New Approach to Large Load Addition Capacity Assignments Endorsed

The PJM Markets and Reliability Committee endorsed a proposal to revise how capacity obligations for serving large load additions (LLAs) are calculated to limit capacity assignments to areas where LLAs are forecast to interconnect.

The MRC did not vote on an alternative motion offered by American Municipal Power (AMP) under the committee’s truncated voting structure. (See “Changes to Capacity Assignments for Large Load Additions Contemplated,” PJM MRC Briefs: April 25, 2024.)

When bringing the issue charge in October 2023, American Electric Power (AEP) and Dominion Energy said the current capacity obligation assignments spreads PJM-approved LLAs across transmission zones, meaning an increased load forecast by an electric distribution company (EDC) participating in the reliability pricing model (RPM) could compel a fixed resource requirement (FRR) entity to procure capacity for load it will not serve.

In February, FERC granted AEP a waiver to alter the capacity obligation calculation for four of its vertically integrated utilities to not include forecast LLAs outside their territories. (See FERC Grants AEP Utilities Waiver of Capacity Obligation.)

The tariff and Reliability Assurance Agreement (RAA) revisions would rework how PJM calculates capacity obligation assignments to exclude LLAs included in Table B-9 of the load forecast from base zonal scaling factors and add those LLAs back when determining the obligation peak load input.

The AMP alternative sought to add a definition of large load additions to the Reliability Assurance Agreement (RAA) to clarify how they can result in capacity obligations for LSEs. The proposed redlines also rewrote a section of the “threshold quantity” definition pertaining to the preliminary forecast peak load for FRR entities in a transmission zone alongside RPM participants to remove the phrase “the FRR Entity’s Obligation Peak Load last determined prior to the Base Residual Auction for such Delivery Year, times the Base FRR Scaling Factor.” It will instead point to the relevant RAA section.

DR Availability Issue Charge Approved, Quick Fix Proposal Rejected

Stakeholders endorsed an issue charge to investigate modifying the availability of demand response resources, but they rejected a quick fix proposal to expand the winter availability window by two hours. The issue charge passed with 59% sector-weighted support; however, the proposal failed to carry the two-thirds threshold required at 54% support.

The issue charge and quick fix proposal were sponsored by the Advanced Energy Management Alliance (AEMA), PJM Industrial Customer Coalition (ICC), CPower, Enel and NRG Curtailment Solutions. (See “Demand Response Providers Seek Expanded Availability,” PJM MRC/MC Briefs: Feb. 22, 2024.)

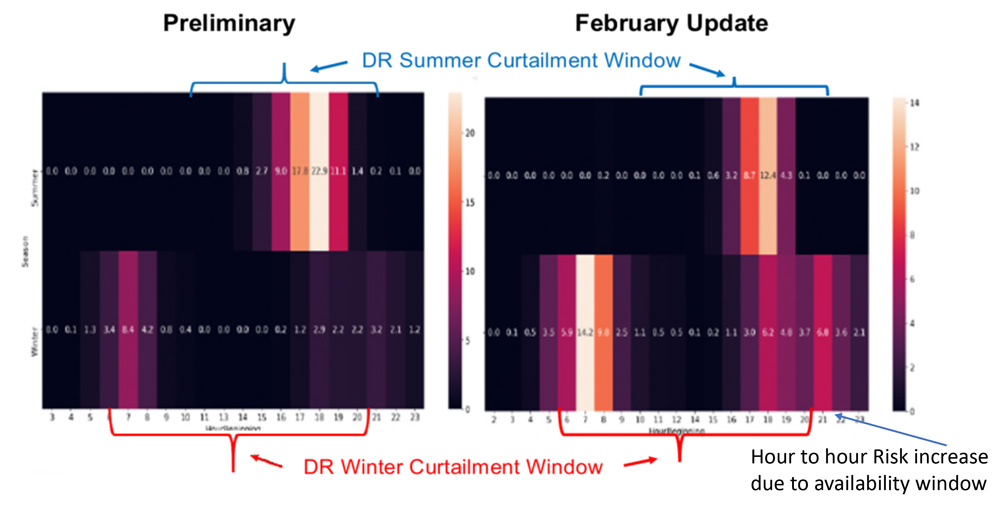

Bruce Campbell, of Campbell Energy Advisors, said the revised risk modeling approach PJM adopted following the critical issues fast path (CIFP) process conducted last year led to the wintertime hours the model has found hold elevated reliability risks being expanded well into the night. However, the DR availability window was not expanded beyond the status quo 6 a.m. to 9 p.m., preventing dispatchers from using DR to address the full risks the RTO has identified. The proposal would extend the window in which DR is dispatchable by two hours to end at 11 p.m. (See FERC Approves 1st PJM Proposal out of CIFP.)

Campbell argued the longer availability window would not negatively affect the reliability contribution of DR resources, as most participants are industrial load that consumes power at a steady rate throughout the day irrespective of season.

Independent Market Monitor Joseph Bowring said the change would affect the effective load carrying capability (ELCC) rating for DR resources, a calculation tied into the ELCC ratings of all resources. Making a change to one resource would require recalculating all resource class ELCC values, which he said would be difficult and inappropriate to do with the original targeted implementation for the 2025/26 delivery year.

“PJM calculates the contribution of DR resources to reliability for ELCC purposes using an assumed maximum level of response rather than actual data on DR response during the winter. PJM uses actual data for generation resources. The result is that the ELCC of DR is significantly overstated,” Bowring told RTO Insider in an email. “Actual DR performance/load reduction during Winter Storm Elliott was well below 50% of the stated capacity values. A one-off administrative change to the rules that would arbitrarily increase payments to DR resources and reduce payments to other resources without a comprehensive review of the DR ELCC would be inappropriate.”

