Driven by global concerns about energy security and new government support — such as the Inflation Reduction Act in the U.S. — renewable energy could see unprecedented growth in the next five years, outpacing natural gas and coal as the world’s top source of electricity, according to a new report from the International Energy Agency.

“In the next five years, the growth will be equal to what we have seen in the last 20 years,” IEA Executive Director Fatih Birol said Tuesday at an online rollout for the Renewables 2022 report. “Solar will be the No. 1 source of electricity in the world.”

Heymi Bahar, IEA | IEA

Heymi Bahar, IEA | IEA

The IEA has upped its projection for renewable capacity growth to more than 2,400 GW by 2027, a 30% increase over its five-year projections in Renewables 2021, said IEA Senior Analyst Heymi Bahar, a lead author of the 2022 report.

But even this accelerated growth, based on existing policies, will not be enough to ensure climate change can be limited to 1.5 degrees Celsius, the global goal set in the Paris climate accords of 2015. To stay on track for that target, the IEA estimates total renewable capacity would have to grow by more than 3,500 GW in the next five years.

“Most advanced economies face challenges to implementation, especially related to permitting and grid infrastructure expansion,” the report says. In the U.S., an estimated 1,400 GW of solar, wind and storage projects are currently in interconnection queues, according to figures from the Lawrence Berkeley National Laboratory.

In developing and emerging countries, policy, weak grid infrastructure and lack of access to financing are the main obstacles. Addressing these challenges, in both developed and developing countries, could close the gap about halfway, the report says.

Still, the IEA report is mostly optimistic. “Annual solar PV capacity additions increase every year for the next five years,” the report says. “Despite current higher investment costs due to elevated commodity prices, utility-scale solar PV is the least costly option for new electricity generation in a significant majority of countries worldwide. …

“Distributed solar PV, such as rooftop solar on buildings, is also set for faster growth as a result of higher retail electricity prices and growing policy support to help consumers save money on their energy bills,” the report says.

In other words, Behar said, “Cheap renewables are providing new capacity that is cheaper than existing systems or new additions.”

Renewables coming online will account for 90% of new capacity growth in energy markets worldwide and almost 40% of all electricity production by 2027, Behar said

By 2027, renewables will be the top source of electricity in the world, surpassing both natural gas and coal. | IEA

By 2027, renewables will be the top source of electricity in the world, surpassing both natural gas and coal. | IEA

“We expect the share of all the other fuels to decline, and their share basically [to move] to the renewables,” he said. Solar capacity will surpass natural gas in 2026 and surpass coal in 2027, Behar said.

The report also sees a gradual shift in global supply chains, with government incentives, like the IRA’s tax credits for solar manufacturing, helping to create domestic supply chains, both in the U.S. and India, which can in turn lessen U.S. dependence on China for solar imports.

The IRA’s manufacturing tax credits, which come with a direct pay option, “could bring all segments of PV manufacturing to cost parity with the lowest-cost manufacturers” in China and Southeast Asia, the report says.

But such policies will, at best, put a dent in China’s dominance of renewable energy supply chains, the report says. The IEA estimates that the country’s share of global supply chains could dip from the current level of 80 to 95% to 75 to 90%. Maintaining trade policies that limit solar imports and encourage domestic production could shrink China’s market share further to 60 to 75% by 2027, the report says.

But, Behar said, the build-out of supply chains in the U.S., India and China could produce a supply glut, with supply “doubling the need of the demand in the coming years. So, there will be an important opportunity to merge several manufacturers in terms of their plants or basically decommission the old capacity, which has the oldest technology today,” he said.

1.5 Still Alive

As it did in its recent report on energy efficiency, the IEA frames drivers and trends in renewable energy development with the impacts of Russia’s war on Ukraine. The war, and the global energy crisis it has triggered, have “turbocharged” renewable energy growth, Birol said. (See IEA: Global Energy Crisis Puts Efficiency at ‘Center of Policy Agendas.’)

Fatih Birol, IEA | IEA

Fatih Birol, IEA | IEA

“Many countries around the world see renewables now as an option to address energy security concerns” and replace Russian gas imports, especially in Europe, he said.

