Washington’s attorney general and a coalition of environmental groups have mounted separate challenges to the U.S. Department of Energy’s December decision to order TransAlta to continue operating the state’s last coal-fired plant for three months beyond its scheduled retirement at the end of 2025.

Attorney General Nick Brown and the coalition — which includes Earthjustice, NW Energy Coalition, Washington Conservation Action, Climate Solutions, Sierra Club and the Environmental Defense Fund — have separately filed requests to rehear DOE’s Dec. 16, 2025, order to keep the Centralia Power Plant’s 670-MW Unit 2 running until March 16, 2026, due to an energy “emergency” in the Pacific Northwest this winter. (See DOE Orders Retiring Wash. Coal Plant to Stay Online for Winter.)

The order was one in a series of such moves the Trump administration’s DOE has taken over the past year to extend the life of aging fossil fuel-fired plants slated for closure, including in Michigan, Pennsylvania and Colorado.

“The Trump administration is once again ignoring both the law and the facts,” Gov. Bob Ferguson said in a Jan. 13 statement accompanying announcement of the state’s request, which asks DOE to “immediately withdraw” the order. “DOE needs to reverse course on this harmful and misinformed order.”

“DOE is misusing its narrow authority reserved for imminent emergencies to force a dirty, inefficient coal plant to keep operating,” Earthjustice attorney Patti Goldman said in a Jan. 14 statement by the coalition. “Our region has moved beyond reliance on coal and this plant. We are meeting our region’s energy needs, now and into the future, with cleaner sources.”

In their statements, the AG’s office and the coalition questioned DOE’s authority to keep the Centralia plant open under Section 202(c) of the Federal Power Act — and the department’s reason for doing so, arguing that the law is intended to address only “real” emergencies.

To submit a commentary on this topic, email forum@rtoinsider.com.

The coalition contended that the order “exceeds that authority and instead tries to impose the administration’s preference for coal-fired power over a 2011 agreement between the state of Washington and TransAlta, the owner of the plant, to shut down the plant by the end of this year.” (Unit 1 at Centralia was shut down in 2020 under the first phase of that agreement, and TransAlta plans to convert the facility to natural gas.)

The AG said the order “is a clear attempt by DOE to bypass the limits imposed on it by Congress.”

In its rehearing request, the AG said the department failed “to properly identify or clarify the appropriate entities that have any authority to direct” Centralia’s operation. The Dec. 16 order called on TransAlta to “take all measures necessary” to ensure the plant is available operated at the direction of either the Bonneville Power Administration as a balancing authority or CAISO’s RC West as the regions reliability coordinator, but it was apparent neither of those entities was consulted before the order was issued.

Getting the Story Straight

The coalition in its rehearing request argued that DOE failed to provide evidence of an energy emergency or electricity shortage that warranted continued operation of the plant. It notes that two third-party studies cited by DOE to support its order “demonstrate the absence of an emergency.”

