The panel of SPP board members overseeing the development of Markets+ has approved the governance transition plan for the construction phase of the day-ahead market.

The Interim Markets+ Independent Panel (IMIP) also signed off on Phase 2 sector representation for stakeholder groups, a meeting attendance and proxy policy, and the budget for the Markets+ State Committee (MSC) during its May 27 virtual meeting.

The IMIP unanimously endorsed the Markets+ Participant Executive Committee’s (MPEC) recommendation to keep the Phase 1 stakeholder groups’ rosters until the committee’s Aug. 12-13 meeting, which serves as the Phase 2 effective date. Potential Markets+ participants must sign one of three agreements — funding, participation or stakeholder — by July 23 to retain seats for their representatives.

MPEC will vote on stakeholder group nominations during the August meeting in Portland, Ore. (See SPP Readies Participants for Next Phase of Markets+.)

IMIP Chair Steve Wright praised MPEC’s suggestion for meeting attendance and use of proxies. A stakeholder task force worked to meet the demands of public interest groups and nonprofits, many of which are stretched to cover the various working groups and subgroups.

“This is a good example of how the process works well. I thought there were some legitimate concerns raised with respect to small organizations’ ability to participate in the process, and some good compromises were made from the initial proposal,” Wright said. “I feel like this is a really strong proposal that aligns with the culture of governance that we want to have as part of the development of Markets+.”

The MSC budgeted $389,680 for 2025 expenses. That covers the cost of a full-time equivalent dedicated to the committee and two in-person meetings during the year, and compares favorably with SPP’s Regional State Committee in the Eastern Interconnection.

The costs are allocated to Markets+ participants. The Western Interstate Energy Board provides independent staffing for the MSC, which is composed of state regulators from the West.

Xcel Defends Markets+ Decision

Joe Taylor, who represents Xcel Energy operating subsidiary Public Service Company of Colorado (PSCo) on MPEC, explained the utility’s decision to join Markets+ rather than an RTO during testimony May 27 before the state’s Public Utilities Commission.

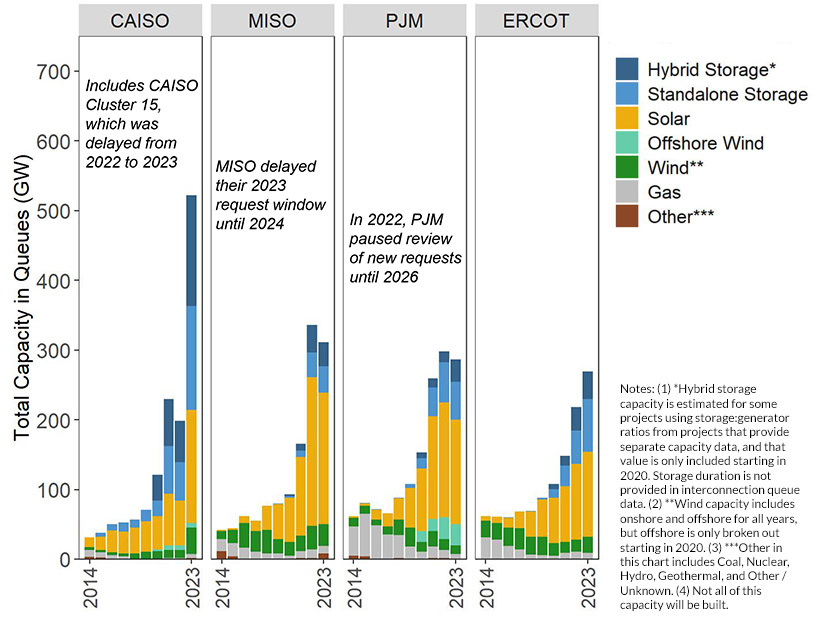

Taylor said the company is concerned about long delays in grid operators’ interconnection queues.

“It gives us pause to turn over those activities to an RTO,” he said. “The ability to plan and build are important considerations.”

A 2021 state law requires transmission-owning utilities to join an organized market by 2030. Tri-State Generation and Transmission Association, Colorado Springs Utilities and the Platte River Power Authority have chosen to become full RTO members of SPP’s Western expansion.

PSCo estimates it will be assessed $20 million in implementation costs for Markets+.

