The Memphis city utility’s hopes of leaving the Tennessee Valley Authority for MISO could be dashed by inflation and high interest rates that could slash potential savings, a consulting firm said last week.

GDS Associates compared the top two bids of the 27 proposals Memphis Light, Gas and Water (MLGW) received in response to its search for alternative energy suppliers as the utility met Thursday with its Board of Commissioners and the Memphis City Council. GDS evaluated the bids against MLGW’s long-term partnership option with TVA, scoring the proposals on pricing, performance guarantees, proven experience, and technical capability.

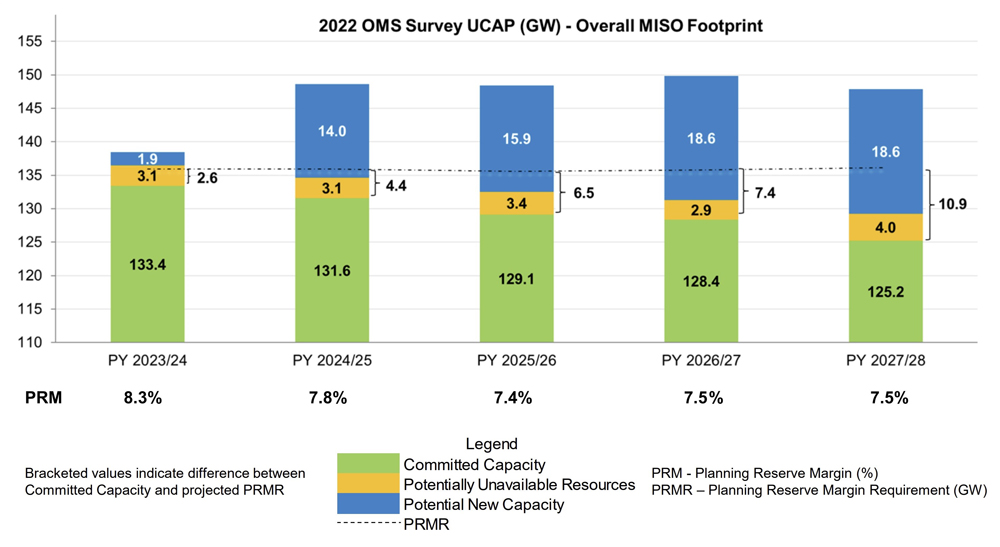

The consulting firm estimated the utility could save almost $31 million annually with the higher-scoring bid and $9.4 million annually under the second bid over a 25-year period that included the utility’s transition from TVA. The analysis assumed higher natural gas prices, higher capacity prices and higher interest rates than MLGW’s 2020 integrated resource plan, which predicted the city could save between $100 and $120 million if the utility left the federal agency for a power mix of natural gas and solar power.

Potential Losses in New Environment

However, GDS Power Supply Principal Chris Dawson warned that the savings could quickly nosedive and turn into losses if inflation, gas and capacity prices, and interest rates all increase by 2028. He said the lower-scored portfolio could saddle MLGW with about $100 million dollars of additional annual costs; the higher-scored bid could lead to $25 million in annual losses.

Dawson’s comments were met with audible rumblings in the conference room.

GDS Associates’ Chris Dawson | MLGW

GDS Associates’ Chris Dawson | MLGW“This is just a reminder about how the world can change. I’m not trying to be a harbinger of doom and suggest it will be like this in 2028 … but it could be like this,” Dawson said.

He said consumer demand and geopolitical events have quadrupled natural gas prices, increasing the risk involved in constructing a gas plant. He also pointed out that MISO’s April capacity auction cleared the highest-ever prices for its Midwest region.

Dawson said he believed MLGW would call for less emphasis on natural gas fired generation were MLGW’s IRP developed today.

A non-TVA arrangement will subject the utility to new risks, including regulatory permitting, a likely credit ratings downgrade, and construction delays, he said.

“Under your current situation with TVA, most of these things you don’t even think about. It’s an afterthought,” Dawson said. “I’m not suggesting MLGW can’t build out that infrastructure, but it’s not cheap, it’s not easy, and you don’t do it overnight.”

Concerned about its power costs, the utility began seriously considering a break with TVA in 2020 when it produced an integrated resource plan. It later issued an RFP based on the plan. (See Memphis Muni Mulls Move to MISO.)

MLGW is at a crossroads. It can select one of the bids and depart TVA for MISO’s energy markets, maintain its current arrangement with TVA, or sign a long-term partnership agreement (LTPA) that will lower costs but tie the utility to TVA for at least two decades.

