The North American grid made it through the winter storm of Jan. 24-26 — dubbed “Fern” by The Weather Channel — relatively unscathed, but the cold weather gripping much of the U.S. and Canada continues, and cold snaps in the future will still stress the interconnected power and natural gas systems.

The industry mobilized ahead of the storm, sending out more than 65,000 workers from 44 states to start damage assessments and repairs as soon as possible, according to a news release from the American Public Power Association, Edison Electric Institute and the National Rural Electric Cooperative Association. As of 9 a.m. Jan. 29, 750,000 customers had their power restored, but work continued, especially in areas that saw an inch or more of ice accumulation.

“This unified effort includes close coordination with federal, state and local officials who share the goal of safely restoring power as quickly as possible,” EEI CEO Drew Maloney said. “The massive mutual assistance mobilization has ensured we have enough workers in place, with crews shared across the region and reassigned to the next priority as soon as they wrap up work.”

The Electricity Subsector Coordinating Council has held three calls to coordinate the response between the industry and federal government.

“Thanks to the work of our industry partners, mutual assistance crews are restoring power as quickly and safely as possible across the country,” Deputy Energy Secretary James Danly said in a statement. “Since Winter Storm Fern began on Jan. 24, the department has issued eight emergency orders to stabilize the electric grid across impacted regions; the department is using all of the available tools at our disposal to mitigate power outages and save lives.”

While the industry wraps up work connecting customers who lost power because of distribution outages and faces some ongoing cold in the coming days, winter reliability will continue to be an issue for the foreseeable future, experts said during a webinar hosted by R Street Institute on Jan. 29.

To submit a commentary on this topic, email forum@rtoinsider.com.

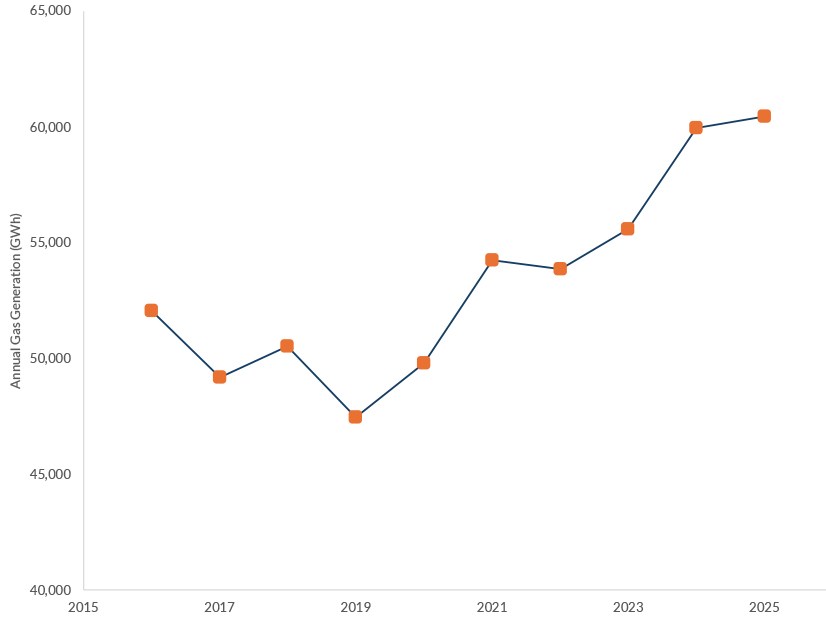

The biggest risk to bulk power system reliability in the coming years is whether the industry can respond to growing demand from data centers and other sources, but recently retired ISO-NE CEO Gordon van Welie listed the gas-electric issue as a close second.

“The biggest secondary factor is this mismatch between planning and paying for the gas system and the electric system, and the mismatch between the reliability standards for these two systems and the lack of recognition that the gas and electric systems have become one interdependent energy system,” van Welie said. “And we’re still regulating these systems as if they exist in independent silos.”

Winter reliability depends on weatherizing equipment and ensuring adequate fuel during cold snaps, which require strong performance incentives in the wholesale markets, investment in the required fuel infrastructure and some way to recover those costs, he added.

After Winter Storm Uri in February 2021, FERC and NERC made significant improvements to the point where that is “largely solved,” van Welie said. The two industries have worked to improve information sharing, but that has provided only incremental gains, he said.

