ERCOT’s Board of Directors last week sided with the ISO’s staff over a nodal protocol revision request that gives the grid operator the authority to review, coordinate and approve or deny all planned generation maintenance outages.

Stakeholders rejected staff’s version of NPRR1108 earlier last month, unanimously approving the measure as amended by several joint commentators. (See ERCOT Technical Advisory Committee Briefs: April 13, 2022.)

However, the directors approved staff comments filed April 26 that eliminated guardrails TAC had placed around the outage process to allow for weather variations during outage seasons that would provide predictable minimum outage windows for resource owners. The staff comments also modified TAC’s approved language for determining the inputs to the maximum daily planned resource outage capacity (MDRPOC) calculation used to evaluate outage requests.

Woody Rickerson, ERCOT’s vice president of system planning and weatherization, told the board the MDRPOC is the process’ key feature. Staff currently approves any outage request that is made 45 days or more in advance, but the calculation places a limit on the total amount of outage capacity for each day over the next five years.

Rickerson said the MDRPOC will be updated twice each month and daily remaining outage capacity values will be updated at least twice per day. The calculation allows a higher number of outages during fall and spring to ensure generation availability for the summer and winter peak load seasons, he said.

“We should have done this a long time ago. This gives resource owners the ability to look at the schedule of available outages, compare them to what is already scheduled, and gives more information when looking at scheduling outages,” Rickerson said in laying out ERCOT’s position. “It’s useful for everyone. Having that transparency will aid us in approving these outages because generators can see what others doing.”

Staff said they were concerned with TAC’s recommendation to establish a guaranteed minimum for the MDRPOC, saying it would impair their reliability responsibility by preventing them from ensuring sufficient generation capacity is available to meet expected conditions when the floor exceeds the MDRPOC.

TAC’s requirement that it approve ERCOT’s methodology also drew pushback from Rickerson. He said ERCOT’s goal is to allow as much capacity and flexibility as possible for planned outages while maintaining reliability.

“ERCOT recognizes the fastest way to get into trouble is to restrict planned outages,” he said. “We want the outage process to be as flexible as possible. We’ve got to find a way that resources can take outages.”

To that end, Rickerson said staff wants to further review the MDRPOC with stakeholders and bring it back to the board. He offered that for any change, the ISO will solicit stakeholder feedback through a market notice at least 14 days before seeking board’s approval of the changes.

“We all want the same thing: safe, reliable operations of this grid,” Calpine’s Bryan Sams said in advocating TAC’s position. “For resource owners, that includes the opportunity to take planned maintenance outages with plenty of time to plan things that are very complicated.”

Sams said that while TAC endorsed the NPRR, “it doesn’t stop ERCOT from maintaining reliability or canceling planned outages and directing generators to be online during tight conditions.”

Asked whether greater visibility into other generators’ planned outages would be beneficial, Sams reminded the board that generators are trying to maximize prices.

“You’ll see generators moving outages when times are time,” he said. “If ERCOT increased the MDRPOC a week before [an outage], you’ve lost a year. As a resource owner, if you believe the time period is going to be a little sketchy, you don’t schedule your outage for that period.”

Board Chair Paul Foster asked that ERCOT continue to work with the generators to refine the outage-calculation’s inputs and bring the NPRR back to the board’s June 20-21 meeting.

“That would be evidence of all of us working together,” he said.

Staff drafted NPRR1108 to meet the requirements of legislation passed last year in the wake of the February winter storm that came within minutes of collapsing the ERCOT grid. Senate Bill 3 included a provision that the grid operator “shall review, coordinate and approve or deny requests by providers of electric generation service … for a planned power outage during any season and for any period of time.”

The board tabled a second staff appeal of another TAC-endorsed rule change (NPRR1112) that would reduce unsecured credit limits from $50 million to $30 million. Staff argued that eliminating unsecured credit “will reduce the inconsistent cross-subsidization of credit exposure and provide a more level playing field for market participants.”

TAC last month rejected a motion to amend the measure with ERCOT’s comments, 16-3 with 11 abstentions. (See “Unsecured Credit Limit Lowered,” ERCOT Technical Advisory Committee Briefs: April 13, 2022.)

Kenan Ögelman, vice president of commercial operations, explained to the board that when ERCOT’s competitive market was opened in 2001, “certain parties” requested the grid operator grant credit, a practice that continues today.

In advocating TAC’s position, Garland Power & Light CEO Darrell Cline said no parties have supported the ISO’s position and that eliminating unsecured credit does not “materially improve” credit risk in ERCOT. He pointed out that about $420 million in market transactions during last year’s winter storm remains in default, in addition to the $1.9 billion Brazos Electric Power Cooperative owes the market.

