ALBANY, N.Y. — The New York Power Authority has expanded its transmission laboratory with extensive new digital twin capabilities, allowing it to model and test the impact of new technologies on the grid.

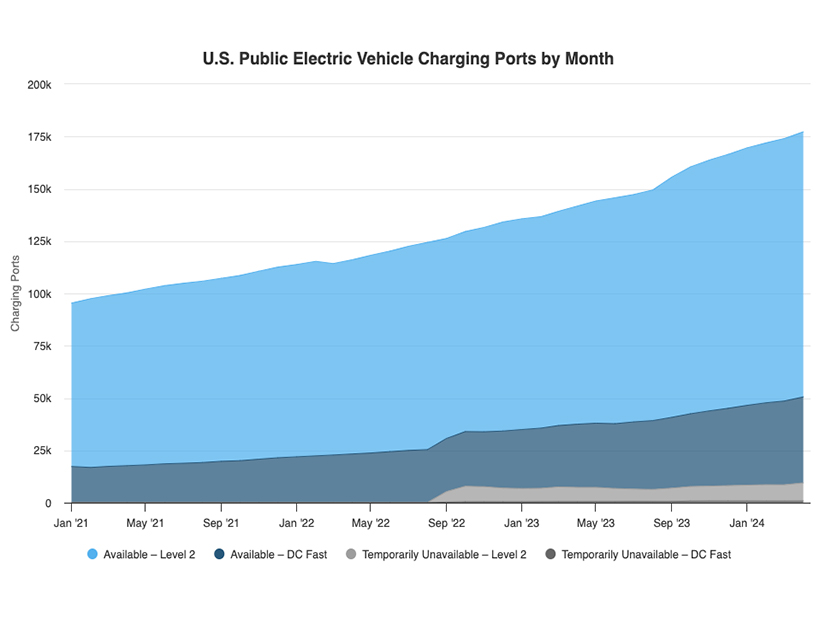

The Advanced Grid Innovation Laboratory for Energy (AGILe) is expected to be an important tool for the public and private sectors alike as New York decarbonizes its grid, identifying the demands that will be placed on existing infrastructure and ways to minimize that impact.

How best to use these new technologies and match them to the grid are critical details of the energy transition. Stakeholders can base their planning on data provided by AGILe, NYPA said at a ceremony unveiling the facility May 29.

NYPA founded AGILe in 2017 at its downstate headquarters and has gradually expanded its capabilities since.

Albany was chosen as the site for the physical expansion of the lab because of the concentration of key stakeholders: The headquarters of NYISO, the Department of Public Service and the New York State Energy Research and Development Authority are all near, as are multiple colleges. The new lab space itself is within NY CREATES, a $15 billion high-tech research hub.

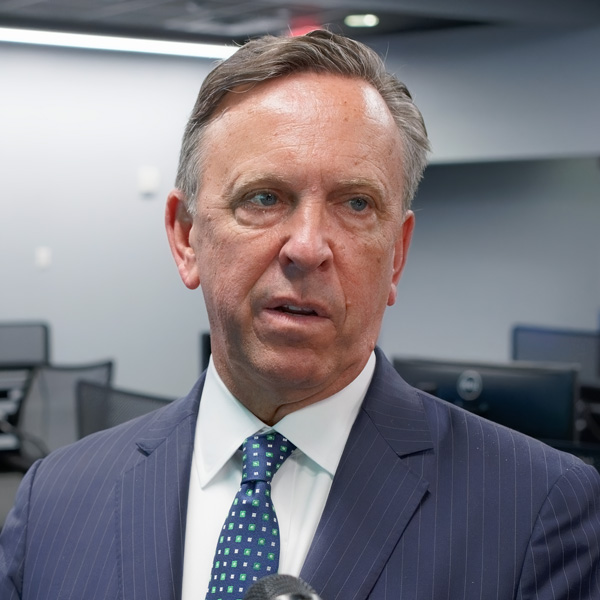

“AGILe is more than just a technical facility; it’s a hub that is designed for collaboration of national and global stakeholders to evaluate and solve grid-related challenges,” NYPA President Justin Driscoll said before a ribbon-cutting ceremony.

NYSERDA President Doreen Harris said AGILe and its ability to model real-time, real-world results will help the state work toward the statutory goals in its clean energy transition.

“Where we sit today, so many of the models we use are static,” she said.

As one of the lead agencies in the state’s energy transition, NYSERDA has a direct stake in expanding this modeling capacity. It will provide $9 million for advanced technology research facilitated by data from AGILe.

Jessica Waldorf, chief of staff and policy implementation for the DPS, said AGILe will be a key part of the department’s efforts to expand and improve transmission, including through the Coordinated Grid Planning Process implemented in 2023.

“AGILe will help confront the challenges of balancing system reliability with clean energy development and cutting-edge technologies,” NYISO President Richard Dewey said in a statement. “NYISO is excited to work with NYPA in this regard, and having a grid ‘digital twin’ in our backyard will only make our collaboration that much closer.”

