PJM presented several changes to its Critical Issue Fast Path (CIFP) proposal during the process’ meeting Thursday, reworking portions related to the seasonal market, weatherization, site visits, performance assessments and market power mitigation.

Getting through a portion of PJM’s 79-slide presentation spanned the entirety of the meeting, postponing presentations from Constellation Energy and the Independent Market Monitor to the next CIFP meeting Tuesday. Additional sections of PJM’s presentation pertaining to reliability risk modeling and accreditation were moved to Tuesday’s meeting, which is set to include presentations from Vistra, Buckeye Power and Leeward Renewable Energy. (See PJM Updates Risk Analysis; Stakeholders Present Revised CIFP Proposals.)

Following Tuesday’s meeting, only one Stage 3 meeting remains on the calendar, set for Aug. 7. The following week will be saturated with standing committee meetings, with Aug. 13 being the final day for agenda items and documents to be added to the materials for the Stage 4 meeting on Aug. 23. In that meeting, stakeholders will present to the PJM Board of Managers and subsequent Members Committee meeting, which will include the vote to recommend a package to the board.

The Stage 4 meeting will begin with a detailed presentation of PJM’s proposal, after which only members and invited non-member stakeholders will be allowed to continue participating. A sign-up form will be emailed to stakeholders subscribed to the CIFP and MC mailing lists.

Seasonal Auction Design Shifts to MRI Curves over VRR

PJM Vice President of Market Design Adam Keech said the new seasonal design stemmed from stakeholder concerns that PJM’s proposal was overly complex and not transparent. The previous iteration would have created variable resource requirement (VRR) curves for each season and aligned the price with the point on the annual VRR curve corresponding to the amount of cleared capacity. (See PJM Adds Seasonal Capacity to Stage 3 of CIFP Proposal.)

Thursday’s proposal instead would use marginal reliability impact (MRI) curves for the seasonal auctions, which would be set in advance and with no adjustments made during the auction clearing. The shape of the MRI curves generally would align with the status quo VRR slope, but the “amplitude” of the curve would be increased to ensure resources could retain the annual costs of taking on a capacity commitment in a single season in the event the other season cleared at zero.

The MRI curve for each season would be calibrated so that if the amount of capacity procured was at or lower than the reliability requirement, the corresponding price would be at least the annual net cost of new entry (CONE) for the reference resource.

PJM Director of Economics Walter Graf compared the current approach to how locational deliverability areas (LDAs) have their own VRR curves designed to ensure that the reference resource can meet its reliability requirement assuming the rest of the RTO cleared at $0 and no outside revenues would be available for resources within the LDA.

Several stakeholders expressed concern that increasing the amplitude of the curve would amount to doubling the cost consumers pay for capacity and requested PJM present more analysis on the expected reliability and cost impacts of the proposed approach.

Economist James Wilson, a consultant for state consumer advocates, gave the example of grafting PJM’s proposal onto a monthly capacity market and questioned if that would result in the possibility of a month with capacity prices increased by a factor of 12.

Graf said he believes it makes sense that the reference resource would be able to meet its annual costs in one month, under Wilson’s example, if that period is determined to hold the entirety of the grid’s reliability risk. He added that PJM’s model wouldn’t increase both the price and the quantity.

“The price in a given season is higher only if the reliability risk is higher and the quantity procured is lower,” he said.

Market Power Mitigation Changes to Must-offer for Intermittents, CPQR

The changes to PJM’s proposal also include removing the must-offer requirement for intermittent resources. Several resource types, including solar, wind and storage, are not subject to the requirement that generators must offer into the capacity market, an exception that PJM had proposed removing in earlier versions of its package. (See PJM Completes CIFP Presentation; Stakeholders Present Alternatives.)

PJM’s Skyler Marzewski said retaining the exception stems from intermittents not possessing a way of physically hedging against the risk that an emergency may occur at a time when they are not able to be online, subjecting them to capacity performance (CP) penalties. He said PJM has not determined if it intends for demand response to be subject to the requirement.

Graf said any resource that would not be required to submit an offer but intends to do so would need to notify PJM sufficiently in advance of the reliability analysis being conducted for that auction.

Emma Nix of Leeward said retaining the must-offer exception likely would lead to Leeward and a coalition of renewable developers dropping plans to offer an alternative to PJM’s proposal. “This is a giant step forward for getting renewable support for PJM’s proposal,” she said.

While the must-offer exceptions were one of the major concerns renewable developers had with the PJM package, Nix said they support requiring intermittents to participate in the capacity market in the long term, so long as the requirement is accompanied by a way of mitigating risk of performance penalties during times those resources can’t be expected to operate.

