Twenty-eight percent of U.S. coal-fired power plants are expected to be retired by 2035.

A recent report by the Pacific Northwest National Laboratory in Richland, Washington, said that the communities hosting those plants need to do a better job of preparing for the loss of these major employers.

“Community impacts of power plant decommissioning are not limited to job and revenue losses. Communities are likely to be impacted culturally, socially, environmentally, and have long-term health-based impacts that should be acknowledged and addressed in post-retirement plans,” the report said. “Despite the economic spillover effects that decommissioning will have on the surrounding community, residents often do not have a say on the decision to decommission a coal plant.”

The report, which is dated September 2021 but was released in April, seeks to understand who in a community is affected when a coal-fired plant shuts down, and how to get those people involved in planning for economic recovery, Bethel Tarekegne, a PNNL equity and renewables researcher, said in an interview. “It’s what is realistic for the community to move ahead,” she said.

The report’s recommendations focus on how a community can get involved as soon as a coal-fired plant is considered for closure, extensive research into options on how to recover from that loss, and public transparency in dealing with the effects

“Understandably, no one size fits all,” Tarekegne said.

As of February, the U.S. had 240 active coal-fired power plants. Between 2010 and the first quarter of 2019, U.S. utilities announced the retirement of more than 546 coal-fired power units, totaling about 102 gigawatts. Plant owners intend to retire another 17 GW of coal-fired capacity by 2025, according to the U.S. Energy Information Administration, with 12.6 GW slated to shut down this year.

In another report, the EIA said utilities plan to retire 28%, or 59 GW, of the coal-fired capacity currently operating in the country by 2035.

The PNNL study looked at four communities that have lost or will lose their coal-fired power plants.

Wise County, Va.

This county of 38,000 expects to lose 153 full-time plant jobs and 300 to 400 plant-supported jobs, $6-$8.5 million in annual tax revenue and $25-$40 million in local economic activity. In 2019, the county had a 9.4% unemployment rate when the national average was 5.3% and Virginia was 4.6%.

“This translates into a significant impact on schools and other public services in the area. For a region with high unemployment and poverty rates, the job losses and decrease in economic activity due to the plant closure would be a critical threat. The issue of environmental cleanup is another huge concern among community members, especially the resources for cleaning up gob [accumulated spoil] piles, for which the only remediation solution currently is to burn the gob at the power plant,” the PNNL report said.

After going online in 2012, Dominion’s 668-MW Wise County plant has picked up many state air pollution violations. It has underperformed in producing electricity, dipping to 22% of expected performance in 2019, and suffered financial losses in 2013 and 2014.

Virginia passed a law in 2020 that requires most of the state’s coal-fired plant to close by 2024. The rest must be decommissioned by 2045. There is no timeline set for decommissioning the Wise County plant. However, Dominion Energy has the option of revamping the site as a renewable energy facility, the PNNL report said.

Wise County leaders were instrumental in getting a 2021 Virginia law passed that required a public hearing on the decommissioning of coal power plants, required the state to maintain a website detailing decommissioning dates for large carbon-emitting plants, and required investor-owned carbon-emitting utilities to provide decommissioning studies to the public.

Anderson County, Tenn.

This county of 75,000 expects to lose 100 full-time jobs, $70 million in annual tax revenue, and 54% of the Clinton, Tennessee, school district’s tax base when the 881-MW Bull Run Fossil Plant (BRFP) closes in December 2023. The Tennessee Valley Authority opened the plant in 1966.

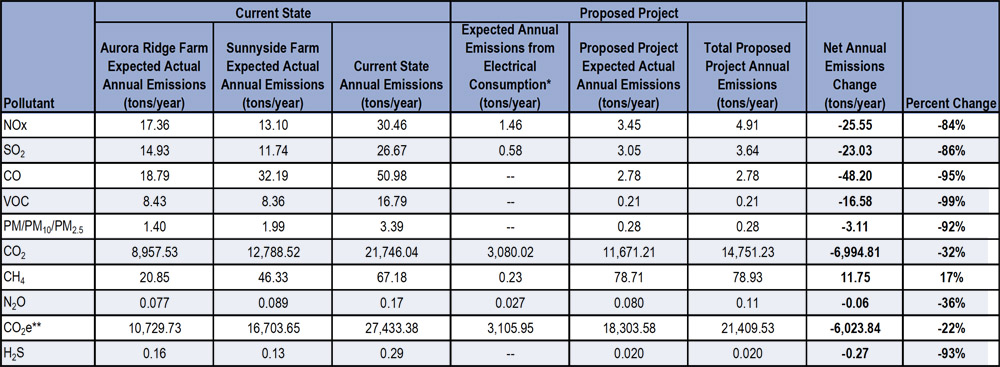

In 2002, the plant accounted for roughly 60% of the greater Knoxville area’s air pollution. Emissions controls have improved, but the plant’s pollutants have been linked to many deaths, including 21 in one year, the PNNL report said. It has collected multiple federal air pollution violations.

