Planning Committee

Interconnection Process Subcommittee Vote Delayed

PJM delayed a vote on the draft charter of the Interconnection Process Subcommittee at last week’s Planning Committee meeting after stakeholders requested changes to the charter language.

Jason Connell, PJM director of infrastructure planning, reviewed the draft charter of the subcommittee, which is being created to continue the discussion of interconnection process changes after the Interconnection Process Reform Task Force finishes its work. Stakeholders endorsed PJM’s proposal for a new interconnection queue process at the April Markets and Reliability Committee and Members Committee meetings. (See PJM Stakeholders Endorse New Interconnection Process.)

The IPS is intended to be a stakeholder forum to “investigate and resolve specific issues related to the interconnection process and associated agreements, governing documents and manuals,” the charter said, and will include discussion topics such as education on current and future interconnection processes and agreements with clarifications around implementation.

Connell said PJM staff routinely receive questions from developers on how interconnection processes not specifically described in the manuals or the tariff are implemented. He said PJM wants to use the subcommittee as an “incubator” for discussions on interconnection issues to come up with solutions.

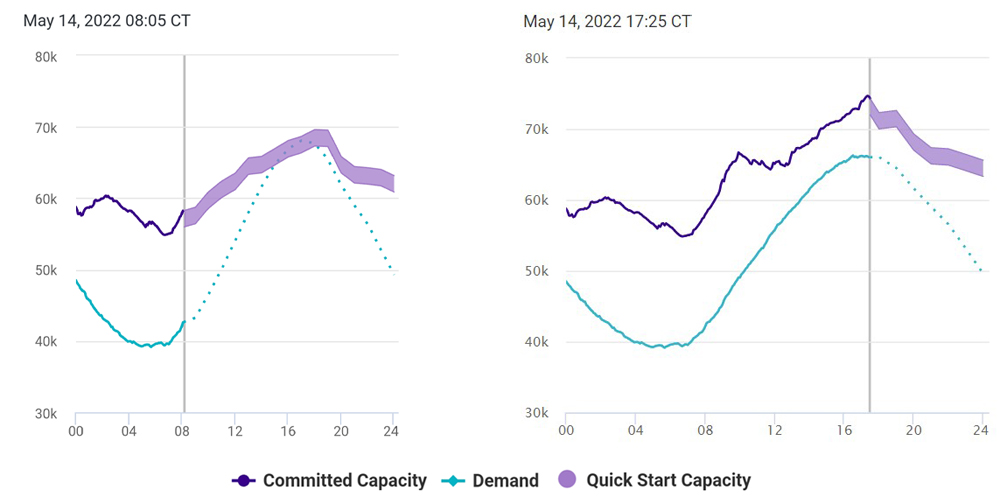

PJM’s new services queue. | PJM

PJM’s new services queue. | PJM

The IPS is designed to mainly report to the PC, Connell said, but some of the discussion may impact operations and markets, requiring reports to the Market Implementation Committee and the Operating Committee.

Connell said some stakeholders requested additional detail in the charter language regarding the governance and administration of the subcommittee. Clarifying language was added stating, “Any recommendations from the IPS will be forwarded to the PC for consideration and voting.”

Sharon Midgley of Exelon said her company is “excited to get this group started” to have ongoing conversations on changes in the interconnection queue process.

Midgley offered another suggestion in the administration section of the charter, saying it should include language that says “issue charges will be used at the subcommittee to support the work plan.” She said an issue charge wouldn’t necessarily have to come back to the PC for endorsement but could instead stay at the IPS where policy experts are working on the issue.

“That way the attendees would know what issues are being worked,” Midgley said. “They would see the work plan.”

Michelle Greening, manager of PJM’s stakeholder process and engagement department, said the subcommittee “can take on any issue charged within its purview under its charter” if it is within the scope of the existing charter and if no stakeholder objects to it at the subcommittee level.

If the issue charge goes beyond the charter and scope of the subcommittee or concerns are raised by a member, Greening said, then the issue charge will come back to the PC for endorsement.

