I have been thinking a lot lately about how we do or don’t plan for technological transitions, like the current clean energy transition now underway in the United States and worldwide.

In his closing remarks at the United Nations’ climate conference known as COP30, Brazilian diplomat and conference president André Corrêa do Lago acknowledged the meeting’s failure, once again, to keep even a mention of a phaseout of fossil fuels in the final statement from the event. He pledged instead to begin work on a roadmap for a “just, orderly and equitable” transition away from fossil fuels and pointed to plans for an international conference focused entirely on such a phaseout, planned for April 28-29, 2026, in Colombia.

That such a conference is being planned is historic in and of itself, though how successful it will be remains an open question, given the ongoing influence of fossil fuel industry lobbyists at climate conferences. More than 1,600 fossil fuel lobbyists took part in COP30 in Belem, Brazil ─ one in every 25 attendees ─ according to a report from the nonprofit Kick Big Polluters Out.

But lobbyists are more a symptom than a cause. The real problem lies in the idea that we can in some just, orderly and equitable way plan for a transition away from fossil fuels. Technological transitions are by their very nature unplanned, disorderly and inevitably unjust.

One need look no further than the lightning speed with which artificial intelligence has become the dominant digital technology worldwide, permeating almost every aspect of our economic, social and political lives and throwing the U.S. electric power industry into a chaotic panic.

And, as in all technological transitions, winners, losers and collateral damage are inevitable.

The narrative from the Trump administration, some regulators and utility industry leaders is that to win the global race for AI leadership, we must keep existing coal and natural gas plants online and build even more to power the hyperscale data centers now springing up across the across the country.

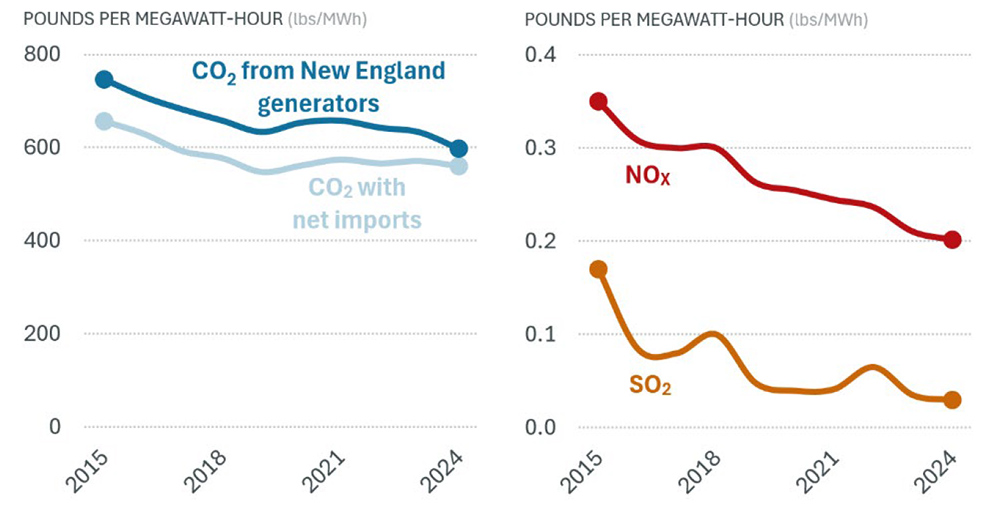

Climate action is the big loser here. Rising greenhouse gas emissions and the increasingly catastrophic extreme weather events and other environmental upheavals they cause have been downgraded, in the words of Energy Secretary Chris Wright, to mere side effects of our digital society.

The collateral damage: developing nations and remote, rural communities ─ including those in the United States ─ that are most exposed and vulnerable to extreme weather.

Which is not to say we should not plan but rather refocus on things that can be planned for, things we can control.

Biden’s Implementation Blues

Lack of planning was a core problem in the Biden administration’s seeming inability to implement ─ at speed and scale ─ the clean energy programs authorized by the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.

“Three years after the first of those laws passed, only a handful of federally funded projects had broken ground,” says a recent report from three former staffers at Biden’s Department of Energy ─ Ramsey Fahs, Alan Propp and Louise White. “This meant the political theory animating the administration’s approach ─ that the economic development generated by clean energy projects and industries would create a durable bipartisan coalition ─ was never truly tested.”

It also meant that President Donald Trump was able to quickly roll back programs and claw back funding, leading to a massive private sector retreat from previously announced multimillion-dollar projects.

“Years of work were undone in just a few months,” the report says, with at least 32 projects totaling $22 billion in investments canceled in the first six months of 2025.

