ALBANY, N.Y. — Regulators, state officials and industry were upbeat about New York’s efforts to decarbonize its grid at the annual New York Energy Summit, staged by Infocast on April 8-10, even as they repeatedly noted that much work needs to be done — namely, building more renewable resources and transmission lines.

Like many states, New York has committed to expanding generation and transmission capacity while simultaneously reducing emissions. For professionals in the field — whether their motivation is profit, the planet or some combination of factors — the Empire State is a target-rich environment. But the targets are not easy to meet.

Once again, state leaders have missed their March 31 budget deadline. As of press time, the state still had no 2024-2025 spending plan and therefore no clear indication which policy initiatives will be baked into it, including the proposal by Gov. Kathy Hochul (D) to speed up transmission siting. (See NY Gov. Proposes Streamlined Transmission Review, Permitting.)

John O’Leary, Hochul’s deputy secretary for energy and environment, delivered a keynote overview of the state’s energy transition but could not give summit attendees any insight on proposals that would affect their business strategies.

“In the parlance of New York state budget making, you might say today is not in fact April 8 but instead March 39,” he said. “We’re certainly into extra innings.”

Vennela Yadhati, vice president of renewable project development for the New York Power Authority, said Hochul’s transmission streamlining proposal — the Renewable Action Through Project Interconnection and Deployment (RAPID) Act — is critical to the state meeting its statutory targets for decarbonization. The first milepost, 70% renewable energy by 2030, is just six years away, and New York is still far short.

“I’m sure that you all agree with me that we need this legislation enacted if New York is going to meet its goals,” Yadhati said.

Faster and Smoother

The RAPID Act would place environmental review and permitting of transmission projects under the purview of the state Office of Renewable Energy Siting (ORES), which in its four years of existence has greatly accelerated the application process for large-scale renewables.

The ORES pre-application process can be lengthy, but it yields an application that is complete and can withstand the close review to which it will be subjected. ORES so far has permitted 15 projects totaling 2.3 GW, the majority of them in less than eight months, Executive Director Houtan Moaveni said.

“It takes longer to get a heated pool permit in Westchester County than a 500-MW solar project in New York state,” he added.

An ORES permit is an important milestone, but it is just one piece of a large puzzle. With the impending retirement of more fossil fuel-fired plants, New York needs more generation and transmission capacity immediately, Moaveni said.

“I’m preaching to the choir,” he told the room. “We really, really have to accelerate the pace of development in New York state.”

The choir had some prominent members, including the federal and state energy regulatory agency heads and NYISO CEO Rich Dewey.

FERC Chair Willie Phillips waved the flag for the commission’s own efforts. “We took the best parts of interconnection reform from every part of the country, and no one part of the country is doing … everything that we’re requiring in Order No. 2023,” he said.

Dewey said NYISO had a head start on Order 2023 compliance and spoke proudly about the ISO’s improvement in managing its queue.

“When Order 2023 came out, we welcomed that, because we had already been at it for about a year in terms of trying to get our processes fine-tuned,” he said. “We’re happy to report that our SRIS [system reliability impact study] process last year took an average of 132 days. The average of the three years preceding that was 420 days.”

When asked what differentiated NYISO’s transmission planning from those of other grid operators, Dewey touted the ISO’s “very, very robust” process for identifying reliability needs and New York’s Public Policy Transmission Needs process, in which the state solicits projects and the ISO evaluates and selects the best solution.

“In the middle of that, we have our economic planning process, and I think that’s where our gaps have been,” he continued. NYISO’s System & Resource Outlook lays out multiple scenarios that might unfold over the next two decades and identifies pathways through them, he said.

It is not an action plan, however. “We don’t have a means to act on that today; it’s more informational,” Dewey said. (See NYISO 20-Year Forecast Highlights Generation, Tx Hurdles to Climate Goals.)

