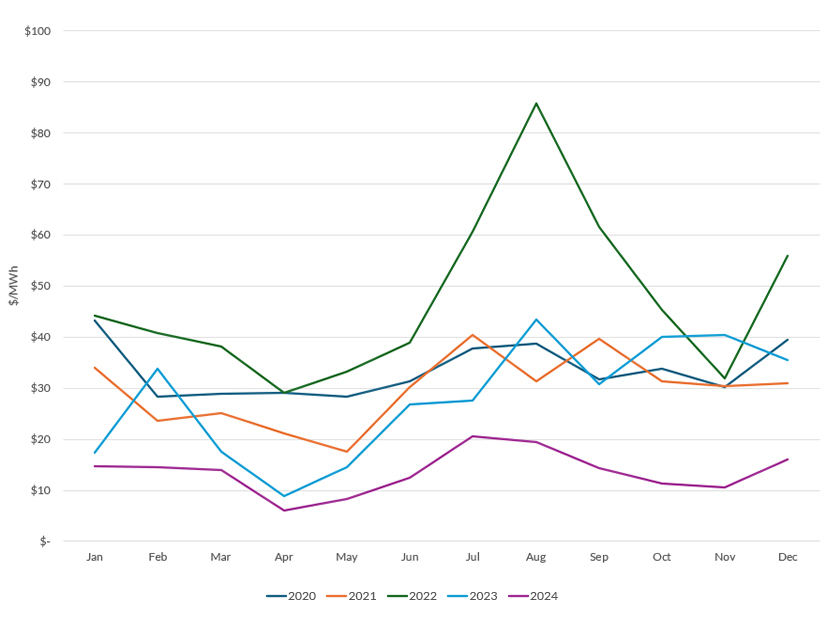

MISO’s 2025/26 capacity auction returned $666.50/MW-day prices across all zones in the summer, reinforcing the need for members to build new generation fast, the grid operator said.

While none of MISO’s resource zones experienced a capacity deficit, MISO said it’s inching closer to pervasive shortfalls. The summer’s capacity prices represent a 22-fold increase over summer capacity prices in 2024.

Beyond summer, MISO zones cleared uniformly at $69.88/MW-day in spring and $33.20/MW-day in winter. For fall, MISO Midwest cleared at $91.60 while MISO South cleared at $74.09/MW-day. MISO said the split in fall pricing occurred due to its transfer limits between its Midwest and South regions.

Annualized, MISO’s capacity prices are $217/MW-day for MISO Midwest and $212/MW-day for MISO South.

Prices go into effect June 1, when the planning year begins.

In the 2024/25 capacity auction, Missouri’s Zone 5 cleared at the $719.81/MW-day cost of new entry for generation in spring and fall. All other MISO zones cleared at $30/MW-day in the summer, $15/MW-day in the fall, $0.75/MW-day in the winter and $34.10/MW-day in the spring. (See Missouri Zone Comes up Short in MISO’s 2nd Seasonal Capacity Auction, Prices Surpass $700/MW-day.)

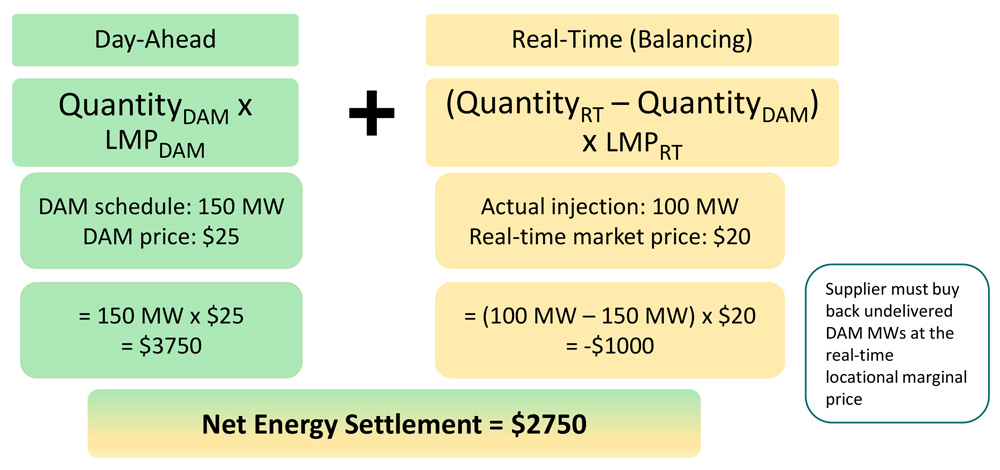

The 2025/26 auction was MISO’s first to feature sloped demand curves by season. The grid operator hoped the curves would function as a safety net to have more capacity on hand than strictly necessary to meet planning reserve margin requirements. FERC in 2024 allowed MISO to use them in place of the vertical demand curve it had been using since 2011. (See FERC Approves Sloped Demand Curve in MISO Capacity Market.)

