The Imperial Irrigation District (IID) has agreed to join CAISO’s Western Energy Imbalance Market (WEIM) and Extended Day-Ahead Market (EDAM), the ISO announced May 27.

CAISO said the publicly owned utility, based in Southern California’s Imperial County, has signed implementation agreements and will begin participating in the markets in 2028.

In a separate announcement on May 20, IID said its board of directors approved a $24 million budget amendment “to advance preparations for joining” WEIM and the soon-to-be-launched EDAM. The money will fund upgrades to the utility’s control infrastructure, telecommunications, metering and energy management systems, according to the announcement.

“As a large public power provider in California, IID is pleased to join both the Western Energy Imbalance Market and the Extended Day-Ahead Market,” Jamie Asbury, general manager at IID, said in a statement. “This is a significant step toward modernizing how we purchase and manage power, which will translate into savings for our ratepayers annually by giving us the ability to react much faster to energy market conditions. This also aligns IID more closely with emerging regional energy practices yet allows us to retain our independence as an energy balancing authority.”

IID serves about 165,000 customers in service territory covering 6,611 square miles that includes California’s Imperial Valley and parts of San Diego and Riverside counties. The utility controls about 1,100 MW of generation, including contracted resources, and operates more than 1,800 miles of transmission and 5,000 miles of distribution lines.

CAISO noted that when IID begins participating in the markets, “it will mark the first time all California balancing authorities are participating in ISO-operated electricity markets.”

The agreement between IID and CAISO comes shortly after California publicly owned utility Turlock Irrigation District announced it would join EDAM in 2027. PacifiCorp and Portland General Electric have agreed to begin participating in EDAM in 2026, with the Los Angeles Department of Water and Power and the Balancing Authority of Northern California set to join in 2027. (See LADWP Gets Board’s OK to Join CAISO’s EDAM and Turlock Irrigation District to Join EDAM in 2027.)

PowerWatch (formerly BHE Montana), PNM, NV Energy, Idaho Power and Arizona G&T Cooperatives have indicated they’re leaning toward EDAM as their preferred day-ahead market choice.

Changed Perspective

IID’s decision also is significant because of the district’s at-times contentious relationship with CAISO — and its past opposition to “regionalizing” the ISO.

In July 2015, IID filed an antitrust suit in the U.S. District Court of Southern California contending CAISO had gained monopoly power over the state’s transmission services and operations markets.

The suit alleged that — through a series of memos and public statements made between 2011 and 2014 — CAISO had “induced” IID to make $30 million in upgrades to Path 42, one of two transmission lines linking the utility district with the ISO.

CAISO had estimated the improvements would increase IID’s maximum import capability (MIC) into the ISO from 462 MW to 1,400 MW, but later downgraded the MIC to the previous level, citing closure of the San Onofre nuclear generating station as the reason for its decision, which IID contested. (See Federal Judge Upholds Imperial Irrigation District Suit Against CAISO.)

The two parties reached a settlement in the suit in 2018 after the ISO approved line upgrades that would allow more renewable energy to flow into the ISO from the utility’s service territory.

IID also opposed CAISO’s previous efforts to expand into an RTO, initiating a separate lawsuit in 2016 seeking to force the grid operator to publicly disclose protected information related to ISO-commissioned studies supporting regionalization.

Speaking at a joint California agency workshop in July 2016, IID’s then-General Manager Kevin Kelley said the utility opposed regionalization because it would require the state to relinquish oversight of an entity that suffered costly market manipulation during the 2000/01 Western Energy Crisis.

Kelley at the time said he suspected the “driver” of regionalization was a “for-profit corporation” — namely, PacifiCorp, which was the first utility to commit to joining both the WEIM and EDAM. (See Governance Plan Critics Urge Slowdown of Western RTO Development.)

But times have changed and IID’s energy consumption and customer base grow each year, with demand increasing, Robert Schettler, a spokesperson for IID, told RTO Insider.

“We’re out there making agreements ahead of time as best we can,” Schettler said. “But then sometimes the energy that we’re expecting isn’t available, and we have to go on the market and get it and pay market prices, and then we have to shift those prices to our customers, which has not been popular.”

IID hopes participation in the markets will broaden the utility’s reach and bring stability to fluctuating adjustment costs in customers’ bills. Additionally, IID has been around for 114 years, and entry into the markets comes as the utility has launched a 15-year plan to upgrade its infrastructure, Schettler noted.

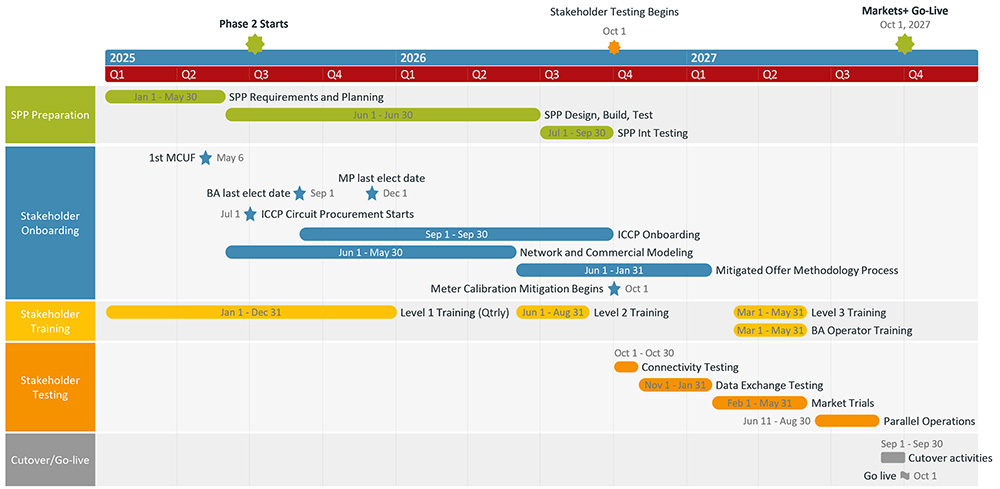

WEIM launched in 2014, and EDAM is slated to go online next spring. IID said in the news release that a “conservative estimate” shows the utility could save $12 million annually once both markets are in use.