The return of electricity demand growth is a reality embraced by both political parties, but a Senate Energy and Natural Resources Committee hearing on July 23 highlighted their differences on how to address it.

“Here’s the real problem: We have spent much of the last 20 years shutting down the generation that can actually meet that demand,” committee Chair Mike Lee (R-Utah) said. “Coal plants retire, nuclear blocked, natural gas tied up in endless litigation; and we replaced a lot of that capacity with wind, solar and batteries, resources that by design don’t work all the time.”

The growth being driven by artificial intelligence and data centers, electrification and resurging domestic manufacturing will require changes to how energy infrastructure is permitted and built, Ranking Member Martin Heinrich (D-N.M.) said.

“No single business or technical workaround can substitute for a coordinated, modern, responsive grid,” Heinrich said. “Fortunately, we sit on the committee that can help make that happen. The urgency isn’t just about maintaining our edge in AI innovation; it’s about affordability.”

The recently passed reconciliation bill cut tax credits for the kind of energy resources that can be most quickly deployed — solar and wind, which Heinrich said would raise nationwide annual energy costs by $16 billion by 2030 and $33 billion by 2035.

“And the president’s tariffs are driving up equipment costs, raising the cost of all energy generation resources — all of them,” he added. “This is leading directly to Americans spending more on their utility bills.”

Lee pushed back on criticism about Republicans using reconciliation and relying on party-line votes to cut renewables subsidies in the recently passed “One Big Beautiful Bill Act,” reversing policies Democrats had enacted three years earlier using the same legislative tactic.

“The Inflation Reduction Act turbocharged subsidies for wind and solar,” Lee said. “And those subsidies are distorting energy investment, because the subsidies can offset more than 50% of the project’s costs — a significant amount that ends up being borne by the U.S. government and the U.S. taxpayer.”

On top of that, he added, those intermittent resources need to be balanced with energy storage or natural gas peaker plants, which add to the costs.

Huntsman Corp. CEO Peter Huntsman agreed, pinning the blame for the decline in its chemical industry on its net-zero policies.

“I’ve experienced this firsthand as our company has laid off thousands of employees in Europe,” Huntsman said. “Facilities that were globally competitive just a few years ago have been closed and are no longer operating due to ruinous and unrealistic net-zero and decarbonization policies and the failed ideas that you can power a modern economy without developing oil and gas resources.”

No AI Leadership Without Power

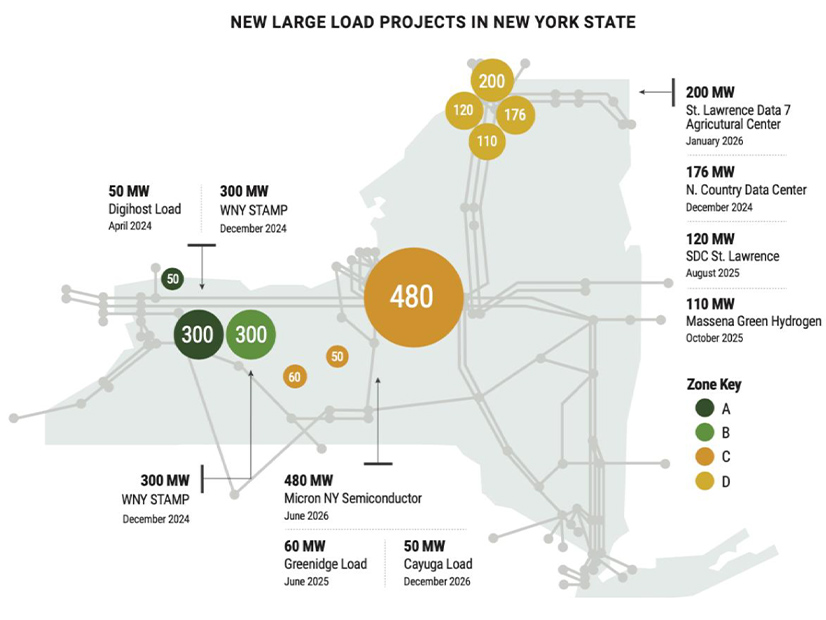

Jeff Tench, executive vice president at Vantage Data Centers, offered the perspective of his industry, saying that, just five years ago, a data center with 30 MW of power demand would’ve been considered “large.” Now, 100 MW is a starting point, and some customers are asking for 1 GW or more for data centers used to support artificial intelligence, he said.

“We cannot get the amount of electricity we need in the time frame to build our data centers,” Tench said. “Without electrical power, it is not possible to build digital infrastructure — the infrastructure that supports AI data centers. Transmission lines and generation facilities must scale rapidly if the U.S. is to remain the global leader in AI innovation. We are asking for your leadership to drive a more modernized policy framework that reflects today’s growth, aligns with investment timelines and ensures that the power system is ready when and where it is needed.”

Interconnection timelines for new generation and new large loads are too slow, the transmission grid needs to be upgraded to support the new demands, and permitting must be improved to ensure the U.S. can lead in AI development, he added.

“The United States is looking at an AI era that is not coming, but is here,” Tench said. “We have the capital, we have the customers and the talent, but we will not lead if we cannot power it.”

Power demand growth is sudden and challenging to meet, and it is contributing to affordability issues around the country, said Rob Gramlich, president of Grid Strategies. While acknowledging the need for more generation, Gramlich focused on transmission first because the federal government has more authority over its development.

“It has the highest impact,” Gramlich said. “It’s the great integrator of all resources. It may seem like it’s a renewable energy piece of infrastructure, but that’s just because over the last five years, that’s all anybody was trying to connect to the grid.

“Right now, we’re seeing a lot of other things trying to connect to the grid, including Jeff’s data centers and data centers around the country, other large loads, manufacturing and other types of generation. And whether it’s nuclear, [carbon capture and sequestration], other types of generation — guess what? It’s going to face that same constrained grid.”

Building new lines can take time, but grid-enhancing technologies and advanced conductors can be deployed more rapidly to get more out of existing infrastructure, Gramlich said. The industry also should keep considering building larger 765-kV lines, which are cheaper compared with building multiple lines to meet the same need, Gramlich said.

“We do need firm power to meet peak loads,” Gramlich said. “Resources provide varying levels of contributions to meeting peak loads. Nuclear has the highest contribution at 95%, but we’re not able to get much more very soon. Gas CTs, at least according to PJM, are around 60% in terms of their ability to serve peak loads. Combined cycle is a little higher in the 70s. Offshore wind is actually 69%.

“And so none of these resources are perfect, but the point is, when you put them all together on the integrated grid, that’s how you get nearly 100% reliability of the power system.”