MISO said the sloped curves placed an expected higher price on capacity, “reflecting the increased value of accredited capacity beyond the seasonal planning reserve margin target.” The grid operator said the auction cleared 1.9% above its 7.9% summer planning reserve margin (PRM). MISO said, effectively, it’s heading into summer with a 10.1% summer margin at 101.8 GW in MISO Midwest and an 8.7% margin at 35.7 GW in MISO South.

Ahead of the auction, MISO anticipated a 122.66-GW summer coincident peak and required a 7.9% PRM at 135.3 GW for the auction.

In other seasons, MISO cleared a 17.50% PRM in fall compared to its initial 14.90%; a 24.50% PRM in winter compared to the original 18.40%; and a 26.80% PRM in spring compared to the initial 25.30%.

During an April 29 conference call to review results with stakeholders, MISO’s resource adequacy manager Andy Taylor said all offered capacity in MISO Midwest ended up clearing while about 300 MW of capacity in MISO South priced above the summer clearing price was left on the table.

MISO said as with previous auctions, most of its load-serving entities “self-supplied or secured capacity in advance” outside of the voluntary auction and thus are shielded from this year’s pricing. Taylor said more than 90% of load in MISO hedged against “direct exposure to these prices.”

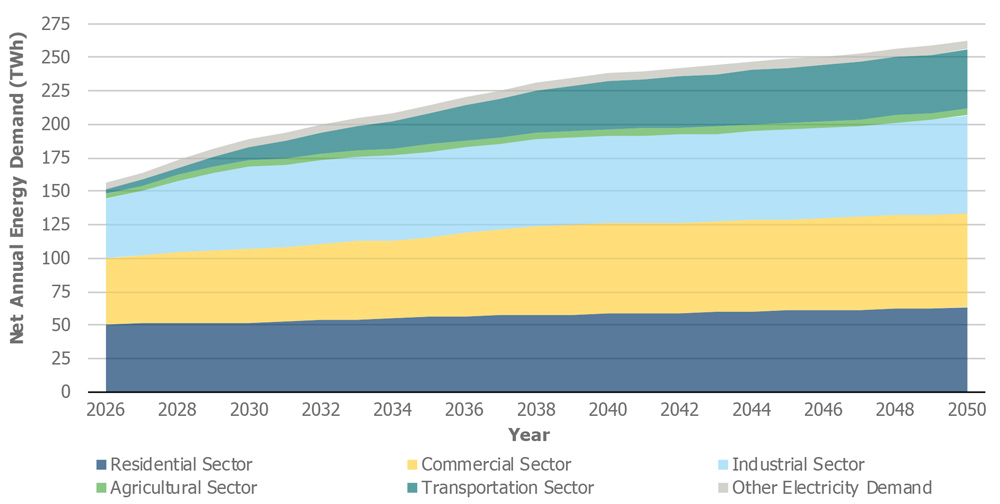

The RTO said while its sloped curves cleared extra capacity, it noticed the footprint’s spare capacity beyond planning reserve margins dwindled 43% this year compared to summer 2024. MISO said the drop occurred despite a slightly lower planning reserve margin aim than summer 2024’s 9% target. The RTO said it oversaw 140.7 GW in summer 2024 offers and 137.8 GW in summer 2025 offers. MISO reported surplus capacity in the summertime has regressed from about 6.5 GW in 2023, to 4.6 GW in 2024, to 2.6 GW in 2025

