Less than five years ago, California’s Lake Oroville was so empty its 644-MW Edward Hyatt Power Plant, a pumped-storage hydroelectric plant, was shut off for the first time since it came online in 1967. The state was in a drought so long and severe that many areas had water restrictions, most reservoirs were at or near record lows, nearly 400,000 acres of farmland were idled, and close to $1 billion worth of crops were lost.

Almond trees in general, and the billionaire couple who own Wonderful Foods specifically, found themselves on the public enemies list again after a 2016 Mother Jones expose uncovered their substantial water use. But neither almonds nor pomegranate juice — nor even billionaires — were mostly to blame. La Niña bore the brunt of the blame for the drought that gripped the West, and climate change exacerbated it.

The hydropower shutoff was just one of the energy-related impacts of the drought. Throughout this extreme dry spell, the water-energy nexus was laid bare.

Today, we need to think of drought as more than an agricultural or wildfire-risk problem; it’s a systemic threat to the electric grid. Drought, like other weather extremes, undermines supply, drives up costs and exposes weaknesses in our infrastructure planning.

When it Rains, it Pours (And When it Doesn’t…)

The irony of researching this article the same month California was declared drought-free for the first time in 25 years is not lost on me. When I returned to Northern California from my holiday break, it was raining. Hard. With the 101 freeway closed in both directions thanks to the storm coinciding with a king tide, my last piece on sea level rise seemed relevant. But drought? It was far from top of mind.

Compared to other climate extremes covered in this series, I assumed drought’s impact on the grid would be both obvious and tangential. More drought means less hydropower generated. Hardly a story. But digging deeper, it’s clear that drought should be thought of as a problem multiplier when it comes to our energy system.

As climate change progresses, we have to build a grid that can handle heat waves, wildfires and extreme drought, as well as extreme precipitation and sea level rise. It’s a complex challenge that will get more urgent as climate swings become more extreme.

The Tangled Water-energy Nexus

The intersection of water and energy is, to put it mildly, complex.

Water is used to produce energy directly (hydropower), is heated to produce steam to produce energy (thermoelectric plants with steam turbines), cools that steam as it leaves the turbine and is pumped underground to capture geothermal energy. Water also acts as a battery in pumped-storage hydroelectric plants, which pump it up during off-peak hours for later release.

Water also consumes energy when it’s pumped up from aquifers, conveyed from one location to another, treated so it’s potable and heated for those long showers we love. In California, those uses consume at least 12% (possibly as much as 19%) of all electricity on the grid. Nationally, it’s lower, with 4% of total electricity generated used for drinking and wastewater services.

Drought affects the physical grid, too. When aquifers are pumped out, the ground above can subside as the pockets of ground that had held water collapse. In California’s San Joaquin Valley, decades of drought-driven aquifer pumping have caused land to sink by a foot a year, damaging roads, pipelines and overhead utility infrastructure.

Then there are the less obvious intersections. Water conveys inputs for the energy system, such as coal barges on the Mississippi: 11% of all coal used by power plants is delivered by barge, and under this administration, coal-fired plants are being revived. And the correlation between rising electricity demand and water demand is high in the booming data center sector, creating stress on both systems.

Drought as a Problem Multiplier

With water woven so tightly into the energy system, drought becomes an electricity problem too.

