CAMBRIDGE, Md. —

PJM’s biannual General Session last week focused on how to ensure both reliability and equity during the transition to a clean energy-based generation mix.

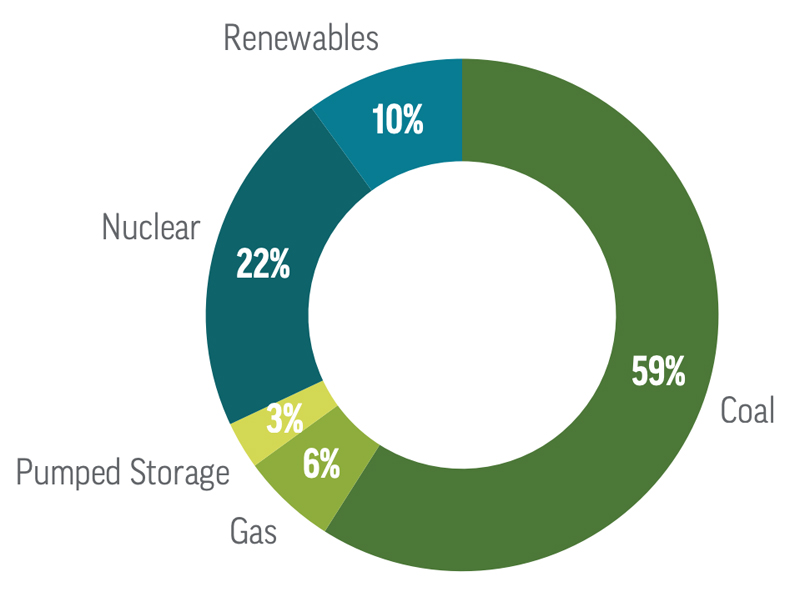

NERC CEO Jim Robb moderated the first panel, introducing it by saying that reliability, environmental impact and affordability will all be challenged during the transition to relying on renewable power. Over the next 10 years, NERC expects to see increased risk from extreme weather and tight supply margins as the decommissioning of fossil fuel generation runs up against increasing demand from electrification.

Jeff Craigo of ReliabilityFirst said the regional entity has had success with an initiative to survey generation facilities’ winterization efforts, which has allowed it to share those experiences across the industry.

Peter Brandien, ISO-NE vice president of system operations and market administration, said the RTO is focusing less on specific percentages of capacity, and more on understanding what kinds of resources are available and their characteristics.

The RTO’s response to the transition has centered on four pillars, Brandien said: handling the influx of clean energy resources; a supply of balancing resources to preserve reliability; maintaining resource adequacy to meet demand when solar and wind power aren’t available; and having adequate transmission to import more renewable energy and to ensure renewable resources aren’t constrained when they’re needed.

Resource adequacy in particular has been challenging within New England. Unlike other areas of the country where the problem is getting through the peak load day and resetting for the next, New England has limited storage (LNG, oil, hydro or long-duration batteries) and can run short of supply, particularly during extended cold weather. Siting has also proven to be another challenge, and Brandien noted the struggle of the New England Clean Energy Connect transmission line.

Confidence in the reliability of the grid is crucial to industries looking to make investments, which Brian George, lead of Google’s energy regulatory and policy engagement team, said is reflected in the company’s heavy investments in PJM.

“Our users expect and demand reliability all the time and everywhere, so that’s at home, that’s in the office. … Whenever they pull up the browser, they expect us to be there,” he said.

To meet the company’s climate goals, he said Google has shifted its focus to the procurement of energy for when and where it’s needed, rather than the installation of additional renewable resources. He said the open markets, which have created affordable and reliable power in PJM, will play a key part in addressing that focus while meeting its growing demand.

Nancy Bagot, senior vice president of the Electric Power Supply Association, said the transition is the time to double down on competition to encourage more innovation, while shielding customers from the risks of finding the right balance of resources. There will have to be an acknowledgement that markets are being asked to break new ground, she said, and the conversations on how to do so will need to remain grounded in reality and based on the voices of reliability experts.

That will involve reimagining the capacity market in what it signals and procures for different regions of the country, including a look at what the mix of capacity available is, rather than the raw amount in the market, Bagot said.

Bobby Jeffers, program manager at the National Renewable Energy Laboratory, spoke about the lab’s efforts to improve the models, tools and calculators available for gauging reliability. Incorporating a better understanding of how supply chains function and geopolitics is necessary for creating modeling for a system that works.

NREL is also upgrading its Interruption Cost Estimate calculator to reflect the societal costs of extended outages, Jeffers said. The economic impacts currently incorporated into the tool fail to reflect the toll outages can take on customers.

Responding to the question of whether FERC should play an activist role or take a more passive, judicial approach to the transition, the panelists largely agreed that stability and deference to RTOs were preferable.

Brandien said that grid operators know their regions best and they can carry out their responsibilities more effectively without NOPRs and filings confusing the waters. George said it’s important that if FERC has a preference on a policy, it should make it known and take the lead, rather than leave RTOs in the dark.

Equity and Environmental Justice

The second panel focused on ensuring that the costs of the transition don’t fall disproportionately on disadvantaged communities and examining how to reconcile the need to expand energy infrastructure and the burden it often places upon the communities that host it.

One of the largest challenges in ensuring the equity of wholesale energy markets remains the lack of public knowledge about their functioning, said Damali Rhett Harding, managing principal for the Regulatory Assistance Project.

“How do we incorporate equity into a marketplace that probably 99% of Americans don’t realize exists?” she questioned.

To provide equity in energy, she said companies need to examine the procedures that prevent people from participating in the siting process.

Beyond just educating the neighbors of a proposed project, former U.S. Rep. Joseph P. Kennedy III (D-Mass.), now managing director of Citizens Energy, said developers and utilities should explore ways to ensure that the expansions directly benefit those communities. He pointed to a project in which his nonprofit partnered with a utility to invest in a large transmission project in California’s Imperial Valley, and then used the profits it earned to construct a 30-MW community solar installation in the city of Calipatria. In addition to improving reliability, the solar project provides about $500 in annual savings every year over 20 years to 12,000 low-income households in a region where temperatures can exceed 110 degrees Fahrenheit, he said.

Such arrangements can prove worthwhile even to for-profit companies by alleviating residents’ concerns that large transmission projects could lower property values or disrupt their neighborhoods with no visible benefit to them, Kennedy said. The costs of the delays or resiting of projects can often well exceed the expense of profit sharing with those communities, he argued.

Delaware Public Service Commissioner Harold Gray, who moderated the panel, said incorporating more voices can help companies find more forms of value than immediate profit alone. In his work on the commission, he has had success showing utilities that by keeping their customer’s interests in mind, they can discover new customers and potentially expand profits.

Former FERC Commissioner Colette Honorable, now a partner at Reed Smith leading the firm’s energy regulatory group, noted that getting all parties on board with a project in the early phases can reduce the likelihood of prolonged, and expensive, delays at FERC and the federal courts.

“You’re in trouble if you have a matter pending and the first time you hear them is when they object,” she said.

Likewise, she said incorporating equity into the work done by RTOs can be accomplished by examining what voices are missing at the table and including those stakeholders who aren’t represented. On public education, she said FERC’s new Office of Public Participation has been making strides in ensuring that individuals at all levels are empowered to make their concerns heard.