Memphis Light, Gas & Water’s (MLGW) leadership said Thursday that a long-term energy contract with Tennessee Valley Authority is a safer alternative than joining MISO and simultaneously generating its own power.

MLGW President J.T. Young said during a special meeting of the utility’s Board of Commissioners that staying with its current electricity supplier represents the “least risk and most value.” He advised the commissioners to reject all alternative supply proposals and to schedule a future vote to consider the recommendation.

The board has up to 60 days to hold a vote. Its members said they would like to speak with TVA executives in the next month about the federal utility’s long-term strategy before making their decision.

The Memphis utility has been exploring alternatives to TVA’s supply since 2020 and has received 27 responses from alternative energy suppliers. In June, consulting firm GDS Associates said leaving TVA and building its own generation and transmission to participate in MISO’s wholesale markets would yield the utility tens of millions of dollars each year — or place the same amount at risk. (See Inflation Dampens Possible Memphis Exit from TVA.)

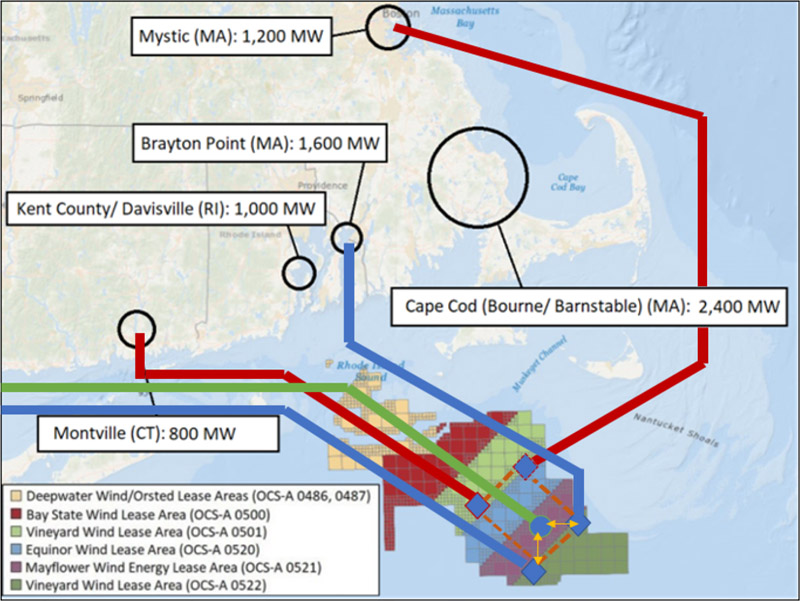

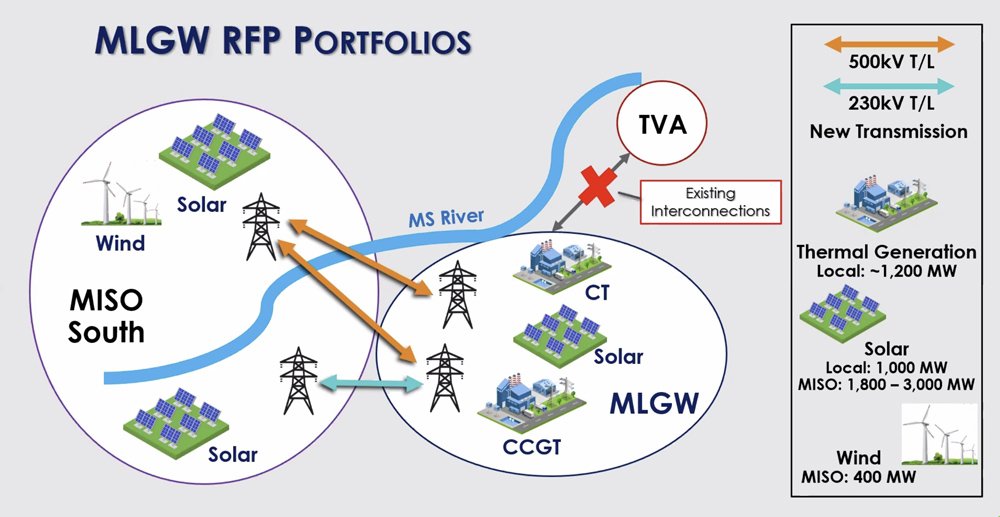

Supply scenario used in MLGW’s request for proposals | MLGW

Supply scenario used in MLGW’s request for proposals | MLGW

GDS told the board Thursday that updated figures indicate none of the alternative bids produce savings when compared to TVA supply. The bids were based on MLGW’s 2020 integrated resource plan (IRP) that envisioned multiple resource portfolios, including 230- and 500-kV links to access wholesale power in MISO South.

Chris Dawson, power supply principal for GDS Associates, said the IRP is not “immune” from inflation, more expensive labor and supply chain issues.

“I hate to keep coming back to this, but … the landscape is different than it was in 2020. … It’s not the same environment that the IRP was developed in,” Dawson said.

He said MLGW’s “from-scratch” power alternatives to TVA will require “an immense amount of funding” and are now more expensive than remaining with TVA under a long-term, 20-year contract.

The commissioners accepted public comments at the beginning of the meeting but did not permit comment following Young’s recommendation.

Memphis resident Pearl Eva Walker, climate and justice chair for the local NAACP chapter, asked that the board choose an energy supplier more focused on affordability, reducing energy burdens, and climate change mitigation.

She said GDS’ analysis seemed to emphasize the risks of switching energy suppliers and ignored potential benefits. Walker said Memphis could likely take advantage of the clean energy incentives in the recent Inflation Reduction Act.