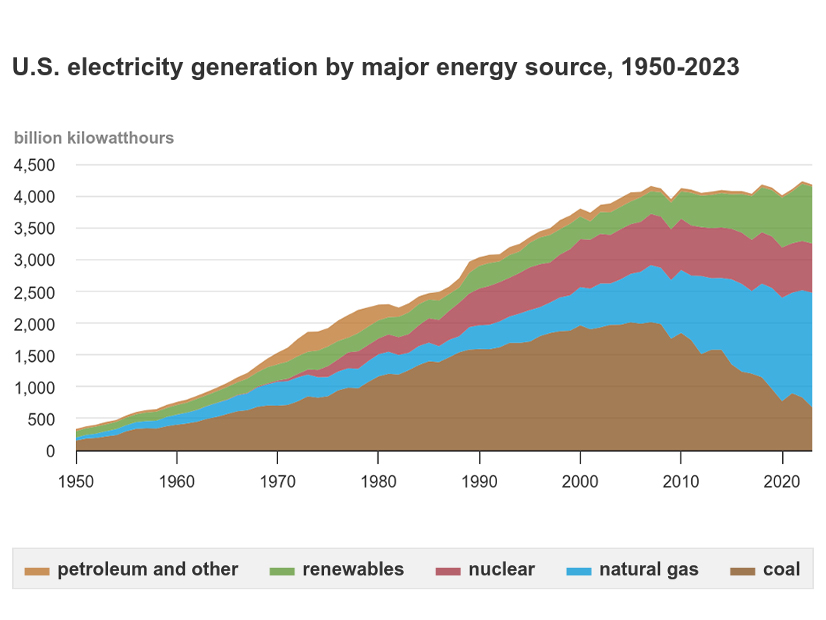

The most obvious impact of drought is a decline in hydroelectric output. Conventional hydroelectric plants in the U.S. contribute about 6% (240,000 GWh) of total U.S. utility-scale electricity generation. Pumped-storage hydro adds 23 GW of storage capacity.

For hydro asset owners, drought has a real cost: A 2024 study found the sector lost 300 GWh of production and $28 billion of revenue over the 2003-2020 period. The period following the study saw droughts worsen. In the 2022-23 water year, Western U.S. hydropower output was the lowest since 2001.

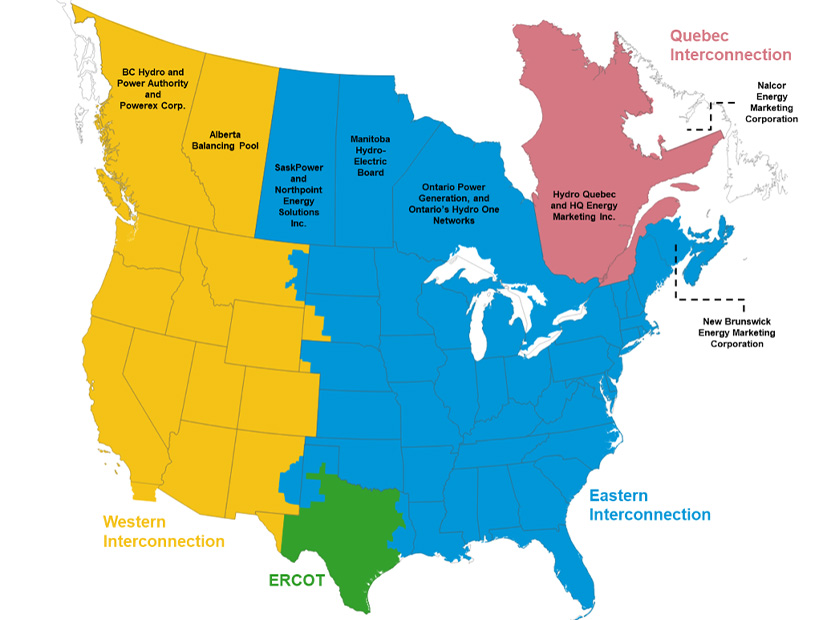

Drought also has cross-border trade implications. The U.S. typically imports electricity from Canada, where hydroelectric plants generate more than 60% of the electricity. In September 2023, drought in Canada reversed that flow, making Canada a net importer for five of the following nine months. While Canadian imports account for less than 1% of U.S. electricity, the exchange plays an important role in grid balancing.

The Drought-demand Spiral

Drought increases energy demand. In the agricultural sector, there’s more energy used to pump water from the aquifer to water crops. Despite a water shortage, some end users, such as golf courses, will increase their water use, meaning more water is treated and pumped before it reaches the green. Droughts often coincide with hotter weather, when the demand for air conditioning rises.

Droughts also increase the risk of wildfires, with bone-dry vegetation more vulnerable to any spark from the grid. And even if the grid’s not the cause of the fire, fighting those fires draws on water supply. The devastating Palisades fires a year ago were exacerbated when electric utilities de-energized lines, leaving water utilities unable to pump enough water to keep the fire hydrants at full pressure. Even without the outage, the unprecedented demand on the hydrant system would have been almost impossible to meet, exposing the need to provide battery backup to critical infrastructure, including water pumps.

Water as a Power Plant Input

It’s a misnomer to say energy is one of the largest users of water in the same way that it’s a misnomer to say wind farms take up massive amounts of farmland. Water used in energy production largely continues its sea-bound journey after use, though warmer than before, in the same way farmlands continue being productive as cattle graze under the wind towers.

