Washington Post headline: “Amid explosive demand, America is running out of power.” 1

The long article cobbles together charts without context, cites states with relatively high electric demand and quotes from all manner of folks.

Missing are the entities that actually know whether there is “explosive demand” and whether “America is running out of power.”

These entities are NERC and the RTOs like PJM that manage generation supply-demand and bulk transmission for most of the country.2 But why ask the experts?

Explosive Demand?

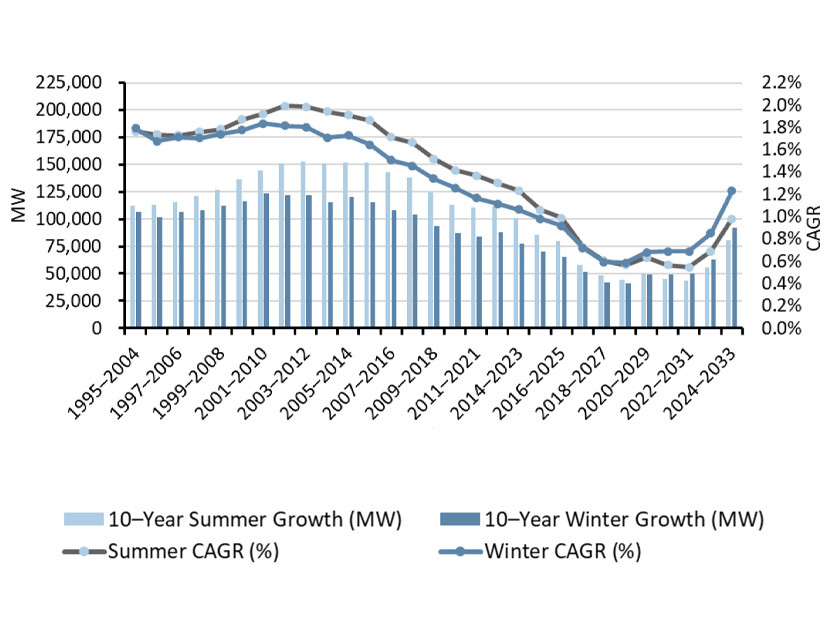

Regarding “explosive demand,” please look at this NERC graph that shows forecast summer and winter peak demand annual growth rates for the next 10 years.3 The lines show the compound annual growth rate (CAGR) values on the right-hand axis. Do you see the most recent 10-year growth rates of 1.0% summer and 1.2% winter? And do you see how much higher these growth rates were from 1995 to 2014? So yes, demand growth is increasing — but at a relatively small rate in absolute and relative terms.

Running out of Power?

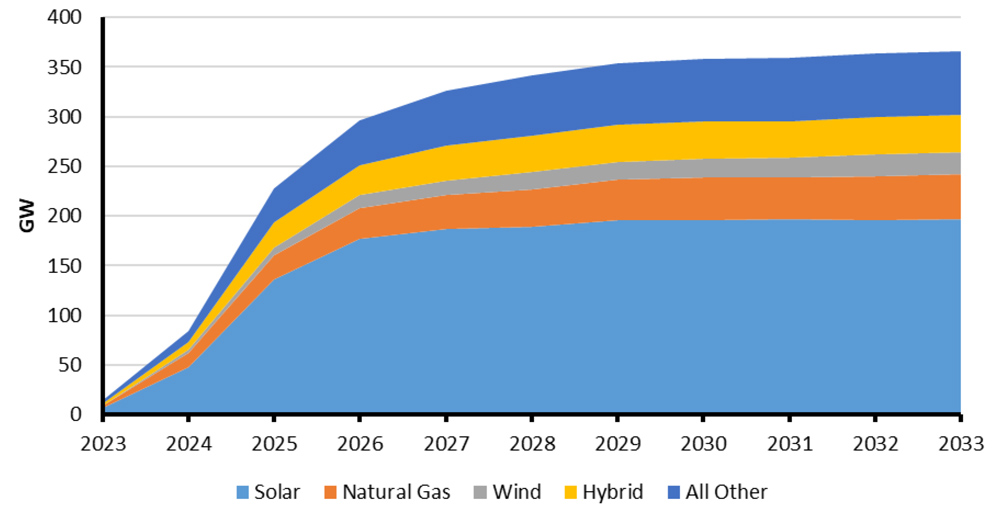

As for America “running out of power,” here’s another NERC chart showing projected new Tier 1 and 2 generation resources over the next 10 years.4 Around 370 GW by 2033. This is a staggering amount of new generation relative to existing generation resources of 1,300 GW.5

Will all of it get built? No. Will the renewable (intermittent) resources have the same reliability value and load factor as dispatchable (firm) resources? No — I’ve written about their limits ad nauseum.6 Are there challenges that need to be worked through to ensure the energy transition does not degrade reliability? Yes. Crisis? No.

