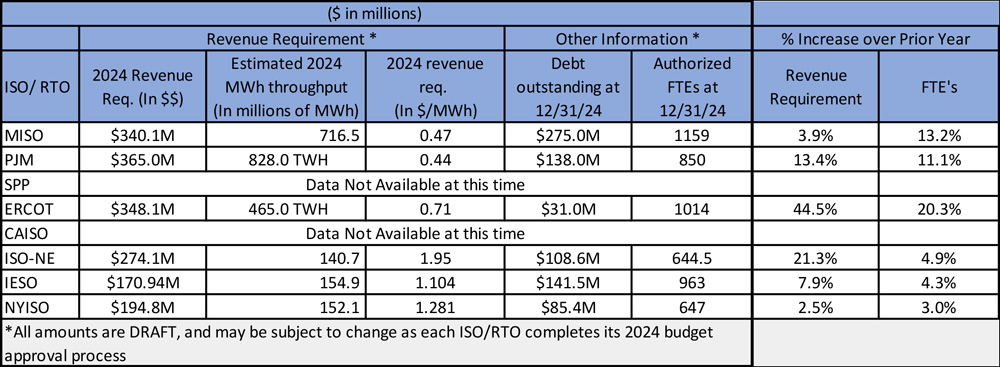

The NYISO Management Committee recommended Oct. 25 that the Board of Directors approve the ISO’s proposed $194.8 million budget for next year, a $4.8 million (2.5%) increase. Because the spending will be allocated across a forecast throughput of 152.1 million MWh, a 2.9% drop from 2023, the Rate Schedule 1 charge/MWh will increase to $1.281/MWh, a 5.6% increase.

The spending plan adds 19 new positions, primarily in the planning and operations units. Other sources of the spending increase are hikes in consulting fees and staff salaries, which are proposed to increase by $7.1 million and $7.4 million, respectively. Much of the increase is offset by the $10 million increase in proceeds from debt.

The ISO said growth drivers, including new large loads, electric vehicles, heating electrification and economic growth, would be more than offset by growth in energy efficiency and behind-the-meter solar.

At the September MC meeting, some stakeholders were taken aback by the proposed staffing increases. (See “Draft Budget,” Emilie Nelson Named NYISO COO, Replacing Rick Gonzales.) Alan Ackerman, director of NYISO regulatory affairs at Customized Energy Solutions, however, justified the ISO’s draft budget, saying, “I think this does a great job of balancing the costs against the long list of items that need to get done next year.”

The spending plan was approved unanimously by the MC on Wednesday. The board is expected to vote on the budget Nov. 14.

NYISO/PJM Joint Operating Agreement

The MC recommended that the board approve proposed revisions to the ISO’s joint operating agreement with PJM, which governs coordination and data collection between the two grid operators.

The changes would migrate a list of interconnection tie facilities between NYISO and PJM from the JOA onto the web, add language clarifying that each operator adheres to its own procedures when developing and maintaining interconnection reliability operating limits (IROL), and make clerical edits to facilitate cooperation in the resource adequacy and transmission planning areas. The IROL are the limits the ISO and PJM develop to ensure steady state and transient performance on the grid, such as voltage stability and transfer capability.

Howard Fromer, who represents Bayonne Energy Center, asked about PJM’s status on this project and how the proposals would be filed with FERC.

Cameron McPherson, an associate market analyst with NYISO, responded, “we worked jointly with PJM to develop these revisions and they are in agreement on what we’re submitting.” He added, “[PJM] did present this information to their stakeholders earlier this month and did not receive any comments or questions.”

These proposals were approved by the Business Issues Committee in September and are projected to be implemented in the first quarter of 2024, assuming approval by the ISO’s board and FERC. (See “NYISO/PJM Joint Operating Agreement,” NYISO Business Issues Committee Briefs: Sept. 14, 2023.)

Interconnection & Transmission

The MC recommended that the board approve tariff revisions intended to improve the coordination between NYISO’s interconnection and transmission expansion studies.

The revisions would revise the criteria for including transmission projects in study assumptions, better capture generators outside NYISO’s interconnection procedures for the purposes of future system planning and improve coordination among transmission projects moving through the ISO’s interconnection processes.

The changes were recommended by the Operating Committee late last year, but the ISO delayed presenting them to the MC while it waited for FERC to rule on proposals by transmission owners concerning their right of first refusal for public policy transmission upgrades, which the commission approved in April of this year. (See “Interconnection & Transmission,” NYISO Operating Committee Briefs: Oct. 11, 2023.)

The board will vote on the revisions in November. Assuming they are approved, NYISO will request its proposals become effective 60 days from when they are filed with FERC.

September Operations

NYISO’s Emilie Nelson delivered her first monthly market and operations reports as chief operating officer, telling the MC that September experienced the summer’s highest peak load (30,206 MW) and that year-to-date energy prices were down 57% compared to last year, declining from $92.27/MWh to $40.06/MWh due to continued decreases in gas prices.

Nelson was promoted to COO last month after Rick Gonzales announced his retirement from the industry. (See Emilie Nelson Named NYISO COO, Replacing Rick Gonzales.)

The peak load Sept. 6 happened during a multiday heat wave in which temperatures exceeded 90 degrees Fahrenheit. NYISO examined how this summer’s extreme weather events impacted grid operations and found that they currently pose little threat but will increasingly become a problem to the ISO’s operations should the pace of fossil fuel retirements continue to outpace the addition of renewable generators. (See “Summer Operations,” NYISO Operating Committee Briefs: Oct. 11, 2023.)

The ISO also added 20 MW of energy storage and 60 MW of behind-the-meter solar resources in September.

MC Election, Promotions

The MC voted to elect Glenn Haake, vice president of regulatory affairs at Invenergy, as new vice chair of the MC.

Haake reminded the MC that he was previously elected to be vice chair of the MC back in 2011, saying, “I’m excited at the prospect of being able to finish what I started a little more than a decade ago.”

He will work with MC Chair Julia Popova, NRG Energy’s manager of regulatory affairs, in his new role next year.

Nelson also told the MC that Shaun Johnson has been promoted to the ISO’s director of market design and Joshua Boles promoted to director of market mitigation and analysis.