Power plants that use energy to cool steam are impacted by drought only when there’s not enough water to intake. Thermoelectric power plants, including coal, natural gas, nuclear, oil and biomass, are becoming both a smaller part of the nation’s electricity supply and more water-efficient. Wind and solar generators have grown from 4% of total utility-scale generating capacity in 2010 to 18% by 2021, so the portion of our power system dependent on water has fallen.

Still, thermoelectric power plants, almost all of which depend on water, provide about three-quarters of the electricity on the grid. They cool the steam from their turbines in one of three ways: once-through, where water is taken from rivers, lakes and aquifers and released back hotter; closed-loop or wet-recirculating, which reuses the water once it’s literally let off some steam in cooling towers; or dry-cooling, which uses air to cool the steam.

Most of the water withdrawn by once-through systems is discharged back into the place it came, not contributing to the drought; however, they can be impacted by drought if the river or dam they draw from is depleted, or is too low to permit the volume of warmed water to re-enter the natural water system. In 2022, the Jim Bridger coal-fired power plant in Wyoming was at risk of being shut off as the Green River it draws from ran low.

Closed-loop thermoelectric plants are less affected by drought but draw more water from the system to replenish the amount that evaporates. Dry-cooling plants, which are relatively rare, use the least water, but at the cost of power plant efficiency.

The EIA reports that thermoelectric plants are becoming more efficient in their water use. “The sector’s water-withdrawal intensity — the amount of water withdrawn per unit of electricity generated — continued to fall, declining 2.1% from 11,849 gallons/MWh in 2020 to 11,595 gal/MWh in 2021.” Pushing against that trend, the rise in data center energy demand may increase the power sector’s total water demand even if the gallons/MWh declines.

Moving Toward a Lower-water Grid

Of course, the easiest way to reduce the grid’s reliance on water is to adopt generation technologies that require little or no water. Solar and wind are obvious candidates, but some types of geothermal and combined heat and power (CHP) need little to no water.

Geothermal technologies’ water needs vary, with binary cycle power plants’ closed loop systems not requiring any aside from water used in the initial drilling process. Some of those that use water, such as Fervo Energy, can use degraded or brackish water that could not be used for agricultural or other purposes.

CHP systems create efficiencies by capturing the energy from the power plant’s steam to provide heating, hot water or chilled water for facilities. They are highly water-efficient, though they’re generally limited to smaller power plants co-located with facilities or areas with district heating.

Policy that Prepares for Drought

Regulators, operators and asset owners need to prepare for a drier (and hotter, and wetter, and stormier) future. And that begins with assessing risk.

The West well understands the impact of droughts after the past few years of real-life experience. In other areas, even those that haven’t had droughts in the past, modeling potential droughts’ impact on reliability and reserve margins is important if the industry is to prepare for the future.

One example: a study of the PJM and SERC region’s generation capacity found that if the area suffered a drought equal to “the 2007 Southeastern summer drought … the usable capacity of all at-risk power plants may experience a substantial decrease compared to a typical summer, falling within the range of 71 to 81%.”

The energy-water nexus must be considered in energy policy and pricing: low electricity tariffs have made it affordable for farmers to pump scarce groundwater from aquifers that do not recharge as quickly as they are being drawn down, especially during periods of drought. And there’s untapped potential, pun intended, for incentivizing farmers to pump irrigation and well water at off-peak times or connect automated irrigation pumps to demand-response programs.

The question is whether utilities have any incentive to support policies that will cut the energy used by the water system. Until policies reward water-efficient moves by the energy industry, moving all of that water will continue to consume much of the electricity we produce, and keep the industry vulnerable to droughts.

Different Problem; Similar Solution

As with floods, fires and other extreme events exacerbated by climate change, preparing for drought requires building a more flexible and resilient grid. Islandable microgrids, more energy storage, stronger infrastructure and diversified generation sources all help stabilize the grid, whether facing a long-duration challenge like a drought or an immediate emergency like a flood.

Extreme weather events require thinking, and collaborating, outside the electric box: no single industry can prepare alone and the sooner that states and regions put together integrated plans for these climate extremes that include all of the energy system players along with those in charge of water, transportation and every other piece of critical infrastructure, the better able we’ll be to cope with the next extreme weather event.