The federal agency’s LTPA option will result in an immediate 3.1% reduction in base rate charges, keeping them steady through 2029 and allow MLGW to acquire up to 5% of its energy needs from renewable sources. However, the contract includes a stranded-cost obligation that will make the utility responsible for a percentage of TVA’s future investments and follow MLGW if it decides to later leave TVA. The LTPA also requires a 20-year termination notice; MLGW’s current agreement has a five-year exit notice.

“It’s not easy just to say, ‘Hey, let’s sign up for the LTPA and figure this out later,’” Dawson said. “I’m not even familiar with agreements that have 20-year termination notices.”

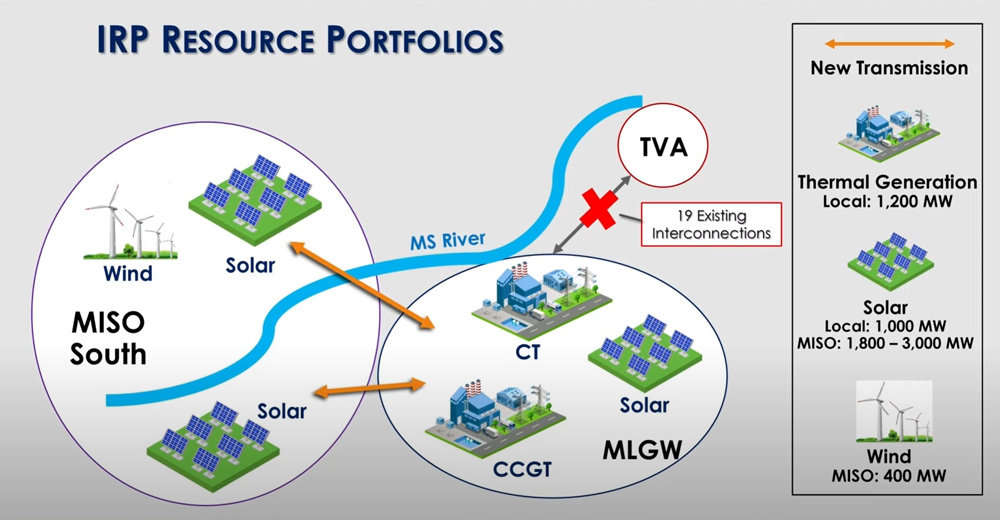

Options explored under MLGW’s IRP include connections to MISO to access renewables and building combined cycle plants and solar near Memphis | GDS Associates

Options explored under MLGW’s IRP include connections to MISO to access renewables and building combined cycle plants and solar near Memphis | GDS Associates

MLGW is TVA’s largest wholesale customer, spending about $1 billion per year on electricity.

“It’s not lost on anybody that unlike pretty much any other one of TVA’s wholesale customers, MLGW does have a real opportunity to do something different,” Dawson said. “No wholesale customers have successfully left TVA. They have a certain type of protection, a certain type of legacy that revolves around their transmission system. That means if you leave TVA, you have to do a lot of work, I mean a lot of work and invest billions of dollars.”

GDS estimated that under the LTPA, MLGW will pay $78.77/MWh for energy from 2028 to 2047. If the utility leaves TVA for MISO and constructs its own transmission, it can expect to spend $78.20/MWh for energy in the same timeframe based on the best bids, Dawson said. He added he wasn’t surprised by those numbers and said that under the more independent MISO option, MLGW will own its transmission links and be able to control its destiny.

$1B in Tx Upgrades

A Siemens analysis prepared for MLGW concluded the utility will require 2,400 MW of new firm import capacity to MISO South should it leave TVA. The technology company said that would entail two 500-kV lines spanning the Mississippi River into Entergy Arkansas’ territory and a 230-kV line terminating in Entergy Mississippi’s footprint. Siemens said it would take seven to eight years to build the lines at a cost of about $1.2 billion.

GDS included the new transmission facilities in considering all the potential costs of leaving TVA.

“As a utility, you just don’t turn on a dime,” Dawson said.

MLGW Board Chair Mitch Graves said things have changed since the utility began exploring bids. He said supply chains have become strained, inflation is squeezing customers and energy prices have climbed sharply.

“All of that has to come in our decision-making process,” he said.

City council member Dr. Jeff Warren said MLGW might consider waiting for economic tensions to settle before proceeding.

“It seems that moving quickly on this may not be very prudent, but getting our ducks in a row for a longer transition may be something that we should be doing as a system,” he said.

GDS said it will finalize its evaluation of the bids and conduct negotiations with a short list of bidders.

MLGW CEO J.T. Young said utility executives will recommend a supplier to its board in August, opening a 30-day public comment period. The commissioners could vote on the issue in September.

The bids, currently confidential, will be made public for the August meeting.

The utility is accepting public comment on the masked bid data at PowerSupply@MLGW.org.