The site has stored more than 10 million cubic yards of coal ash, worrying local residents about the environmental impacts.

“Community opinions about whether the coal ash should be moved offsite or kept in its current location at the BRFP facility are mixed. The decision is a difficult one, because the community will be faced with environmental ramifications and public health consequences if the ash pile is kept onsite but will also encounter significant impacts if the coal ash is removed,” the report said.

TVA is closing the plant because it is unprofitable to run and faces $1.3 billion in needed improvements. TVA has determined it can serve its customers without the facility. The agency is considering tearing down the plant, but there has been little community input into the site’s fate since the closure decision was made in 2019.

“TVA’s noncommittal attitude toward engaging the community in the decommissioning process has strained their relationship with the community and constituted a large barrier in setting the stage for a just transition process,” PNNL said. “The community wants more direct input in the retirement planning process, and more specifically, a formal negotiation agreement to be signed by the TVA, especially to ensure that the community has some influence on the landfill permitting issue. Since 2018, the TVA has hosted or planned a total of 13 sessions for information dissemination/public involvement in the (the plant’s) retirement process … [three sessions] did not provide opportunities for formal public comments.”

Muskegon County, Mich.

Opened in 1948 and located one mile from Lake Michigan, Consumers Energy’s 320-MW B.C. Cobb plant was closed in 2016 and demolished in 2020. The closure eliminated 160 jobs and about $70 million in annual tax revenue in the county of 173,000. Roughly 13.5% of the county’s population lived below the poverty line in 2019.

The Muskegon County plant was the last of seven coal plants Consumers Energy decided to close because they were no longer economical to operate, prompting the utility to convert to more economical natural gas and renewable energy. In closing the seven plants, Consumers, which wants to reach net zero emissions by 2040, reduced its carbon emissions by 90%.

The PNNL report said the community was largely uninvolved in the pace and direction of the plant’s closure, although the local government provided some expedited permitting in return for Consumers Energy removing its ash ponds.

“Although the decision-making process was neither equitable, nor entirely transparent, [Consumers] Energy did give the community some leeway in assessing the best future use for the site. [Consumers] Energy recommended alternative uses for the site, including an expanded deep-water port, an agribusiness center, and a sustainable manufacturing center, but ultimately provided funding for the community to conduct studies to better understand their options,” the report said.

Through a third party, Consumers Energy sold the site to a shipping company at the nearby port.

Sherburne County, Minn.

Xcel Energy’s Sherburne County Generating Station (Sherco) in Becker, Minnesota, consists of three coal-fired units capable of producing 2,400 MW and burning 30,000 tons of coal a day. The utility plans to close one unit in 2023, another in 2026 and the third in 2030, and is proposing to open a 460 MW solar plant at the site in 2024.

The closures will eliminate 300 jobs, as well as 14% of Sherburne County’s tax base and 75% of Becker’s tax base.

In 2007, Minnesota lawmakers set economy-wide carbon reduction goals of 30% by 2025 and 80% by 2050. Xcel initially targeted a 40% reduction in its Midwest carbon emissions by 2030, but the retirement of the first two Sherco units would allow the utility to reach 60% reduction by 2030.

“The Becker and broader Sherburne County communities were initially in denial about the plant’s fate and thought Sherco might be saved because it powered a quarter of the Twin Cities. However, the Becker City Administrator strategically shifted the conversation from the need to save the power plant to developing plans for the anticipated power plant decommissioning. … Dealing with the anticipated decommissioning of the plant was a significant undertaking for the community,” the PNNL report said.

Local leaders then began researching options and what the community had to offer to prospective new businesses, including thousands of acres of buffer areas around the three units. Becker has ended up building a metals recycling plant, helping expand two existing trucking companies, and is planning to obtain a data center to attract new businesses.

Lam Chung, MRO | NERC

Lam Chung, MRO | NERC