Committee, which makes recommendations to the board, cannot be eliminated unless directed by the commission.

Commissioner Jimmy Glotfelty said he has seen RTOs become “extremely powerful and insulated” and organizations where “many projects go to die.”

“Not this [grid operator] … I believe it’s our responsibility in conjunction with [ERCOT] to make sure that they’re all doing what we see fit to ensure that we have a functioning reliable and economic marketplace and that the bylaws, that input from TAC, are part of that process,” Glotfelty said. “The professionals on the board that come from power and gas know that they don’t know everything, so having TAC, having industry input, will be critically important for them as we go forward.”

Entergy Plant Approved

The commission approved Entergy Texas’ (NYSE:ETI) application to build its 1.22-GW Orange County Advanced Power Station in MISO South’s Texas footprint Southeast Texas, siding with an administrative law judge’s decision to remove the plant’s hydrogen capabilities (52487).

The PUC, citing rising labor costs and other inflationary pressures, removed a cost cap imposed during an administrative law judge’s approval of the project in September, saying it will revisit cost increases in a future rate case. The project’s costs have already risen from $1.19 billion to $1.58 billion in a year. (See “Entergy Power Plant not Considered,” Texas PUC Briefs: Nov. 3, 2022.)