During the May 22 meeting, Campbell worked with other package sponsors to revise the issue charge to delay the targeted implementation of the quick fix portion of the issue charge to the 2026/27 Base Residual Auction (BRA). The issue charge was also revised to shift implementation of the third key work activity (KWA) — which seeks to eliminate the window outright or create an additional DR classification that would be available all day — to the 2027/28 delivery year. But this alternate version was rendered moot by endorsement of the original package.

PJM Director of Stakeholder Affairs David Anders said with the vote on the expanded availability window failing, the KWA is now considered complete and future stakeholder discussions will focus on the other work areas.

PJM Presents Electric Gas Coordination Proposal

PJM presented a first read on a proposal seeking to improve alignment between components of the gas procurement timeline and the PJM energy market endorsed by the Electric Gas Coordination Senior Task Force (EGCSTF). (See PJM Stakeholders Open Poll on Proposal to Align Electric and Gas Markets.)

The proposal would add three intraday resource commitment runs to the day-ahead market, lining up with the North American Energy Standards Board’s (NAESB) gas nomination cycle deadlines. Gas generators would be notified that they are being committed with adequate time for them to nominate for fuel in the subsequent cycle and generators would be asked to voluntarily “use every reasonable effort to notify” PJM if they have procured fuel or expect to do so in time to be scheduled. The manual revisions also say PJM may perform additional resource commitment runs when necessitated by load forecasts, updated resource parameters or changing system conditions.

The proposed revisions to Manual 11 stress that the request for generators to notify PJM if they have or intend to procure fuel is voluntary and does not come with penalties for those who do not provide an update. Gas resources that do not procure fuel necessary to meet their day-ahead or reserve commitments are required to notify dispatchers by adjusting their availability or parameters in Markets Gateway, submitting an eDART ticket and by calling PJM dispatch. The changes include a note stating that keeping dispatchers informed about fuel availability during critical conditions “is essential to providing optimal situational awareness of generator availability to PJM Operations.”

Dominion Energy’s Jim Davis said the proposal is another step building on real-time values to increase operational certainty around the alignment of the electric and gas markets. The package was sponsored at the EGCSTF by PJM, Dominion and Gabel Associates.

First Read of CIFP Manual Revisions

PJM’s Skyler Marzewski presented a set of manual revisions implementing capacity market changes drafted through the CIFP process and approved by FERC in January, including several changes to reflect stakeholder feedback received since it was endorsed by the Market Implementation Committee on May 1.

The manual revisions would phase out Manuals 20, 21 and 21A and replace them with new Manuals 20A and 21B, as well as “cleaning up” Manuals 18 and 14B. (See “Stakeholders Endorse Manual Revisions to Implement CIFP Changes to Capacity Market,” PJM MIC Briefs: May 1, 2024.)

The changes to the Manual 18 language include spelling out a formula that helps determine unforced capacity (UCAP) values for load management resources and clarifying that existing FRR entities may terminate their election to participate in FRR rather than the RPM through “and including” the 2028/29 delivery year without being penalizes.

If endorsed, the capacity market changes would expand the use ELCC analysis for accrediting all generation types, require that planned resources notify PJM of their intent to participate in a Base Residual Auction (BRA) at least 90 days in advance and change how generation UCAP values are calculated. The MRC manual revisions are set to be voted on by the MRC during its June 27 meeting.

The revisions to Manuals 20, 21 and 21A — which focus on the planning side of the CIFP proposal — would establish a new approach to capacity accreditation, reliability risk modeling and BRA procurement targets. The PC is set to vote on the revisions on June 4 and would be included alongside the Manual 18 revisions at the MRC if approved. (See “First Read on CIFP Manual Revisions,” PJM PC/TEAC Briefs: April 30, 2024.)

Consumer Advocates Intend to Propose Wider DESTF Scope

Maryland and Illinois consumer advocates plan to propose revisions that would widen the scope of the Deactivation Enhancements Senior Task Force (DESTF) to include finding resources that could replace retiring generators and and have PJM consider alternatives to maintaining costly reliability-must-run (RMR) contracts while traditional transmission expansions are constructed to resolve any reliability violations prompted by the deactivation. The current issue charge is focused on how RMR compensation is determined, when generation owners need to notify PJM of their intent to deactivate and improving transparency.

Clara Summers, of the Illinois Citizens Utility Board (CUB), said the intent is to supplement the work of the DESTF, which is discussing proposals from the Monitor and PJM, rather than supplant those efforts.

Phil Sussler, of the Maryland Office of People’s Counsel (OPC), said there are multiple stakeholder discussions looking at generation deactivation siloed between the DESTF and other groups, such as the Interconnection Process Subcommittee’s work on how capacity interconnection rights (CIRs) may be transferred from a deactivating generator to a replacement resource at the same point of interconnection. Harmonizing those efforts raises the odds of a solution that allows the interconnection process to better react to a deactivation request, he said.

Vistra’s Erik Heinle said a balance is needed to ensure discussions do not become so broad that they collapse in on themselves.

“Each of these issues is an important one … but we also want to make sure we don’t get stuck and have the weight of multiple interests preventing us from getting to a solution as expeditiously as possible,” he said.

The call for harmonization mirrored comments at the May 8 Public Interest and Environmental Organization User Group (PIEOUG) meeting, where advocates said siloed processes make it difficult for offices with limited resources to track numerous discussions and limits the solutions on the table. (See “Consumer Advocates Call for More Holistic Thinking at PJM,” Consumer Advocates, Environmentalists Urge Holistic Thinking at PJM.)