Based on interviews with more than 80 DOE staffers, the report’s list of implementation blockers includes an absence of “clean, sector-specific deployment targets” and a reliance on “obligation metrics” ─ that is, money that was officially awarded but not actually spent ─ which resulted in a “false sense of progress.”

Other challenges included tangled decision-making processes and an overly cautious approach to risk management, resulting in long and complicated application and award processes.

Funded with $5 billion from the IIJA, the National Electric Vehicle Infrastructure program is a case in point. NEVI was aimed at installing DC fast EV chargers along major highways in every state, and when it was rolled out in February of 2022, the administration hoped to have the first chargers in operation by the end of the year. Hobbled by a range of federal, state and local requirements, the first NEVI station was opened in Ohio in December 2023.

Following Trump’s unsuccessful efforts to roll back NEVI, the most recent count has about 133 federally funded stations open in 16 states. Revised guidelines from Secretary of Transportation Sean Duffy have removed or minimized certain NEVI requirements, like ensuring that NEVI chargers benefit low-income communities.

What Fahs, Propp and White propose is that Democrats take a page from the Heritage Foundation’s Project 2025, the massive manifesto setting out plans for a second Trump administration, published in April 2023, and immediately start planning clean energy policies and programs, and recruiting staff for a future Democratic administration.

“Any attempt by the federal government to play an important role in advancing industrial and clean energy development across the United States will require a great deal more thoughtfulness and detail than even Project 2025 achieved,” the report says.

Essential parts of such a plan ─ let’s not call it Project 2029 ─ should include setting goals for “specific sectoral outcomes,” with strategies “designed to be actionable in a single term.” An administrative culture that promotes speed, decision-making and accountability for meeting goals and timelines will also be critical, as will more streamlined and flexible contracting practices, the report says.

For example, Build America, Buy America policies that require “lawyers to certify every bolt” of a project is domestically produced should be replaced with an approach that focuses on “a few high-impact sectors and provide[s] waivers or exemptions for low-value components and equipment with no domestic supply chain yet.”

The report also calls for more public-private partnerships, such as Trump’s recent deal with rare-earths supplier MP Materials, which “combined an equity stake, loans, warrants and a 10-year price floor and offtake agreement … [showing] how a sufficiently motivated executive branch can comprehensively derisk deployment in a key sector.”

(Certainly, under former Energy Secretary Jennifer Granholm, DOE pursued similar derisking partnerships, if not as blatantly commercial or raising concerns about conflicts of interest as Trump’s deals.)

The Need to be Feared

The other side of this conversation centers on how states and the clean energy industry itself are or aren’t planning for the dramatic swings in federal energy policy they now face ─ specifically the loss of federal tax credits, grants and other incentives and Trump’s ongoing war against renewables.

At the recent Solar Focus conference in Arlington, Va., sponsored by the Chesapeake Solar and Storage Association, known as CHESSA, Jigar Shah, former director of DOE’s Loan Programs Office, also called for a major cultural shift in the clean energy industry.

Too many businesses “are planning for the days that look like last year, and I think it’s important for us to recognize that those days are gone, and they’re never coming back, like even after the Trump administration leaves office,” he said.

Now leading a clean tech consulting firm, Multiplier, Shah delivered a typically provocative call to action. “Why do we have rules in place that make it impossible for us to integrate with electric utilities? … It’s not enough to be liked; you really need to be feared,” he said. “When people don’t deliver for us, they should lose their seats. …

“One of the biggest challenges that we have in this moment is that … there’s still a feeling that our industry doesn’t work unless it’s mandated, that people have to use us,” he said. Rather, with new Democratic governors in New Jersey and Virginia, the industry should be coming at them with clear, outcome-focused plans, for example, to build utility-scale batteries in key locations to improve system reliability, while reducing consumer electric bills by 20%.

“If we only achieve 80% of that stuff two years later, no one’s going to vilify us for that,” he said.

Speaking on the same panel, Sachu Constantine, executive director of the advocacy group Vote Solar, laid out what has become the industry’s standard argument for renewables as a vital solution to the growth in demand for electric power, driven by data centers, electrification and industrialization.

