The 2,600 GW of wind, solar and storage sitting in RTO/ISO interconnection queues across the U.S. represent a major imbalance in energy resources that could lead to brownouts or blackouts, former North Dakota Gov. Doug Burgum (R) said during his Senate confirmation hearing Jan. 16 to be President-elect Donald Trump’s secretary of the interior.

“We are in an energy crisis in our country,” Burgum said in response to a question on permitting from Sen. Jim Justice (R-W.Va.), member of the Senate Energy and Natural Resources Committee. “Electricity is at the brink. Our grid is at a point where it could go completely unstable. We could be just months away from having skyrocketing prices for Americans.”

Burgum argued for an infusion of “baseload” power from fossil fuel generation to ensure grid stability, affordability and sufficient electricity to power the data centers the U.S. needs to win the “AI arms race” against global competitors.

“Right now, in some queues in FERC, it’s 95% intermittent resources and only 5% baseload,” Burgum said. “We need baseload to be able to allow renewables on the system. … We’ve stacked the deck where we are creating roadblocks for people who do baseload, and we’ve got massive tax incentives for people that want to do intermittent and unreliable. … The balance is out of whack, and we’ve got to bring it back in line.”

Burgum apparently was under the assumption that FERC manages generator interconnection queues. In response to another senator’s question, he said, “You take a look at a FERC queue that’s got 95% intermittent and unreliable, that probably tells us we’re a little bit out of balance, and we’ve just got to bring it back and then keep moving forward.”

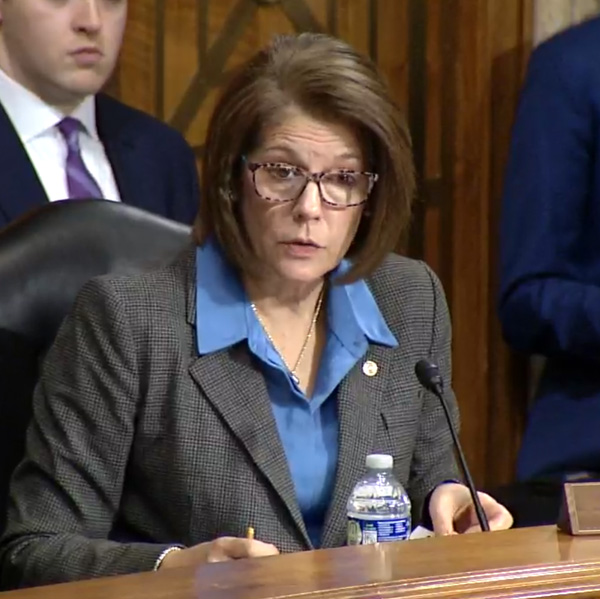

Electricity and the grid were among several of the high-priority issues Republicans and Democrats raised during Burgum’s three-and-a-half-hour confirmation hearing. Both Sen. Mike Lee (R-Utah), the committee’s chair, and Sen. Catherine Cortez Masto (D-Nevada) spoke of the challenges of living in states where two-thirds or more of the land is federally owned and quizzed Burgum on his views on residential development on federal property.

One solution could be public-private land swaps, Burgum said, pointing to trades of state and private land in North Dakota “to provide better outcomes for both of those pieces of land.”

Other concerns raised included local consultation in the designation of national monuments, protecting hunting and fishing rights on public lands, improving relations with tribal nations, and addressing the maintenance backlog at national parks, all of which he said he would support if confirmed.

On another energy-related issue, Burgum gave assurances to Republican lawmakers he would increase auctions for oil and gas drilling on public lands, both on and offshore, noting that as governor of North Dakota, he repeatedly fought Bureau of Land Management efforts to restrict drilling on federal land.

Public lands should be viewed as national assets, Burgum said. “The Department of the Interior has got close to 500 million acres of surface [land], 700 million acres of subsurface and over 2 billion acres of offshore. … That’s the balance sheet of America.

“If we were a company, they would look at us and say, ‘Wow! You are really restricting your balance sheet.’ … It’s our responsibility to get a return for the American people.”

The ‘Clean Coal’ Argument

With an MBA from Stanford, Burgum started out as a computer entrepreneur, growing a local company, Great Plains Software, from an accounting software startup to a publicly traded firm with 2,200 employees across the state. Microsoft acquired the company in 2001.

Before winning his first election as governor in 2016, Burgum worked for Microsoft for several years and then started a real estate development company and a venture capital firm.

Re-elected in 2020, Burgum had supported an all-of-the-above approach to energy, prioritizing innovation over regulation. North Dakota is the third-largest producer of crude oil in the U.S. but gets close to 40% of its power from wind.

