MISO leadership again promised to step up the RTO’s advance communication of tight system conditions following its four-hour load-shed directive for about 600 MW in Greater New Orleans on May 25.

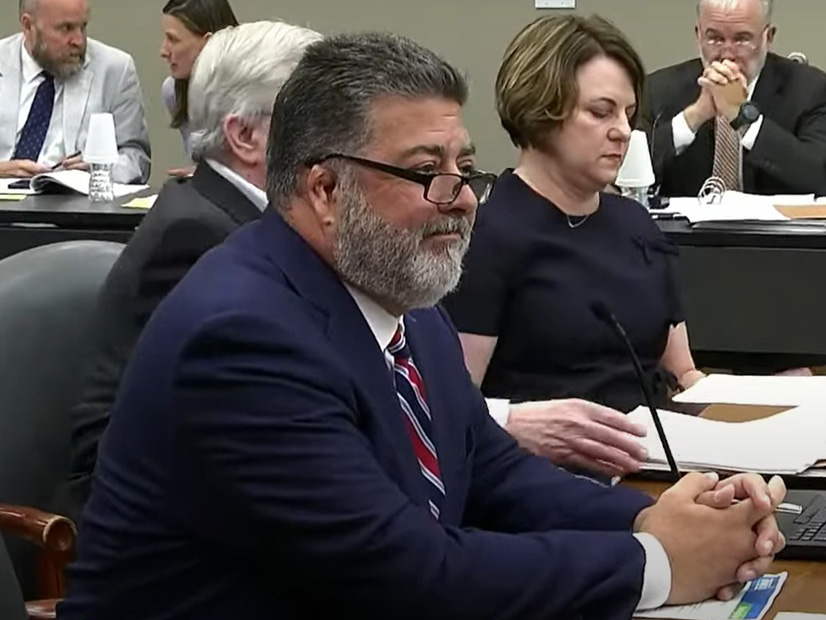

MISO dispatched Senior Vice President Todd Hillman and MISO Executive Director of Market Operations JT Smith to the Louisiana Public Service Commission’s June 18 meeting to elucidate steps leading up to the blackouts and face censure from commissioners.

Hillman said MISO is thinking through how it can better communicate the risk it expects before “these types of rare and unfortunate events.” He said MISO is accountable as the reliability coordinator of the wholesale electric grid and that staff worked diligently on that Sunday to combat unavailable generation, transmission congestion and a tornado-damaged, unreachable Nelson-Richard 500-kV line. (See MISO Says Public Communication Needs Work After NOLA Load Shed.)

Hillman told commissioners that because the emergency ultimately can be traced to a transmission emergency instead of a capacity emergency, MISO did not sequence through its typical alerts and warnings before resorting to load shed.

MISO’s capacity advisories and maximum generation alerts and warnings are reserved for when MISO could be short on capacity, not transmission availability. Hillman said MISO doesn’t have warning protocols for transmission emergencies and is working on implementing some.

“We don’t have a lot of those. We’re not quite used to those,” he said of transmission emergencies.

Entergy CEO Phillip May said Entergy is similarly investigating how to improve the “timeliness of communication of load-shed risk.”

Commissioner Foster Campbell asked Hillman if MISO thought it owed people compensation for damages, lost revenue and adverse health outcomes during the blackouts. He said it’s “hard to swallow” that customers are obligated to not miss bills, but MISO could drop the ball without consequence.

Like he did before the New Orleans City Council, Hillman explained that MISO does not interact with retail customers and only has operational control over Entergy and Cleco’s transmission, not generation. He said MISO is a nonprofit that doesn’t have a mechanism to reimburse ratepayers, and its wholesale customers are Entergy and Cleco. (See NOLA City Council Puts Entergy, MISO in Hot Seat over Outages and MISO: New Orleans Area Outages Owed to Scant Gen, Congestion, Heat.)

Campbell said that Entergy seemed to be pointing the finger at MISO for providing roughly eight minutes of notification before the utility was forced to take load offline. Once MISO identified the risk of exceeding an interconnection reliability operating limit (IROL) on Entergy’s system on May 25, the RTO had a total of 30 minutes to offload demand and clear conditions per NERC requirements.

“That’s the nature of the conditions of this IROL,” Hillman said.

May confirmed that Entergy had less than 10 minutes to comply and dial down load.

Smith said MISO spent some of the half-hour trying to find alternatives to the last resort of blackouts. He added that MISO is trying to figure out if it met NERC’s 30-minute time limit and told commissioners MISO should have been “communicating much earlier about this risk.”

