American Electric Power (NASDAQ:AEP) executives said Thursday that “the usual suspects” are interested in the company’s unregulated renewable energy assets as the company seeks to become a “pure play” regulated utility.

AEP launched the two-step sale process for the 1.37-GW portfolio in August and has accepted bids for the first phase of the auction process. The company announced the sale in February. (See AEP to Sell Unregulated Renewables Portfolio.)

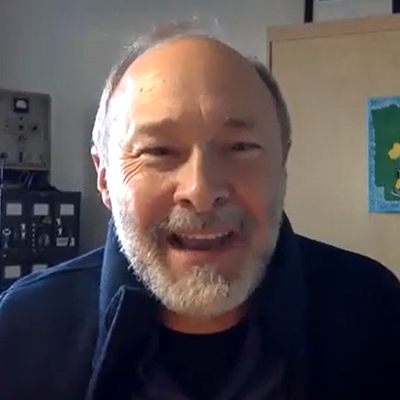

AEP CEO Nick Akins | © RTO Insider LLC

AEP CEO Nick Akins | © RTO Insider LLC

“Selling the portfolio will allow AEP to shift focus and rotate capital towards regulated businesses as we continue to transform our generation fleet and enhance transmission infrastructure,” CEO Nick Akins told financial analysts during a Thursday conference call. He said a sale agreement is on pace to be signed during the second quarter next year and to close by midyear.

The Columbus, Ohio-based company reported earnings of $684 million ($1.33/share), as compared with earnings of $796 million ($1.59/share) for the same quarter a year ago. The results exceeded analysts’ expectations of $1.56/share.

Transmission will be key to AEP’s earnings growth plan. The company plans nearly $26 billion in wires investment opportunities over the next five years as it focuses on “improving the reliability and resiliency of the grid and integrating new resources to support the clean energy economy,” CFO Julie Sloat said.

AEP said it is responding to a second subpoena from the U.S. Securities and Exchange Commission related to a corruption probe into the passage of an Ohio nuclear and coal subsidy bill.

“We view it as a continuing part of the process. … We said we would be transparent, and we have been transparent, and we’ll continue to work in a positive fashion with the SEC,” Akins said. “They just need more information, and we’re going to supply it. We’ll continue to work with them to get this thing resolved.”

The first subpoena asked for documents related to the bill’s passage and AEP policies, financial processes and controls. Akins said the company has recognized it needed to make changes in a nonprofit’s governance, “and we made those changes.”

AEP’s share price finished the week at $89.40, up $1.96 after its pre-earnings close.

The analyst call marked Akins’ last after 11 years as AEP’s CEO. He will be replaced by Sloat, who takes over on Jan. 1. (See Akins Steps down as AEP President; Sloat to Become CEO.)

“I’m confident in [Sloat’s] deep knowledge of AEP, as well as the emphasis she places on consistency, quality of earnings and dividends and shareholder and customer value creation that will be instrumental to AEP’s continued success,” Akins said, marking the occasion with his trademark references to rock music.

Quoting Rush’s “Closer to the Heart” and Led Zeppelin’s “Thank You,” the rock musicophile said, respectively, “And the men and women who hold high places must be the ones who start to mold a new reality closer to the heart. … And so today, my world, it smiles.”

NextEra Again Exceeds Expectations

NextEra Energy (NYSE:NEE) said that a 13% increase during the third quarter in adjusted earnings year-over-year, reflecting continued strong performance by its utility and clean-energy subsidiaries, has the company well positioned to achieve its overall objectives for the year.

The Juno Beach, Fla.-based company delivered quarterly earnings of $1.69 billion ($0.86/share), compared to $447 million ($0.23/share) for the same period a year ago. Wall Street had expected earnings of 80 cents/share; NextEra has exceeded expectations for the past two years.

The Inflation Reduction Act’s passage “provides a tremendous opportunity set for us across the board,” CEO John Ketchum told analysts during a conference call Friday. “It creates a lot of immediate money opportunities for us going forward on wind, solar and on battery storage.”

NextEra Energy Resources, the company’s wholesale supplier subsidiary, added 2.3 GW of new renewable resources and storage projects during the quarter.

NextEra said Hurricane Ian’s landfall in September knocked out service to more than 2.1 million Florida Power & Light customers, but that a restoration workforce of about 20,000 workers and FPL’s grid-hardening and smart-grid investments restored service to about two-thirds of those affected customers after the first full day. It was the fastest restoration rate after a major hurricane, officials said.

The company’s share price closed Friday at $79.03, a gain of $3.56 (4.7%) on the day.

Xcel: IRA Will Lower Renewable Costs

Xcel Energy (NASDAQ:XEL) on Thursday reported third-quarter earnings of $649 million ($1.18/share), up from last year’s third quarter net total of $609 million ($1.13/share). The company cited capital investment recovery and other regulatory outcomes for the improvement.

CEO Bob Frenzel said the IRA’s passage will reduce the cost of the Minneapolis-based company’s clean energy transition and improve liquidity through tax credit transferability, besides providing “significant” customer benefits. He said the legislation will lower the cost of the recently approved 460-MW Sherco Solar project by more than 30% and also reduce the expense of the 10 GW of approved renewable resources in its Minnesota and Colorado resource plans.

“It shows the tremendous customer benefits of being an early leader in the clean energy transition,” Frenzel told analysts during Thursday’s call.

The quarter’s performance was short of analysts’ expectations of $1.22/share. However, Xcel’s share price closed the week at $65.37, up $2.80 (4.5%) from its pre-earnings close.