Learning Process

The new space is a 10,000-square-foot office and control room powered by a data center drawing 400 kW of power and cooled with a 40-ton air conditioner.

It is the first facility of its kind, NYPA said, able to use digital twins of devices and wires to see how they will interact.

AGILe can model cyberattacks and responses, draw on an archive of the effects of actual weather events, and run a post mortem on past failures of components or systems. Engineers can wheel actual components into the lab to record and analyze their performance, or they can work from existing performance data.

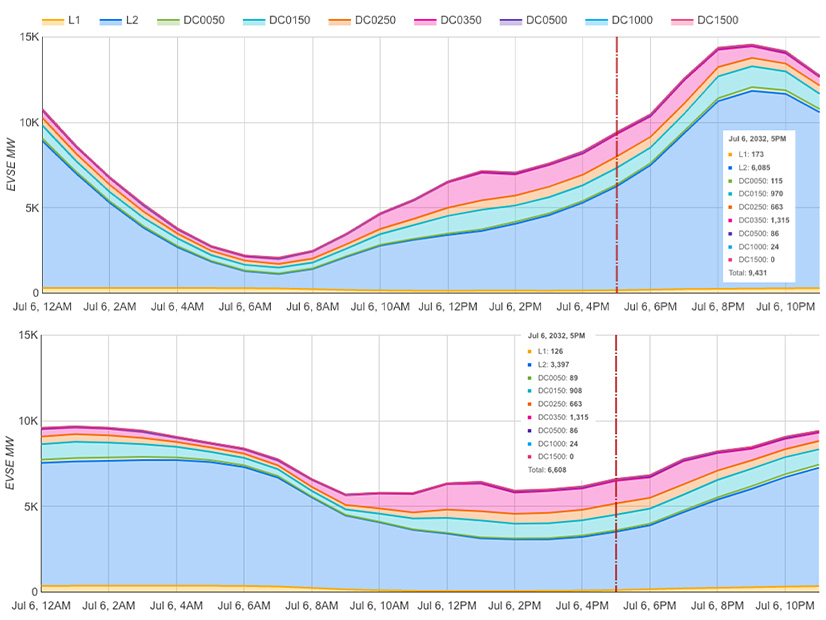

Importantly for the decarbonization of the grid, AGILe can model the effects of inverter-based resources and grid-enhancing technologies. It starts with the best possible model of the existing grid functioning perfectly and the best possible model of the effects of changes on anything from a 13-kV local line to a 765-kV backbone line.

AGILe Director Hossein Hooshyar said, as an example, that a wind farm developer could bring a control panel into the lab and simulate operation to see how it would affect the grid and find a way to avoid affecting the grid negatively.

“That’s the beauty of it,” Driscoll said. “You create what ‘perfect’ looks like … and then test aberrations or changes in circumstances that you might face … dynamic line ratings, advanced power controls, advanced conductoring — we could test that out before deploying it in the field.”

Standing amid banks of supercomputers and speaking over the cooling system’s hum, Reza Pourramezan, senior power systems engineer, explained AGILe’s capabilities.

“By receiving real-time measurements and data from sensors, as well as weather forecasts and load forecasts and market information, I can incorporate all this input into our simulations — that makes it even more realistic,” he said. Training, asset management, field support and collaborative decision-making also are enhanced with this digital twin approach.

Senior power systems engineer Rahul Kadavil said the simultaneous rise of intermittent renewables, societal increase in power demand and growing weather-related threats to transmission created a need for the capabilities of AGILe.

“It will revolutionize the way we manage our energy infrastructure,” he said, standing before a wall of screens in the control room that provide a visual display of all the factors acting on the New York grid in increments of milliseconds.

Kadavil had Driscoll press the prominent red button in the middle of the room, triggering a simulated large grid disturbance, complete with flickering room lights, and an appropriate simulated response by the grid management.

The readouts for load and frequency spiked up and down briefly, then flattened back out.

“We have married real-time simulators with the immersive power of visualization to create that tactile feedback,” Kadavil said.

NYSERDA’s Harris said AGILe’s capabilities will speed the adoption of new technologies because utilities and other customers will be more confident about something that has been tested.

“This simulation allows us to understand the impacts [in advance] as opposed to physically deploying it in the field,” she said.

Ali Mohammed, NYPA senior director of digital innovation and transformation, said the lengthy evolution that led to the debut of the new lab created a unique tool for the energy transition.

“The digital twin asset is pretty much new in the industry,” he said. “No one has ever built a grid-level digital twin. Asset-level, yes, but not at the grid level.”

AGILe’s research partners will include Electric Power Research Institute, NYISO, NYSERDA, the Long Island Power Authority and investor-owned utilities. Potential clients include vendors, innovators, universities and grid operators from around the world.

Fees will vary by project details and by client, Mohammed said.