Dave Anders, PJM director of stakeholder affairs, said the IPS will operate similarly to other subcommittees that report to a standing committee, citing the Cost Development Subcommittee as an example. Anders said Manual 34 stipulates that subcommittees are allowed to take on work that’s within the charter of the group.

Adrien Ford of Old Dominion Electric Cooperative suggested changing “PC” to “standing committee” in the administrative section stating, “Any recommendations from the IPS will be forwarded to the PC for consideration and voting.” Ford said it would be better to keep the term general in case issues need to go to the MIC or OC.

Connell recommended holding off on the charter vote until next month so that PJM staff can formulate clearer language.

RSCS Charter Endorsed

Stakeholders unanimously endorsed minor changes to the Reliability Standards & Compliance Subcommittee (RSCS) charter.

Monica Burkett, PJM senior lead knowledge management consultant, reviewed the changes to the charter, saying the RTO wanted to improve discussions and find more efficiencies in the RSCS, such as maintaining up-to-date information on issues. She said the changes improve what compliance information is provided and shared with stakeholders in the subcommittee.

Burkett said the charter updates included “simple tweaks” to language for clarification.

One item removed from the charter language is the development of a list of functions performed by other registered entities “in support of PJM compliance.” Burkett said the list of functions are reviewed at the RSCS, but they are not developed by the subcommittee.

Under the responsibilities section of the charter, PJM removed the item “cooperate with PJM with regard to data requests and submittals related to NERC and regional reliability standards” and inserted “allow for exchange of best practices and discussions surrounding upcoming data requests related to NERC and regional reliability standards.”

“We wanted to ensure that everything is specific to the RSCS,” Burkett said.

2022 RRS Assumptions

Jason Quevada, a senior analyst in PJM’s resource adequacy planning department, presented the 2022 reserve requirement study (RRS) assumptions developed in the Resource Adequacy Analysis Subcommittee (RAAS).

Quevada said the study results reset the installed reserve margin (IRM) and the forecast pool requirement (FPR) for the 2023/24, 2024/25 and 2025/26 delivery years and establish the initial IRM and FPR for the 2026/27 delivery year.

Quevada said the 2022 RRS assumptions are similar to those in the 2021 RRS and are an update of the specific historical period to be used for the winter peak week modeling.

For generator performance, Quevada said, the PRISM model uses each generating unit’s capacity, forced outage rate and planned maintenance outages to develop a cumulative capacity outage probability table for each week of the year, except the winter peak week. For the winter peak week, Quevada said, the cumulative capacity outage probability table is created by using actual historical PJM-aggregate outage data from the 2007/08 delivery year through the 2021/22 delivery year.

“The methodology to develop the winter peak week capacity model is to better account for the risk caused by the large volume of concurrent outages observed historically during the winter peak week,” Quevada said.

Generator unit model data will be available for review, Quevada said, with a July target for completion by generation owners. The load model time period analysis will be presented to the RAAS and PC in July, he said, and PJM will seek approval in August. The final report is scheduled to be presented to the RAAS and PC in September with final approval in October.