Another key driver is cost, Birol said. “The high-end, volatile fossil fuel prices [for] gas and coal make renewables competitive, even more competitive when it comes to electricity generation and high oil prices,” he said. “So solar is and will be the king of global power markets.”

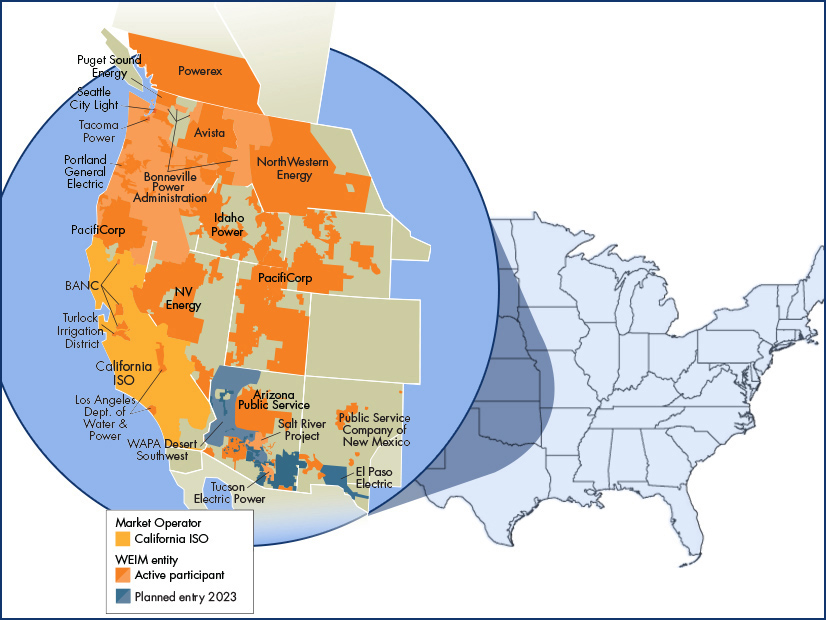

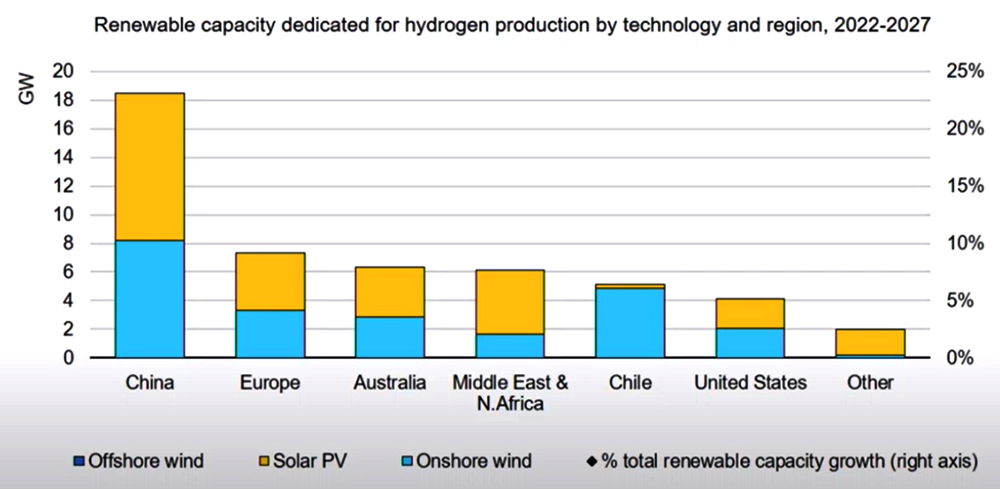

The IEA report also, for the first time, looks at green hydrogen production as an emerging, but significant driver for renewable energy growth. More than 25 countries, including the U.S., and the European Union have introduced “policies and support measures.”

At present, IEA says about 500 MW of solar and onshore wind are dedicated to green hydrogen production, powering electrolyzers that produce hydrogen without carbon emissions, unlike most “grey” hydrogen produced from natural gas. IEA expects 50 GW of renewables will be used for green hydrogen production worldwide by 2027, a 100-fold increase, Behar said.