Cline said none of the entities at default were extended unsecured credit and that other more appropriate vehicles exist to target credit risk, such as a comprehensive study of best practices.

“I believe I’ll be able to say all of those that are receiving unsecured credit have fully repaid ERCOT,” he said.

Director John Swainson, saying TAC’s presentation “should raise a level of doubt in the board about the wisdom of proceeding” with the approach, urged tabling the NPRR and directing staff to study best practices. Legal counsel Chad Seely responded that staff would gather additional information from other ISOs and bring it to TAC’s May 25 meeting.

Board Nears Decisions on Governance

Foster said the directors, fully seated since January, have been spending time with ERCOT staff and stakeholders “to become better educated on the board’s duties and responsibilities” so they can make “sound and strategic decisions” on the ISO’s governance framework.

He said the board plans to reach consensus on key principles that will guide decision-making as it considers modifications to the “governing documents and stakeholder process structure in a way that helps us all achieve our goal of a reliable, resilient and secure Texas power grid and fair, competitive markets.”

Foster said the directors expect to provide more information and begin staff and stakeholder discussion on the changes during their June meeting. In the interim, senior staff will reach out to TAC’s leadership to discuss the board’s preliminary thoughts.

TAC Chair Clif Lange, with South Texas Electric Cooperative, told RTO Insider he is glad the board’s learning curve has begun to flatten and that the directors are ready to discuss “the future of stakeholder interaction and participation.” TAC members have raised concerns since last summer that its participation may be bypassed under the new governance structure.

“I think the robust discussions held recently pertaining to high profile NPRRs really displays the mutually beneficial nature of a strong process that allows ERCOT and stakeholders to vet ideas,” Lange said.

ERCOT Tracking 17 GW of Crypto Load

ERCOT interim CEO Brad Jones told the board that staff is tracking 17 GW of potential cryptocurrency mining load that is interested in connecting to the Texas grid. That would be more than a 20% increase in peak demand were all 17 GW to begin operations.

“That’s just slightly over two New York Cities,” Jones said in providing directors an image of what could be coming. “This seems to be a great place to come.”

The ISO expects about 5 to 6 GW of crypto load to be added in the next two years. The miners have been drawn to the state by cheap power prices and lax regulations. They have argued they can make the grid more resilient because their load can be quickly shut down when demand spikes.

“We’ve got to get ready for that, because it’s an entirely new type of load for us,” Jones said. “It’s a loan that we know is going to come offline at certain price points, and we have to prepare for that,” Jones said.

He said he has had “great conversations” with 75% of U.S. investment in cryptocurrency. “They’re very willing to work with us to find reliability solutions for us and all of Texas,” Jones said.

ERCOT has already established an interim process to ensure new large loads can be reliably connected to the grid, helping staff to identify and resolve any issues before adding the loads to the system. The process applies to those projects or expansions that add 20 MW of demand at a generator within the next two years.

The ISO is also creating a task force to develop policy recommendations for interconnecting large flexible loads. (See “Committee Approves Task Force to Address Crypto Mining Loads,” ERCOT Technical Advisory Committee Briefs: March 30, 2022.)

In his CEO’s report, Jones also said the grid operator’s budget variance is facing a $13.6 million shortfall, primarily because of a $9.7 overrun due to data center timing issues. Some of the projects expenditures were held over last year and some budgeted for next year were accelerated.

TAC Leadership Finally Confirmed

The board confirmed TAC’s leadership after a two-months delay. Lange and Engie’s Bob Helton, the committee’s vice chair, will serve through 2022.

TAC approved Helton, who stepped down as chair after 2020, as its vice chair in March. He replaced Just Energy’s Eric Blakey, whom the board had “discomfort” with over his company’s November lawsuit against ERCOT and the Texas Public Utility Commission. That discomfort led the board to put off confirmation of Blakey and Lange during its March meeting. (See “Helton Replaces Blakey as Vice Chair,” ERCOT Technical Advisory Committee Briefs: March 30, 2022.)

Just Energy filed for bankruptcy after the February 2021 winter storm. It is trying to recover payments that were made by its parties to the grid operator for certain invoices relating to the storm.