The real need is for more infrastructure, van Welie argued. But while the two systems have become increasingly interdependent, they are regulated differently.

“The restructuring took different paths with different economic structures for cost recovery,” van Welie said. “And the consequence now, since they’ve become interdependent, is this total mismatch in terms of cost recovery for the underlying network, so I’m not talking about production here of gas, but the networks for delivering the gas.”

Inadequate gas infrastructure can lead to unreliable electricity supply, which compromises all aspects of the economy, including the ability to deliver gas to heat homes during cold snaps. After Uri, van Welie asked RTO staff to work with electric utilities and local distribution companies to estimate how the system in the Northeast would handle similar outages as seen in Texas.

“The biggest alarm bell came from the gas LDCs, who said, ‘There’s no way we can tolerate rotating feed outages, because what we’ll end up doing is a flameout,’” van Welie said. “‘We’ll end up with a flameout on the gas system. It’ll take us weeks to restore the gas system.’”

That nearly happened during the cold snap over the holidays in 2022 to Consolidated Edison’s LDC serving New York City. (See Déjà Vu as FERC, NERC Issue Recommendations over Holiday Outages.)

“I fear we’re going to need another 2003 event to really move the needle on this issue,” van Welie said.

The Northeast blackout in 2003 gave Congress the impetus to create a mandatory reliability system for the grid with the Energy Policy Act of 2005. Van Welie said the same kind of shock could force it to finally better align the gas and electric systems.

New England has been facing gas-electric coordination issues for more than two decades, but as Electric Power Supply Association CEO Todd Snitchler recalled on the webinar, it has been a focus at FERC since at least 2011.

“Well, that was 15 years ago, and we still haven’t solved it,” he added. “I do think we’ve made progress, and I’m happy to say that that’s been the case.”

The current cold snap is affecting a wide swath of the country, and so far, those improvements have borne fruit, with the two industries working well together, Snitchler said.

“I think the information sharing has improved dramatically,” he added. “I think the ability for the RTOs to interact with the gas system and with the power system and speak more common language has improved fairly significantly.”

Getting more infrastructure built would help, but Snitchler said cost recovery is an important issue.

“Markets treat cost recovery differently. Independent market monitors have different views about what’s eligible for cost recovery and what can be bid into the system,” he said. “And I think those questions are yet to be fully resolved in a way that helps to mitigate the volatility and stressful conditions but ensures, ultimately, that reliable system.”

Even outside of the issues in winter, the need to meet data center demand is going to require additional gas pipelines — and electric transmission lines, he added.

Uri hit Texas worse than anywhere else, as ERCOT suffered major outages exacerbated by gas-electric coordination issues, and led to hundreds of deaths. ERCOT’s former Independent Market Monitor and R Street Fellow Beth Garza noted that the gas-electric issues are different in Texas because of the lack of restructuring on the gas side.

“In Texas, the majority of natural gas-powered generation is supplied by intrastate pipelines [that] aren’t required to have the same kind of unbundling and restructuring that has happened in the rest of the country,” Garza said. “I would just point folks to the aftermath of Uri. Look at the profits that Energy Transfer; look at their profits of billions during that event, versus the loss of the largest generator in Texas, Vistra, which were also in the billions. And that, to me, tells a story.”

The oil and gas industry is politically powerful in Texas, and it has not been restructured at all, which is the opposite of what has happened in ERCOT’s electricity market, she added. The biggest thing aimed directly at winter reliability since Uri was that generators started getting paid to keep oil stored on-site at dual-fuel units, but Garza sees a bigger need for stored fuel.

“There needs to be an investment in gas storage,” she added. “It’s not just pipelines. It’s the ability to withstand, particularly in the wintertime, the production decreases that are going to happen because of the cold weather.”

One state that has done well with gas-electric coordination issues is Florida, which has the highest percentage of gas generation and is at the end of the pipeline network like New England, NERC Director of Reliability Assessments John Moura said.

“They build the gas pipeline for the generators,” Moura said. “They’re high-pressure contracts. They have a mandate to have oil backup because there’s a good amount of generation, 16,000 MW, that is south of any other pipeline options —kind of a single contingency there, so there’s dual fuel. So, they’ve done things, worked it into their integrated resource plans, not the markets. But I think there’s things to learn from the signals that they’re putting in them.”