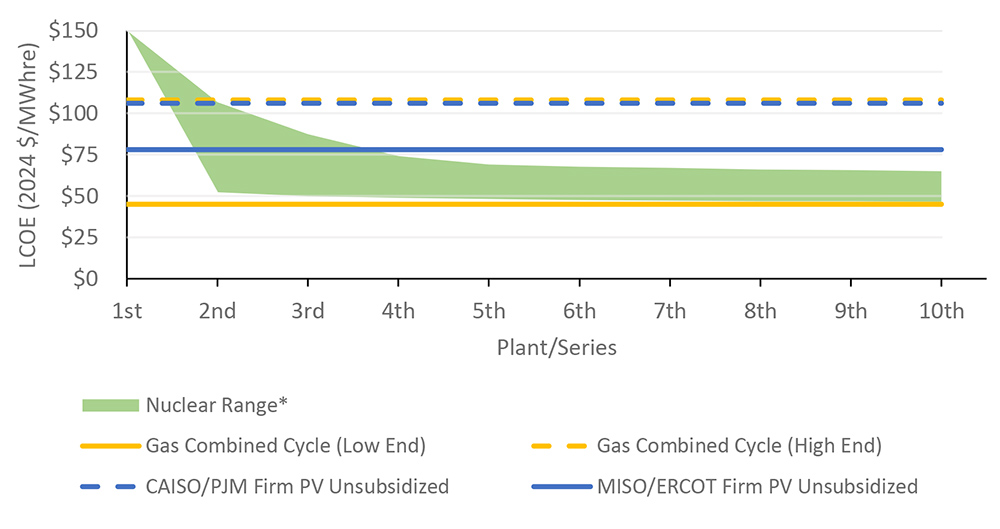

“We are the lowest-cost, fastest, market-scalable energy source out there,” he said.

But Constantine also said states should be seen as a testing ground for the new policies and regulatory structures needed to set goals and ensure outcomes that respond to that growth. “We shouldn’t be afraid of that. This is a chance, a generational chance, to create the regulatory scheme we want. We should look to the states and what they’re trying and what’s successful as a blueprint for what the future looks like,” he said.

Integrating and assigning value to solar, storage and other distributed resources as assets for capacity markets should be a top priority, he said.

Nicole Steele, another former DOE and EPA staffer, is now director of climate policy at Amalgamated Bank, a commercial bank that devotes 40% of its lending to climate solutions.

Like Shah and Constantine, she is similarly focused on outcomes, often at the local level, in a post-subsidy world where projects must be able to access market-rate capital. At EPA, she worked on the Greenhouse Gas Reduction Fund, which was intended, in part, to help fund state-level green banks.

With that funding still frozen by EPA, “there’s a whole shift coming together that really is looking at revenue bonds [for] supporting green banks,” Steele said. “We’re throwing our weight behind some of that work to really make sure that green banks are not only structurally playing a role ─ to not just be a lender, but to be the lender that can seed private sector capital and drive down the cost of that capital or make that capital more accessible.”

Why 1,600 Lobbyists?

So, is a just, orderly and equitable transition away from fossil fuels possible? I would never say never, but based on the analysis and insights of those who worked so hard for it during the Biden administration, what may be more likely and effective is a strategically planned and outcome-focused transition toward clean energy.

In other words, we need a plan with targets we can achieve within four years and then ensure we have the financial and administrative infrastructure to do just that.

Wright’s recent DOE reorganization ─ killing the Office of Clean Energy Demonstrations, the Office of Energy Efficiency and Renewable Energy and the Grid Deployment Office ─ continues his efforts to wipe any mention of renewable energy from the national consciousness. The National Renewable Energy Laboratory has been renamed the National Laboratory of the Rockies.

But even Wright must know, in his heart of hearts, that solar, wind, storage and other clean technologies are the future. In the first half of 2025, renewables accounted for 91% of new power on the U.S. grid. During the same time period, new solar and wind (403 TWh) more than covered new electric power demand around the world (369 TWh), according to U.K. industry analyst Ember.

The International Energy Agency expects renewable capacity worldwide will double, to 4,600 GW, by 2030 ─ still short of the international pledge at COP28 to triple renewable power over 2022 levels by 2030, but impressive.

The transition increasingly is being driven by the combined forces of economics and technology; clean technologies are frequently just better, more efficient and affordable.

Rising electric bills were a critical issue in off-year election wins for Democratic governors-elect Abigail Spanberger in Virginia and Mikie Sherrill in New Jersey ─ one that could drive more Democratic victories in the 2026 midterms. Both residential and commercial solar and storage provide one of the quickest ways to cut bills, with very small-scale, plug-in (and largely unregulated) “balcony” solar and storage systems gaining in popularity.

With more renewables on the grid, Americans may see that we don’t need new fossil-fueled generation and can retire existing plants, without threatening reliability or affordability.

The fossil fuel industry will bring all its power, money and influence to slow the transition ─ as it has, at least temporarily, in the U.S. But perhaps why the industry needed those 1,600 lobbyists at COP30 was fear and a dawning recognition that it will eventually become irrelevant.

Livewire columnist K Kaufmann has been writing about clean energy for 20 years. She now writes the E/lectrify newsletter.