“We want a supply moving forward that will help MLGW take advantage of these tax credits,” she said.

Multiple residents asked that the utility not tie itself to a supplier like TVA, which they said is shortsightedly focusing on expanding natural gas-fired resources as historic heatwaves engulfed Tennessee over the summer. (See SACE Urges FERC Inquiry into Proposed TVA Gas Plant.)

The Sierra Club’s Dennis Lynch, who served on MLGW’s Power Supply Advisory Team, said signing a long-term contract with TVA would be “the wrong direction.”

Lynch called MLGW’s IRP “bogus” because it relied too heavily on adding a natural gas-fired plant. He called on the utility to commission a 100% clean-energy IRP.

Other residents told the board that TVA appears to be its most reliable option, with some invoking ERCOT’s disastrous outages during the February 2021 winter storm. They said Memphis must avoid a similar catastrophe.

MLGW is TVA’s largest wholesale customer, comprising about 10% of total load and spending about $1 billion per year on electricity. The city has been a TVA customer for 80 years, but recently voiced displeasure over energy burdens and prices under the federal utility.

MISO this March held its quarterly Board Week in Memphis in an apparent attempt to woo MLGW. While there, the RTO’s leadership met in private with the utility’s executives. (See “Memphis Location for Board Week May Pay Off,” MISO Board of Director Briefs: March 24, 2022.)

Ahead of the board meeting, the Southern Alliance for Clean Energy (SACE) accused TVA of being evasive about the extent of its dependence on MISO for energy imports.

“Without MISO, there’s a good chance TVA couldn’t keep the lights on in Memphis. Yet TVA continues to lead people in Memphis to believe joining MISO would threaten reliability,” SACE said in a press release emailed to RTO Insider.

The alliance said that based on interchange data from the Energy Information Administration, TVA has imported 11% of its demand from the MISO footprint in 2022. “It’s fair to say that TVA relies on MISO,” SACE said, noting Memphis accounts for almost 10% of TVA’s total load and imports from MISO have roughly equaled the amount of total power TVA has supplied to MLGW in recent years.

TVA’s vice president of transmission and power supply Aaron Melda pushed back on SACE’s conclusion, saying interchange and power flows do not necessarily equate to energy purchases. He said MISO also flows power over the TVA system by way of its Midwest-South transmission constraint.

Melda said TVA’s 69 interconnections with other utilities means that it can and should purchase less expensive power at times to save its customers money.