MMU Releases 2024 Market Report

SPP’s Market Monitoring Unit has released its annual State of the Market report for 2024 and continues to find the Integrated Marketplace to be competitive.

The Monitor shared a draft with stakeholders during the quarterly Joint Stakeholder Briefing in May. (See “MMU’s Draft Market Report,” 2025 ‘Challenging’ Year for SPP, Exec Says.)

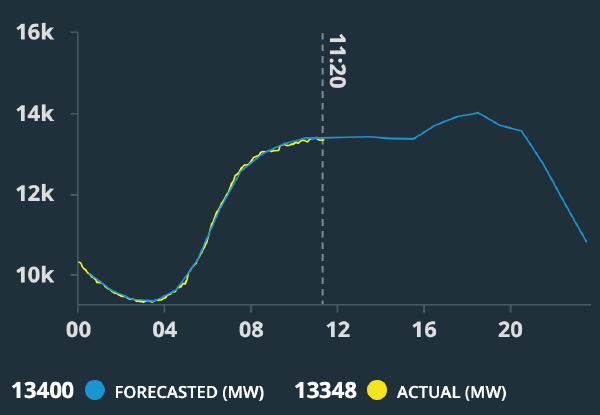

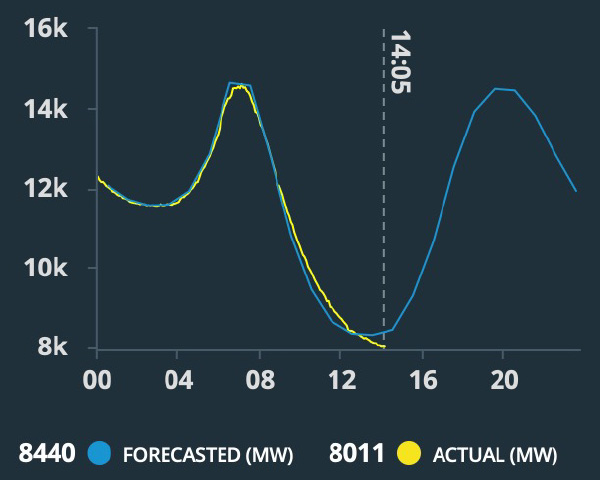

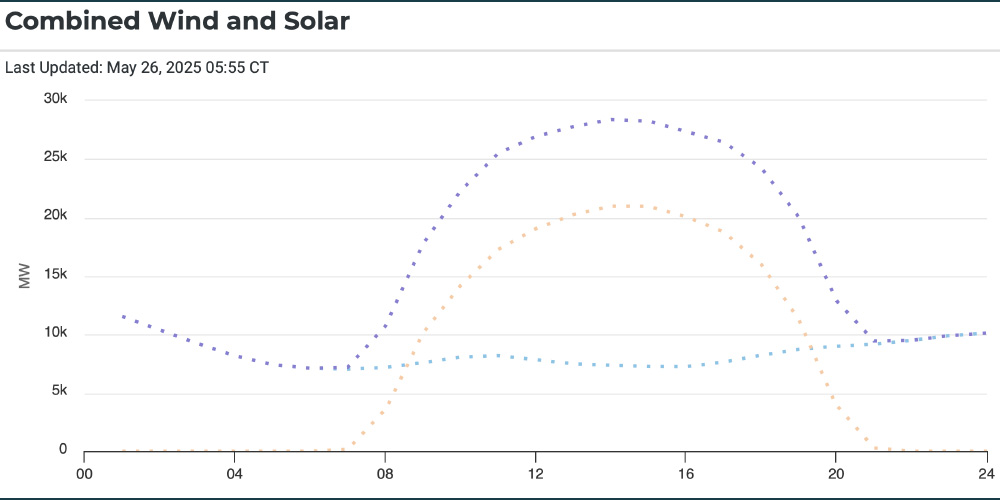

The MMU said many of the themes identified in previous years — resource adequacy challenges and increasing renewable generation — persisted in 2024. The market continues to see escalating load growth with a “high likelihood” that it will continue in future years.

Intermittent resources continue to play an ever-growing role in the SPP markets, with increasing variability and uncertainty of supply, out-of-market actions to ensure system reliability, higher make-whole payments and negative prices, according to the report.

The MMU will host a webinar June 12 to discuss the report.