NYISO released its 2023/32 Comprehensive Reliability Plan (CRP) on Nov. 29, finding no “actionable reliability needs” for the next decade, but warning of narrowing reliability margins.

The biennial-CRP serves as the ISO’s 10-year strategy map for New York’s electric system, outlining emerging risks and recommending actions the state can take to ensure grid reliability. It encompasses demand forecasts, resource adequacy, infrastructure development and renewable energy integration. The CRP is the culmination of NYISO’s reliability planning process and assesses the feasibility of solutions proposed in the annual Reliability Needs Assessment (RNA).

The draft CRP, which received NYISO stakeholder approval earlier this month, was presented throughout the year. (See “Comprehensive Reliability Plan,” NYISO Operating Committee Briefs: Oct. 11, 2023.)

The CRP concludes that the system should be reliable, assuming demand and weather conditions align with NYISO’s forecasts. However, delays in key projects like the Champlain Hudson Power Express (CHPE), increased electric demand, additional generator deactivations due to state regulations, unplanned outages or extreme weather events could necessitate new reliability measures in next year’s RNA.

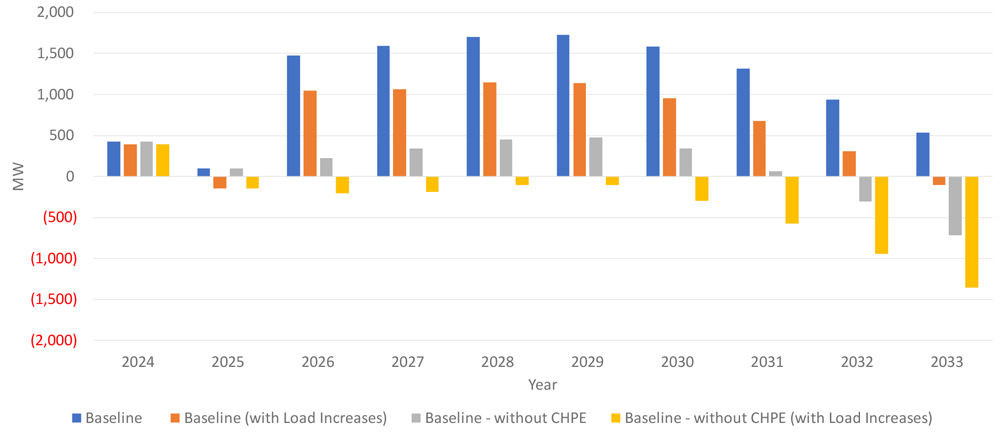

The critical risk outlined in the CRP is the on-time completion of the 1,250-MW HVDC CHPE project, which will bring hydropower from Québec to New York City. If delayed beyond its expected May 2026 completion, reliability margins could become “deficient for the ten-year planning horizon,” leaving New York City unable to meet demand from 2026 onwards.

The plan also anticipates a notable increase in peak demand driven by the electrification of transportation and buildings, along with the addition of large loads, especially in upstate New York.

This growing demand becomes even more pressing since about 3,300 MW of fossil fuel plants, which tend to meet demand during extreme conditions, are expected to retire due to the Department of Environmental Conservation’s peaker rule starting in May 2025. This is a particular concern for New York City, which heavily relies on natural gas.

NYISO recently announced plans to extend the operation of two natural gas peaker plants beyond their 2025 retirements to address a 446-MW shortfall in New York City identified in the second quarter Short-Term Assessment of Reliability. (See NYISO to Keep Gas Peakers On.)

The CRP cites the 2023 Fuel and Energy Security study, which predicts that New York will transition from a summer to a winter peaking system as electrification increases and become increasingly reliant on dual-fuel generation resources in winter. This poses a future challenge, especially as many fossil fuels plants expected to retire soon would have been key to meeting peak winter demand.

The CRP recommends introducing new dispatchable emissions-free resources (DEFRs) and inverter-based resources (IBRs), constructing additional transmission, integrating more distributed energy resources (DERs), and expanding demand response and energy efficiency programs.

In an Oct. 23 memo commenting on the draft CRP, Potomac Economics, the ISO’s Market Monitoring Unit, recommended market design changes to encourage the development of flexible resources and the integration of intermittent renewables to maintain reliability. (See Providers See ‘Mixed Signals’ on Demand Response in NYISO.)

