A two-turbine pilot project so far has been the only U.S. offshore wind installation south of New England.

While pioneering projects in the Northeast have been first out of the gate and first to the finish line, the nation’s largest offshore wind farm to date — Coastal Virginia Offshore Wind — is set to start construction imminently in the Central Atlantic region.

Several other wind energy lease areas have been designated and leased in the Central Atlantic, and federal regulators plan another auction this year.

At the International Partnering Forum on April 25, representatives of four states shared their thoughts on how best to advance this new energy and economic sector.

The Central Atlantic region already has had one casualty amid the financial and supply chain constraints that came to fore in the past two years: Skipjack Wind canceled its offtake contract with Maryland, though the project itself remains in development. (See Ørsted Cancels Skipjack Wind Agreement with Maryland.)

“The theme to walk away with is collaboration and the need for collaboration,” Eric Coffman of the Maryland Energy Administration said as an introduction to the discussion. And that was a theme: Central Atlantic states advancing their own interests by collaborating to help grow a new industry that sprawls beyond any one state’s borders.

But as with other discussions at IPF24, the growing pains of the U.S. offshore wind industry also were evident in the remarks.

“One of the biggest challenges we’ve experienced talking with our stakeholders and our Tier 2 and Tier 3 suppliers is that there’s a lack of understanding of what industry needs,” said Emma Stoney, wind and water energy program manager at the Maryland Energy Administration. “Maybe not transparency, just a lack of understanding [of] what the industry needs, when it’s needed, and how the state can be that facilitator and help companies actually get into the industry.”

Stoney tallied the offshore wind aspirations of Maryland and its neighbors: “We have over a 20-GW goal for the Central Atlantic, and that is extremely vague and it’s going to provide a lot of economic development opportunities, but to engage our businesses in it, it requires collaboration.”

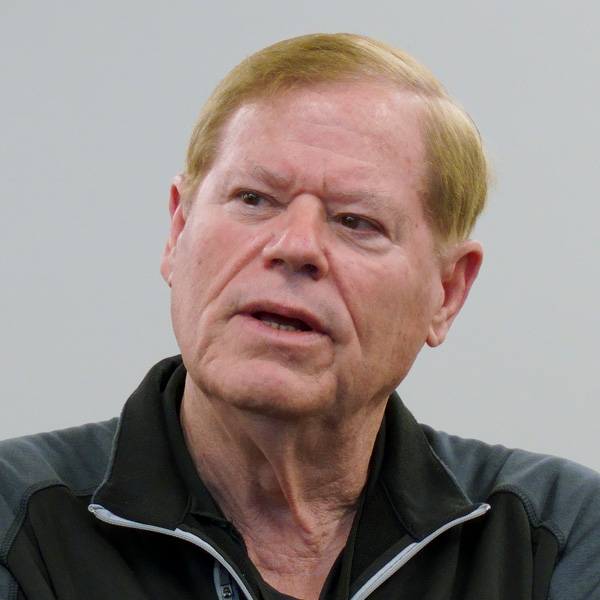

John Hardin, executive director of the North Carolina Department of Commerce’s Board of Science, Technology and Innovation, said offshore wind is an unknown for many businesses in his state.

“One thing that we have learned is that the general level of awareness in the industry about offshore wind opportunity is very limited,” he said. “There’s just not much awareness now. So, one thing we’ve been doing is doing a lot of webinars and in-person presentations across the state. We have done several dozen in the last couple of years.”

Alone among its neighbors, Delaware has no formal offshore wind goals. It is by far the smallest state in the region, unlikely on its own to develop economies of scale that could support the offshore wind sector, so it might find interstate collaboration particularly helpful.

Tom Noyes, principal planner for energy policy at the Delaware Division of Climate Coastal and Energy, reported some recent news: Legislation has been introduced that would authorize procurement of 800 to 1,200 MW of offshore wind capacity in his state.

