Following a marathon overnight session of debate and amendments, the U.S. Senate on Sunday passed the Inflation Reduction Act with all of its $369.75 billion in clean energy spending intact.

Under special budget reconciliation rules that allowed passage with a simple majority, the bill was approved on a 50-50 party-line vote with Vice President Kamala Harris providing the tie-breaking vote that will now send the bill to the House of Representatives.

Speaking before the vote, Senate Majority Leader Chuck Schumer (D-N.Y.) called the bill “one of the defining legislative feats of the 21st century” and “the boldest climate package in U.S. history. This bill will kickstart the era of affordable clean energy in America. It’s a game changer.”

“Senate Democrats sided with American families over special interests,” President Biden said in his statement hailing the IRA vote. “This bill … makes the largest investment ever in combating the existential crisis of climate change.”

House Speaker Nancy Pelosi (D-Calif.) promised “the House will return and move swiftly to send this bill to the president’s desk.”

Getting to the Sunday afternoon vote has taken close to a year, beginning with Democrats’ $2.2 trillion Build Back Better Act originally introduced in September 2021. Sen. Joe Manchin (D-W.Va.) walked away from negotiations on trimming the bill’s price tag twice, once in December and again earlier in July.

But Schumer and Manchin hammered out the renamed IRA, with tax reform, health care and clean energy measures, behind closed doors last month, framing it as an inflation fighter that would reduce health care and energy costs for American families and cut the federal deficit by more than $300 billion. (See Schumer, Manchin Reach Climate Deal.)

In a Twitter thread following the vote, Manchin praised passage of the bill as the result of years of cross-aisle efforts to “determine the most effective way to increase domestic energy production, lower energy and health care costs, and pay down our national debt without raising costs for working Americans.”

Still, with a 50-50 split in the Senate, Schumer and Manchin had to negotiate further concessions to ensure the critical vote of Sen. Krysten Sinema (D-Ariz.). Sinema was successful in removing language from the bill that would have closed a tax loophole on the profits of high-income hedge fund investors and asset managers.

Republicans also forced two last-minute changes to the bill during the 13-hour “vote-a-rama,” that began late Saturday night and ended just after 3 p.m. Sunday. Part of the budget reconciliation process, the rules allow an unlimited number of amendments to be considered before a final vote on the bill.

The amendments offered by GOP senators during this time were often unrelated to the bill and were mostly voted down. However, the Republicans were able to remove a $35/month cap on insulin payments for consumers with private insurance, while retaining the cap for consumers on Medicare.

They also pushed through a further change on the bill’s 15% corporate minimum income tax, exempting companies owned by private equity from the provision.

‘An Arsenal of Clean Energy’

However, Republican attempts to change the bill’s energy provisions were universally voted down.

For example, Sen. John Barrasso (R-Wyo.), ranking member of the Senate Energy and Natural Resources Committee, offered an amendment that would have required the Department of Interior to hold additional sales of onshore oil and gas leases on public land by the end of 2022.

Similarly, an amendment from Sen. John Kennedy (R-La.) would have required the sale of offshore oil and gas leases, while Sen. Richard Shelby (R-Ala.) proposed requiring new coal leases.

“The Democrats’ war on American energy continued today,” Barrasso said in a statement following passage of the IRA. “While jamming through their reckless tax and spending spree, Democrats voted against common-sense Republican proposals.”

Clean energy advocates were quick to applaud the bill’s passage and its clean energy incentives, ranging from various tax credits to incentives for big transmission projects and for consumers purchasing electric vehicles.

“Rising inflation and global instability have put America’s energy security in jeopardy,” said Nat Kreamer, CEO of Advanced Energy Economy. “A federal clean energy investment of this magnitude is our best defense.”

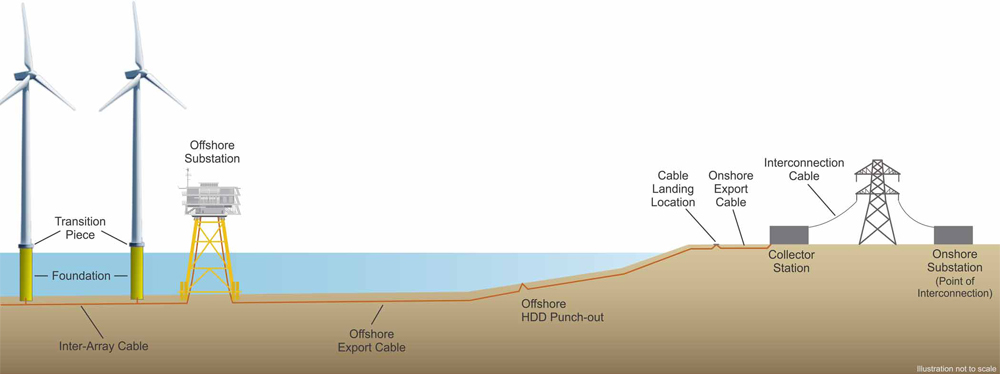

Key clean energy provisions in the bill include extensions of the solar investment tax credit and wind production tax credit, through the end of 2024, to be followed by technology-neutral clean-energy credits that will provide incentives for renewables, nuclear and green hydrogen. (See What’s in the Inflation Reduction Act, Part 1 and What’s in the Inflation Reduction Act, Part 2.)

Tax credits for electric vehicles, both new and used, are also part of the package, with EVs costing less than $55,000 eligible for a $7,500 credit and used EVs costing less than $25,000 getting a $4,000 credit. Incentives for transmission include $2 billion in direct loans for construction and modification of transmission deemed in the national interest and $760 million in grants for permitting and siting and for economic development in communities with transmission builds.