In a joint report released Wednesday, NERC and the Texas Reliability Entity shared the lessons learned from a disturbance to ERCOT’s wind generation fleet earlier this year.

The Panhandle Wind Disturbance report covers the events of March 22, when faults at two separate wind facilities in North Texas caused output to be reduced by 765 MW and 457 MW respectively. Neither fault qualified for reporting as a Category 1i event under NERC’s event analysis process, which in ERCOT requires the loss of at least 1.4 GW to earn the label. However, in light of the ERO Enterprise’s efforts to examine the impact of inverter-based resources on the bulk electric system, Texas RE suggested that NERC and ERCOT join it to review the disturbance.

On the morning of the event, issues had already been building on the system for hours: freezing rain, snowfall and high winds were observed early in the morning, and generator operators “reported wind turbine icing and high wind speed cutoffs.”

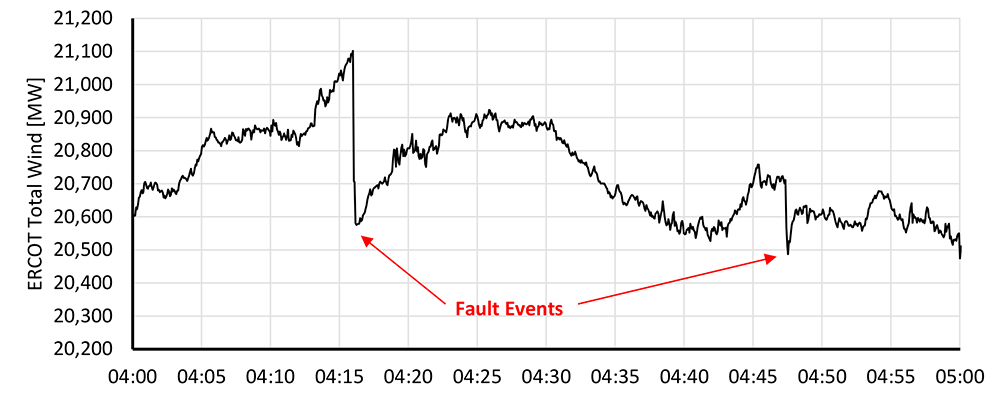

The faults occurred at 4:16 and 4:47 a.m. CT near Amarillo. The first was an A-B phase fault on a radial 345-kV generator tie line, and the second was a B-C phase fault on a nearby 345-kV transmission circuit. ERCOT attributed the second fault to “galloping conductors,” a condition that occurs when ice forms on transmission towers and conductors and catches the wind, lifting the conductors in a galloping or jumping motion.

Both faults cleared normally in 3.38 and 2.88 cycles, respectively. Based on data from supervisory control and data acquisition systems, the first tripped 273 MW of wind generation, after which additional wind plants in the area unexpectedly reduced power output by a total of 492 MW; the same unexpected power reduction occurred after the second fault, with 457 MW lost in all.

As a result of the generation loss, system frequency also fell. In the first event frequency dropped from 60.01 Hz to 59.9 Hz; ERCOT tapped 524 MW of generation responsive reserve service (RRS) in response, and the system recovered to 59.998 Hz within three minutes. During the second event frequency fell to 59.942 Hz but recovered to “nominal values” within 30 seconds without the deployment of RRS or load resources.

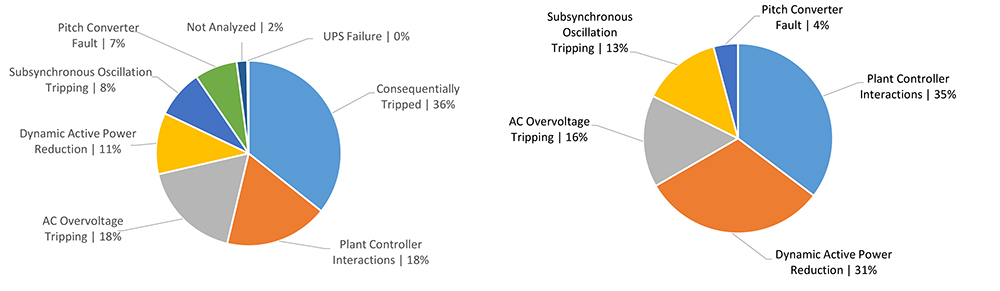

Analysis of the events found that the greatest share of generation reduction in the first fault was consequential tripping of wind resources, accounting for 36% of reduction. However, the report noted that such loss is expected for this kind of event. The next biggest cause, at 18%, was plant controller interactions that restricted “the ability of the plant to return” to normal operating levels. Multiple inverters at one facility were tripped by AC overvoltage, making this the third-biggest issue.

By comparison, in the second fault plant controller interactions counted for 35% of voltage reductions, followed by dynamic active power reduction at 31%. AC overvoltage tripping was third, with 16% of the reduction.

The report concluded with recommendations for multiple stakeholders. For FERC, the authors suggested “significant overhauls” to the “interconnection procedures and agreements administered” by the commission to address gaps relating to interconnection studies, model quality checks and commissioning testing. Noting that FERC in June issued a notice of proposed rulemaking on interconnection procedures, the report said that NERC plans to push such changes in comments on the NOPR.

The report also urges NERC to update its reliability standards to account for the known performance issues in inverter-based resources, in particular by implementing a performance-based generator ride-through standard. Finally, the authors recommended that ERCOT follow up with facility owners on corrective actions and conduct a detailed model quality review and validation effort.