Transmission Expansion Advisory Committee

Generation Deactivation

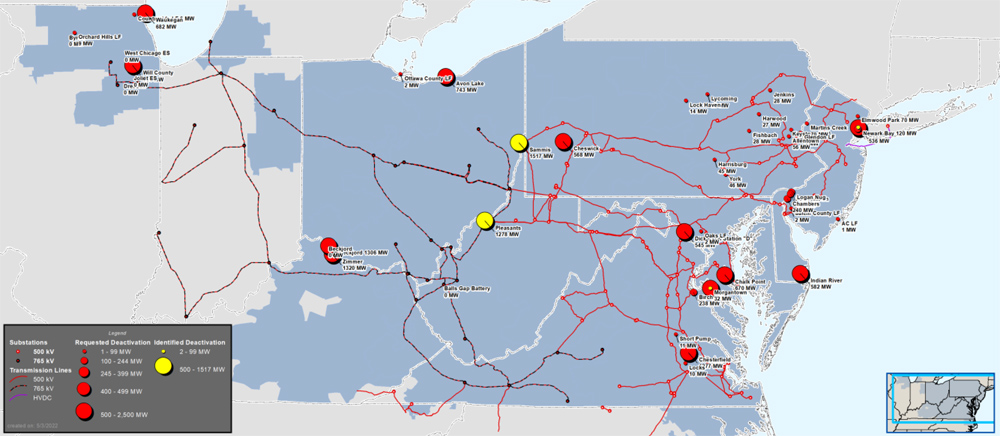

Phil Yum of PJM’s system planning modeling and support department provided an update at last week’s Transmission Expansion Advisory Committee meeting on recent generation deactivation notifications, including Energy Harbor coal units in Ohio and West Virginia with a requested deactivation date of June 1, 2023.

Energy Harbor requested deactivation of coal-fired units 5-7 of the 1,504 MW W.H. Sammis Power Station in the American Transmission Systems Inc. (ATSI) transmission zone in Ohio. The company also requested the deactivation of the 13 MW diesel unit at Sammis.

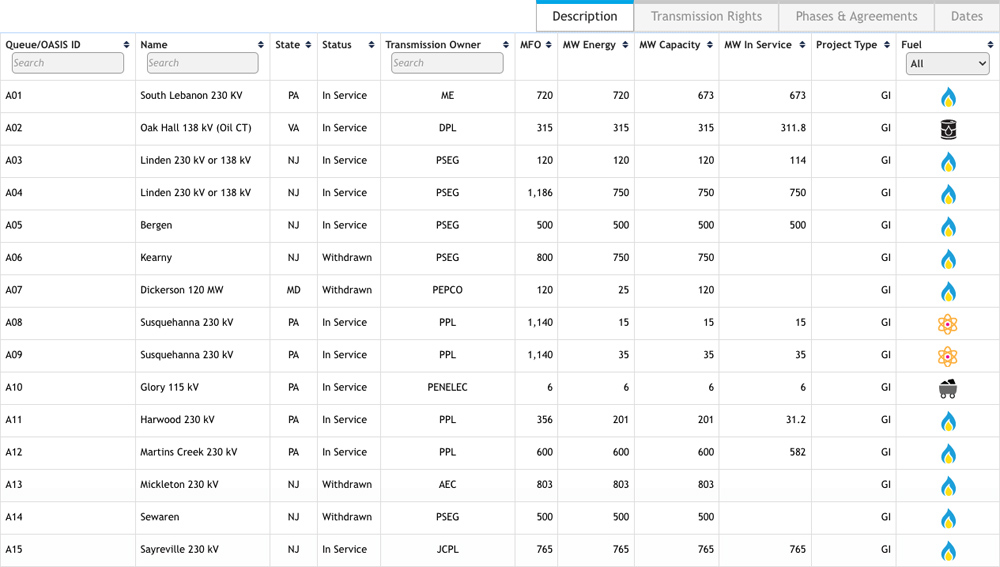

Generation deactivation requests in PJM between 2020-2022. | PJM

Generation deactivation requests in PJM between 2020-2022. | PJM

Energy Harbor also requested deactivation of units 1 and 2 of the 1,278 MW Pleasants Power Station in the Allegheny Power Systems transmission zone at Willow Island, W.V.

Yum said reliability analyses are complete for the Sammis and Pleasants units, and a thermal violation was identified on the Beaver-Hayes 345 kV Line in Ohio. The recommended solution calls for replacing four 345 kV disconnect switches with 3000A disconnect switches, replacing substation conductors between bus bar and wave trap, replacing line drop and stranded conductor and upgrading transformer protection relays at two breakers at the Beaver substation.

The projected in-service date for the project is June 1, 2024, Yum said, and the estimated cost is $2.1 million. Yum said operating measures have been identified to mitigate reliability impacts in the interim since the requested deactivation date is a full year before the in-service date for the upgrades.

PJM also received two new deactivation requests, Yum said, including the 32-MW Morgantown CT1 and 2 oil-fired units in the Pepco transmission zone in Maryland and the 19.3-MW Carbon Limestone landfill in the ATSI transmission zone in Ohio. Yum said reliability analyses are underway for both deactivations.