In addition to 2.65 GW of planned outages across four generating units near the southeastern Louisiana load pocket, MISO experienced eight unplanned generation outages on May 25 totaling 3.86 GW. Generation derates accounted for another lost 1.1 GW on top of that.

“That’s just a very large number to have out in a load pocket,” Hillman said.

Commissioner Davante Lewis asked if MISO would name the generators. He said that although he knew of Entergy’s two offline nuclear units, no one has identified the other generators.

Hillman said MISO would provide that information in data response requests and only when a utility has allowed MISO to release the information. MISO as a rule doesn’t identify units that are on outage.

However, Commissioner Eric Skrmetta said Entergy told him it has a waiver letter on file with MISO that allows the RTO to disclose utility data when asked by the commission. He said he viewed it as a “serious infraction” that MISO seemed not to follow the waiver letter and noted that commissioners must answer questions from the public and the press while MISO does not. He added that the PSC will seek data requests.

Skrmetta said he thought MISO could have “staved off” some of the load shed by turning to some of Entergy’s more than 400 MW of interruptible customers. He said some generating units that were on unplanned outage had been offline for days at that point, so they wouldn’t have shown up in the day-ahead market that morning either.

Skrmetta said the outage seemed carried out “in more of a panic” than in a “planned, methodical … activation.” He said in pre-RTO days, it seemed that companies took more pains to avoid blackouts, and the PSC could issue fines against shareholders and order rate credits for the public. He said in this case, the PSC is left with no recourse save for maybe a class-action lawsuit against MISO because it left Entergy and Cleco no choice but to “start flipping switches” or risk widespread system damage.

“I think we’ve got real problems with this,” Skrmetta said. “It’s unacceptable, and I hope people find a way to, you know, effectively get their pound of flesh out of you. We’re not going to be able to do it, but we’re going to have to find a way to make it more reliable in the future.”

Skrmetta said he did not need MISO leadership to respond to his criticisms.

Earlier, Hillman said he understood the load-shed event was “frustrating, disruptive and deeply concerning.”

Lewis asked if MISO had ever before experienced so many outages in a single local resource zone.

Smith said outside of significant storm damage, he couldn’t recall ever having “such a consolidated area of outages like that.”

Lewis noted that some unplanned outages already were in play the week prior and asked what conversations MISO had around contingencies ahead of time.

Hillman said communications were flowing between operators, with reconfiguration plans, studies and analyses performed throughout the day.

Smith said May 24 started out remarkably similar to May 25, but storms in the afternoon cooled the air and dampened demand. He said operator logs from May 24 noted that MISO was coming close to localized load shed, though they managed conditions with reconfiguration and dispatching generation down to avoid infrastructure damage.

Commissioner Jean-Paul P. Coussan asked if the load-shed judgement call was the result of automated processes or AI use.

Hillman said while a computer system runs system simulations, it’s backed up by MISO’s experienced human operators. He said the decisions that day were not dominated by technology, and control room operators tested conclusions and made phone calls to members in a plea for emergency-range output before making the order.

Smith said that on May 25, about 160 MW of Entergy’s approximately 400 MW of load-modifying resources were available with about four-hour lead times. Had MISO called them up in advance, they may have improved conditions, he said.

However, Smith said MISO’s forecasts at the time were “generally good” and its forward-view models did not reflect “the dire conditions that were eventually shown.” He said the IROL was unforeseen, and MISO is investigating the accuracy of its modeling. Hillman said in addition to modeling improvements, MISO is considering introducing drills so it can lay out what members can expect in a transmission emergency.

Lewis said the event clearly shows that Louisiana needs more transmission capacity in and around the Downstream of Gypsy load pocket. That load pocket predates Entergy’s inclusion into MISO.

May said Entergy is pursuing multiple, “significant” transmission projects that could help inject more power into the Amite South load pocket, which encompasses most of southeastern Louisiana and includes the Downstream of Gypsy load pocket. Entergy representatives said a new 41-mile, 230-kV Adams Creek-to-Robert line approved under MISO’s 2023 Transmission Expansion Plan and expected to be in service at the end of 2027 should help the area by adding 100 MW of import capability.

Asked by Lewis about Entergy’s receptiveness to long-range transmission planning from MISO, Entergy Associate General Counsel Matthew Brown said he didn’t believe long-term transmission is best suited to resolve load pockets in Louisiana. Brown said more targeted transmission that can be built quickly is an ideal solution, not big-picture, long-range projects that can take a decade to build and can assign costs to customers in states that don’t stand to benefit.

Lewis said he worried that without some intensive transmission planning, Louisiana could be in for more problems.