Platte River Joins Western Utilities Evaluating RTO Membership

SPP on Thursday welcomed Colorado utility Platte River Power Authority as the latest Western utility to provide a notice of intent to evaluate participation in the grid operator’s planned RTO West.

Platte River is the eighth Western entity that has publicly committed to exploring SPP’s RTO expansion. The utility has already announced plans to join the RTO’s Western Energy Imbalance Service (WEIS) market next April.

“We look forward to joining the WEIS next year and SPP’s RTO in 2025,” Platte River COO Melie Vincent said.

SPP administers the WEIS market on a contract basis and provides participants with a suite of services including market administration, transmission planning, reliability coordination and more. It says WEIS participants that become full RTO members can expect to receive similar savings and benefits as its Eastern Interconnection members. According to the grid operator, those members saved $2.696 billion last year, a benefit-to-cost ratio of 18-to-1 given $149 million in net revenue requirement costs.

The RTO has set a March 2023 target for Western utilities to indicate their intent to participate in its initial expansion into the interconnection. SPP expects to extend its RTO into the West in March 2024.

“We are pleased that Platte River will be joining the WEIS market next year and is evaluating the cost and benefits of full RTO membership,” said Bruce Rew, SPP’s senior vice president of operations. “Our continued collaboration will enable us to help them reliably and economically serve their communities while meeting their clean energy goals.”

Basin Electric Power Cooperative, Colorado Springs Utilities, Deseret Power Electric Cooperative, Municipal Energy Agency of Nebraska, Tri-State Generation and Transmission Association, Western Area Power Administration and Wyoming Municipal Power Agency are the other entities that have already expressed interest in the RTO.

MMU Releases WEIS Spring Report

SPP’s Marketing Monitoring Unit (MMU) last week released its WEIS quarterly State of the Market report for the spring period, which covers March through May 2022.

The MMU said it believes that the WEIS “functioned as expected” during its second spring quarter of operations. It said the market continues to struggle with ramp availability and short-term system flexibility despite an abundance of online capacity but noted those issues have persisted since it began operations in February 2021.

The Monitor said many dispatchable resources are offered with minimal available dispatchable and/or rampable capacity. “Market participants are also reluctant to offer additional resources due to risks associated with recovering costs when prices drop,” the MMU said.

It noted SPP has begun conversations with market participants to discuss offered rampable capacity and encourages more capacity to be offered to increase market efficiency. “The MMU supports the incremental improvements to the market enacted during this period and continues to recommend further enhancements,” it said.

Average load prices during the period were consistent with the year prior at $15.71/MWh and $19.48/MWh for March and April, respectively, and increasing to $26.85/MWh in May. Coal remained the predominate fuel source ahead of hydropower, accounting for 66% of the market’s generation in March before dropping to 59% by May.

SPP administers the market for 12 utilities, centrally dispatching energy from participating regional resources every five minutes.

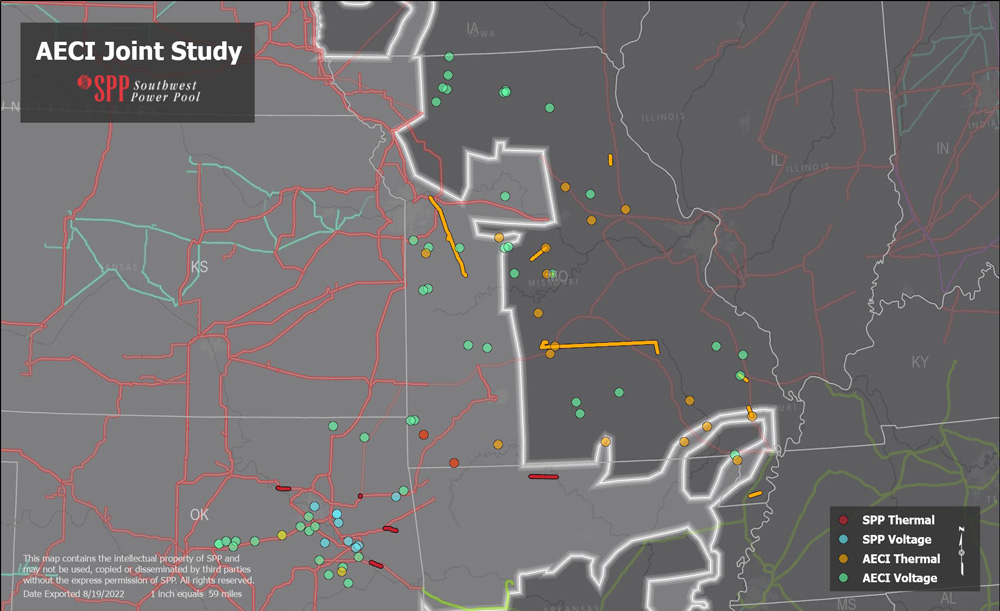

RTO, AECI to Target Efficient Joint Solutions

SPP staff told stakeholders last week that they will be taking additional steps this year as they work across the seam with a neighboring cooperative to identify interregional projects.

Neil Robertson, the RTO’s coordinator of system planning, said during a joint stakeholder planning meeting with Associated Electric Cooperative Inc. (AECI) on Wednesday that the staffs are going to work with local transmission owners to find the best solutions for their needs.

“In years past, I felt soliciting for transmission solutions for all the needs was not efficient. As we refined [the solutions], we discovered we might not have a true jointly funded opportunity,” Robertson said.

SPP has already analyzed updated models and contingency files provided by AECI and found more than 90 thermal and voltage needs. He promised a review of proposed solutions and to discuss potential joint projects when staff next meet with AECI and stakeholders later this year.

Thermal, voltage needs on the SPP-AECI seam | SPP

Thermal, voltage needs on the SPP-AECI seam | SPP

“We got some good project solutions, but when we’ve looked at that through a joint system plan with AECI, the benefits went to one or the other,” Robertson said. “In this refinement, we’ll do some additional due diligence to ensure that the opportunities that move forward clearly demonstrate a shared reliability need and shared benefits. I think this will increase overall efficiencies.”

RFP out for NM Project

SPP has issued a request for proposals in soliciting bids for the 345-kV Crossroads-Hobbs-Roadrunner project in eastern New Mexico.

Companies soliciting proposals will need to include a $50,000 deposit for each response. Each deposit will be held in a segregated interest-bearing account in the respondent’s name.

Notices of intent to submit an RFP response are due Nov. 23. The final deadline for responses and deposits is Feb. 21, 2023. A pre-response open meeting will be held Sept. 23 for qualified RFP participants to ask questions and get feedback.

The project, proposed by Southwestern Public Service, was approved in July as part of the 2021 Integrated Transmission Plan. The project was re-evaluated after load-projection errors were discovered in the original solution. (See “Members Approve SPS Tx Project over Staff’s Recommendation,” SPP Board of Directors/Members Committee Briefs: July 26, 2022.)

Staff said in July the project would likely qualify as competitive under FERC Order 1000. The grid operator has already awarded four such projects.