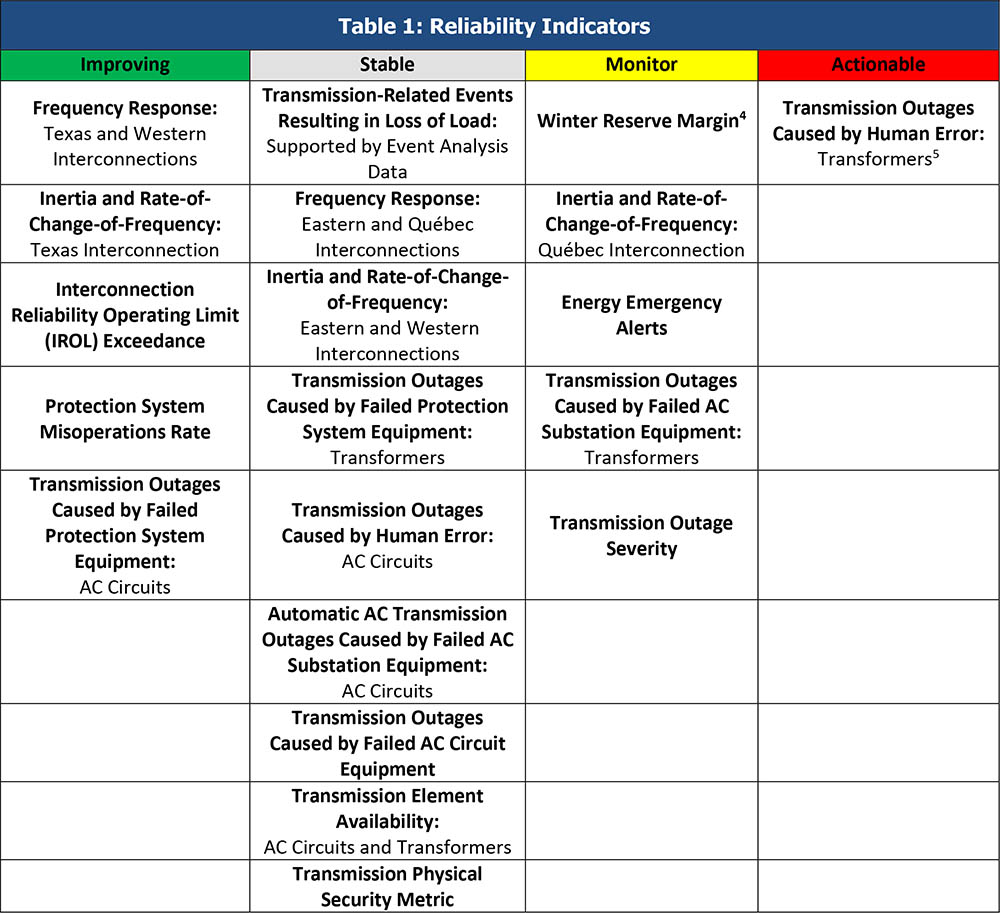

The coalition points out that the first study, NERC’s assessment of reliability for this winter, “expressly states that ‘operating reserve margins are expected to be met after imports in all winter scenarios.’ … This means that the study on which the department relies anticipates that the region will be able to meet peak demand and maintain the full added buffer of reserves on top.”

The second study, by Energy and Environmental Economics (E3), has not yet been released, the coalition noted. Instead, DOE based its finding on a September 2025 presentation on the pending study, whose author has said shows the Northwest’s resource adequacy risk is “slightly elevated above the target risk,” which “was calculated to achieve a loss of load expectation of one event-day per decade.”

“E3 also confirms that it calculated this ‘slightly elevated’ risk without examining the actual conditions this winter; as a planning document, the presentation is based on a historical model and does not reflect actual weather and hydrological conditions presently existing for this winter,” the coalition wrote in the rehearing request.

The coalition contends that recent actions by DOE undercut the department’s claim of an emergency, including an October 2025 order by the Grid Deployment Office that allowed the Northwest to export electricity to Canada based on a finding (in DOE’s own words) “that the wholesale energy markets are sufficiently robust to make supplies available to exporters and other market participants serving United States regions along the Canadian and Mexican borders.”

In that order, DOE itself pointed to the “comprehensive” reliability processes in the region that ensure “bulk-power system owners, operators and users have a strong incentive both to maintain system resources and to prevent reliability problems that could result from movement of electric supplies through export,” the coalition noted.

“The Trump administration can’t get its story straight,” Tyson Slocum, Public Citizen’s Energy Program director, said in the coalition’s statement. “While it claims the West Coast is in a state of emergency requiring families to bail out an expensive coal plant, Trump’s Department of Energy is simultaneously concluding the region has energy abundance to authorize electricity exports to Canada. Which is it, Donald?”

The coalition contends that complying with the DOE order will “be expensive, as Centralia does not have the coal, customers or workforce to keep the coal plant running. Other coal plants forced to keep operating are experiencing extremely high costs, which [FERC] can require ratepayers to pay.”

The groups point to the pollution impact of the order, and how it violates Washington’s Clean Energy Transformation Act, which required the state’s utilities to stop using electricity from coal-fired plants by the end of 2025.

“So many of us — from state leaders and utilities to elected officials and public interest groups — have worked for decades to plan for and build cleaner, more efficient generation and transmission that will ensure Washington state’s transition to clean energy while keeping energy affordable and reliable,” said Lauren McCloy of the NW Energy Coalition. “That work is ongoing, and burning more coal at Centralia is not the answer to meeting growing energy demand in the Northwest.”

Asked to comment on the challenge, a DOE spokesperson responded: “Under the disastrous energy subtraction policies of the previous administration, the U.S. was on track to lose 100 GW of reliable generation capacity by 2030. Much of the U.S. is now at ‘elevated risk’ of blackouts under extreme conditions, which NERC declared a ‘five-alarm fire’ for grid reliability.

“At the same time, the U.S. may need to build 100 GW of new reliable capacity to win the AI race and onshore manufacturing. The Trump administration is committed to preventing the premature retirement of baseload power plants and building as much reliable, dispatchable generation as possible to achieve energy dominance.”