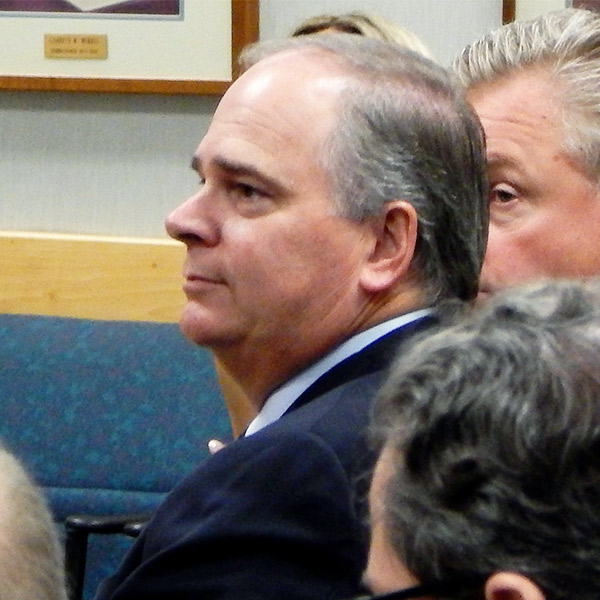

Kathleen Staks, chair of the Colorado Electric Transmission Authority (CETA), thinks the creation of an RTO is “imperative” for Western states to develop the transmission network needed to meet their clean energy and electric reliability goals.

Staks, who also serves as deputy director of Western Freedom, a self-described “grassroots and grasstops” coalition that is advocating for a Western RTO, also believes it’s just a matter of time before one or more organized market takes shape in the region.

Speaking Thursday on a virtual “Transmission Time” panel hosted by Americans for a Clean Energy Grid, Staks noted the “momentum” building in the West from the competing day-ahead markets being prepared by CAISO and SPP.

“I think what you’re hearing now, even from the utilities in public forums, is that we are on the path to an RTO — or several RTOs, which is probably the more likely sort of future state — where we have two different operators covering slightly different footprints in the West. But I think there’s more of an inevitability in the talking points that you hear at this point in time,” she said.

While Staks thinks the proposed day-ahead markets are a “great next step,” she said they can’t deliver the unified transmission planning and operational benefits of a full RTO.

Staks said legislatures in Colorado and Nevada “lit a fire” in 2021 when they each passed bills requiring their state’s utilities to join an RTO by 2030. (See Polis Signs Bipartisan Bill to Support Interstate Tx and Many Next Steps to Follow Passage of Nevada Energy Bill.)

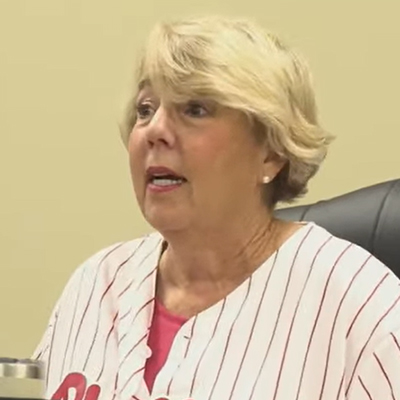

But when panel moderator Kristine Raper, a former Idaho regulator who is now vice president of external affairs at WECC, asked whether other states should follow suit and pass similar laws, Staks demurred, saying additional mandates aren’t yet necessary.

“Almost all of the utilities in the West are participating in these day-ahead market developments, and I think there’s enough other sort of pressure points — and almost even peer pressure, really — to keep things going,” she said.

Fellow panelist Jeremy Turner, director of New Mexico project development at Pattern Energy, said he could see some benefit in states legislating membership in an RTO but thinks a better approach would be for states to direct commissions and utilities to “force the RTO issue a little bit,” without specifying exactly how.

“California has done a good job with the Energy Imbalance Market [as] kind of a half-step to a formal RTO, but in order to fully build out the transmission system and align on all the decarbonization goals and meet those, I think it’s absolutely going take an RTO in the West,” Turner said.

CETA and RETA

That Colorado sees a vital link between a Western RTO and effective regional transmission planning is evidenced by the fact that the 2021 law (SB 72) requiring utilities to join an RTO also established CETA.

According to the law, CETA is an “independent special purpose authority” that can act as a transmission developer of last resort in areas that the state identifies as needing transmission — particularly those promising for the development of the renewables Colorado needs to meet its clean energy targets. In short, CETA will direct the construction of lines in areas where utilities are declining to build, with an emphasis on interregional projects.

“CETA has eminent domain authority and has the ability to build and own transmission projects,” Staks pointed out.

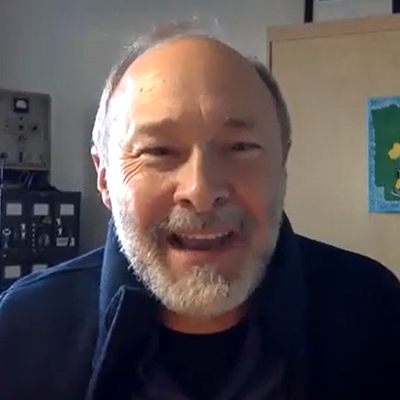

CETA was modeled on New Mexico’s Renewable Energy Transmission Authority (RETA), which was established in 2007 “to plan, develop finance and acquire utility-scale, high-voltage transmission lines and energy storage projects,” RETA Executive Director Fernando Martinez said during the webinar.