But the present practice of building transmission one interconnection at a time as needed is neither efficient nor effective, Dewey said. Measures such as proactive infrastructure construction and New York’s new Coordinated Grid Planning Process (CGPP) will address this, he said. (See NY Creates Coordinated Grid Planning Process.)

Zeryai Hagos, of the state Department of Public Service, explained that the CGPP will attempt to integrate the distribution, local transmission and bulk transmission planning processes on a repeating cycle to identify upcoming infrastructure needs.

New York Public Service Commission Chair Rory Christian spoke of the imperative to think beyond interconnections and conductors when developing the grid of the 21st century.

If demand-side management isn’t used, that grid must be overbuilt or overused to handle peak load, with a proportionally greater impact on equipment, the environment and ratepayers.

“Addressing the rise in peak load … is central to the commission’s ability to ensure affordable, safe, secure and reliable access to utility services and just and reasonable rates,” he said. “Our ability to control the peak gives us flexibility that we would otherwise not have. This is the challenge the grid of the 21st century is being designed to meet.”

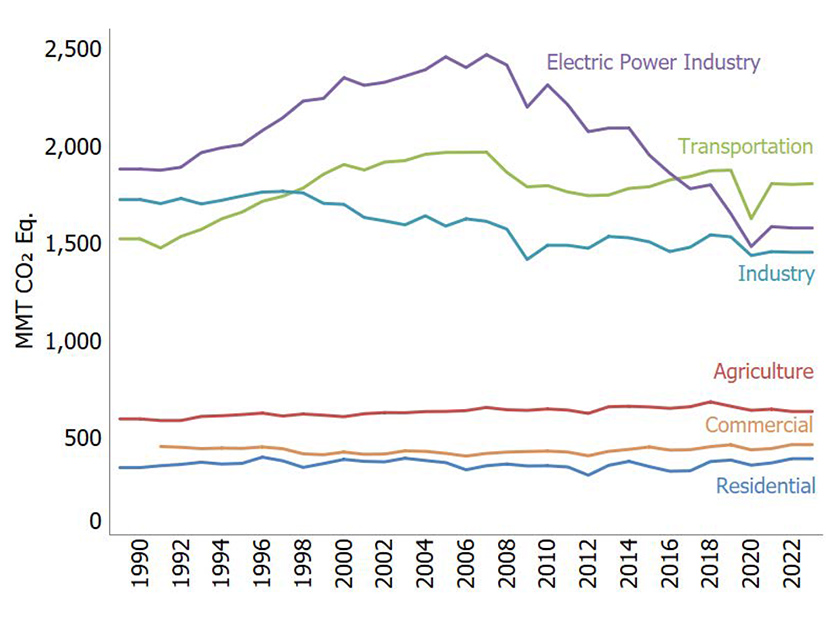

NYISO’s Yachi Lin said the ISO’s upcoming report on capacity and transmission constraints will predict a need for 100 to 130 GW of installed capacity in New York in 20 years. This compares with approximately 37 GW of existing generating capability identified by the NYISO Gold Book in April 2023.

Glenn Haake, vice president of regulatory affairs at Invenergy, applauded the PSC for creating the CGPP and for greenlighting billions of dollars’ worth of transmission projects after decades of minimal investment.

John Howard, who recently completed a term as a PSC commissioner, said transmission investments have long been trimmed when utility regulators review rate cases. As a result, he said, some conductors in New York are as old as he is.

“It’s certainly something that commissions knew was dropping off the table,” Howard said.

Christian and many others have spoken of this problem as a way of easing customers’ sticker shock over the costs of the energy transition: The nation’s grid would need extensive and expensive investments even without an energy transition.

Energy transition challenges notwithstanding, the grid does function well, NYISO COO Emilie Nelson said.

“One of the things that we do have in New York is we’ve invested in a lot of capability through the years. Our interconnected grid — our ability to move power across each and every border of New York to the neighboring areas — serves us well.”