Hydrogen production emerges as a new driver for solar and wind growth. | IEA

Hydrogen production emerges as a new driver for solar and wind growth. | IEA

Looking specifically at the U.S., IEA predicts a 74% increase in renewables, adding more than 280 GW of solar and wind to the grid by 2027, with only a very small 4 GW dedicated to green hydrogen production. At present, the U.S. has about 131 GW of solar, according to the Solar Energy Industries Association.

Supply chain interruptions and the Commerce Department’s preliminary decision extending solar tariffs on solar cells and modules imported from companies in Cambodia, Malaysia, Thailand and Vietnam have slowed solar growth, with a 20% dip predicted for 2022, the report says. (See Solar Industry Slams Commerce Decision Extending Solar Tariffs.)

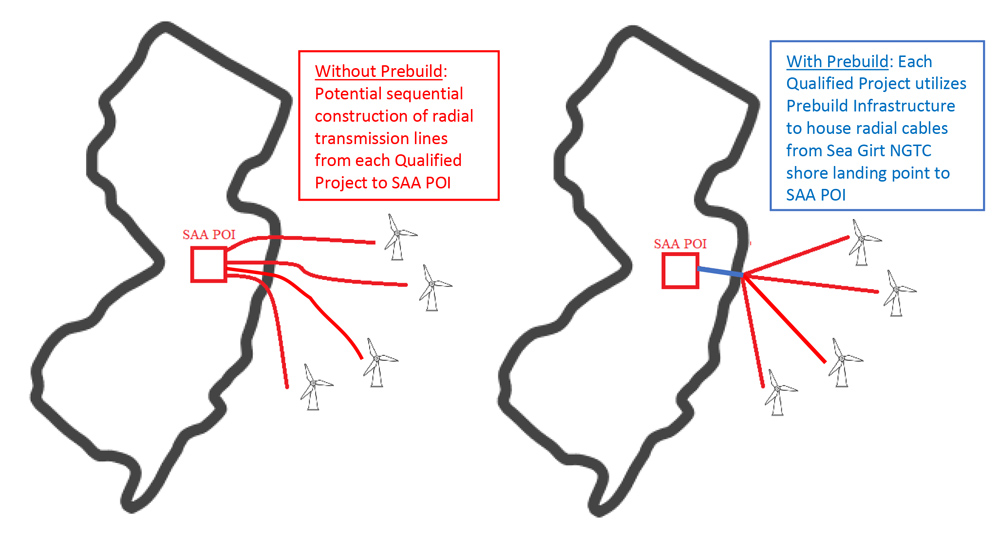

IEA expects the slowdown to be short-term. A range of incentives and tax credits in the IRA are “expected to make the business case more attractive for utility-scale projects,” the report says. Growing momentum in offshore wind is also expected, with the potential for up to 15 GW of projects in the development pipeline to go online by 2027.

President Biden’s goal of 30 GW of offshore wind by 2030 faces a list of barriers, the report says, “including long federal and state-level permitting wait times; Jones Act requirements that reduce the number of installation vessels available; and the need for port and transmission infrastructure development.”

The Jones Act requires that ships moving goods between U.S. ports be U.S.-owned and -operated. Such vessels for offshore wind deployment are currently limited.

The obstacles still slowing renewable energy growth inevitably raise questions about whether the Paris accord’s 1.5-degree limit on climate change is still possible, as one reporter asked Birol at the end of Tuesday’s webcast.

While acknowledging the difficulties ahead, Birol said, “It is far too early to write the obituary of the 1.5-degree target.”

Investments in clean energy are expected to reach $2 trillion by 2030, only about half of the $4 trillion needed to get to net zero by 2050, he said.

“Is it easy? Not at all,” Birol said. “Especially if we note that the bulk of this money needs to go to emerging and developing countries, it’s a big challenge. But in our view, to say that a 1.5-degree target is dead is factually poor and politically irresponsible. Such a conclusion may even jeopardize [our ability] to reach the targets of 1.6 [and] 1.7 degrees.”