The U.S. steel industry can cut its carbon emissions almost to zero by 2050 while increasing production by 12%, according to a new Industrial Decarbonization Roadmap the Department of Energy rolled out Wednesday.

Energy efficiency and a switch to low- and no-carbon fuels will drive about two-thirds of those emission reductions, the roadmap says.

While acknowledging the difficulties involved in decarbonizing U.S. heavy industry, such as iron and steel, Energy Secretary Jennifer Granholm said, “The roadmap lays out how the different players in the industrial sector can develop tailored approaches to decarbonization. It’s bold; it’s comprehensive. It takes the long view to 2050, and it details the need to get existing technologies to scale and to continue to invest in applied research and development for next-generation technologies.”

Granholm, along with outgoing National Climate Advisor Gina McCarthy, was speaking at a rollout event for the roadmap, with a panel of industrial sector representatives, including trade, labor, nonprofit and environmental justice leaders. U.S. industry accounted for about 30% of the nation’s carbon dioxide emissions in 2020, according to DOE, and decarbonizing the sector is central to U.S. economic growth and competitiveness, and the achievement of the President Joe Biden’s climate targets, Granholm said.

The president has set ambitious goals for decarbonizing the U.S. electric grid by 2035 and achieving a net-zero economy by 2050, now backed by billions of federal dollars from the Infrastructure Investment and Jobs Act and the recently passed Inflation Reduction Act.

“The facts are, we can’t live without the industrial sector, and yet we can’t live with the climate impacts and the pollution impacts, the carbon pollution in particular, that the sector produces,” Granholm said.

“We also know that those externalities affect disproportionately communities of color, poor communities, disadvantaged communities, Black communities, Latino [and] Native American communities, and we have to be honest about that.”

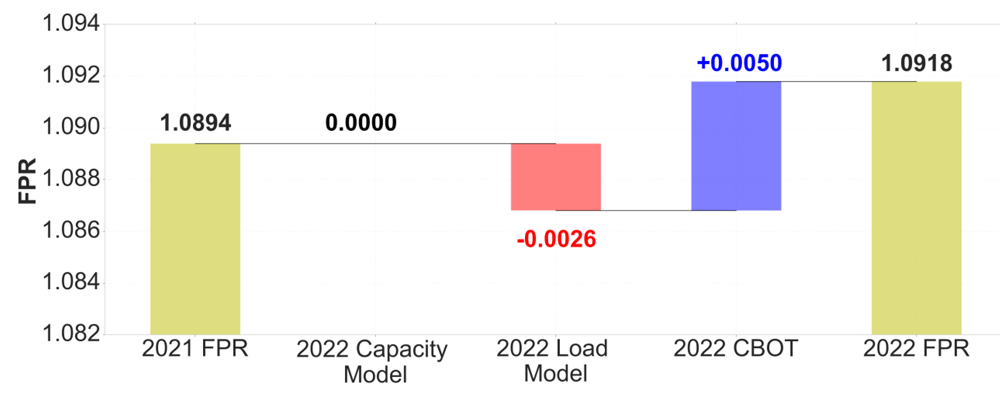

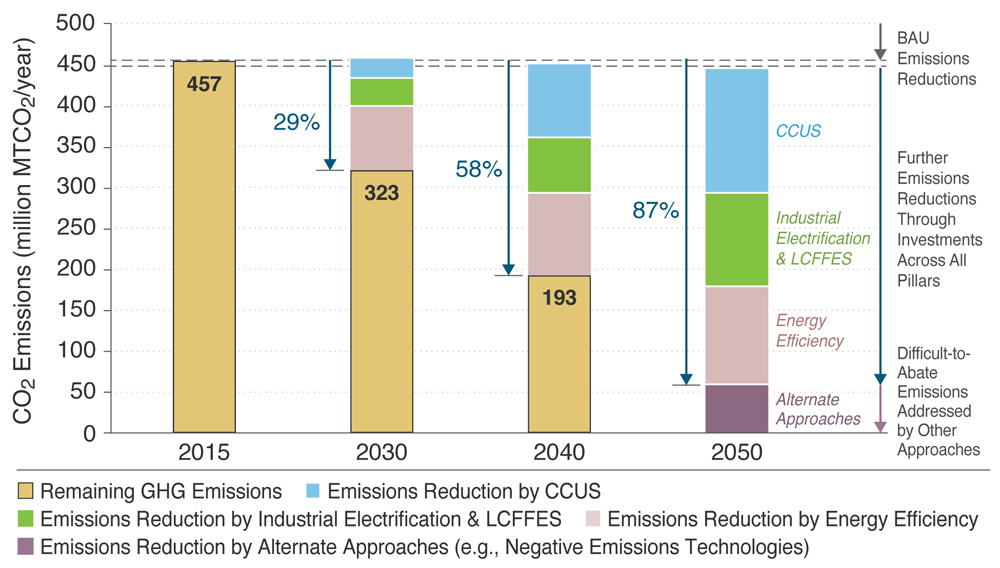

Compiled with input from more than 300 federal, industry and community stakeholders, the roadmap focuses on the five most carbon-intensive manufacturing sectors in the U.S. — iron and steel, chemicals, cement, food and beverage production and petroleum refining. Decarbonization strategies are broken down into four “pillars:” energy efficiency, industrial electrification and low-carbon fuels, carbon capture, utilization and storage (CCUS), and “alternate approaches,” such as direct air capture and reforestation.