Risk Factors

While identifying no immediate reliability needs requiring action, the CRP says that generation retirements could outpace resource additions, which it says could result in a transmission security deficit exceeding 600 MW in New York City by 2033. It says the state’s 2019 Climate Leadership and Community Protection Act, along with other public policy initiatives, significantly accelerated generator retirements.

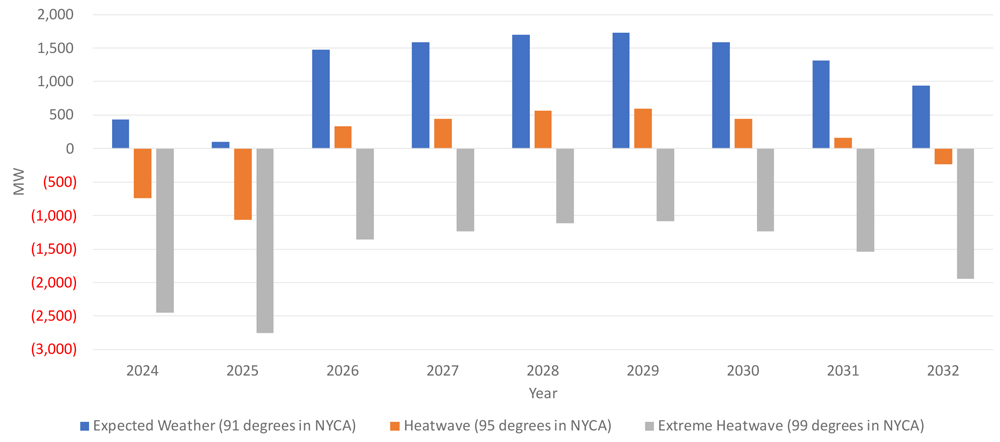

Even with projects like CHPE, meeting peak demands during extreme winter conditions could become a challenge as early as the winter of 2027/28 due to increased building electrification, electric vehicle growth and the addition of large energy loads like data centers and microchip fabrication plants.

The CRP warns of potential power deficits in future winters, with a projected shortfall of 6,000 MW by winter 2032/33, which could be compounded by gas shortages and extreme cold snaps.

Extreme weather events such as heat waves and storms also represent significant risks, potentially leading to increased electrical demand and more frequent generator outages. An extreme heat wave could cause a statewide deficiency of over 2,500 MW by 2025.

The plan encourages continued interregional collaboration, predicting NYISO will likely have to increasingly rely on its neighbors to meet demand during above-average loads.

Road to 2040

New in this year’s report is a section titled “Beyond the CRP — Road to 2040,” which assesses the impacts of public policies on New York’s electric grid and fuel mix, outlining steps needed to meet the state’s climate targets amidst reliability, generation and transmission risks.

NYISO estimates New York will require between 111 GW and 124 GW of capacity by 2040, with at least 95 GW coming from new generation projects or modifications to existing plants. However, the CRP says this may not even be enough, warning “the sheer scale of resources needed to satisfy system reliability and policy requirements within the next 20 years is unprecedented.”

The section notes a significant portion of this new generation will be IBRs, which are subject to meteorological conditions and also willl need to be supplemented with other resources like energy storage and DERs.

The section emphasizes the need for DEFRs to provide energy and capacity over long durations, especially during low output from intermittent resources, and to replace the attributes of retiring synchronous generation. Resources with the attributes needed for DEFRs are not yet commercially available, prompting the New York Public Service Commission to explore potential technologies such as hydrogen, bioenergy, nuclear power and carbon capture (15-E-0302).

And although NYISO has identified several major public policy transmission projects to deliver renewable energy efficiently across the state, further development is needed to serve renewable generation pockets.

The Road to 2040 also discusses the need for a more resilient power system against climate change impacts and extreme weather, appropriate market price signals and ensuring new resources can provide essential grid services like operating reserves, ramping or voltage support.

The section acknowledges the need for New York to adapt its planning strategies to guarantee future reliability and maintain energy markets flexible enough to respond to evolving grid and environmental conditions.