In 2021, hours before Energy Secretary Jennifer Granholm landed for a state visit, Burgum issued a challenge for North Dakota to become carbon-neutral by 2030, primarily through carbon capture and sequestration. A press release from the governor’s office at the time stated that North Dakota has “252 billion tons of underground storage capacity — enough to store 4,400 years’ worth of the state’s carbon output or 50 years’ worth of the nation’s energy-related carbon output.”

With CCS, North Dakota now is producing “clean coal,” Burgum said at the hearing.

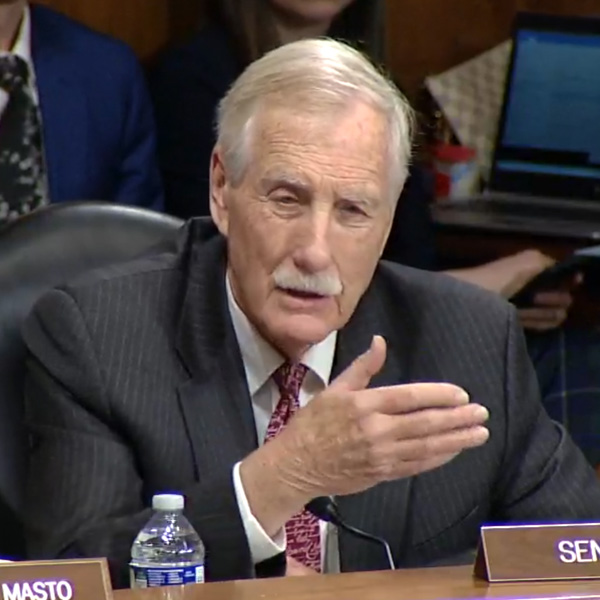

But he downplayed wind’s role in the state’s energy mix in an exchange with Sen. Angus King (I-Maine), who asked for assurances that existing leases for offshore wind projects in the Gulf of Maine would be allowed to continue. Trump has railed against wind energy, and offshore wind in particular.

Those projects “will produce enough energy for all the homes in Maine, New Hampshire and Vermont. … The capacity factor of offshore wind is significantly higher than terrestrial wind,” King said. “I hope you can talk to [Trump] about the fact that wind has its virtues and can contribute significantly, because we are … facing a huge energy challenge over the next 15 to 20 years.”

Burgum’s response again was to call for “balance” between intermittent and baseload resources. Most of North Dakota’s wind power is exported, he said. “We need more, and the thing we’re short of most right now is baseload.”

Democrats Push Back

In addition to interior secretary, Burgum also has been tapped by Trump to lead a still-to-be-formed National Energy Council, where he could have more authority to implement Trump’s agenda and his own views on the need for balance, more baseload power and the national security impacts of energy policy.

Burgum said the council will be formed under an executive order he expects Trump to issue soon after his inauguration.

“Today, America produces energy cleaner, smarter and safer than anywhere in the world, and when energy production is restricted in America, it doesn’t reduce demand,” Burgum said in his opening remarks. “It just shifts production to countries like Russia and Iran, whose autocratic leaders not only don’t care at all about the environment, but they use their revenues from energy sales to fund wars against us and our allies.”

Producing enough oil and gas to sell to U.S. allies means “they don’t have to buy it from our adversaries. That’s how we reduce tensions in the world,” he said.

With overwhelming support from Republicans, Burgum seems headed for approval by the committee and the Senate, but he did get pushback from some Democratic senators on some of his statements.

Cortez Masto challenged his definition of baseload energy, noting that solar is a major source of power in Nevada, “and that’s why battery storage is important. So, let me ask you this … isn’t the combination of renewables plus battery storage baseload?”

When Burgum suggested that “storage is still a few years out,” Cortez Masto quickly countered that “it’s happening in Nevada right now. I’ve been to facilities. If we don’t have those incentives, then we’re never going to get there.”

Cortez Masto was referring to the incentives for storage and clean energy in the Inflation Reduction Act, which Trump and Republicans could target for rollbacks. Sen. Ron Wyden (D-Ore.) also raised concerns about IRA tax credits, and in particular, Burgum’s level of support for the technology-neutral tax credits for emerging clean energy technologies that he wrote into the law.

“Nobody knows what the big carbon reducers are going to be 30 years from now, and so the reason I insisted on that provision is it creates what I call an innovation lane,” Wyden said. “It’s an opportunity to send a message to people … that you’re going to have a chance, if you innovate, to be part of a very bright future.”

While agreeing with Wyden in principle, Burgum again argued that “these things have been so successful as it relates to the electric grid that we have got now a significant imbalance in the amount of projects that are intermittent.”