The roadmap sees the alternate approaches providing the final 13% of emission reductions needed to get the U.S. to a net-zero economy by 2050. Together, the other three pillars will provide the other 87% of reductions, beginning from a 2015 baseline of 450 million metric tons of industrial CO2 emissions per year.

Granholm pointed to the “cross-cutting” impacts of the different pillars and sectors. For example, carbon capture will be critical for decarbonization of cement making, according to the roadmap. About 65% of the emissions reductions needed to get the sector to near net-zero by 2050 will come from CCUS, the road map says.

But those emission reductions will also help drive a 46% increase in cement production, the report says.

‘Liposuction Solution’

Echoing Granholm, McCarthy — who will be leaving her post on Sept. 16 — emphasized the importance of ensuring the new federal funding and “the work that we’re doing here [are] relevant to people. We have to make sure that we’re improving the lives of real human beings in a way that they can see. We have real resources; we need to show people how we’re going to make it work for them.”

Anna Fendley, director of regulatory and state policy for the United Steelworkers, said the federal government has a key role to play as a “convener, driving collaboration among industry, labor [and] management, because we need to catch the low-hanging fruit, but we also need to do the really big things that are going to be hard but transformational, and invest in jobs in the long-term.”

Robbie Orvis, senior director for modeling and analysis for industry consultants Energy Innovation, said one way to promote worker buy-in is by highlighting that “decarbonizing industry … actually can save industry money and make our goods cheaper, and free up money to pay workers more.”

He also pointed to incentives for reshoring or onshoring industry, such as the production tax credits in the IRA, which will “make sure that as U.S. industries decarbonize, [their] goods are remaining competitive with other countries, particularly those that may not be decarbonizing as quickly.”

Beverly L. Wright, executive director of the New Orleans-based Deep South Center for Environmental Justice, called for equity and justice in planning for industrial decarbonization, which, she said, must start with “the use of science to produce sound technology and industrial development that reduces carbon emissions.”

New technologies must also be carefully evaluated to ensure they do “not harm the environment or communities in ways that exacerbate existing disparities and environmental pollution and health risks in environmental justice and climate-impacted communities,” Wright said.

She was particularly skeptical of carbon capture, raising concerns that it would promote continued use of fossil fuels. It is a “liposuction solution,” Wright said — sucking out fat (or in this case, emissions) that would only come back without systemic changes.

Clean Steel

While voicing strong support for the roadmap and DOE’s outreach to a broad range of stakeholders, leaders from industry trade associations emphasized the advanced technologies they are already using to cut carbon emissions. For example, Philip K. Bell, president of the Steel Manufacturers Association, noted that about 70% of U.S. steel is now produced using electric arc furnaces, which are powered by electricity and have significantly lower carbon emissions than more traditional blast furnaces.

Both Bell and Kevin Dempsey, CEO of the American Iron and Steel Institute, pointed to a growing interest in renewable energy and hydrogen fuels across their industry.

“What’s going to be critical though is that the electricity that is used to power our electric arc furnaces is clean,” Dempsey said. “So, all of the efforts to further decarbonize and produce clean energy, including in particular the incentives that were part of the Inflation Reduction Act, we think are really critical. That’s been a major focus for many of our steel companies, to work with their electricity providers to get that clean energy so we can even further reduce the emissions we have.”

But to build on the funding and incentives in the IIJA and IRA, Rebecca Dell, senior director of the ClimateWorks Foundation, a San Francisco nonprofit, argued that “we need to be building strong institutions in our government in order to effectively implement these laws and make the transition that we have in front of us over decades.

“A startling fact is that there is not a single Senate-confirmed position in the entire federal government focused on the future of American manufacturing or the American-made industrial sector,” Dell said. Work on these issues has been fragmented across different agencies, including DOE, the Commerce Department and the Environmental Protection Agency, she said.

“What we need to be doing is pulling them out and elevating them and strengthening the institutions … that can actually do this work over the long term.”

Other key recommendations in the roadmap include:

- Investing in multiple low-carbon technologies. Such investments must be “concurrently pursued to ensure viable pathways for industrial decarbonization.”

- Accelerating deployment of decarbonization technologies through testbeds and demonstration projects “to catalyze and de-risk private sector investments. Low-capital approaches that maximize energy, material, and systems efficiency should be pursued.”

- Integrating technology into systems and supply chains. “Research will be needed to anticipate the changes in supply and value chains that will result from the transition to a low-carbon economy.”