Start-up Cost Offer Development Proposal Endorsed

Stakeholders at last week’s PJM Markets and Reliability Committee meeting unanimously endorsed a revised proposal from the RTO and the Independent Market Monitor addressing start-up cost offer development worked on through the Cost Development Subcommittee (CDS).

Tom Hauske, principal engineer in PJM’s performance compliance department, reviewed the joint proposal to revise Manual 15: Cost Development Guidelines, along with revisions to the tariff and Operating Agreement.

The CDS initially brought two proposals for first reads to the October MIC meeting, but a vote on the proposals was postponed, allowing for more discussions and stakeholders to reach consensus on a single proposal. (See “Start-up Cost Offer Development,” PJM MIC Briefs: Oct. 6, 2021.)

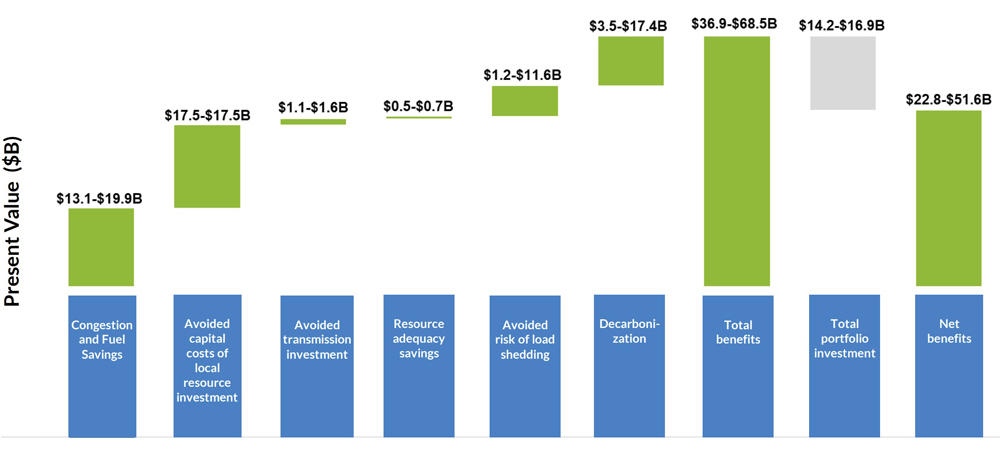

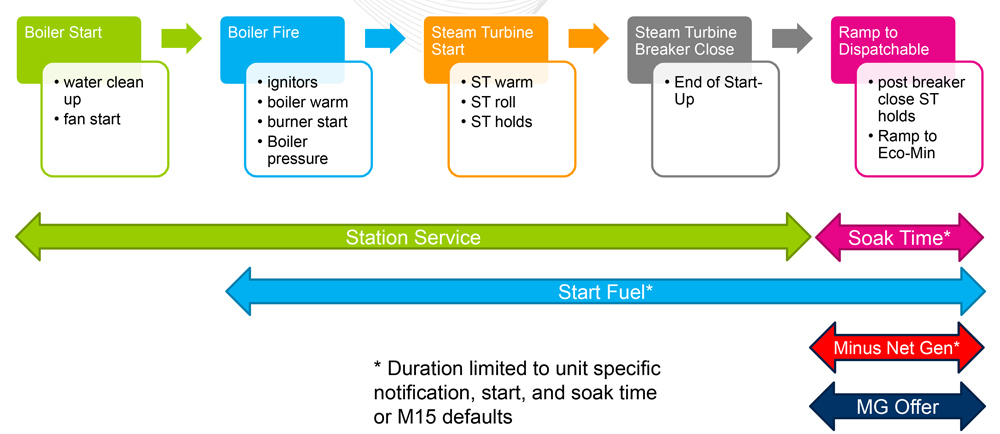

Manual 15 allows the start-up costs for combined cycle units to include fuel costs after generator breaker closure and synchronization to the grid, a feature not available to other unit types, such as steam and nuclear plants. The revisions align start-up costs for all units with a soak process, or units that use steam turbines.

For units with a soak process, including steam, combined cycle and nuclear units, some of the soak costs will be included in the start-up costs from PJM’s notification to the “dispatchable output” and from the last breaker open to the shutdown process.