RETA’s mission, Martinez explained, is to help New Mexico develop the transmission needed to tap its extensive wind and solar resources, with an eye to serving both in-state needs and exports to neighboring states.

“Our whole [electricity] infrastructure in in New Mexico was set around fossil fuel plants taking the power to population centers, and so our renewable resources were in other parts of the state where very little transmission existed, and we knew that was a landlocked treasure,” Martinez said. “And the only way to access that was by building transmission and energy storage capacity.”

Because RETA’s jurisdiction ends at the New Mexico state line, the agency relies “almost exclusively” on its transmission development partners to advance lines through other states, Martinez said. He cited the example of Pattern Energy’s proposed SunZia project, a 550-mile, 525-kV bidirectional line designed to move wind output from eastern New Mexico to population centers in Arizona.

“So it’s really been up to [Pattern] to work with Arizona and get that project going in that state, and we worry about what’s going on in New Mexico,” he said.

But projects become “a lot more difficult” once they hit the state line, Martinez said.

“The question is, ‘Then what?’ … And that’s one of the primary reasons that we’re looking at a regional transmission organization and really promoting that and trying to socialize that idea, because I think that is the most effective way to build an upgraded flexible grid that’s geographically diverse, that’s meteorologically dissimilar, [and] that has as many interconnections as possible,” he said. “And then couple that with building utility-scale long-duration storage. I think that’s the only way you’re going to get firm capacity.”

Building Relationships

Apart from their shared views on interregional planning, the three panelists also agreed that transmission developers face similar on-the-ground hurdles in developing projects in different states across the West.

“I think the biggest challenge here in the West is getting the permission to build the generation; getting the permission to build the transmission and storage projects,” Martinez said. “And what I mean by that is there’s a lot of laws that must be complied with that a lot of times are run sequentially, rather than concurrently, and so you have a lot of difficulties in the permitting process at the local level, the state level [and] the federal level.”

Martinez ticked off the various agencies and stakeholders that developers might have to deal with to gain permission for an energy project in New Mexico, including local governments; the state’s Public Regulation Commission (for reliability requirements); FERC; the U.S. Bureau of Land Management or Forest Service (for environmental impact statements); tribes; military bases; and private landowners. All told, permitting across various agencies can stretch project timelines to 10 to 20 years, he said, a problem for states attempting to meet climate goals by 2030.

“We need to find a way to streamline that process without cutting any corners whatsoever and — hopefully working with the permitting agencies; we can do that by simply by cutting down sequential permits versus concurrent permitting,” Martinez said.

Martinez expressed gratitude for the efforts of the interagency Federal Permitting Improvement Steering Council, which has been tasked with speeding up federal infrastructure permitting. Pattern’s Turner agreed that the council has been “incredibly helpful” but thinks increased FERC siting authority will be needed to advance transmission projects in the West.

Turner is also encouraged by the creation of state agencies such as RETA and CETA, which have the eminent domain authority that independent developers lack.

But Staks said any transmission authorities set up by Western states must still deal with opposition from landowners and regional stakeholders, she added.

“People don’t want transmission lines in their backyards,” she said. “They don’t want wind projects; they don’t want solar projects. They don’t want oil and gas pipelines; they don’t want anything. They want to be able to sort of maintain their viewshed or their neighborhood or whatever.”

She said community involvement and relationship-building around proposed projects will be important tools for CETA.

Turner said Pattern Energy, which has about 750,000 acres of private and state land under lease for wind projects, has found ranchers to be among the strongest supporters of new energy projects.

“Most of the ranchers that we have properties leased [from] are seeing this as a way to supplement their income and actually continue their way of life,” he said. “And they’re actually the ones that are trying to help advance, in many cases, the transmission development, because they know that is their path forward to continuing that way of life and seeing wind built on their property.”

Ordering the List

Raper asked Staks how CETA might approach working with neighboring states that do not share Colorado’s political views and climate goals.

Those discussions will come down to appealing to economics of a project, Staks said, imagining such a conversation with a more politically conservative state: “It’s your energy resources, Montana. You have the opportunity to sell those to someone else.”

Staks said she takes a similar approach when she stumps for a Western RTO.

“When I have conversations with different people about the benefits of an RTO … the list of priorities [and] the list of benefits [are] the same. You’re just sort of reordering depending on who you’re talking to and where you are,” she said. “When you’re in Colorado and New Mexico, those climate benefits are going to be really, really important to most of the decision-makers that we’re working with. If you’re in Idaho and Montana and Wyoming, you’re going to prioritize economics and reliability.”

“Everybody’s going to get those all of those benefits. I think part of it is the order [in which] you’re making this list,” she said.