When it comes to choosing one of the two competing Western day-ahead market offerings, who else is participating in the market is a key consideration, a representative of a New Mexico utility said last week.

The New Mexico Public Regulation Commission (PRC) held a workshop on Sept. 21 to discuss the pros and cons of utility participation in a regional day-ahead market or RTO. The discussion came as CAISO prepares to roll out its extended day-ahead market, in competition with SPP and its Markets+ offering.

Kelsey Martinez with the Public Service Company of New Mexico (PNM) said during the workshop that both market operators are “proven,” and PNM believes the two offerings would provide similar benefits.

“Less and less of the decision feels about the market operator and the market design,” said Martinez, who is PNM’s RTO and markets manager. “And more and more of it feels really about who’s in the market with you. So which resources are in the market, which transmission is in the market, what loads are in the market.”

In written comments to the commission, PNM was even more specific, saying “existing market transmission connectivity represents the largest deciding factor in choosing a day-ahead market.”

PNM said it currently has the most market transmission connectivity with Arizona Public Service. PNM expects to select a day-ahead market in 2024.

PNM also worked with consultant Energy and Environmental Economics (E3) to look at the impact of market seams between New Mexico and Arizona. The utility defined seams as areas where entities that share transmission connectivity are in different market footprints.

“For PNM … [the study] showed a large reduction in benefits when seams exist between Arizona and New Mexico,” the utility said in its comments.

PNM noted that it won’t know what transmission connections will be in each footprint until other utilities reveal their day-ahead market choices.

The E3 analysis was a follow-up to a report the consultant prepared for the Western Markets Exploratory Group, looking at the impact of different market footprints on WMEG member benefits.

Moving Renewables to Market

In August, the PRC opened a docket to establish “guiding principles” for participation in a regional day-ahead market or RTO by two investor-owned utilities in the state, PNM and El Paso Electric. (See NM Commission to Set Standards for RTO, Day-ahead Participation.)

PNM has been participating in CAISO’s Western Energy Imbalance Market (WEIM) since 2021 and El Paso Electric joined the WEIM this year.

Last week’s workshop was scheduled as part of PRC’s guiding principle development. In addition, PNM, El Paso Electric and other stakeholders filed lengthy written comments answering questions posed in the commission’s initial order opening the docket.

Some stakeholders used the workshop as an opportunity to make a pitch for a Western RTO.

“Moving forward in the stepladder of market opportunities before us is good, but stopping short of a full RTO leaves real opportunity on the table,” said Rikki Seguin, executive director of the Interwest Energy Alliance.

Interwest is an advocacy group that represents utility-scale renewable energy developers in six Western states. For the renewable industry, “getting to the benefits of centralized transmission planning and cost allocation is key,” Seguin said.

To meet state policy goals, the West will need to add 9 GW of renewable energy each year starting in 2026, Seguin said, citing data from Energy Strategies’ Western Flexibility Assessment.

New Mexico is well-positioned to help satisfy that demand, she said, with its “world class” solar and wind resources.

But “absent the transmission planning … it’s going to be really hard to move those renewables to market,” Seguin said.

Bifurcation Challenges

Public interest group Western Resource Advocates (WRA) also weighed in on the regional market issue in written comments and with a presentation during the PRC workshop.

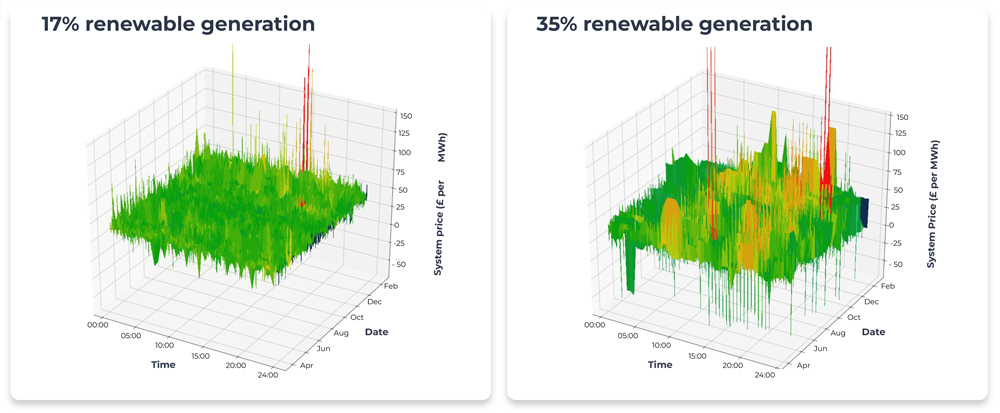

WRA said a single, large-footprint market would provide the most economic, environmental and reliability benefits to New Mexico. In terms of challenges arising from regional markets, WRA said one of the largest would be a bifurcation of day-ahead energy markets and their impact on efficient clean energy dispatch and economic gains from the WEIM.

In addition, WRA is concerned about New Mexico utilities’ decision-making process for joining a market.

“The choice to join a regional market … should not be based on grounds of expediency to satisfy an adjoining utility that it relies on for transmission access and dispatch,” WRA said in written comments.