PJM’s revised steam unit start-up cost offer procedure | PJM

PJM’s revised steam unit start-up cost offer procedure | PJM Units that don’t have a soak process, like combustion turbines and reciprocating engines, maintain the status quo, with start-up costs that include costs from the time of PJM’s notification to the first breaker close and from the last breaker open to the conclusion of the shutdown process.

The approved revisions include several other changes to Manual 15 to provide additional guidance and clarification, Hauske said, such as equations to calculate start-up costs, station service calculations for units with and without a soak process, and unit-specific parameter limits on includable costs.

Manual 15 allows generators to include an additional labor cost in their start-up costs, Hauske said, but generators already are permitted to include the labor cost in the unit’s capacity offer through its avoidable-cost rate (ACR). The revisions eliminate the labor cost language in the tariff and OA offer cap sections and the start-up cost calculation so that all the operating labor is includable in the ACR.

PJM is providing a six-month window for implementation to allow market sellers the opportunity to have their fuel costs or net generation used for the offset to be reviewed by the Monitor prior to the revisions going into effect.

Hauske described the new start-up cost definition included in Manual 15, which states it will “consist primarily of the cost of fuel, as determined by the unit’s start heat input (adjusted by the performance factor) times the fuel cost. It also includes operating costs, maintenance adders, emissions allowances/adders and station service power cost. Start costs can vary with the unit offline time being categorized in three unit temperature conditions: hot, intermediate and cold.”

Adrien Ford of Old Dominion Electric Cooperative offered a friendly amendment that was adopted by stakeholders to the end of the definition, which says, “Units with a soak process include nuclear, steam and combined cycle units. Units without a soak process include engines, combustion turbines, intermittent and energy storage resources.”

Ford said the suggestion came from ODEC staff to “provide clarity” for the units impacted by the changes.

“We were just looking for it to be better defined upfront when you’re first reading this, so that the puzzle has some of the overview pieces up front, and then you can get into the detail pieces later,” Ford said.

DEA Proposal Denied

Members rejected a PJM proposal to address changes to the Designated Entity Agreement, sending the issue back for more stakeholder discussions.

The proposal, which PJM was seeking a quick-fix approach to make changes, received a sector-weighted vote of 2.51 (50.2%), falling short of the necessary 3.33 threshold for adoption.

FERC in February rejected a filing by PJM in its Order 1000 compliance docket that would have updated the definition of “designated entity,” agreeing with a coalition of stakeholders that it infringed on their due process rights. (See FERC Rejects PJM Redefinition of ‘Designated Entity’ Under Order 1000.)

Ken Seiler, vice president of PJM’s planning department, said the proposal was meant to accommodate the “lack of clarity” in the OA regarding the DEA. Seiler said the existing OA language is “a little too broad,” and PJM wanted to clear up the definition.

Seiler said PJM wants to look at all construction-related activities in the RTO to make sure the process is being done efficiently.

“We’d like to take a holistic look at everything and consider how this is impacting any risk to any stakeholders, consumers or ratepayers; how it’s impacting our ability to get work done; how it’s impacting our coordination with all the other projects coming through the [transmission planning] process,” Seiler said.

Augustine Caven, manager of PJM’s infrastructure coordination department, presented the proposal consisting of a problem statement, issue charge and OA revisions.

Caven said the OA language can be interpreted differently because of the “imprecise” use of the term “designated entity,” so PJM’s proposal called for several revisions to “eliminate the ambiguities” and “align the OA language with the intent and use of the DEA.”

“Given the urgency associated with compliance considerations and the narrow scope of the issue charge, PJM believes this issue is well suited for the quick-fix process,” Caven said.

Several stakeholders questioned the use of the quick-fix process on the issue, saying the complexity of DEAs warranted more in-depth discussions.

Two different alternatives to PJM’s proposal were also presented for stakeholder consideration. Greg Poulos, executive director of the Consumer Advocates of the PJM States, offered an issue charge on behalf of the Delaware Division of the Public Advocate to allow for more education on the DEA process and the formation of a senior task force to work on any possible OA changes if needed.

