The California Energy Commission has signed off on a forecast showing the state’s electricity consumption could surge by as much as 61% over the next 20 years, but it pegs the biggest driver as increased electric vehicle use, with new data centers coming in second.

The CEC on Jan. 21 voted to approve a resolution adopting the forecast and including it in the agency’s 2025 Integrated Energy Policy Report (IEPR), which informs the state’s resource adequacy requirements, integrated resource plans, reliability assessments, and transmission and distribution planning.

CAISO’s peak load is predicted to increase to about 66 GW in 2045, up from 46.5 GW in 2025. The 2024 IEPR forecast estimated 2045 peak load of about 66.8 GW. (See Data Centers to Drive Calif. Power Demand, Sales.)

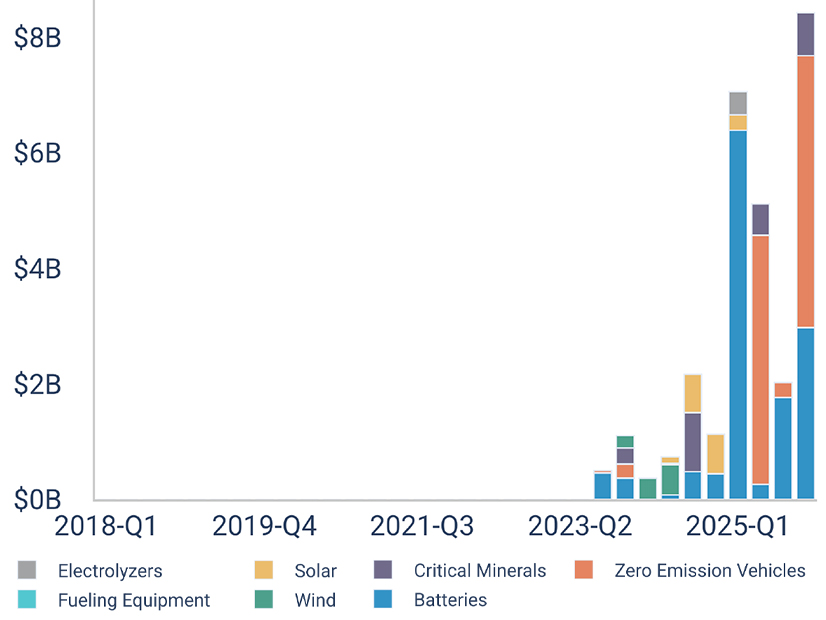

The adoption of electric vehicles is the biggest driver of peak load growth at 8,234 MW, followed by new data centers (4,721 MW), fuel substitution from electrification (4,464 MW) and climate change impacts (1,811 MW), according to CEC lead forecaster Nick Fugate. New consumption outside those categories accounts for 6,011 MW of peak load growth.

Fugate noted that the 2025 forecast is the first for which the CEC has considered using “known load” data in its forecasts, which include “energization requests at the distribution system level” and “project-level data” from investor-owned utilities — many of which are proposed data centers.

Still, the CEC decided not to include known load data in this round of planning forecasts because it lacked historical records to examine “when evaluating key assumptions made in our analysis,” Fugate said. The agency did provide alternative forecasts that reflect those data, and Fugate said the agency will continue to monitor known loads in 2026 and 2027 for possible inclusion in future planning forecasts.

“The approach we’ve taken to determine incrementality to our forecast allows for substantial room for double counting,” Fugate said. “It’s meant to give a bookend estimate to cover the very high-end risk, rather than to project a most likely outcome at the system level. So, while we are working with the IOUs to sort through the energization timelines to better understand this data, to validate our key assumptions and to refine our analytical approach, there is still this question of how to mitigate potential risk applied by known loads data.”

The forecast’s “high case” shows that California’s annual electricity consumption could rise to 450 TWh in 2045, compared with about 280 TWh in 2025. By comparison, the state’s consumption was 270 TWh in 2005. (See Calif. Electricity Consumption Headed off the Charts, CEC Forecast Shows.)

The high case shows a compound annual grow rate (CAGR) of 4.2% from 2024 to 2030 and 1.5% from 2030 to 2045, translating to 2.3% over 2024-2045.

For the “mid case,” the CAGR figures are 2.3%, 1.7% and 1.9%, respectively, with 2045 consumption estimated at just above 400 TWh.

“This is one of the most important aspects of the commission’s role and job, and one that I’ve always been very, very fascinated with and interested in,” Commissioner Nancy Skinner said ahead of the vote during the CEC’s monthly business meeting Jan. 21.

But speaking on behalf of the California Coalition of Large Energy Users during the meeting, Meredith Alexander said the group was troubled by the CEC’s decision to exclude known loads from its planning and local forecasts.

“At this point, we’re concerned that there could be real effects on reliability and costs in the next few years, if the forecast is artificially low,” she said. “Load-serving entities could under-procure capacity, meaning that our load-serving entities are not sufficiently resourced to serve our new loads.”

Speaking ahead of the vote, Commissioner Andrew McAllister said he was “comfortable with” adopting the forecast while acknowledging the concerns, which he said reflected the “increased uncertainty” around growing loads.

“I do want to note there are so many moving parts and so many new electric technologies being introduced to the market — really, at rates we’ve never seen before — that close dialogue with stakeholders and continued engagement throughout the years is more important than ever, so that we get as close to being right as we possibly can,” CEC Chair David Hochschild said.