“We understand that a gigawatt is sort of the sweet spot for a project, and at the same time, we’re interested in opportunities to partner with neighboring states if such an opportunity were to arise,” Noyes said. “We’re sort of bringing up the rear, we have learned a lot from working with, learning from our neighboring states.”

Maryland and New Jersey have offshore wind goals of 8.5 GW and 11 GW, respectively, so Delaware’s proximity positions it to support both and benefit economically, he said.

Stone said a study is looking regionally at ways to use each state’s strengths to overcome each state’s challenges, but also for ways to avoid a boom-and-bust cycle.

That’s a good thing, Noyes said. “We can’t be all things to all the districts, and economic benefits don’t stop at the boundaries.”

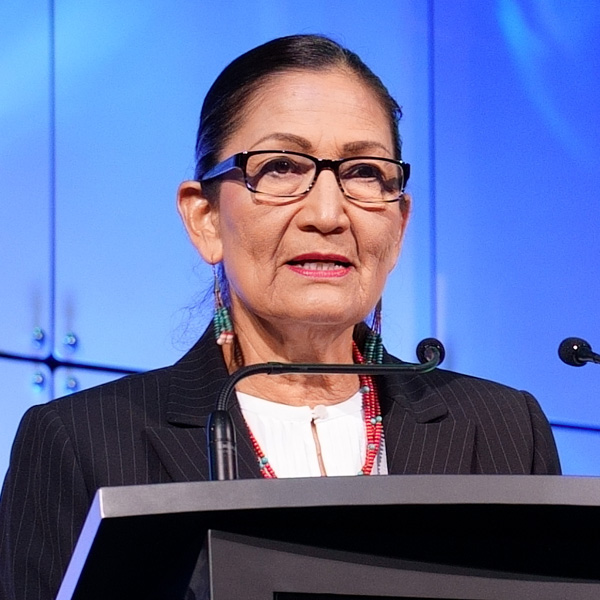

Jo-Elsa Jordan, business manager at the Virginia Economic Development Partnership, said her state has extensive maritime and industrial assets. Companies looking to enter the offshore wind space should explain their needs and ask for help — there are multiple agencies working to help them succeed.

“Be clear,” Jordan said. “What do you need? What do you like? What are your challenges, what suppliers are contingent on others? Let us know. We can’t write a blank check because we’re stewards of taxpayer dollars. But what we can do is be creative and bring solutions to the table.”

Hardin said there is not universal support for offshore wind in state government, and he advised businesses that want to benefit from the industry to tell their legislators. Businesses telling lawmakers about jobs and economic benefits for their constituents are more persuasive than bureaucrats, he said.

“That’s an important message, and you can help cut through some of the misinformation as well.”

Pulling back to the larger picture, Jordan said local and state entities need to be less parochial if they want to reap benefits.

“From an economic development standpoint, if I’m being really candid — we don’t collaborate, we compete. We want the capital investment; we want the jobs. We want that, and that’s traditional economic development. But offshore wind is a different animal.”

Stoney and Noyes called on the offshore wind industry itself to step up.

“There is a point where a supply chain needs to be able to keep up with the innovation,” Stoney said. “It is a challenge to continually have new turbine sizes coming out every single year, knowing that we need to build Tier 2 and 3 and 4 suppliers who can help support those turbine components. And that makes it really challenging to build a domestic supply chain.”

Noyes added: “We are counting on the industry working its way down, we call it, the learning rate. We’re counting on this industry becoming more efficient over time. We’ve been told to expect that … more important than any particular piece of the supply chain, we need — we all need — a supply chain that’s working and getting more efficient. Because that’s how the industry grows.”

Additional IPF24 Coverage

Read NetZero Insider’s full coverage of the 2024 International Partnering Forum here:

How Best to Address OSW’s Effects on Fisheries

Interior Announces Updated OSW Regs, Auction Schedule at IPF24

Louisiana Manufacturers Expand into Offshore Wind

Moving Offshore Wind Beyond Contract Cancellations

New York Starts Another OSW Rebound