Denise Foster Cronin of the East Kentucky Power Cooperative presented an alternative issue charge from EKPC, Exelon and Public Service Enterprise Group that called for endorsing PJM’s OA changes and also starting a stakeholder process to discuss other possible changes to the DEA.

In a sector-weighted vote of 3.95 (79%), members voted to table the two additional proposals until the June MRC meeting.

Dynamic Line Ratings Proposal Endorsed

Members unanimously endorsed PJM’s proposal and manual revisions supporting the interim integration of dynamic line ratings (DLRs) into its operations.

Chris Callaghan, PJM senior business solution engineer, reviewed the proposal that included corresponding revisions to Manual 1: Control Center and Data Exchange Requirements, Manual 3: Transmission Operations and Manual 3A: Energy Management System Model Update and Quality Assurance.

PPL is tentatively scheduled to go live in June with a DLR system on some of its transmission lines, Callaghan said, and PJM wanted to “enable the operational implementation of dynamic ratings” through temporary manual revisions, which will be in place pending submission of the RTO’s FERC Order 881 compliance filing.

In December, FERC ordered transmission providers to end the use of static line ratings in evaluating near-term transmission service and required transmission providers to employ ambient-adjusted ratings for short-term transmission requests of 10 days or less for all lines that are impacted by air temperature. (See FERC Orders End to Static Tx Line Ratings.)

The manual revisions are meant to have new guidance and requirements related to the operational and technical implementation of DLR systems, Callaghan said. Some of the manual revisions include adding timeline requirements to notify PJM about any new DLR systems to be installed on the grid and to provide details on requirements for real-time and forecasted DLR submissions.

Rate and Waiver Filings

Steve Pincus, associate general counsel of PJM, reviewed a proposed problem statement and issue charge addressing service to members’ tariff rate and waiver filings under the RTO’s governing documents.

In 2018, Pincus said, PJM proposed a new OA requirement as part of a larger group of changes from the Governing Document Enhancement and Clarification Subcommittee (GDECS) that called for ensuring the RTO is “properly served with members’ and interconnection customers’ rate and waiver filings” impacting PJM and stakeholders’ rights and obligations.

Pincus said a motion was made at the September 2018 MRC meeting to defer the consideration of the revisions after some stakeholders objected to the scope of the changes coming from the GDECS. PJM approached stakeholders earlier this year about reviving discussions on the issue.

The proposed problem statement says that PJM has experienced incidents when relevant FERC filings are made by members but are not served to the RTO, including tariff and service agreement filings.

“Service of such filings on PJM is important to ensure PJM is able to intervene and participate in such proceedings to protect the interests of PJM members and markets,” the problem statement said.

Key work activities in the issue charge include education on PJM’s need to be served with rate, waiver and other filings and the development of a solution to include any changes to governing documents or manuals.

Pincus said work on the issue charge is planned for special sessions of the MRC and is expected to take six months.

Consent Agenda

Stakeholders unanimously endorsed several manual changes as part of the MRC consent agenda. They included:

- revisions to Manual 3: Transmission Operations resulting from a periodic review. The changes include updating stability limitation process language in accordance with docket ER21-1802 and aligning language with the current TO/TOP matrix language.

- revisions to Manual 11: Energy & Ancillary Services Market Operations, Manual 12: Balancing Operations and Manual 28: Operating Agreement Accounting addressing conforming changes for stability limits in markets and operations. FERC ruled in February that PJM has the right to refuse lost opportunity cost payments to generators that are temporarily required to limit output to prevent loss of synchronization and additional strain on the system during transmission outages.

- revisions to Manual 21A: Determination of Accredited UCAP Using Effective Load Carrying Capability Analysis addressing an effective load-carrying capability model run timing update. PJM rules allow voluntary submission of unit-specific wind and solar parameters for development of backcasts for newer resources, but manual language has an expiration date of March 1 for voluntary submissions. The quick fix removes the March 1 expiration date.

- revisions to Manual 36: System Restoration resulting from a periodic review. The minor changes include replacing the System Restoration Coordinators Subcommittee with System Operations Subcommittee and updating the under-frequency load shed table with new data.