Georgia

Georgia is the poster child for the Post article, where the major utility there, Georgia Power, projects increased demand from various sources.7 But is there a crisis? No. Georgia Power identifies eight measures to address the increased demand, including power purchase agreements with generators in Mississippi and Florida, expanding battery storage, building additional simple-cycle combustion turbines, and expanding distributed energy resource and demand response programs.8 Where’s the fire?

Distracting from the Real Work at Hand

Articles like the Post’s distract from the real work at hand. Here are a few no-brainers I’ve flagged before:

(1) Keeping existing nuclear plants open. Thank goodness Diablo Canyon was saved, as I pleaded for eight years ago;9

(2) banning cryptocurrencies (especially “proof of work” crypto like Bitcoin), which have nothing but negative externalities like emissions, ransomware enabling, money laundering, drug smuggling and human trafficking; 10

(3) rational onshore wind instead of irrational offshore wind, which costs at least twice as much per MWh;11

(4) rational grid solar instead of irrational rooftop solar, which costs five times as much per MWh;12

(5) high-voltage interconnections between Texas/ERCOT and the rest of the country;13

(6) unique emergency ratings for generation interconnection studies (and dispatch);14

(7) new (but known) technologies for increasing capacity of existing transmission lines;15

(8) not wasting money on green hydrogen electricity;16 and, dare we keep saying it,

(9) carbon pricing.17

The flip side of good public policies is bad public policies, such as premature closure of dispatchable resources (a threat that goes unaddressed in the Post article). Bad public policies can create a crisis that would be otherwise avoidable. But we shouldn’t assume we’ll foolishly create a self-inflicted crisis.

A Last Word

In my humble opinion, the damage from an article like the Post’s goes beyond distracting us from the real work at hand. It adds to the collective trauma from all the big things we already worry about, like climate change, artificial intelligence, politics and international crises.

We have plenty to worry about. Enough already.

Columnist Steve Huntoon, principal of Energy Counsel LLP, and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.

1 https://www.washingtonpost.com/business/2024/03/07/ai-data-centers-power/

2 As an example the most recent PJM load (demand) forecast is here, https://pjm.com/-/media/library/reports-notices/load-forecast/2024-load-report.ashx. Load growth attributable to electric vehicles and data centers is accounted for.

3 https://www.nerc.com/pa/RAPA/ra/Reliability%20Assessments%20DL/NERC_LTRA_2023.pdf, Figure 25.

4 NERC report, Figure 16.

5 https://www.publicpower.org/system/files/documents/Americas_Electricity_Generating_Capacity_2023_Update.pdf. This is U.S. generation capacity and does not include Canada.

6 https://energy-counsel.com/wp-content/uploads/2022/11/More-Happy-Talk.pdf; http://energy-counsel.com/docs/No-Carb-California.pdf; http://energy-counsel.com/docs/German-La-La-Land.pdf; http://energy-counsel.com/docs/Cue-the-PixieDust.pdf.

8 IRP report, pages 2-3.

9 My column on the insanity of closing Diablo Canyon is here, http://energy-counsel.com/docs/Helter-Skelter-September-Fortnightly.pdf. No such luck with saving Indian Point which closure I showed would cost New Yorkers $830 million/year, http://energy-counsel.com/docs/New-Yorks-Surreal-New-Deal.pdf

10 https://energy-counsel.com/docs/The-New-Technoking-and-His-Bitcoin-Crown.pdf; https://energy-counsel.com/wp-content/uploads/2022/04/Stop-the-Insanity.pdf.

11 https://www.energy-counsel.com/docs/we-see-through-a-glass-darkly.pdf, item 3 and sources cited there.

12 Same column, item 4 and sources cited there.

13 https://www.energy-counsel.com/docs/a-modest-proposal.pdf; https://energyathaas.wordpress.com/2022/01/31/the-most-obvious-way-to-avoid-another-texas-blackout.

14 https://energy-counsel.com/docs/waste-not-what-not.pdf; tangible comments in the FERC rulemaking are here, https://elibrary.ferc.gov/eLibrary/filedownload?fileid=15740097.

15 https://www.epri.com/research/products/000000003002023004; https://energy-counsel.com/wp-content/uploads/2022/06/Transmission-and-Technology.pdf (penultimate paragraph).

16 https://energy-counsel.com/wp-content/uploads/2023/12/Hydrogen-Reality.pdf.

17 “‘If we don’t put that price of carbon on the system, I don’t see how anything could work,’ Harvard economist William Hogan said in the last session of the daylong conference.” https://www.rtoinsider.com/articles/29867-epsa-members-renew-call-carbon-price.