SERC Reliability expects above-average temperatures to drive higher demand this summer, and registered entities should have the resources to meet demand under normal operating conditions, the regional entity said in its 2025 Summer Reliability Assessment.

However, SERC also warned that some areas do face a risk of shortfalls should weather conditions become more extreme.

SERC published the SRA on May 29 as a supplement to NERC’s 2025 summer assessment, in which the ERO warned that multiple subregions across North America showed a potential for insufficient operating reserves in above-normal conditions. (See NERC Warns Summer Shortfalls Possible in Multiple Regions.) NERC identified rising demand and the retirement of traditional generation resources as primary contributors to the risk in the summer season, which for both assessments runs from June to September.

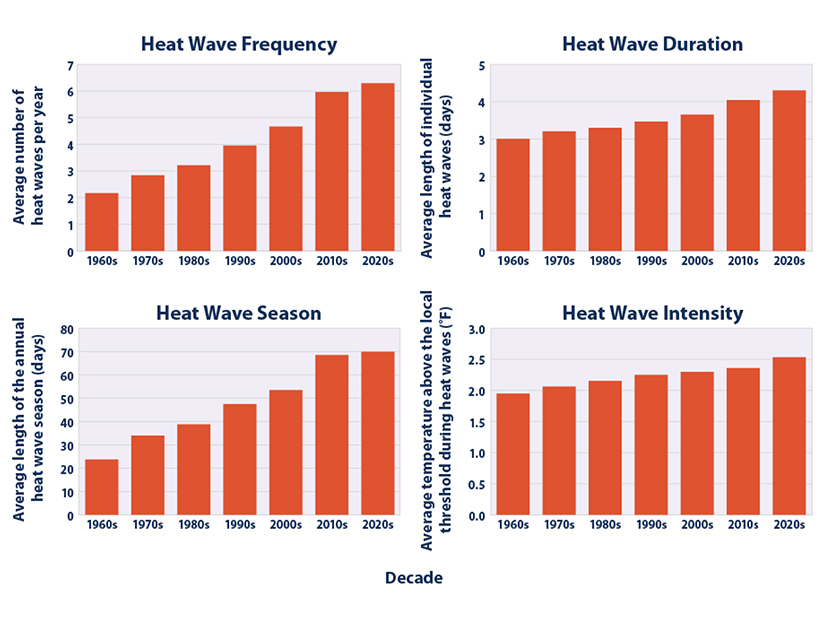

SERC’s assessment noted that extreme weather continues to be a major concern for the region, which “contains those areas of the U.S. most likely to be in the path of a hurricane, as well as many of the states that are prone to high summer temperatures.” The RE included data from EPA showing that the frequency, intensity and duration of heat waves in major U.S. cities have all steadily increased since 1961, while the average length of heat wave seasons has lengthened from just over 20 days in the 1960s to 70 days in the 2020s.

“Hotter summer temperatures cause increased demand due to heightened use of commercial and residential air conditioning,” SERC said. “Simultaneously, hotter temperatures can reduce the generation capacity and efficiency of thermal generation units and reduce air density, which decreases the capability of wind turbines. … Extreme heat along with high demand can overwhelm the transmission lines and cause them to sag and touch trees or other objects, which can potentially lead to outages.”

Despite the growing threat of extreme heat, SERC said all of its subregions have enough resources to meet NERC’s recommended 15% reserve margin target under the 50/50 load forecast, which represents a 50% chance that the actual peak load will be higher or lower than the prediction. This prediction held for most areas even under the 90/10 forecast, in which there is a 10% chance that peak load will be higher than expected.

The one exception was the Central subregion, covering all or parts of Alabama, Georgia, Iowa, Kentucky, Mississippi, Missouri, North Carolina, Oklahoma, Tennessee and Virginia. Its predicted reserve margin was 19% under the 50/50 forecast, but 9% under the 90/10, putting it into the “elevated risk” category.

Natural gas generation constituted the largest share of SERC Central’s summer on-peak generation mix, with 19.7 GW, or 41% of the total generation fleet; coal was next at 12.7 GW (27%); followed by nuclear at 8.2 GW (17%). For comparison, in SERC’s overall footprint, gas accounted for 49% of the nearly 324 GW on-peak generation capacity, with coal at 18% and nuclear at 13%.