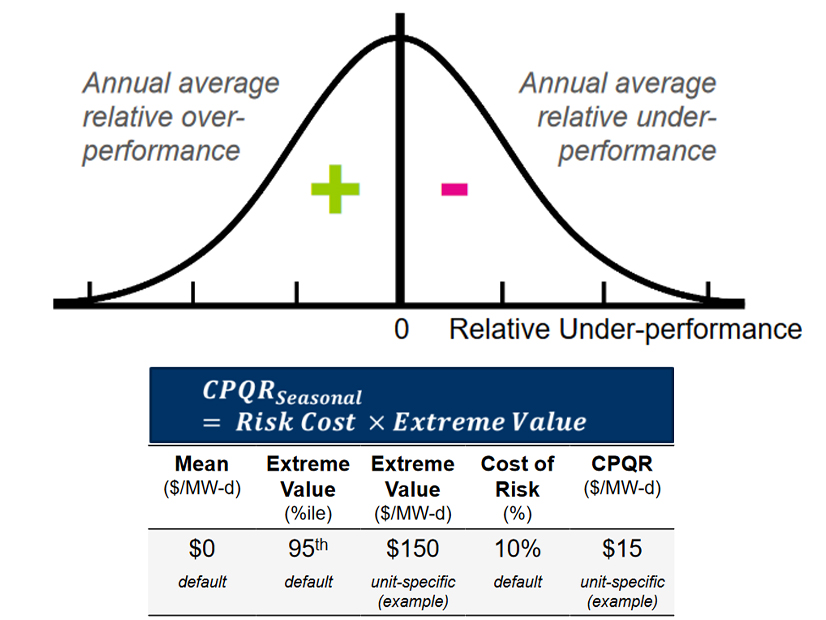

PJM added detail to its default capacity performance quantified risk (CPQR) calculation, in which it would create a default risk value for each resource class with an option for generation owners to continue to submit unit-specific values instead.

Graf said PJM would look at the 95th percentile of events to estimate a unit-specific analysis of how resources may over- or underperform during modeled performance assessment intervals (PAIs).

The amount of risk determined to be present at the 95th percentile would be multiplied by a cost-of-risk parameter, which in his demonstration Thursday was set at 10%. The cost-of-risk and other parameters in the calculation would be reviewed periodically.

Calpine’s David “Scarp” Scarpignato questioned why the result shouldn’t be the risk at the 95th percentile. Graf said competitive market sellers would be willing to have a small downside as a potential outcome at less than the full amount they stand to gain.

Rework to Performance Assessment Testing

PJM’s proposal to require a physical demonstration that resources can meet their capacity commitments, with penalties for any shortfalls during testing, was revised to measure generators against their daily committed ICAP, rather than against their average seasonal committed ICAP. PJM’s Pat Bruno said the change was made with the understanding that a resource’s capability can change throughout a season.

The test would be based on either operational data for the relevant season provided by the generator or a demonstration that the resource schedules with PJM.

PJM also would be able to initiate two operational tests by scheduling a unit, following its parameter limits and considering the test a success if it is able to come online within a certain amount of its expected time and operates for its minimum run time. Generators would be made whole for costs incurred during testing.

Bruno said tests would be conducted at times that mirror reliability risk, such as cold weather during the winter.

A failed test would result in a forced outage ticket and the unit would be marked unavailable until it indicates to PJM that the issue behind the failure is resolved, or it successfully starts back up. PJM would be able to schedule re-tests, which would result in a capacity deficiency penalty if failed. Re-tests following a failure also would not be eligible for make-whole payments.

Bruno said the deficiency penalties are designed to be imposed following a failed re-test out of a desire to not assess large penalties against a generator for a random mechanical failure and to focus instead on repeated inability to come online.

Vistra’s Erik Heinle asked if resources would have enough time to nominate for fuel prior to a test. Bruno responded they would respect the notification times in a generator’s parameters.

Site Visitation Details

PJM gave more detail on plans to include site visits in its CIFP proposal with the goal of ensuring preparations for extreme conditions are being undertaken and to gather information on any challenges. The current thinking is to have every capacity resource visited around every five years, with a focus on newer generators.

The visits would look to ensure compliance with weatherization requirements and to evaluate if fuel arrangements are being made.

Owners would be given advance notice of any visits and any issues identified would have a “cure period” established with generator input in which no penalties would be imposed. Failure to address issues long-term could result in penalties.