Board Signs Off on SCT Directives, 13 Changes

Meeting for the first time in almost two months, the directors approved a raft of changes brought forward by staff and TAC:

-

-

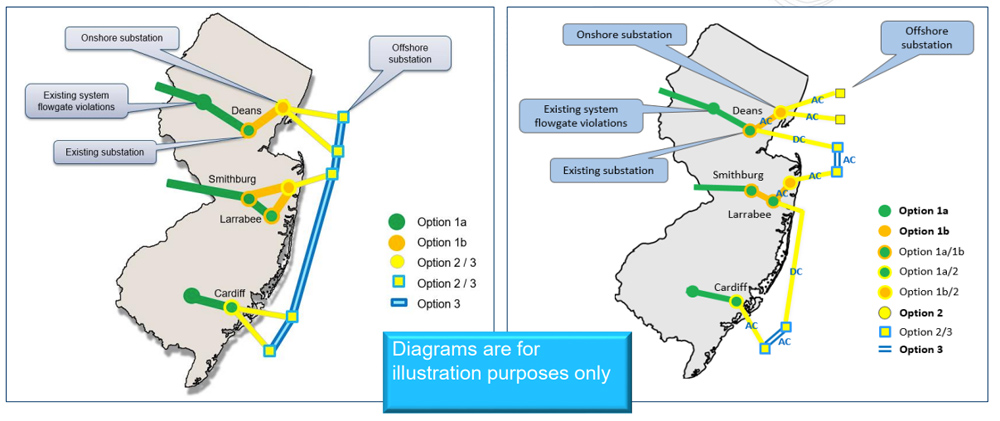

- Two directives issued by the PUC related to the Southern Cross Transmission (SCT) project, a merchant long-haul HVDC transmission line that would connect ERCOT with systems in the SERC Reliability region. In responding to the 14 PUC directives, ERCOT staff found they would not need to study and determine transmission upgrades to address congestion caused by SCT (No. 6). They also determined in the second directive (No. 8) that as of Jan. 1, 2021, DC ties should be required to have at least a 0.95 power factor leading/lagging reactive power capability, which several revision requests have already addressed. (See “Two More SCT Directives Approved,” ERCOT Technical Advisory Committee Briefs: April 13, 2022.)

- A minimum duration threshold of two hours for energy storage resources (ESRs). Lower-duration ESRs would be prorated to their continuous real power capability for two hours.

The board also approved eight NPRRs, two revisions to the Planning Guide (PGRR), a system change request (SCR) and a modification to the Settlement Metering Operating Guide (SMOGRR):

-

-

- NPRR1092: lowers the reliability unit commitment’s (RUC) offer floor from $1,500/MWh to $250/MWh and includes a two-hour opt-out provision.

- NPRR1096: requires resources providing ERCOT contingency reserve service (ECRS) to provide two consecutive hours and/or be capable of sustaining four consecutive hours of non-spinning reserve service. The measure also requires the ISO to conduct unannounced tests on energy storage resources providing ECRS and/or non-spin in real time to verify their state of charge.

- NPRR1116: removes obsolete language from Market Information System Administrative and Design Requirements referencing other binding documents on the system. Those documents are posted to the ERCOT website.

- NPRR1117: aligns the protocols with the Settlement Meter Operating Guide revisions to allow for losses in short runs of connecting lines to be disregarded when the ERCOT-polled settlement meter (EPS) is not physically placed at the point of interconnection (POI).

- NPRR1122: clarifies that ERCOT will retain all securitization default charge escrow deposits to cover necessary potential future obligations for securitization default charges, and that funds provided for default charge escrow deposits must be sent to the correct account to be properly credited. It also corrects a subscript definition error in the securitization default charge maximum MWh activity ratio share.

- NPRR1123: provides for the assessment of securitization uplift charge escrow deposits based on counter-party initial estimated adjusted meter load.

- NPRR1124: ensures generation resources that receive a RUC dispatch instruction can recover their actual fuel costs by setting the start-up price and minimum-energy price to the start-up cap and the minimum-energy cap.

- NPRR1125: clarifies that ERCOT may use available financial security held for other market activities should there be payment defaults in either of the two securitization proceedings. The change also specifies the prioritization for applying the securities when there are concurrent defaults for either invoices or escrow deposit requests.

- PGRR096: establishes requirements for the consistent representation of distribution generation resources, distribution energy storage resources, settlement-only distribution generators and unregistered distributed generation in steady-state base cases.

- PGRR098: enables corrective action plans to be developed under certain outage scenarios to the existing reliability performance criteria.

- SCR818: modifies the Network Model Management System (NMMS) and topology processor to incorporate geomagnetically-induced currents (GIC) modeling data for maintaining GIC system models for the ERCOT planning area to comply with NERC Reliability Standard, TPL-007-4 (Transmission System Planned Performance for Geomagnetic Disturbance Events). Additional changes include automated email notifications of the need for the GIC modeling data submittals and updates.

- SMOGRR025: allows for losses in short runs of connecting lines to be disregarded in instances where the EPS meter is not physically placed at the POI and requires calculation to verify that the watts copper losses are below 0.001%.