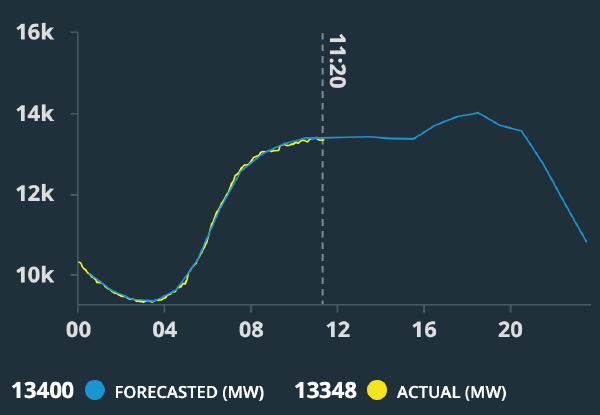

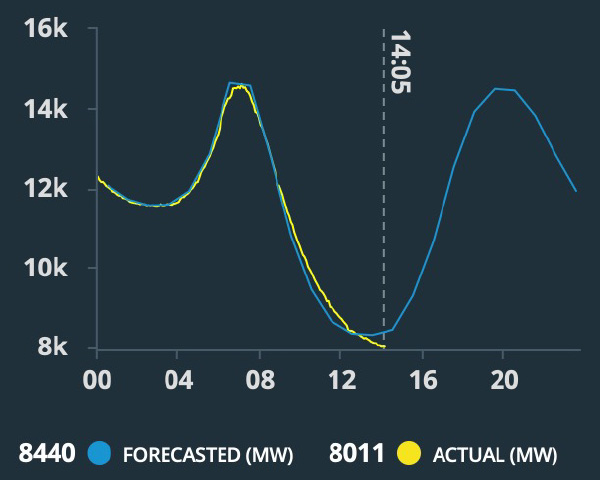

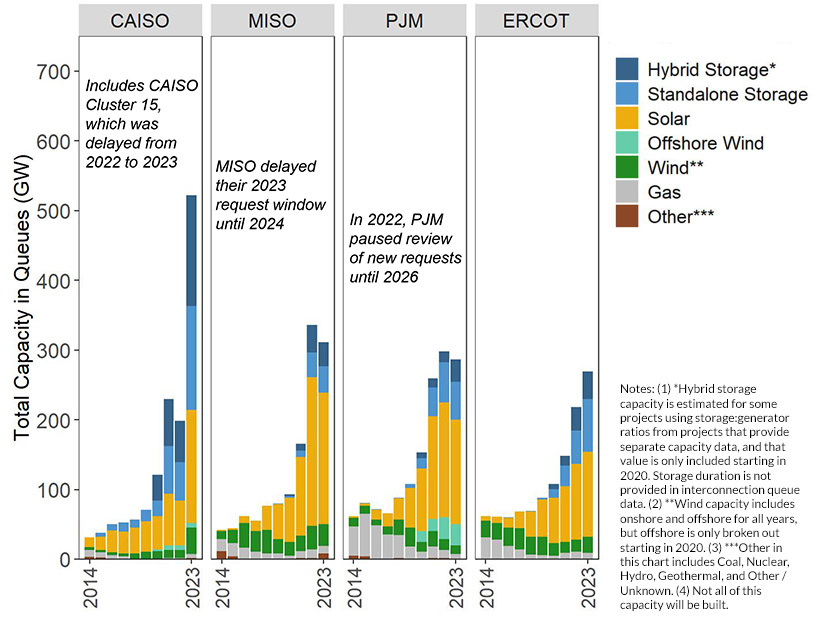

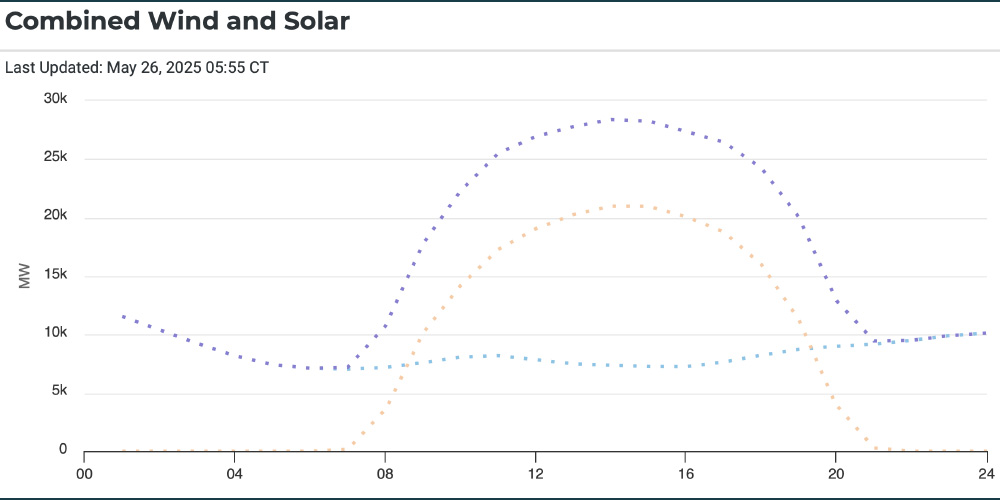

The report observed solar generation still is increasing across the SERC region, with 30 GW of on-peak solar capacity expected to be online by this summer, up 7 GW from summer 2024. This growth has driven operators to rely on natural gas to balance the weather dependence of solar generation.

However, SERC noted that “while [gas] generators are capable of quickly ramping up and down to provide ‘load following’ service as necessary, this is only possible if they have access to the full amount of natural gas commodity needed for the periods for which they are dispatched.”

The RE mentioned that one registered entity said, “If operational flow orders (OFO) were issued on the pipelines serving its generating units, the OFOs would require the units to maintain the day-ahead planned fuel usage.” This could prevent operators from redispatching the affected gas units to handle transmission line loading issues.

SERC recommended that reliability coordinators, balancing authorities and transmission operators review their seasonal operating plans with a focus on communication and resolution of potential supply shortfalls during periods of extreme demand. The RE also said utilities should ensure resource availability through conservative generation and transmission outage coordination procedures, and state and provincial regulators should prepare to implement demand-side management mechanisms.