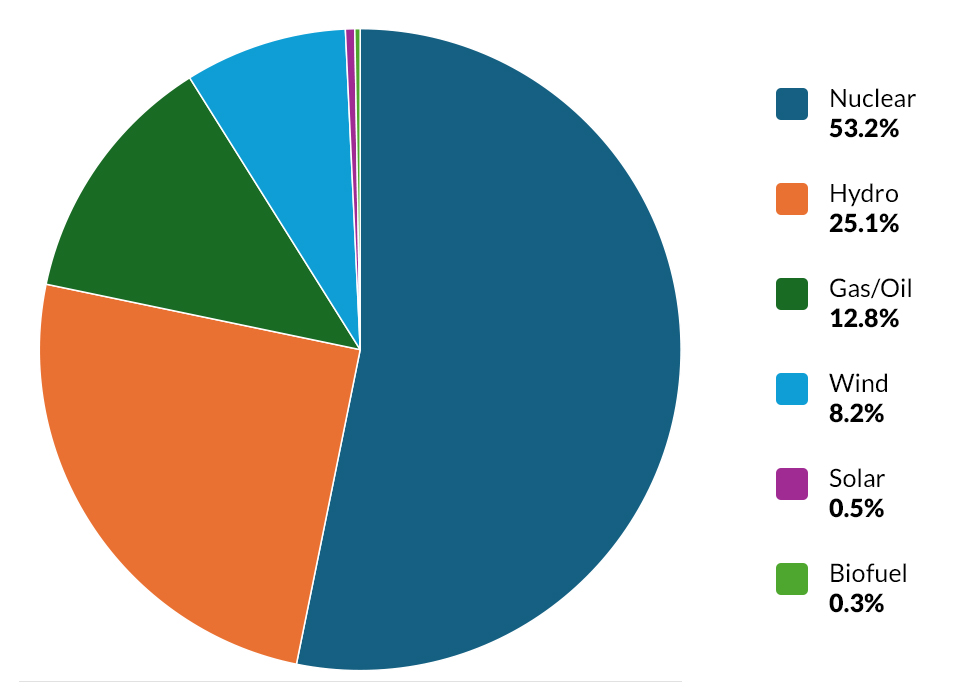

The 5.1 GW in new capacity, made up mostly of solar generation, and 1.2 GW in capacity accreditation increases added over the last planning year were no match for 4.9 GW in accreditation decreases, 3.3 GW in retirements and suspensions, and a nearly 1-GW loss in external suppliers in the same timeframe, MISO reported.

“New capacity additions did not keep pace with reduced accreditation, suspensions/retirements and slightly reduced imports. The results reinforce the need to increase capacity, as demand is expected to grow with new large load additions,” MISO said in a presentation accompanying auction results.

MISO Vice President of System Planning Aubrey Johnson said clearing prices more accurately reflected the growing value of accredited capacity as MISO’s supply drops closer to its resource adequacy requirements.

During the teleconference, Johnson said the auction “reinforces the challenges of preserving online resources and bringing more resources online as soon as possible.”

Taylor said prices better represent the value of reliability given the “relative risk in each season.” In summer, MISO neared but didn’t hit its preset, approximately $850/MW-day cost of new entry (CONE) for summer. Taylor said although MISO achieved its RA requirements and then some without experiencing any capacity shortages, MISO’s total surplus capacity continues to shrink.

“This has been a trend for many years,” Taylor told stakeholders.

MISO Executive Director of Markets Innovation and Strategy Zak Joundi said prices are “way more reflective of the risk profile we’re operating under.”

But stakeholders questioned whether the surplus is worth the expense.

Sustainable FERC Project’s Natalie McIntire asked how members are supposed to determine how much supplemental capacity MISO might deem appropriate in upcoming years.

“It seems like the PRM is no longer a really firm target,” McIntire said. She asked MISO to be mindful when deciding what volumes are sufficient beyond MISO’s one-year-in-10-years standard, because the surplus comes at a cost to consumers. McIntire requested MISO to balance affordability with reliability.

“It makes everyone feel very comfortable to have large margins, but there is a cost to large margins,” she said.

Taylor responded that MISO’s overall margins are “extremely thin” and acknowledged that MISO would exceed its baseline reliability targets moving forward under the sloped design curve. He MISO’s annual “static” sloped curves — which are calculated annually and use a blend of seasonal, systemwide curves and subregional sloped curves — would determine cleared capacity excesses in upcoming years.

Other stakeholders agreed the added reliability reassurance came at a high cost. Some also questioned whether MISO relied on the correct curves to lock in summertime prices.

Taylor said if not for the sloped curves and additional cleared supply, auction prices could have risen even higher and topped out at CONE under the old vertical curve paradigm. He also said MISO plans to host a more in-depth presentation on auction results at its May 21 Resource Adequacy Subcommittee.

Constellation Energy’s John Orr asked MISO to analyze and share what prices would have been had MISO used its vertical curve. WPPI Energy’s Steve Leovy seconded the request.

Over 2024, MISO and the Organization of MISO States through their joint resource adequacy survey showed that anywhere from a 1.1-GW surplus to a 2.7-GW shortfall could be possible by summer 2025. MISO leadership has been cautioning its stakeholders for more than a year that faster generation additions are a must.